Starting a barbershop business can be both an exciting and rewarding venture. However, just like any other business, success is dependent on strong financial planning. Developing a detailed financial model helps you understand your projected revenue, expenses, and profits, allowing you to make informed decisions for growth and sustainability.

In this article, we will break down the process of building a barbershop financial model from the ground up. We’ll cover key components, including how to forecast your revenue, understand your expenses, calculate profits, and make adjustments to improve your financial health. We have also built a ready-to-go Barbershop Financial Model Template for Founders looking for an easy-to-use Financial model template with Balance Sheet, Income Statement and Cash Flow.

What is a Financial Model?

A financial model is a mathematical representation of your barbershop’s financial performance. It outlines how different business operations, such as sales, costs, and investments, interact to produce profits or losses. A financial model serves as a tool for understanding how your business will perform over time, helping you manage cash flow, secure funding, and make key business decisions. For instance, the Barber Shop Business Plan Financial Model from eFinancialModels provides key financial indicators that show sales and profitability performance.

Why is Building a Financial Model Important?

Having a financial model is critical for several reasons:

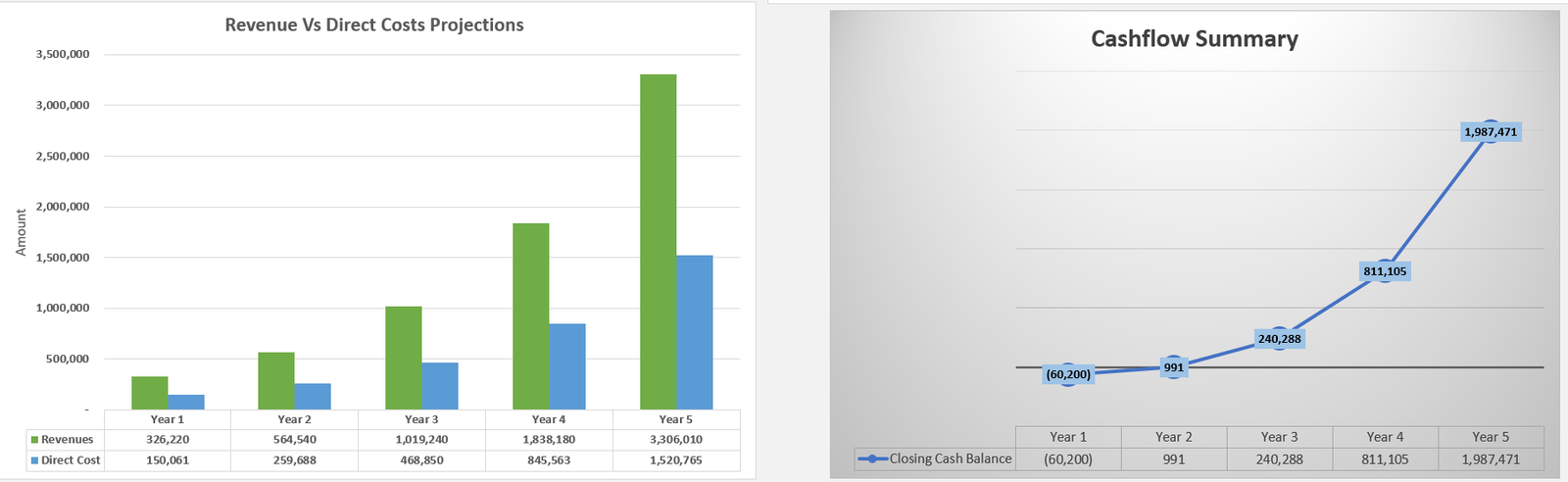

- Forecasting Revenue: Understanding how much money you can expect to generate helps you plan for growth and avoid surprises. Solid financial models, like those offered by PlanBuildr, help you estimate profits and identify trends by calculating projected income from services and products.

- Managing Costs: A financial model helps you anticipate and plan for recurring costs like rent, salaries, and utilities, ensuring you are never caught off guard by unexpected expenses.

