Understanding Private Equity Fund Cash Flows

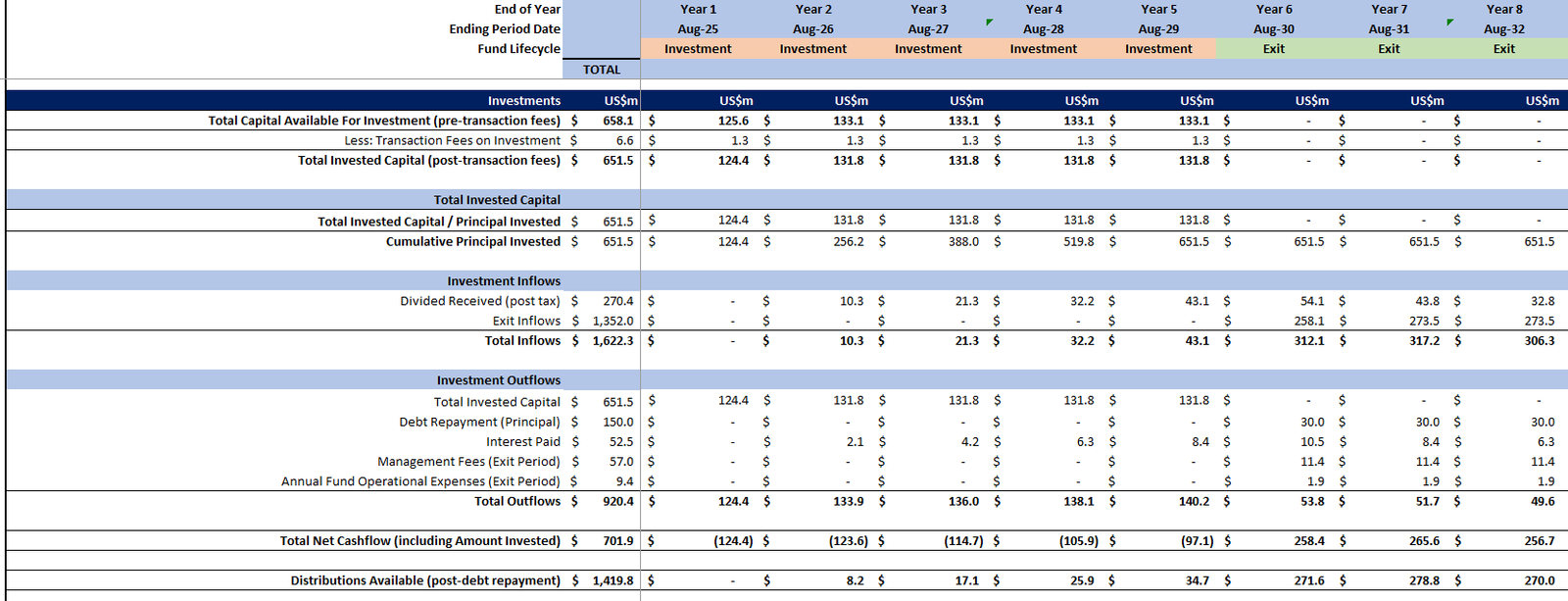

Private equity funds operate differently from traditional asset classes, necessitating a nuanced understanding of cash flow dynamics. Unlike traditional investments, private equity funds involve a series of capital contributions and distributions over many years. This results in unique cash flow considerations as explained by CalPERS, where the economic structure of private equity affects cash flow management and allocations. We have built a Private Equity Fund Cashflows Model (Investor Cashflows) template which includes waterfall distributions from GPs and LPs on a deal-by-deal investment schedule, along with the appropriate ratios (IRR, MOIC, TVPI, NAV, DPI).

Capital Contributions and Pace

The pacing model is essential for private equity investments, guiding the timing and size of capital calls. Typically, contributions peak in the early years, with distributions increasing as investments mature. Models like the Private Equity Pacing Model help investors plan future cash flows, ensuring alignment with investment stakes and overall strategy.

Cash Flow Models and Dynamics

Financial models are vital in predicting cash flow patterns. The Modeling the Cash Flow Dynamics research highlights how stochastic modeling applies to these cash flows, offering insights into the variability and unpredictability that accompany private equity investments. Such sophisticated cash flow models are especially useful in managing the complex dynamics of equity investment.

Achieving a Target Private Equity Allocation

Determining a forward-looking private equity allocation involves thorough planning and modeling. Commitment schedule modeling is a cornerstone of this process, enabling LPs to maintain desired allocations and manage associated cash flow as seen in cash flow forecasting examples.

Commitment Schedule Modeling

Creating effective commitment schedules involves understanding the cyclical nature of private equity cash flows. The variance in fund performance can significantly affect allocation targets, making it crucial to consider both current commitments and the future commitment size. Modeling aids in performing stress tests and adjusting expectations according to risk management and return profile objectives.

Optimizing Cash Flow Forecasting with Chronograph

Chronograph offers advanced tools for managing investor cashflows and cash flow forecasting, which are indispensable for LPs handling significant commitments. By leveraging Chronograph’s xConnect, LPs can integrate detailed cash flow models, making it easier to forecast capital calls and distributions, and align these with diversification strategies and investment objectives.

How xConnect Enhances Forecasting

By using xConnect, LPs can customize cash flow models to reflect their assumptions and methodologies. This level of integration allows for real-time updates and adjustments to forecast calls and distributions, ensuring optimal pacing and fund allocations. Chronograph’s capabilities exemplify how technology can enhance cash flow management and allocation efficiency.

Frequently Asked Questions

What is the role of a cash flow model in private equity?

A cash flow model helps investors and fund managers predict cash inflows and outflows, aiding in strategic planning for capital calls, distributions, and achieving target allocations.

How do LPs benefit from using commitment schedule modeling?

Commitment schedule modeling allows LPs to plan for future cash flow requirements, ensuring they can meet capital calls while maintaining desired private equity allocations.

How does Chronograph’s xConnect improve cash flow forecasting?

xConnect streamlines data integration for accurate cash flow forecasting, providing real-time updates and the ability to customize forecasts based on institutional methodologies and assumptions.

You can also look at our article How to Build a Private Equity Fund Cash Flow Model: Step-by-Step for Beginners