Building a digital marketing agency is an exciting venture, but it requires strong financial planning. Understanding how to build a financial model will allow you to forecast revenue, manage costs, plan for the future, and make informed decisions. A digital marketing agency’s financial model provides insight into its overall profitability, cash flow, and potential growth. We have also built a ready-to-go Digital Marketing Agency Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their business.

Why is a Financial Model Important for a Digital Marketing Agency?

A financial model for a digital marketing agency is essential because it helps you:

- Estimate Revenue: Predict income based on client contracts, services offered, and pricing.

- Manage Costs: Identify fixed and variable costs involved in running the agency, from salaries to software subscriptions.

- Measure Profitability: Evaluate whether your business is profitable and forecast when you will break even.

- Plan for Growth: Assess scalability potential and sustainability in the long run.

- Attract Investors or Loans: Provide investors and lenders with a financial model to evaluate risk and understand your strategy.

- Cash Flow Management: Forecast cash inflows and outflows to cover expenses and avoid liquidity crises.

A sound financial model provides direction, helping you navigate the complex world of digital marketing and grow your agency effectively.

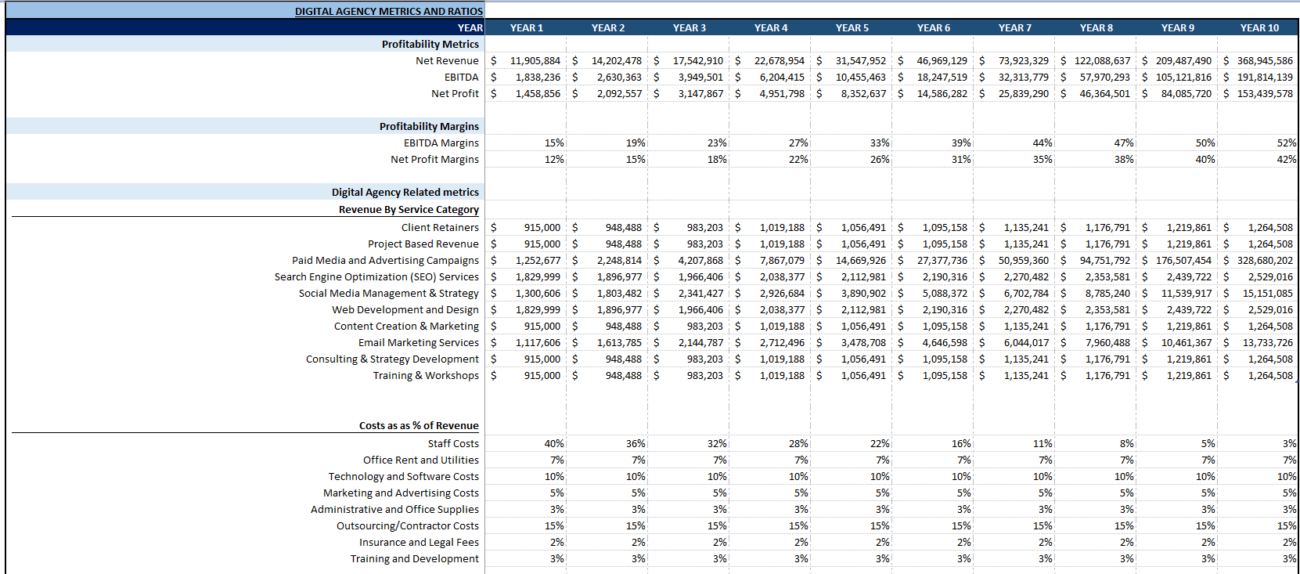

Key Components of a Digital Marketing Agency Financial Model

A financial model for a digital marketing agency typically consists of several key components:

Revenue Streams

- Client Fees: The primary revenue source for any digital marketing agency is the fees charged to clients for services like SEO and paid advertising.

- Retainer Contracts: Fixed monthly payments for ongoing services, providing predictable revenue.

- Project-Based Fees: One-off services like website launches or advertising campaigns.

- Commission-Based Fees: Charges based on ad spend or performance-based results.

