Building a financial model for a car wash business might seem daunting, yet with the correct tools and approach, it offers valuable insights into financial health and potential. This guide will help entrepreneurs, investors, and managers make informed decisions. We have also built a read-to-go Car Wash Financial Model Template for car wash founders to use to model out their business with a 3 way Income Statement, Balance Sheet and Cash Flow Statement.

Understand the Car Wash Business Model

Before delving into financial modeling for a car wash, understanding its operation is key. Car washes generally fit into:

- Automated (Self-Service or Tunnel): Customers drive through systems for washing and drying.

- Full-Service or Detail: Offers personalized services like hand washing and waxing.

Our focus will be on an automated car wash model.

Gather Key Assumptions

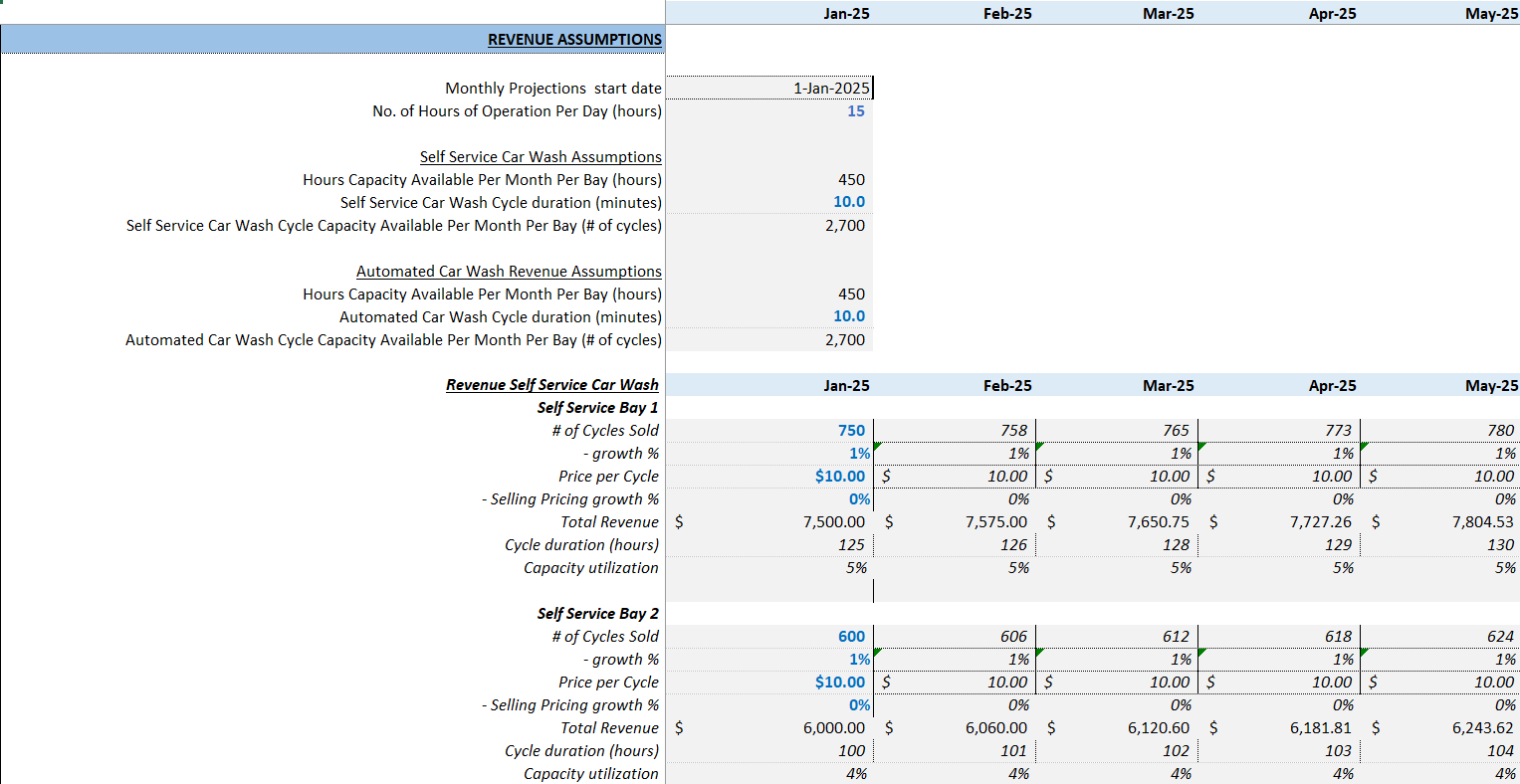

Building a comprehensive financial model requires identifying key assumptions, which form the foundation of your revenue forecasts and cost estimates. Important assumptions include:

- Pricing Structure: Includes base prices and optional services.

