Podcasting is rapidly becoming one of the most consumed forms of media, drawing millions of listeners globally. Whether your goal is to launch a podcast as a passion project or to create a profitable business, comprehending the financial intricacies of your podcast channel is vital for sustained success. Building a robust financial model for your podcast will guide you in forecasting potential revenue, tracking expenses, and strategizing for growth.

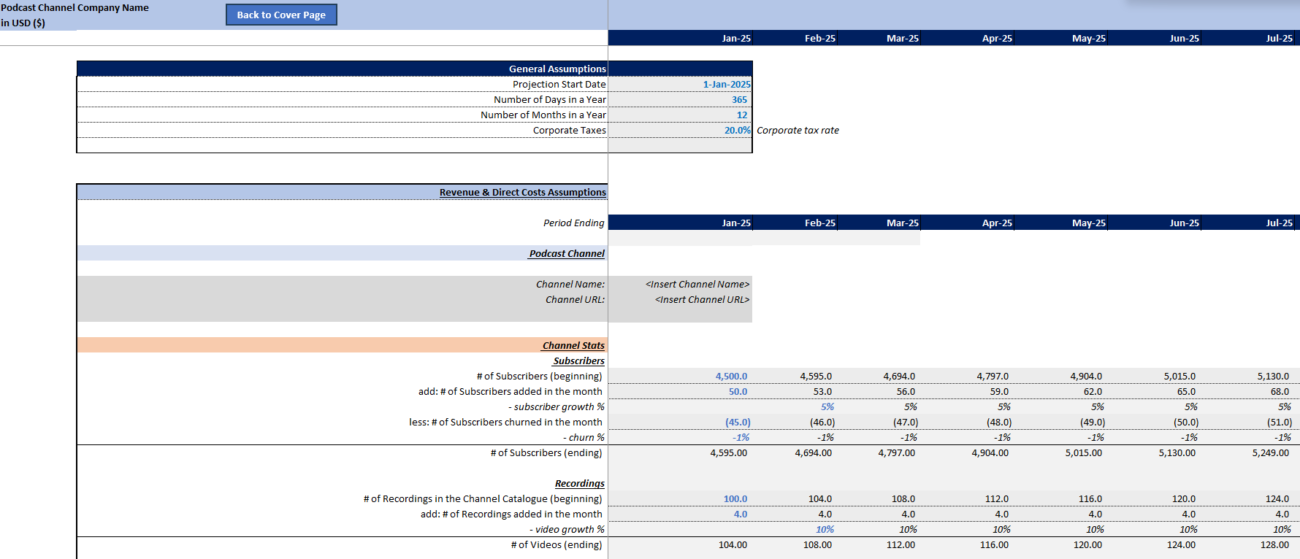

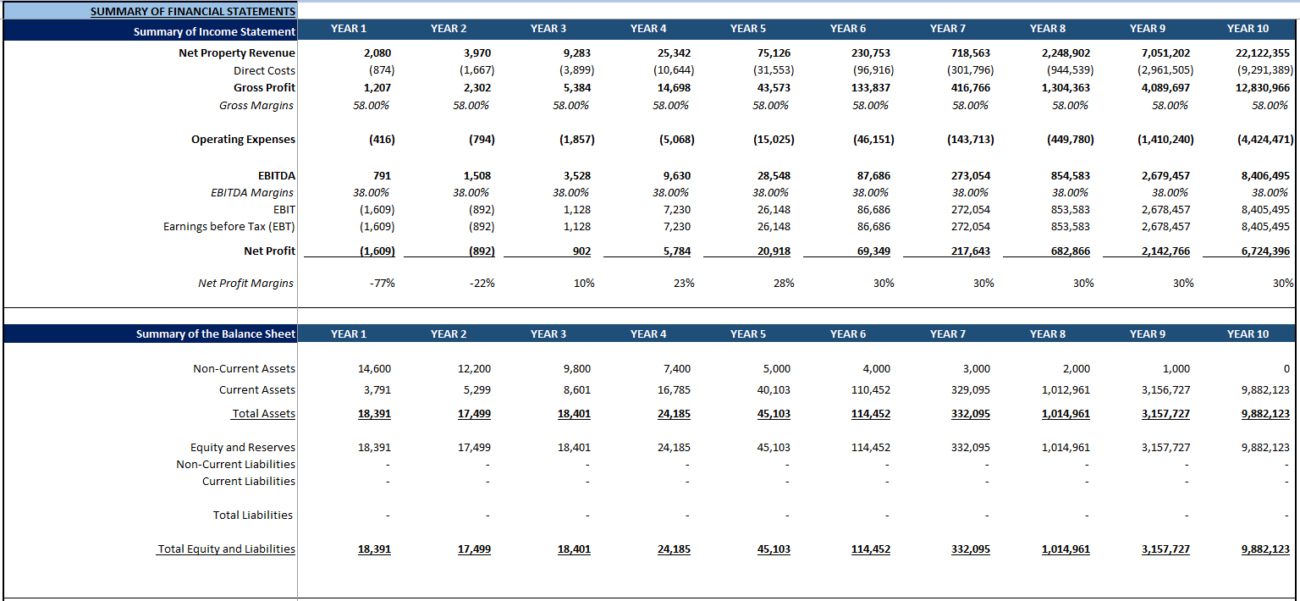

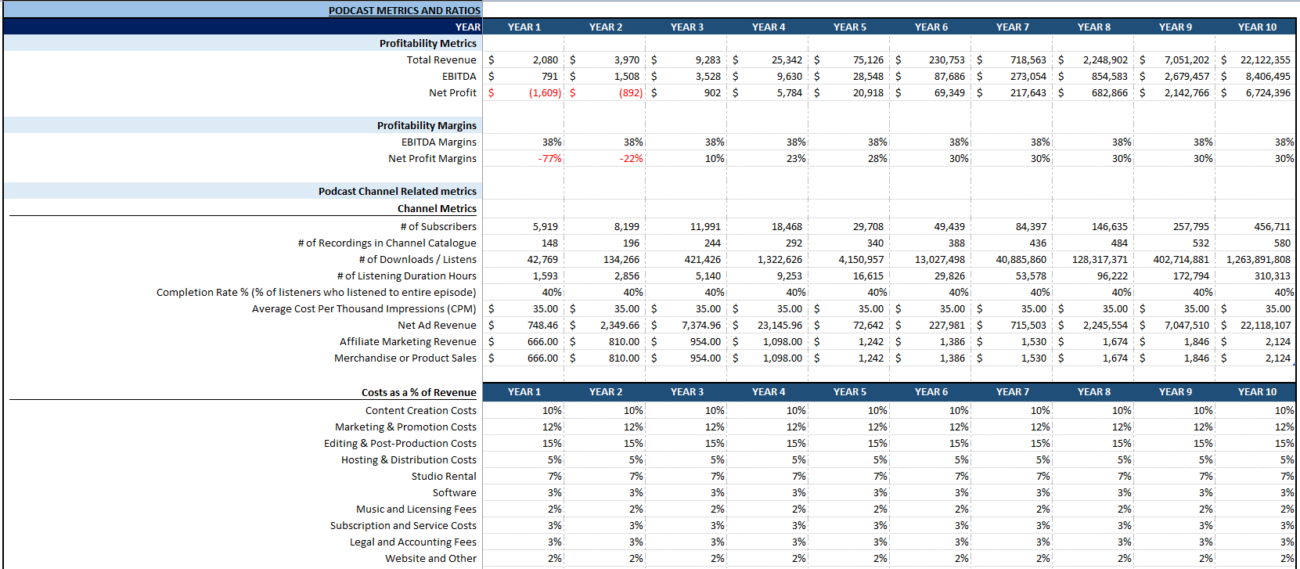

This guide will walk you through creating a financial model for your podcast channel, covering essential components such as revenue streams, expenses, key assumptions, and profitability projections. We have also built a Podcast Channel Financial Model Template for Founders and Entrepreneurs to use. Just input your assumptions, and our model does the rest! It’s a complete 3-way financial model with an Income Statement, Balance Sheet, Cash Flow Statement, Podcast channel specific metrics, ratios, and more.

Why a Financial Model Is Essential for Your Podcast

A solid financial model is indispensable for any podcaster looking to establish a sustainable endeavor. It empowers you to make informed, data-driven decisions regarding:

- Budgeting: Assessing production, marketing, and other expenses.

