Building a financial model for a vacation rentals hotel is a critical task for anyone looking to invest in or manage such a business. Whether launching a boutique hotel, investing in vacation homes, or managing a rental property, a financial model offers insights into revenue expectations, cost management, and profitability. It ensures the property generates sufficient income to cover costs and provides valuable information for attracting investors or securing financing. We have also built a ready-to-go Vacation Rentals Hotel Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their business.

Why is a Financial Model Important for a Vacation Rentals Hotel?

A vacation rentals hotel financial model is crucial for several reasons:

- Revenue Forecasting: Predict the revenue from rental income and other services.

- Cost Management: Estimate operational costs, including staffing, utilities, maintenance, and marketing.

- Profitability Assessment: Determine if the vacation rental property is likely to be profitable.

- Investment and Funding: A detailed model can help attract investors or secure loans by showcasing the financial potential of the property.

- Risk Mitigation: The model allows testing different scenarios to understand risks and plan accordingly.

Key Components of a Vacation Rentals Hotel Financial Model

Before diving into the steps to build the model, let’s first examine the key components of a vacation rental hotel financial model:

Revenue Streams

- Rental Income: The primary source of income from renting rooms, suites, or vacation homes.

- Additional Services: Income from extras like housekeeping, restaurant/bar services, parking, and events.

- Ancillary Revenue: Income from amenities such as airport transfers or spa treatments.

- Seasonal Adjustments: Income fluctuations due to peak seasons, holidays, and events.

Costs and Expenses

- Fixed Costs: Costs that remain constant, such as property taxes and insurance.

- Variable Costs: Expenses that vary, like utilities and housekeeping.

- Operational Costs: Costs related to staffing and guest services.

Capital Expenditures (CapEx)

Large, one-time costs for property improvements or major upgrades.

Financing and Funding

- Debt Financing: Loans or mortgages used for property purchase or renovation.

- Equity Financing: Investments from shareholders or partners.

