Building a financial model for a mobile game app is a critical step for game developers, entrepreneurs, or investors seeking to assess the feasibility, profitability, and long-term success of their mobile gaming project. A well-crafted financial model provides insights into potential revenue, costs, and the overall financial health of the game, helping you make data-driven decisions. Whether starting from scratch or refining an existing concept, this step-by-step guide will help you create a solid financial model for your mobile game app. We have also built a ready-to-go Games Mobile Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their business.

Why Is a Financial Model Important for a Mobile Game App?

A financial model for a mobile game app is essentially a blueprint that outlines how your game will generate revenue, incur costs, and achieve profitability over time. It is a valuable tool for:

- Forecasting financial performance: Knowing how much money your game can make and when it will start being profitable.

- Attracting investors or partners: A strong financial model shows potential investors or collaborators that you understand the game’s economics.

- Managing cash flow: Ensuring you have enough funds to cover development, marketing, and operational expenses.

- Making strategic decisions: Using data from the model to determine pricing, monetization strategy, marketing budget, and even game design.

Key Components of a Mobile Game App Financial Model

Before diving into the steps of creating a financial model, let’s first look at the key components that need to be included:

- Revenue Streams:

- In-App Purchases (IAP): This includes revenue generated from players buying virtual goods within the game.

- Ad Revenue: Money earned from displaying ads such as banner ads or video ads.

- Subscription Models: Recurring revenue from players subscribing for premium content.

- Paid Downloads: Revenue from users purchasing the game upfront.

- Sponsorships and Partnerships: Revenue from brand collaborations.

2. Costs and Expenses:

- Development Costs: Includes design, programming, and ongoing development expenses.

- Marketing and User Acquisition: Costs for acquiring users through advertising or social media.

- Operational Costs: Hosting fees, server maintenance, and customer support.

- App Store Fees: A percentage of your revenue paid to app stores.

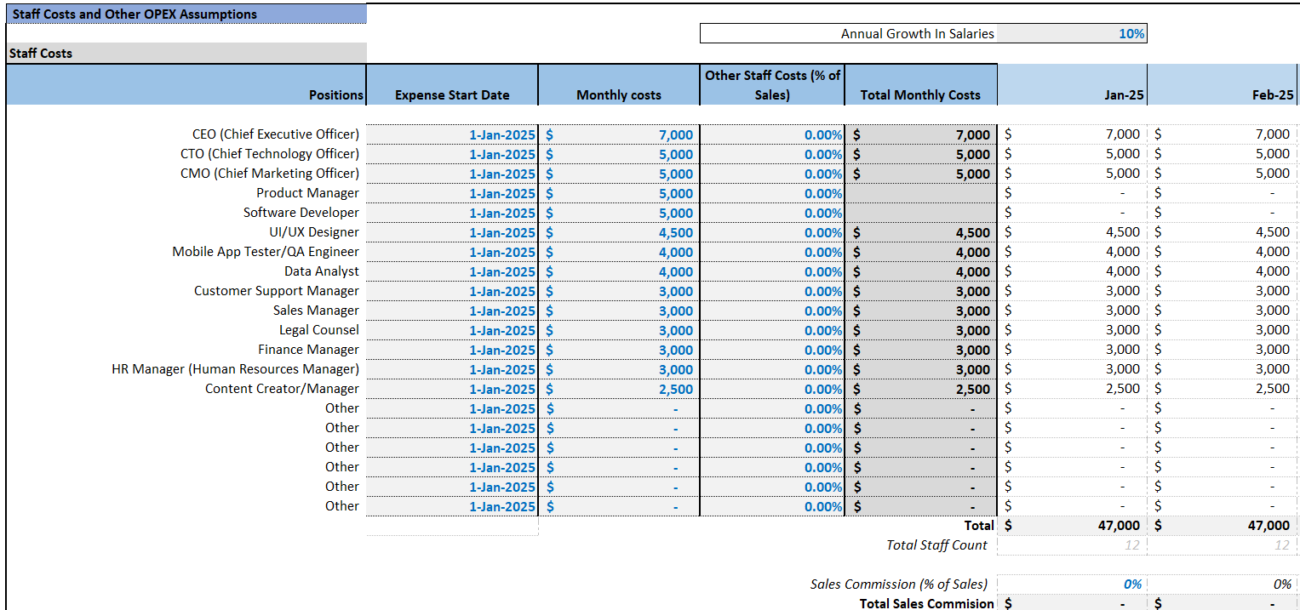

- Team Salaries and Labor Costs: Payments to developers and other team members.

- Legal and Accounting: Any necessary consultancy fees.