- Customer Traffic: Estimated number of cars washed regularly.

- Operating Hours: Daily and weekly operational hours.

- Costs: Considers labor, maintenance, and consumables.

- Capital Expenditures (CapEx): Initial investments for equipment and property.

- Depreciation: Depreciable fixed assets like machines and buildings.

These assumptions are vital for building projections and understanding financial outlooks.

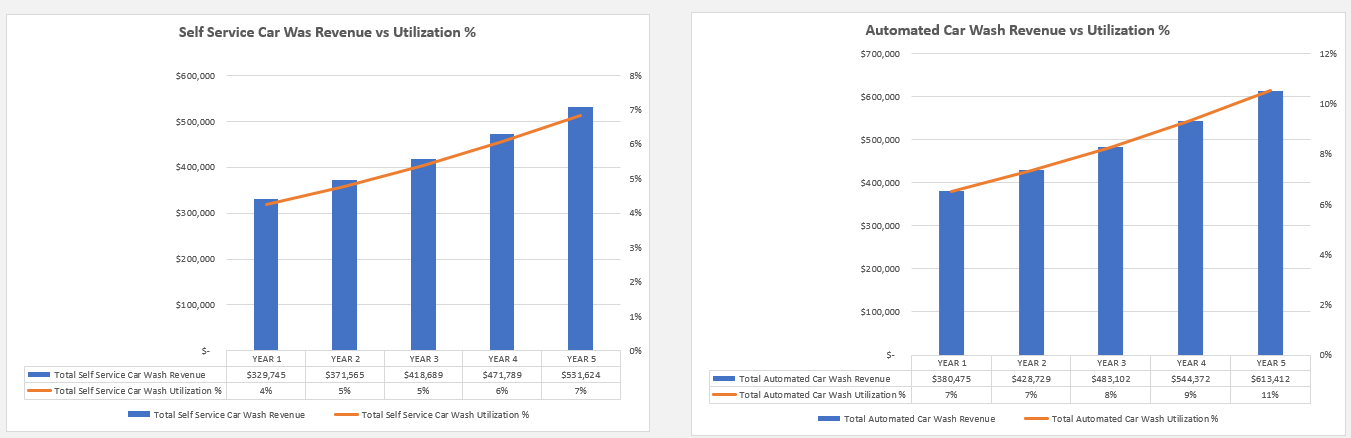

Revenue Forecast

The revenue forecast is critical. Revenue will come from various car wash services and offerings.

Estimate Number of Cars Washed

Consider location and competition. For example, if your setup handles 100 cars daily, expect 3,000 monthly.

Determine Average Price per Wash

Calculating the average revenue per wash involves various services and their prices. Suppose you offer:

- Exterior wash = $12

- Full-service = $25

- Detailing = $50

With 60% opting for basic, 30% for full-service, and 10% for detailing, the weighted average price is $19.10.

Calculate Monthly Revenue

Multiply the 3,000 cars monthly by $19.10 for a total revenue of $57,300.