- Revenue Forecasting: Understanding potential earnings from sponsorships, advertising, or merchandise sales.

- Profitability: Determining if your podcast will be lucrative long-term and finding ways to optimize revenue.

- Attracting Investors or Partners: A robust financial model is crucial for showcasing growth potential and returns to sponsors or investors.

Step 1: Identify Your Revenue Streams

Podcast monetization can occur through various channels. The first task in crafting a financial model is to recognize the different monetization options. Here are common revenue streams for podcasters:

Advertising and Sponsorships

Advertising and sponsorships are primary income sources for many podcasts. Advertisers compensate you for promoting their products if your podcast has a large audience. Revenue from ads typically relies on the number of episode downloads.

- Cost Per Thousand Impressions (CPM): This is a prevalent payment method where sponsors pay based on audience size. Rates can range widely, depending on your niche and audience quality.

- Flat Fees: Some sponsors might offer a fixed fee for specific episodes.

Explore excellent examples of podcasts maximizing this revenue stream, such as The Financial Modelling Podcast.

Listener Donations and Crowdfunding

If your audience is loyal and engaged, consider soliciting listener contributions. Platforms like Patreon provide a method for supporters to donate in exchange for perks such as bonus content or early access.

Affiliate Marketing

This revenue stream involves advertising products and earning a commission per purchase via referral links. Some hosts include affiliate links in their show notes, boosting revenue effortlessly.

Merchandising

Selling branded merchandise can be a lucrative revenue stream if your podcast enjoys a strong, dedicated audience. Items such as shirts or mugs can bolster income significantly.

Premium Content or Memberships

Delivering exclusive content via paid subscriptions can boost revenue. Platforms like Supercast allow podcasters to monetize additional content, enhancing listening experiences.

Live Shows and Events

With audience growth, hosting live events becomes feasible and profitable. Charge for tickets, merchandise, or fan interactions.

Licensing and Syndication

High-quality podcasts with broad audiences may license content to media outlets, ensuring compensation for syndicated content.

Learn how to create an income stream like this with the inspiring example of Financial Modelling Podcast Live, a podcast that merges industry-leading advice with innovative technology insights.

Step 2: Outline Key Assumptions

Before diving into revenue and expense predictions, identify critical assumptions driving your model. Key assumptions include:

Audience Size and Growth

Forecast audience growth to predict earning potential accurately. For example, if you commence with 1,000 downloads per episode with a projected monthly growth rate, you can estimate audience evolution and increased monetization avenues.

CPM Rate

Your CPM influences advertising revenue predictions. Rates fluctuate based on niche and audience characteristics, necessitating a realistic estimation drawn from industry data.

Sponsorship Deals

Establish anticipated monthly sponsorships and corresponding revenues, adjusting for audience growth to refine sponsorship value.

Listener Donations

Predict listener donation growth aligned with audience expansion to enhance this revenue stream in your financial model.

Merchandise Sales

Forecast merchandise sales, considering audience size and marketing effectiveness, to estimate this income reliably.

Podcasters seeking fiscal savvy can refer to The Financial Modeler’s Corner for insights into financial strategies and key assumptions.