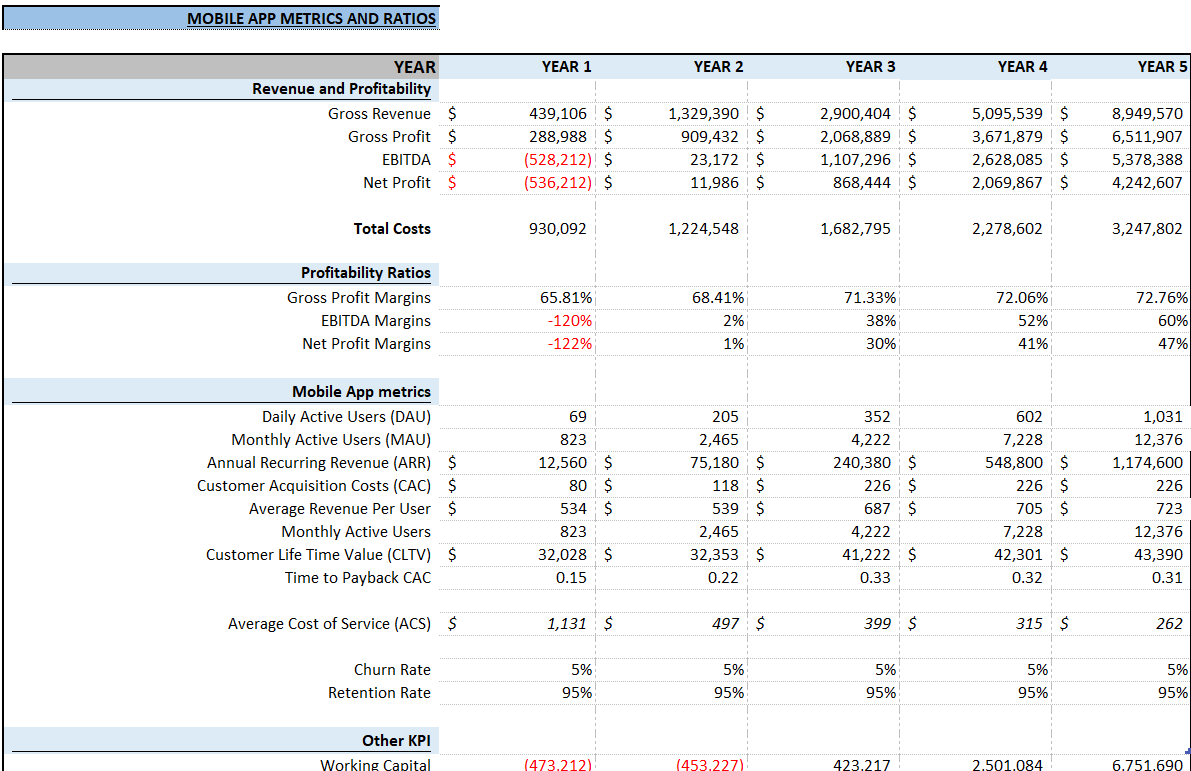

3. Key Performance Indicators (KPIs):

- Monthly Active Users (MAU) and Daily Active Users (DAU): User engagement metrics.

- Customer Acquisition Cost (CAC): The cost to acquire a new user.

- Lifetime Value (LTV): The average revenue from a player over their lifetime.

- Retention Rate: The percentage of returning players.