Step-by-Step Guide to Building a Vacation Rentals Hotel Financial Model

Step 1: Define the Scope of Your Vacation Rentals Hotel

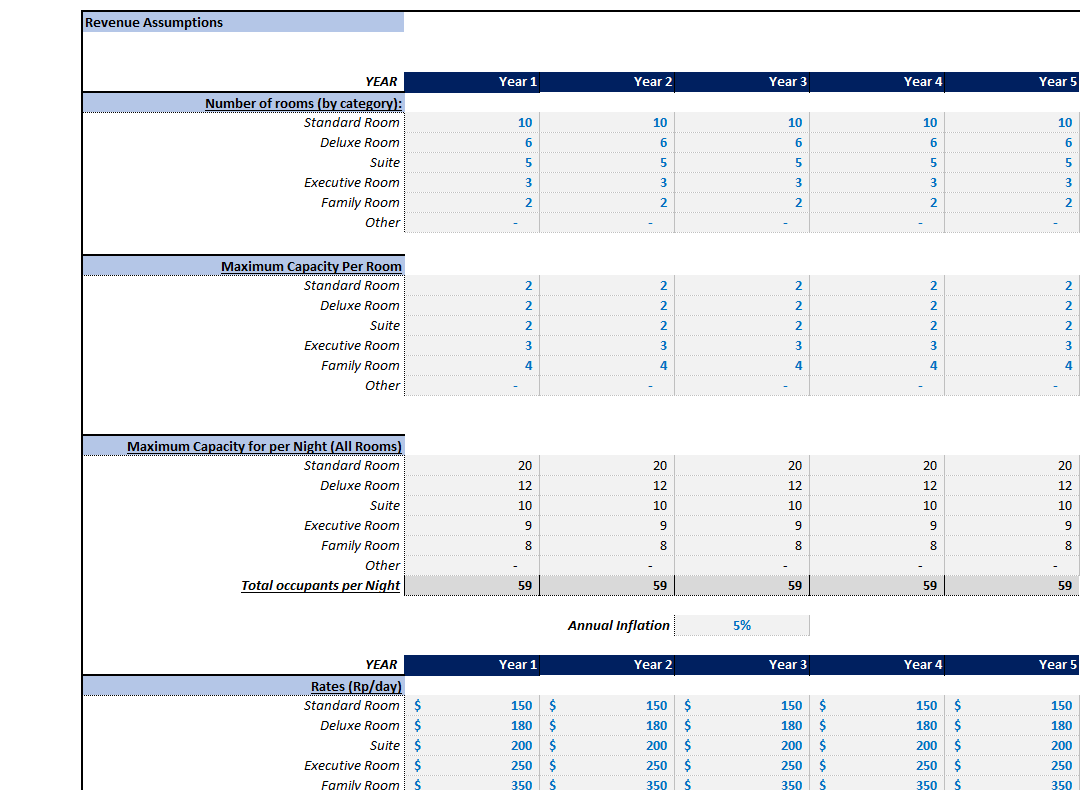

Define your property’s specifics, including type, location, size, and seasonality, to influence revenue projections, staffing, and cost estimates. For example, see this Hotel Financial Model to learn more about inputs like room capacity and rates.

Step 2: Estimate Revenue

Estimate revenue from rental income and additional services. For guidance, check out the Vacation Rentals Hotel Financial Model Excel Template.

- Rental Income: Calculate using ADR and occupancy rate.

- Additional Services: Include revenue from services like housekeeping.

- Ancillary Revenue: Forecast income from amenities like parking.