Costs and Expenses

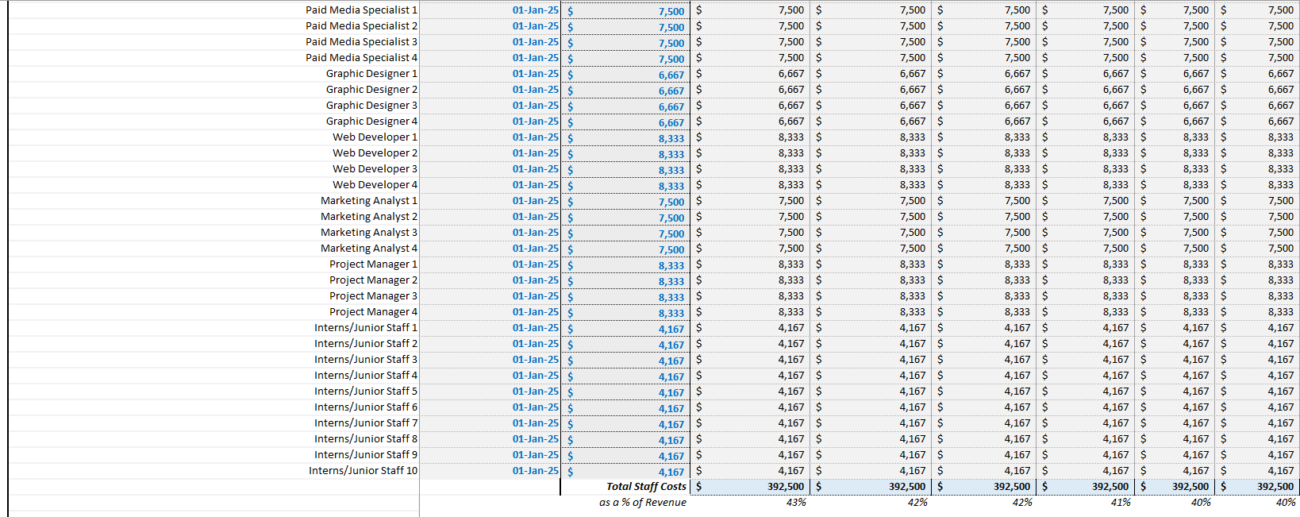

- Employee Salaries: The biggest expense, including agency founders, account managers, and specialists.

- Outsourced Services: Contractors for tasks like content writing or design.

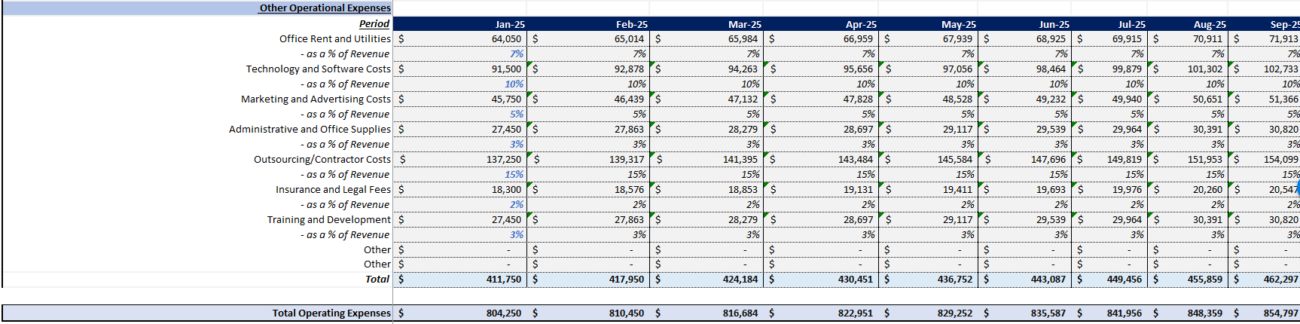

- Software and Tools: Subscriptions to tools like Google Ads and SEMrush.

- Office Rent and Utilities: Costs for physical office spaces.

- Marketing and Sales: Expenses for promoting your agency, including ads and networking.

- Professional Fees: Legal and accounting service fees.

Capital Expenditures (CapEx)

These are one-time investments in equipment or infrastructure necessary for running the agency.

Financing and Funding

Include loan repayments, interest rates, or equity distributions if seeking external investment.

Key Performance Indicators (KPIs)

- Gross Profit Margin: Percentage of revenue remaining after service delivery costs.