- Attracting Investors: If you’re seeking loans or investors, having a detailed financial model will demonstrate that you’ve thoroughly planned for your business’s success. Investors look for solid projections to evaluate potential profitability.

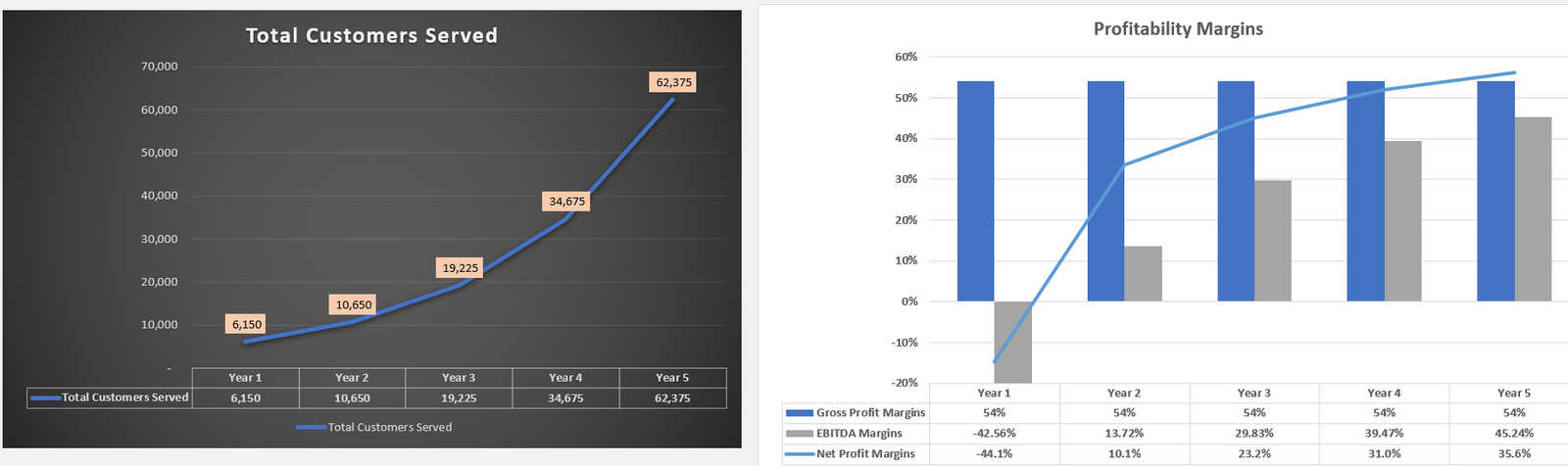

- Improving Profitability: Models like the Barber Shop Financial Model allow you to evaluate your cost structure, pricing, and profit margins. Adjusting these elements can significantly increase your barbershop’s profitability.

Step 1: Understand Your Business and Market

Before diving into numbers, it’s essential to grasp your barbershop’s operations and market. This includes knowing your target audience, service types, and competitive landscape.

Key Questions to Answer:

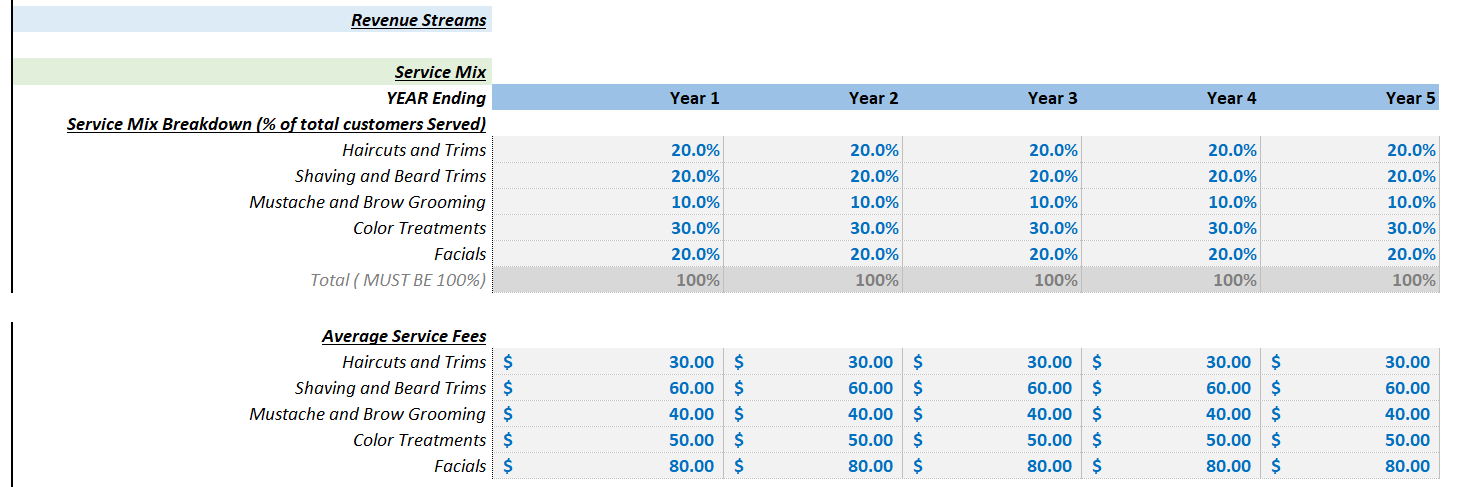

- What services does your barbershop offer? Understanding whether you provide only haircuts or additional services like shaves or beard trims will influence your financial model.

- What are your prices? Setting price points helps calculate revenue potential.

- How many barbers will work in your shop? Employee numbers directly impact revenue and payroll expenses.

- What is the average foot traffic? Estimating daily customer volume is crucial.

- Who are your competitors? Understanding competition aids in pricing services competitively and assessing market share.

Step 2: Create a Revenue Forecast

Projecting revenue is vital. It involves estimating how much money your barbershop will earn from core services and additional sources, such as product sales.

Breakdown of Revenue Streams:

- Service Revenue: Primary income source includes haircuts, beard trims, shaves, and other grooming services. To calculate this, estimate daily client numbers, average service price, and the number of working days.

- Retail Revenue: Selling products like shampoos or styling gels is an additional income source. Estimate monthly sales to calculate this revenue.

- Other Revenue: Consider additional streams like renting out chairs or offering premium services.

Use a template like the Salon / Barbershop Financial Model Template to customize pro forma financial statements quickly.