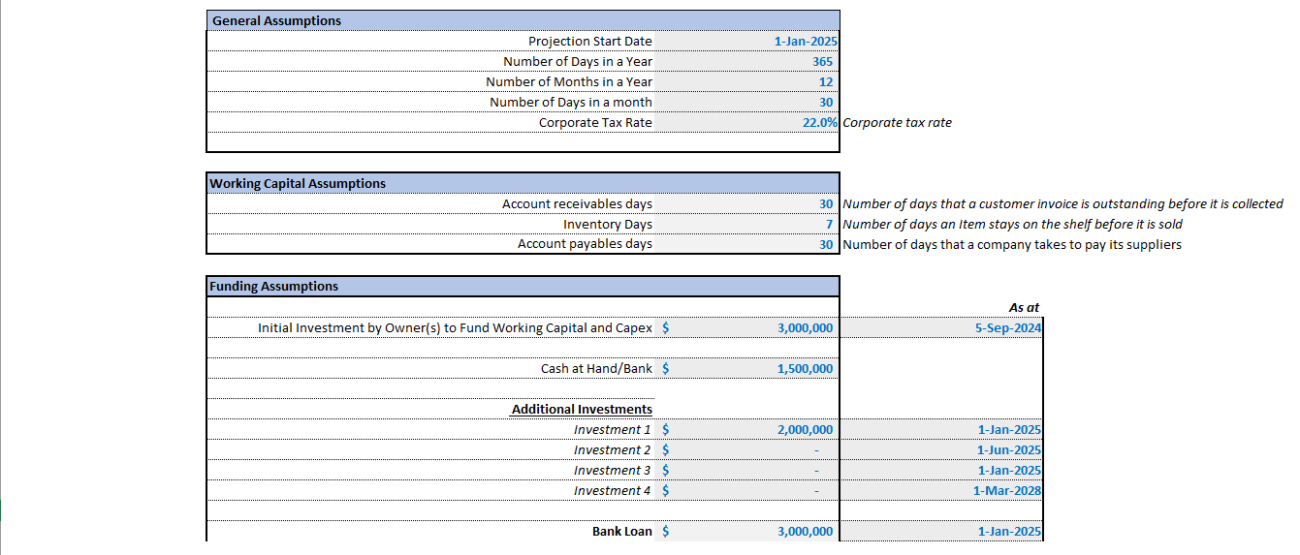

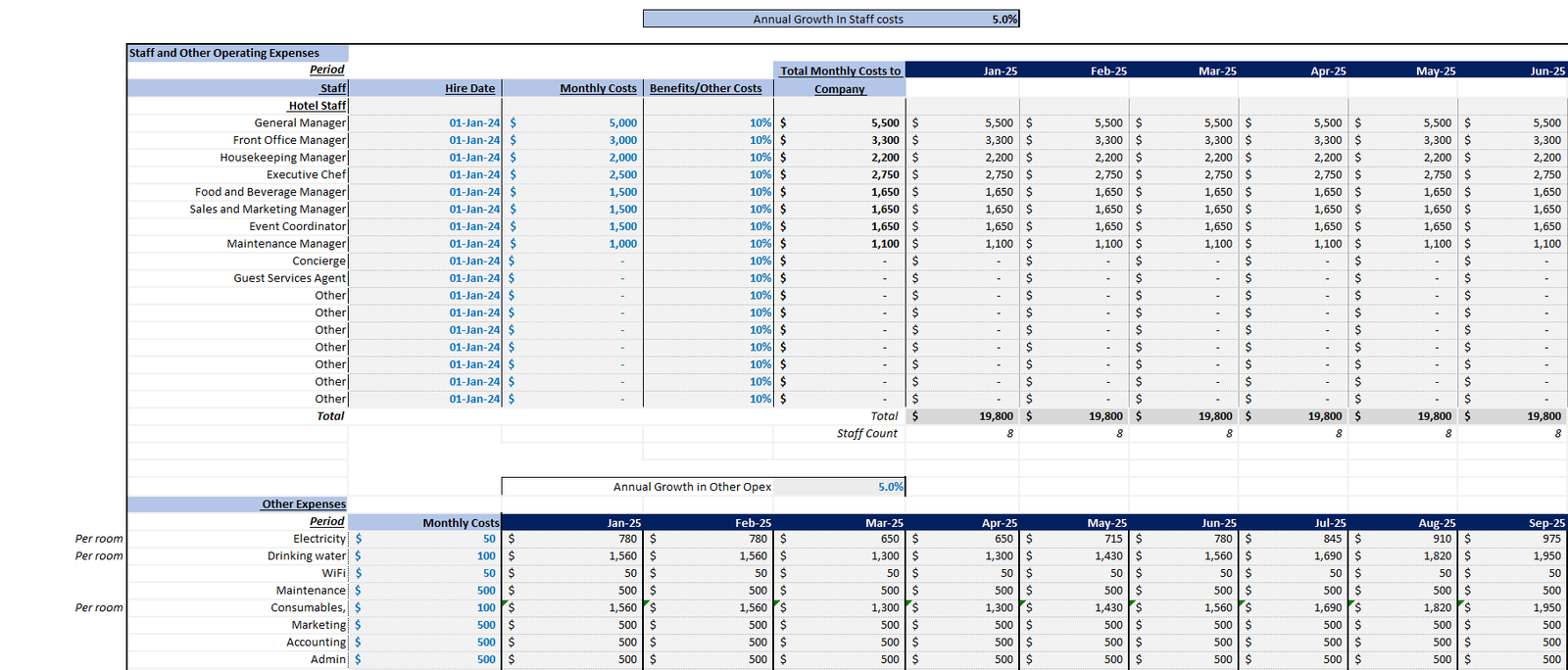

Step 3: Estimate Costs and Expenses

Estimate both fixed and variable costs. Refer to Financial Model Templates in Hospitality for detailed templates.

- Fixed Costs: Property taxes, insurance, debt repayments.

- Variable Costs: Staffing, utilities, cleaning, marketing.

- CapEx: New equipment or renovations.

Step 4: Forecast Cash Flow

Forecast cash inflows and outflows to manage cash effectively. Tools like the Short-Term Rental Financial Model can aid in this process.

