Operating expenses are a critical component of any business’s financial structure. These costs play a vital role in determining a company’s profitability and efficiency. In this article, we explore the operating expense definition, common components, and how they differ from capital expenditures.

What Are Operating Expenses?

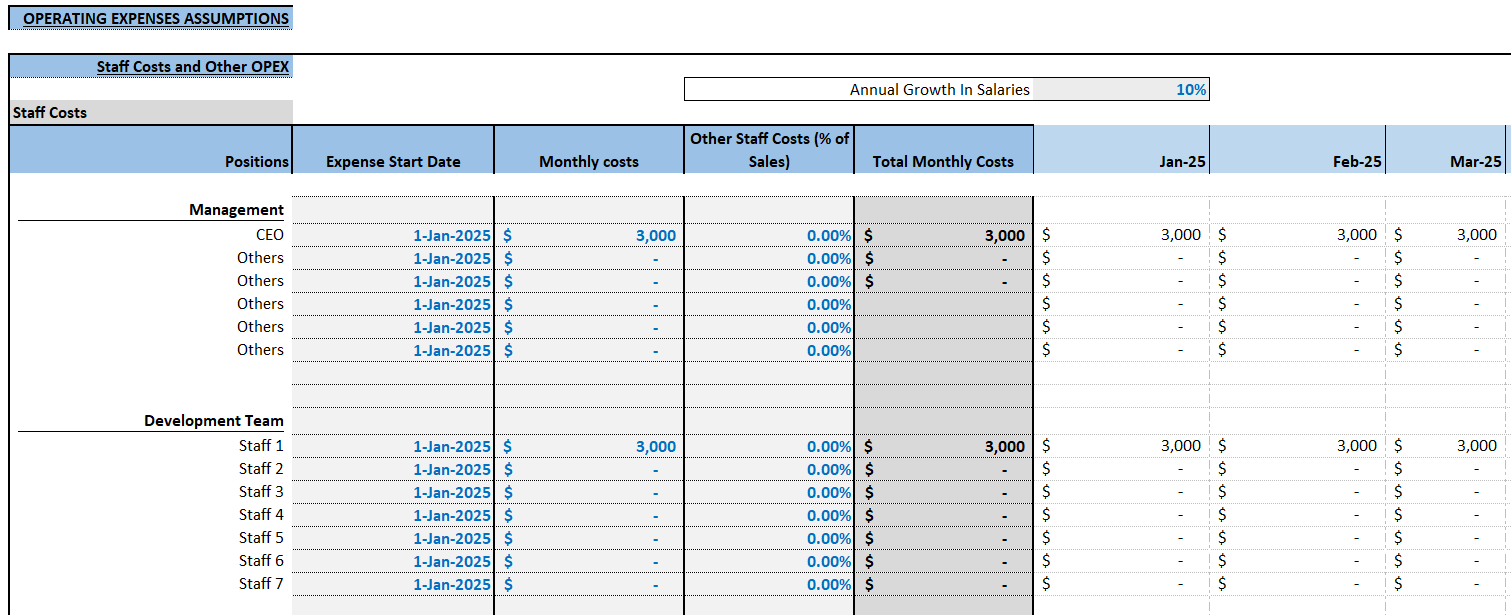

Operating expenses, often shortened to OPEX, refer to the ongoing costs that a business incurs during its regular business operations. Unlike capital expenditures, which relate to long-term investments, operating expenses cover the day-to-day running of the company. These may include rent, utilities, and payroll expenses.

Key Components of Operating Expenses

Indirect Costs

Indirect costs are expenses not directly attributable to a specific business product or service. Examples include general and administrative expenses, marketing charges, and other overhead costs.

Cost of Goods Sold

While sometimes confused with operating expenses, cost of goods sold (COGS) pertains to the direct costs related to producing goods sold by a company. COGS is an essential element in calculating a company’s gross margin.

Tax Deductions

Businesses can often claim a tax deduction for their operating expenses, as these are necessary for the business functioning. This reduces the taxable income and provides financial relief.

Distinguishing Operating Expenses from Capital Expenditures

While operating expenses refer to short-term costs required to run the business, capital expenditures involve spending on long-term assets like buildings or machinery. These assets, unlike operating expenses, are capitalized and depreciated over time.

Managing Operating Expenses

Effective management of operating expenses involves tracking these costs on a profit and loss statement. Identifying high-expenditure areas such as payroll expenses and property rent can help businesses optimize and minimize unnecessary spending.

Frequently Asked Questions

What is the difference between operating expenses and capital expenditures?

Operating expenses cover day-to-day costs, whereas capital expenditures are long-term investments in the business’s future.

Can operating expenses be a tax deduction?

Yes, businesses often claim operating expenses as a tax deduction because these costs are essential for business operations.

Why are indirect costs considered operating expenses?

Indirect costs are not directly linked to production but are necessary for overall business operations, hence classified as operating expenses.