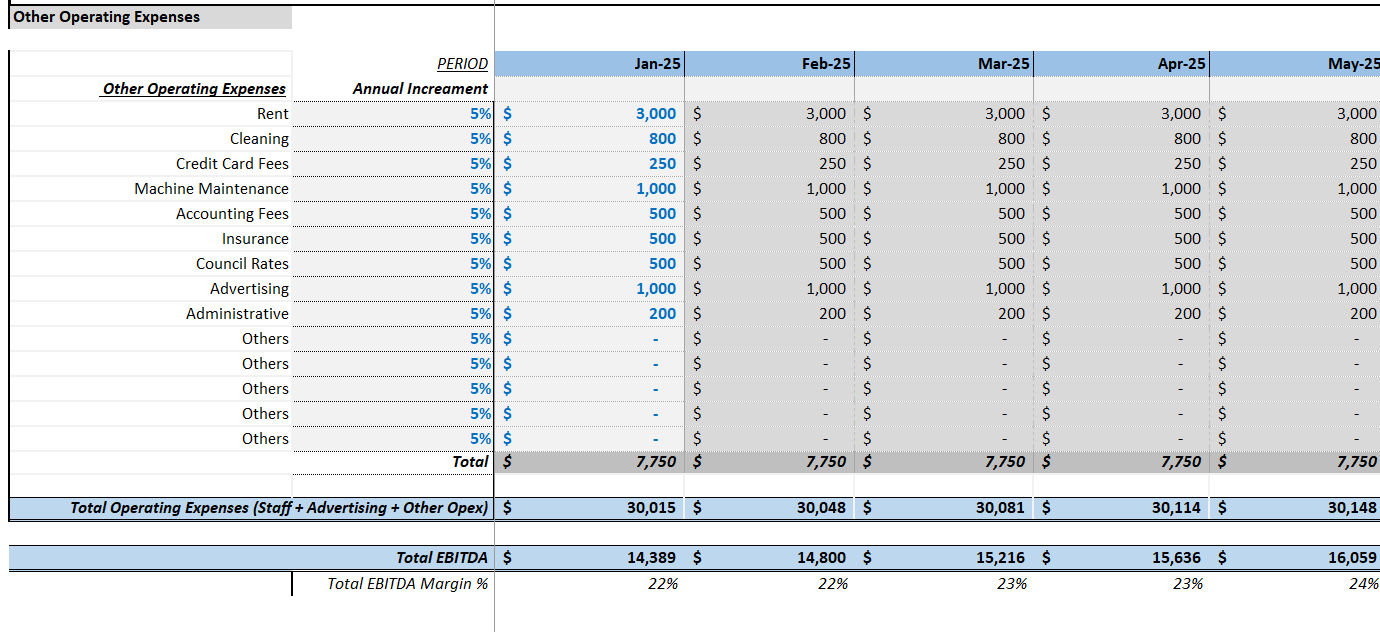

Estimate Costs

Car wash businesses have fixed and variable costs.

Fixed Costs:

- Rent/Lease Payments: Cost for space utilization.

- Salaries: Managerial wages.

- Insurance: Covers liabilities and worker safety.

- Depreciation: Of equipment and buildings.

Variable Costs:

- Labor Costs: For attendants and cleaners.

- Supplies: Includes cleaning products and utilities.

- Maintenance: For equipment upkeep.

- Advertising: Marketing to attract customers.

Example of a Monthly Cost Breakdown:

- Rent: $5,000

- Salaries (fixed): $4,000

- Insurance: $1,000

- Supplies (variable): $2 per car

- Labor (variable): $3 per car

- Utilities (variable): $1 per car

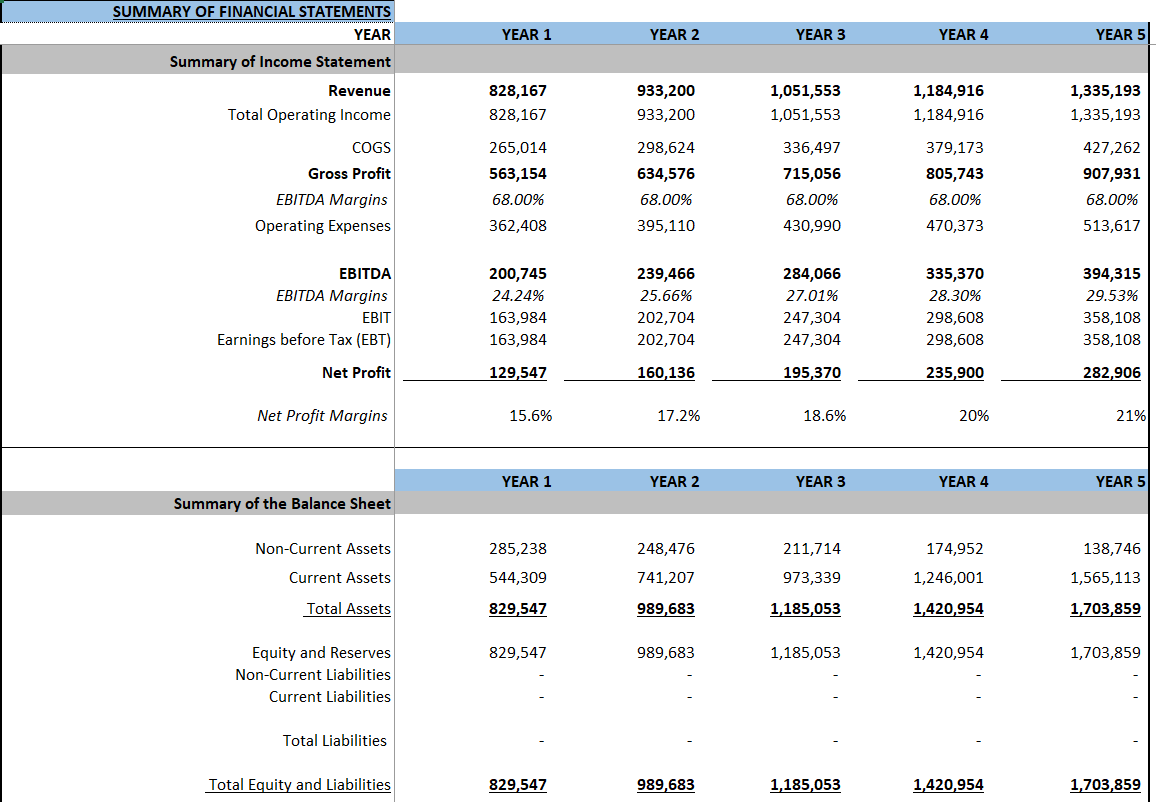

Build the Profit and Loss (P&L) Statement

The P&L Statement reviews the business’s income versus expenses, estimating profitability.