Step 5: Calculate Key Performance Indicators (KPIs)

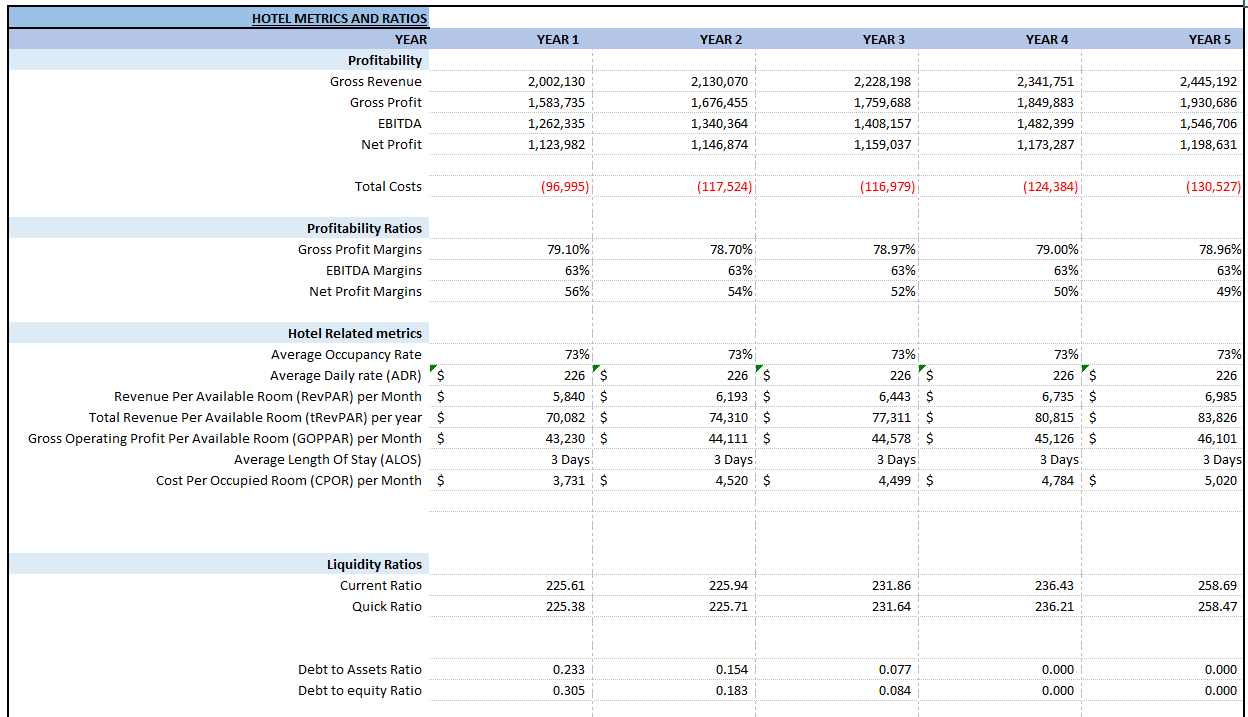

Calculate KPIs like occupancy rate, ADR, RevPAR, and GOPPAR to evaluate financial health.

Step 6: Sensitivity Analysis and Scenario Testing

Conduct sensitivity analyses to test variables and plan for diverse market conditions. Explore different options with the Real Estate Models for Hotel Properties.

Frequently Asked Questions

Q1: What is the significance of the average daily rate?

Average Daily Rate (ADR) helps determine pricing strategies by tracking how much revenue a property earns per booked room each day.

Q2: How do scenario testing and sensitivity analysis benefit hotel management?

They allow management to prepare for various market conditions and potential risks, optimizing decision-making.

Q3: Why are capital expenditures considered separately in financial modeling?

CapEx are large, one-time expenses impacting long-term value, requiring separate accounting from regular operational costs.

Creating a financial model for a vacation rentals hotel is essential for understanding profitability, managing costs, and ensuring long-term success. By estimating revenue, tracking expenses, and calculating KPIs, businesses can assess financial health and make informed data-driven decisions.