Step 3: Estimate Your Fixed and Variable Expenses

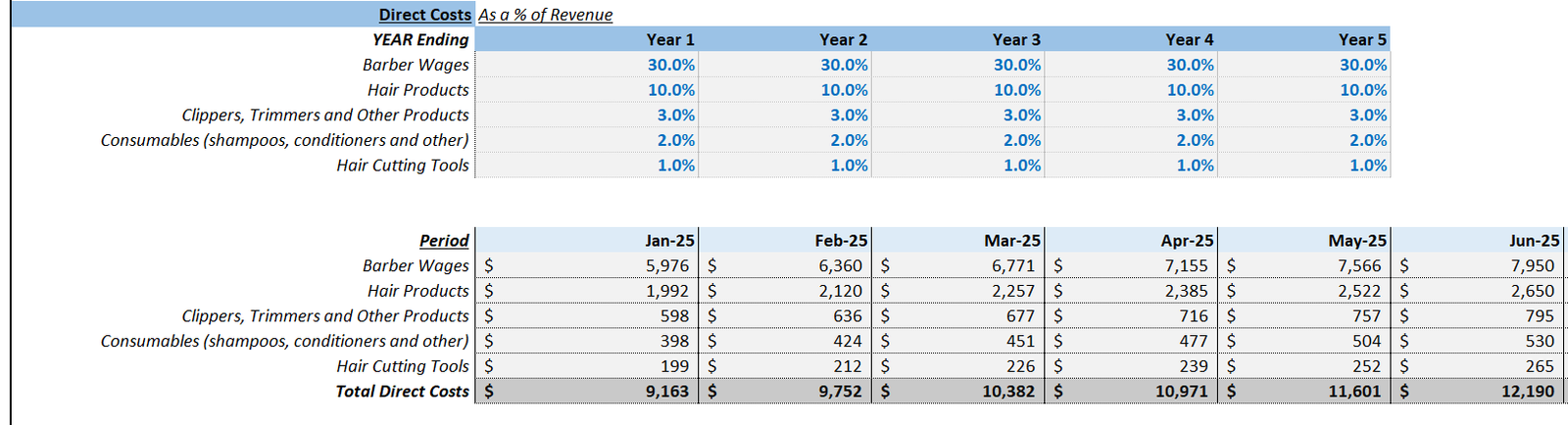

Expenses in a barbershop include fixed and variable costs.

- Fixed Expenses: These remain constant, such as rent, utilities, and salaried employees.

- Variable Expenses: These fluctuate, like inventory, depending on the business activity level.

Fixed Expenses to Consider:

- Rent: Lease or rent costs for your space.

- Salaries: Wages for barbers and front desk staff.

- Insurance: Business, liability, and employee health coverages.

- Utilities: Ongoing service costs for water and electricity.

- Marketing: Regular advertising and promotional expenses.

- Software/Subscriptions: Costs for scheduling, payment processing, or accounting software.

To accurately forecast expenses, consider tools like the Barber Shop Financial Plan from Upmetrics.

Example Expense Forecast Template:

| Expense Category | Monthly Cost | Description |

|---|---|---|

| Rent | $2,500 | Lease payment for commercial space |

| Salaries | $5,000 | Salaries for 3 barbers, 1 front desk |

| Utilities | $300 | Water, electricity, internet |

| Insurance | $150 | Business insurance premiums |

| Marketing | $500 | Online ads, flyers, promotions |

| Supplies | $1,000 | Razors, clippers, shampoos, etc. |

| Total Expenses | $9,450 |

Step 4: Project Profit and Loss (P&L)

With forecasted revenue and expenses, calculate potential profits.

Profit Calculation:

- Gross Profit: Subtract variable costs (e.g., supplies) from total revenue.

- Net Profit: Subtract fixed costs (e.g., rent, utilities) from gross profit.

For more detailed guidance, refer to the Barbershop Financial Plan Excel.

Step 5: Plan for Cash Flow

Cash flow, the lifeblood of your business, requires careful planning, especially during revenue fluctuations. Create a cash flow statement monthly to see when your business will need additional liquidity.

Step 6: Create Financial Projections for Growth

With a basic financial model, project future growth by considering possible changes like staffing, service expansion, or increased marketing. Essential guidelines on creating projections are offered by resources such as How to Create Financial Projections for a Barbershop.

Final Thoughts!

Building a financial model for your barbershop can seem daunting but is crucial for informed decision-making and profitability maximization. Forecast revenue, estimate expenses, track cash flow, and plan for growth to manage finances efficiently and support long-term success. A well-structured financial model is an invaluable tool for guiding your barbershop towards a prosperous future.

Frequently Asked Questions

What is a Barber Shop Financial Model?

A Barber Shop Financial Model is a mathematical framework outlining revenue, costs, and profitability, helping manage finances effectively. It includes revenue forecasts, expenses, and cash flow projections.

How does a Cash Flow Projection help my business?

A Cash Flow Projection predicts monthly cash movements, enabling budgeting for expenses and anticipating potential cash shortages, ensuring smooth operations and helping secure funding.

Why are Financial Projections important for a Barbershop?

Financial Projections help understand potential business growth, attract investors, manage costs, and forecast revenue, essential for strategic decision-making.