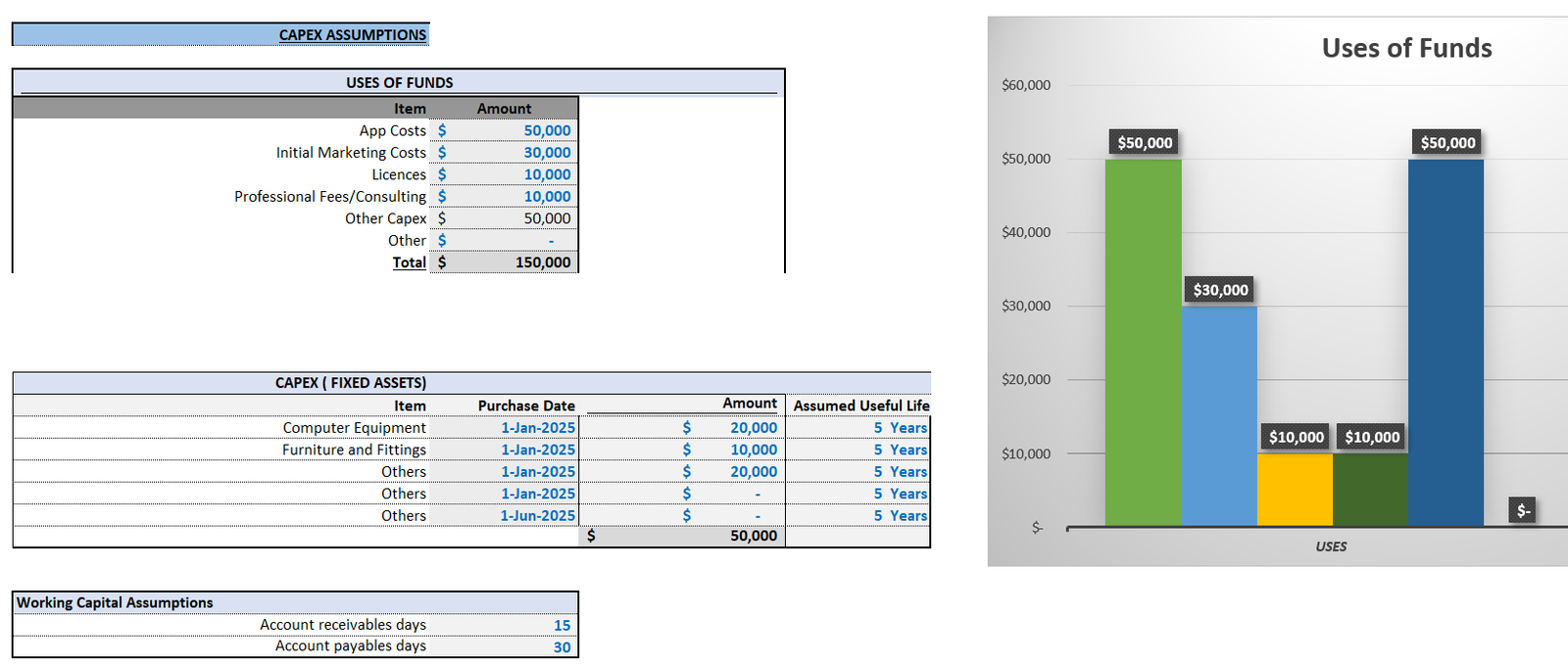

4. Capital Expenditures (CapEx): Investments in assets like game development software.

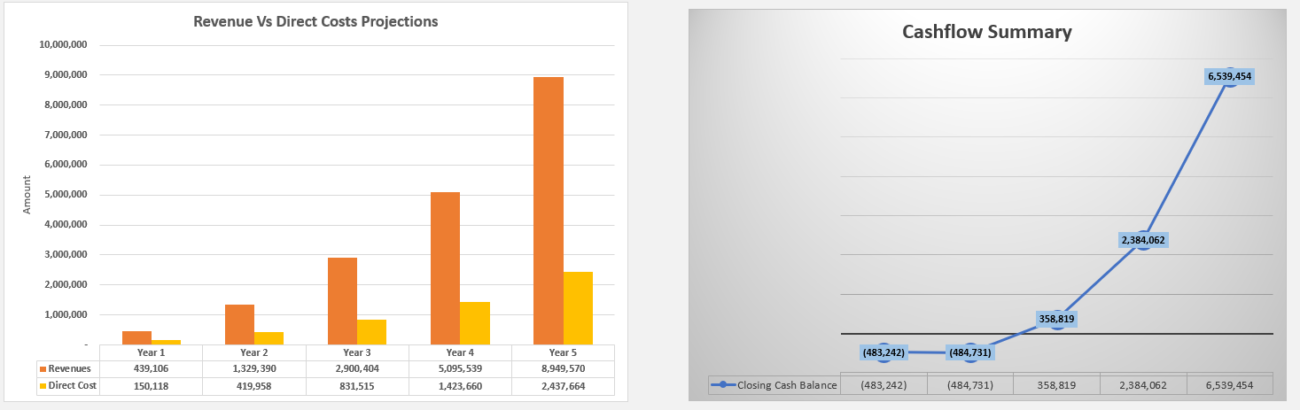

5. Cash Flow Projections: Ensure sufficient liquidity to cover operational costs.

Step-by-Step Guide to Building a Financial Model for a Mobile Game App

Step 1: Define the Game’s Objectives and Time Frame

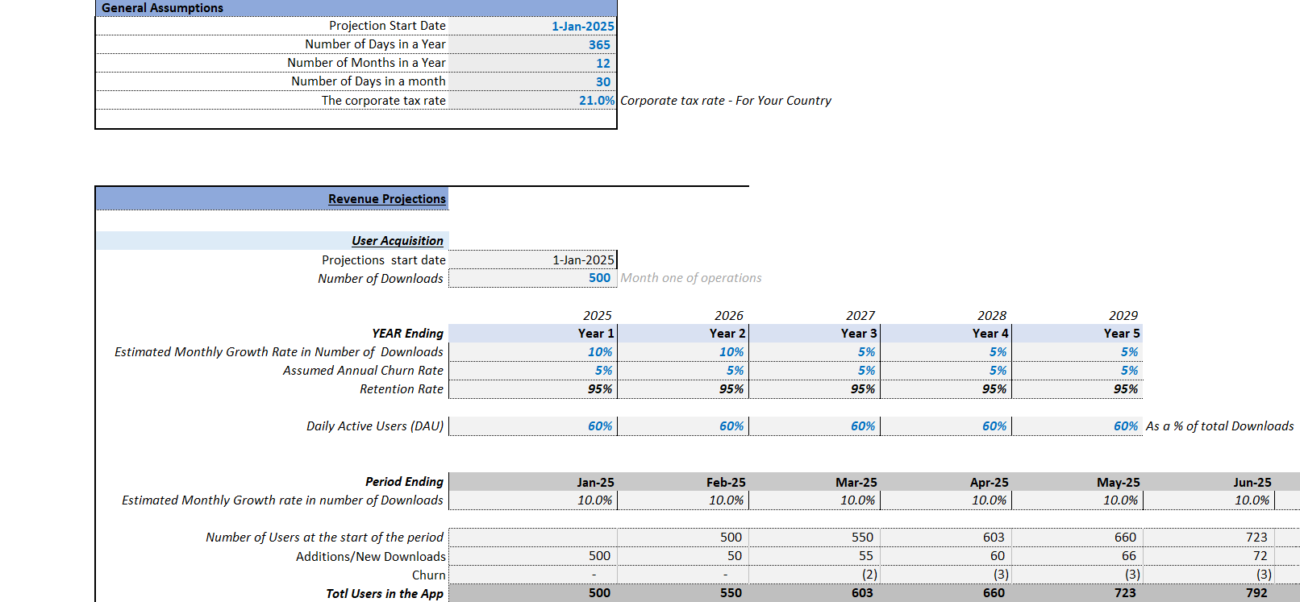

Start by defining the objectives of the game and the time frame you plan to model. The purpose and scope will guide your assumptions.

- Time Frame: Most models are projected over 3-5 years.

- Objectives: Decide if you’re aiming for immediate profitability or early-stage growth.

Step 2: Estimate Development Costs

Development costs vary by complexity and team size. Consider salaries, technology (e.g., licensing for Unity or Unreal Engine), and any outsourcing expenses.

Learn about mobile game financial models with the Mobile Game Business Models resource by ironSource.

Step 3: Project Revenue Streams

Estimate potential revenue from in-app purchases, ad revenue, subscriptions, and paid downloads. Consider a freemium model and plan for different monetization strategies.

Use the Mobile Game Financial Model Template from Poindexter to customize pro forma financial statements easily.

Step 4: Forecast Operational and Marketing Costs

Include marketing/user acquisition costs, operational expenses, and app store fees. Use insights from the Financial Model for Mobile App: 3 Monetization Models to refine your strategy.

Step 5: Cash Flow Forecasts