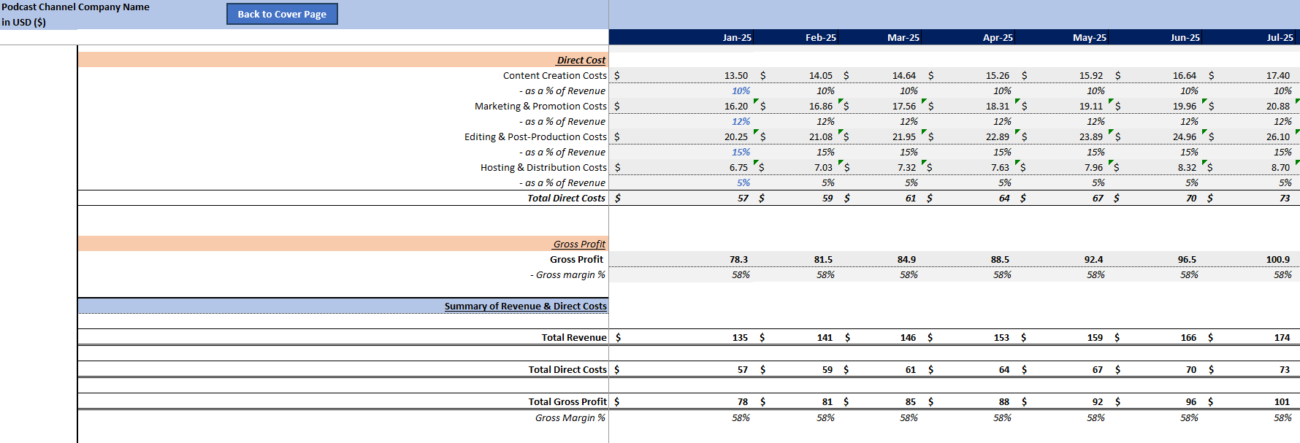

Step 3: Estimate Your Costs

Estimating costs paints a clear picture of podcast profitability. Key cost categories include:

Fixed Costs

These remain stable, irrespective of production scale. Examples include:

- Hosting Fees: Expenses for hosting platforms like Libsyn or Buzzsprout.

- Website Maintenance: Costs linked to websites promoting your podcast.

- Production Tools: Software subscriptions and audio equipment.

Variable Costs

These fluctuate with production scale. Examples include:

- Marketing: Expenses for social media campaigns and paid ads.

- Freelancer/Employee Costs: Salaries paid to staff or contractors.

- Guest Appearances: Fees for guest speaker appearances.

Content Creation Costs

Expenses associated with episode production, including:

- Equipment: Microphones, headphones, and other sound gear.

- Editing Services: Costs related to outsourced editing tasks.

- Music Licensing: Licensing fees for music or sound effects.

Enhance fiscal understanding with Listen to the Financial Modelling Podcast for deeper dives into financial management processes.

Step 4: Build Your Financial Projections

Combine revenue streams and expenses for detailed financial projections, critical for tracking podcast progress.

Revenue Projections

Estimate revenues by multiplying audience size with CPM rates and anticipated sponsorships. Aggregate these with donations and affiliate income for comprehensive projections.

Explore comprehensive podcasts like Best Financial Modelling Podcasts for an understanding of revenue projection strategies.

Expense Projections

Estimate fixed and variable costs monthly to determine total anticipated expenses. Evaluate how expenses correlate with revenue to fine-tune projections.

Profit and Loss Statement

Compile revenue and expenses into a Profit & Loss Statement for insight into profitability.

| Category | Amount (Monthly) |

|---|---|

| Revenue | |

| Advertising & Sponsorships | $2,000 |

| Listener Donations | $500 |

| Affiliate Revenue | $300 |

| Merchandise Sales | $200 |

| Total Revenue | $3,000 |

| Expenses | |

| Hosting Fees | $50 |

| Marketing | $200 |

| Freelancer Costs | $1,000 |

| Production Costs | $300 |

| Total Expenses | $1,550 |

| Net Profit | $1,450 |

Cash Flow Forecast

Construct a cash flow forecast to map cash movement—crucial for budgeting.

Final Thoughts

Developing a financial model for your podcast might seem daunting but is essential for ensuring success and sustainability. By constructing thorough revenue streams, discerning costs judiciously, and approaching projections analytically, your podcast will be strategically positioned for growth.

In a constantly evolving industry, regularly update your financial model to acclimate to new data and opportunities. Structure your podcast for success with insights from fiscal exemplars like the Financial Modeller’s Corner on Spotify.

Frequently Asked Questions

Why is a financial model important for my podcast?

A financial model helps forecast revenue and expenses, guiding decisions on budget allocation, profitability, and growth strategies, thus establishing a strong business foundation.

How can I increase podcast monetization?

Enhancing monetization involves diversifying revenue streams including advertising, donations, merchandise, premium content, and exploring innovative marketing strategies.

How often should I update my financial model?

Update your financial model regularly to reflect current data, adjusting for shifts in audience size, revenue opportunities, and expense fluctuations.

Maximize your podcast’s financial potential by integrating insights and strategies articulated in engaging platforms such as 21 Best Finance Podcasts Professionals Listen to.