- Client Acquisition Cost (CAC): Cost of acquiring a new client.

- Customer Lifetime Value (CLTV): Expected total revenue from a client over the relationship.

- Utilization Rate: Percentage of staff time spent on billable client work.

Step-by-Step Guide to Building a Digital Marketing Agency Financial Model

Step 1: Define Your Agency’s Scope and Services

Clarify the services offered, target market, and pricing models to create a foundation for revenue projections and cost assumptions.

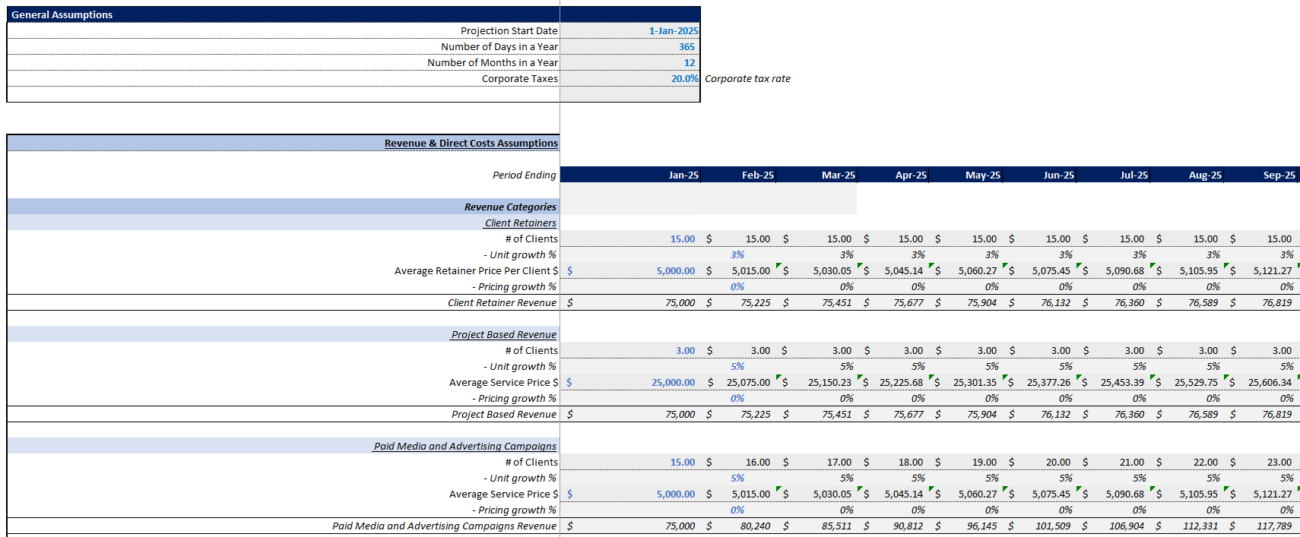

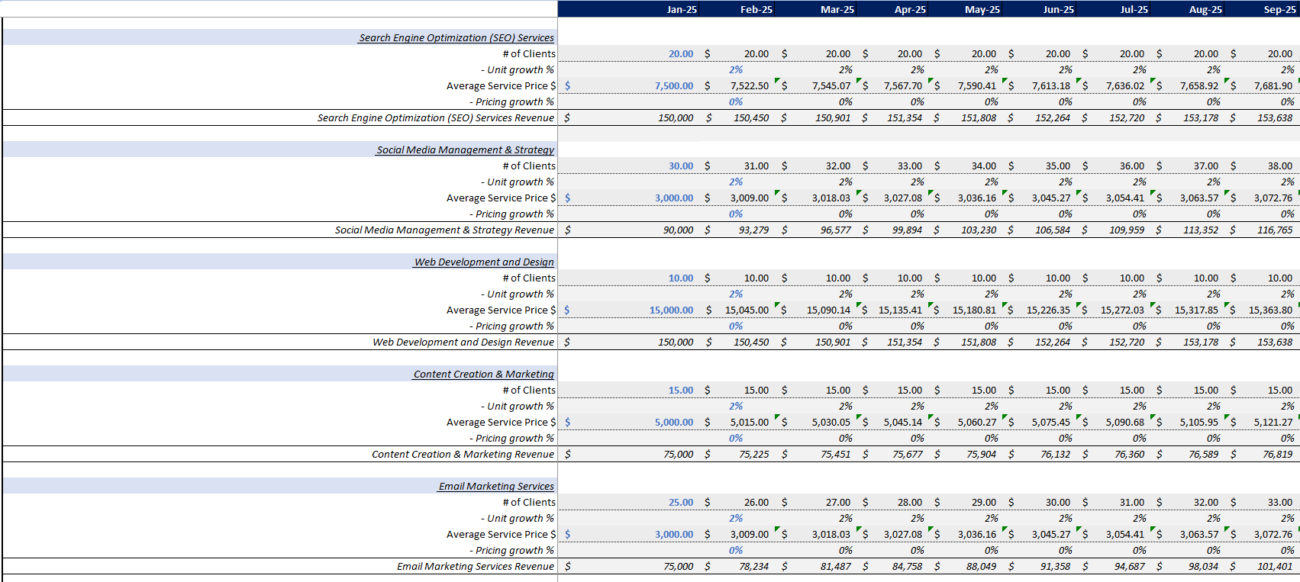

Step 2: Estimate Revenue

- Service Pricing: Research industry standards for digital marketing services.

- Client Volume: Estimate monthly or annual client numbers.

- Revenue Projections: Calculate expected revenue from all services.

- Recurring vs. Project-Based Revenue: Predictable recurring fees and irregular project-based income.

Step 3: Estimate Costs and Expenses

- Fixed Costs: Salaries and office expenses.

- Variable Costs: Outsourced services and marketing efforts.

- Capital Expenditures: One-time purchases like software licenses.