Revenue:

Already determined as $57,300 monthly.

Cost of Goods Sold (COGS):

- Supplies: $2 × 3,000 = $6,000

- Labor: $3 × 3,000 = $9,000

- Utilities: $1 × 3,000 = $3,000

COGS totals $18,000.

Gross Profit:

Gross Profit = Revenue – COGS = $57,300 – $18,000 = $39,300

Operating Expenses:

Include rent, salaries, insurance, and depreciation. Total = $11,000.

Net Profit:

Net Profit = Gross Profit – Operating Expenses = $28,300.

Cash Flow Projections

Understanding cash movements requires detailed cash flow projections, focusing on operating, investing, and financing activities.

Build a Financial Model in Excel

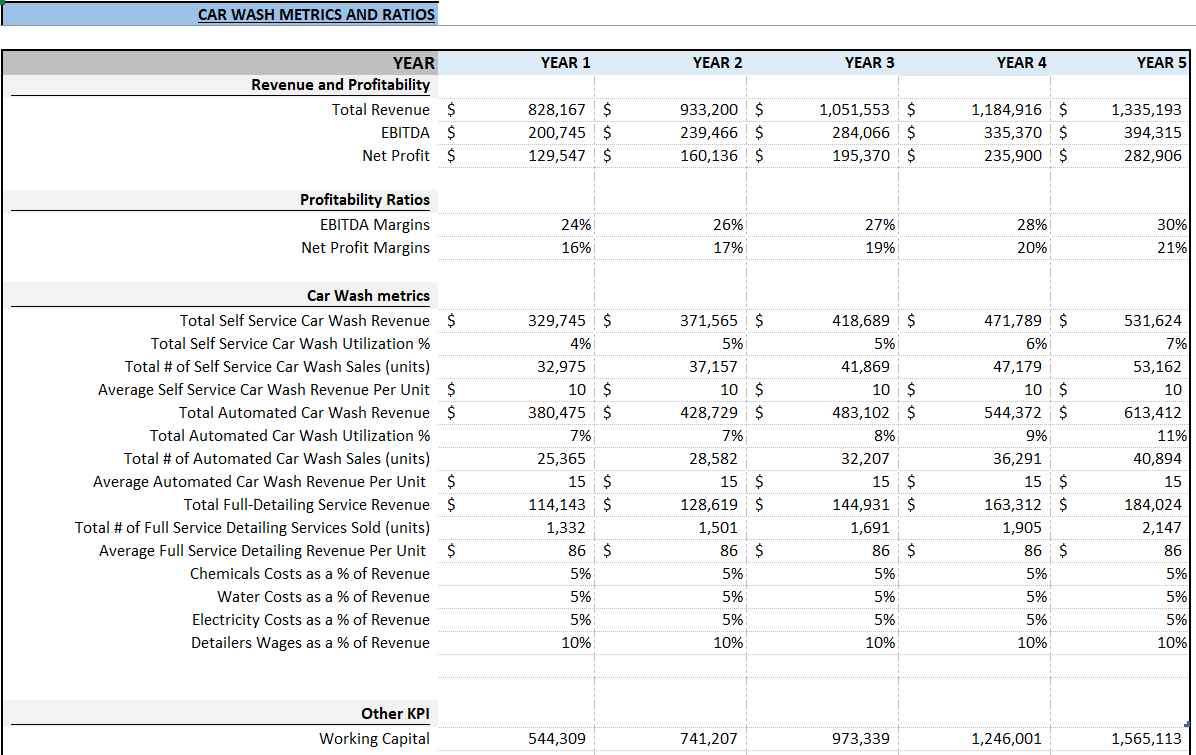

Compile your projections using a spreadsheet template, including:

- Revenue Projections

- Cost Projections

- Profit and Loss Statement

- Cash Flow Statement

- Balance Sheet

Frequently Asked Questions

What is a financial model?

A financial model simulates a business’s financial performance. It includes revenue projections, expenses, and cash flows.

Why is cost-per-car important?

Tracking cost-per-car helps manage variable costs and improves budget control, impacting profitability.

How do changes in membership growth affect forecasts?

Member increases often lead to higher revenue forecasts, needing adjustments in projections to reflect this.

Creating a financial model for your car wash is essential for revenue forecasting and cost management. Templates and tools ensure comprehensiveness, enabling insightful financial analysis.