Understanding the intricacies of a SaaS financial model can be the difference between success and failure for a SaaS company. These models are critical for making informed decisions, forecasting future growth, and securing investment. For those that want a SaaS Financial model that has already been built ready to go, we have built a complete SaaS Financial Model Template that entrepreneurs can use to model out their business, including E-Commerce, B2B SaaS and Subscription-Based B2C SaaS.

Importance of SaaS Financial Models

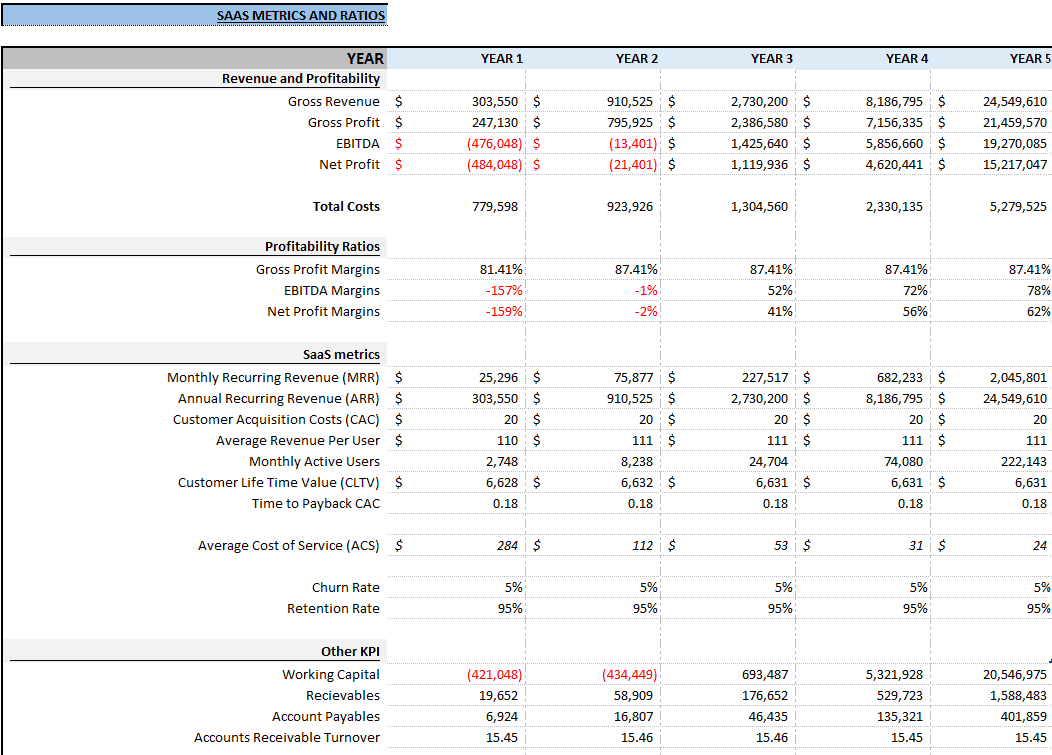

In the competitive landscape of SaaS, financial models are indispensable tools. Companies like SaaS Academy stress their importance for the following reasons:

Financial Planning and Analysis

SaaS financial models help businesses analyze their current financial positions and project future performance. By evaluating financial forecast models, companies can anticipate potential financial hurdles.

Pricing and Revenue Optimization

Detailed insights from models allow you to adjust your revenue model and better understand cost structure. This enables optimal pricing strategies, as outlined in The SaaS Financial Model You’ll Actually Use.

Investor Confidence

A comprehensive model demonstrates financial acumen, crucial for attracting investors. It shows potential backers your grasp on customer acquisition and retention, churn rate, and other metrics crucial to business performance.

Building a SaaS Financial Model

Developing a well-rounded SaaS financial model involves understanding various financial statements and projections.

Revenue Models and Projections

Your revenue model should detail how your business plans to generate income, whether through subscription charges or a low-touch sales model. How to Build a SaaS Financial Model offers insights into crafting accurate revenue projections.

Cost Structure Considerations

Understanding the unique cost structure in SaaS, such as server costs and customer acquisition, is pivotal. The SaaS Financial Model For Startups & SMBs underscores the need to anticipate these expenses.

Customer Metrics

Churn rate and customer acquisition costs are vital metrics. Modeling these can aid in reducing churn and optimizing spend on customer acquisition and retention initiatives.

Utilizing Spreadsheet Forecasts

Tools like Microsoft Excel enable precise spreadsheet forecasts. Templates make the process manageable even for those without advanced spreadsheet skills.

Step-by-Step Model Development

- Start with Historical Data: Analyze past performance to inform future forecasts.

- Create Financial Breakdowns: Segment data to spotlight areas of opportunity and risk.

- Use Projections for Growth: Implement models that simulate various growth scenarios.

Common Financial Models in SaaS

Several specific types of financial models are beneficial for SaaS businesses:

Recurring Revenue Models

Focus on predicting monthly and annual recurring revenue streams. SaaS Financial Modeling for Startups discusses how to effectively utilize these models.

Cash Flow Forecasts

Understand the cash inflow and outflow to better manage operational finances. A SaaS Financial Plan 2.0 helps in maintaining fiscal health.

FAQs on SaaS Financial Models

Q1: What is a SaaS financial forecast model?

A SaaS financial forecast model projects a company’s future financial performance based on historical data and assumptions.

Q2: How can I reduce customer churn in my SaaS company?

Focus on enhancing customer retention through personalized engagement and robust support systems, which are highlighted in successful models.

Q3: What tools are best for building a SaaS financial model?

Tools like Microsoft Excel or Google Sheets are commonly used for model creation, supported by templates and guides such as those from SaaS Academy.

You can also see our article How to Build a SaaS Financial Model: Step-by-Step for Beginners