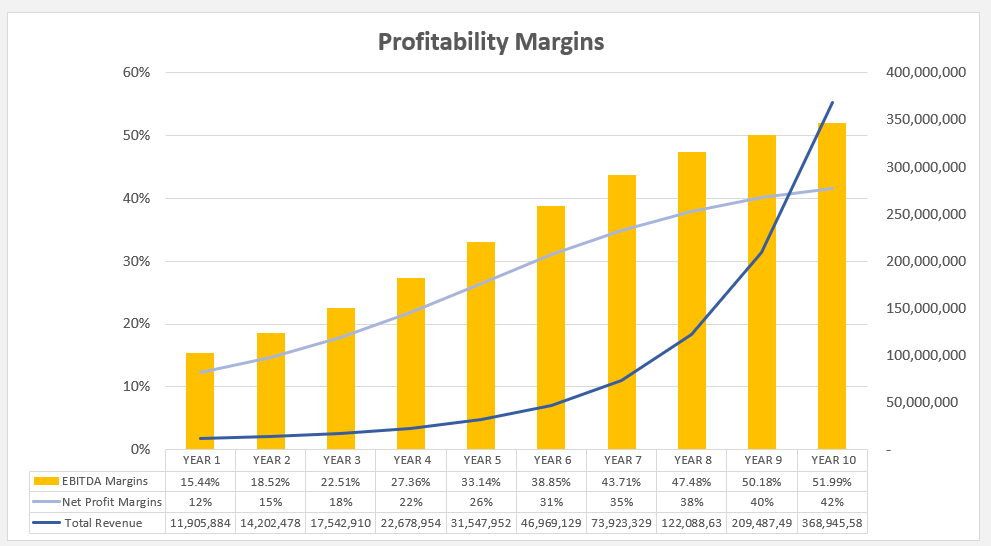

Step 4: Calculate Profitability

- Gross Profit: Revenue minus cost of goods sold.

- Operating Profit: Subtract operating expenses from gross profit.

- Net Profit: Operating profit minus taxes and other expenses.

Step 5: Create a Cash Flow Statement

Forecast cash inflows and outflows to avoid shortages.

Step 6: Break-Even Analysis

Calculate the break-even point to determine when revenue matches costs.

Step 7: Sensitivity Analysis

Perform analysis to test how changes in variables affect profitability.

Frequently Asked Questions

What is the purpose of a financial model?

A financial model helps forecast revenue, manage costs, and guide strategic decisions in a digital marketing agency.

How do you estimate revenue for a digital marketing agency?

Estimate revenue by pricing services and predicting client volume based on market analysis and marketing operations.

What are key costs in a digital marketing agency?

Key costs include employee salaries, outsourced services, software subscriptions, and office-related expenses.