Create monthly cash flow projections to track inflows and outflows of cash, enabling you to manage liquidity effectively.

Step 6: Calculate Key Metrics and KPIs

Determine KPIs such as Lifetime Value, MAU, DAU, Retention Rate, and CAC. This will help evaluate the game’s success potential.

Step 7: Test Different Scenarios

Adjust assumptions in your model to understand financial impacts under different scenarios. This helps prepare for uncertainties.

Step 8: Refine the Model Regularly

Regular updates to the model with real-world data help track actual performance against projections, ensuring long-term profitability.

Frequently Asked Questions

1. Why is a mobile game financial model necessary?

A financial model helps forecast profitability, manage cash flow, and attract investors by providing a detailed economic blueprint.

2. What key metrics are used to assess a mobile game’s success?

Key metrics include Monthly Active Users (MAU), Customer Acquisition Cost (CAC), Lifetime Value (LTV), and Retention Rate.

3. How often should a financial model be updated?

Regular updates with real-world data and refined assumptions are recommended to track and adjust financial performance.

Crafting a financial model for your mobile game app involves estimating development costs, projecting revenue, forecasting expenses, and evaluating performance metrics. By following this guide, you can build a robust model to make informed decisions and manage financial health. Linking vital information through resources like How To Build A Rock-Solid Mobile App Financial Model enhances your understanding and implements best practices for startup financial modeling.