Private equity (PE) funds are structured investments designed to achieve significant returns by managing investments in private companies. Successfully navigating these investments requires a robust understanding of cash flows, and the Private Equity Cash Flow Model (PECFM) is indispensable in this endeavor. This model helps fund managers and investors gain insights into the fund’s financial well-being and make informed decisions. We have built a ready-to-go Private Equity Cash Flow Model Template for an American Waterfall distribution and a European Waterfall distribution. Both of which have a ‘Key Metrics’ page tracking all the important metrics discussed below.

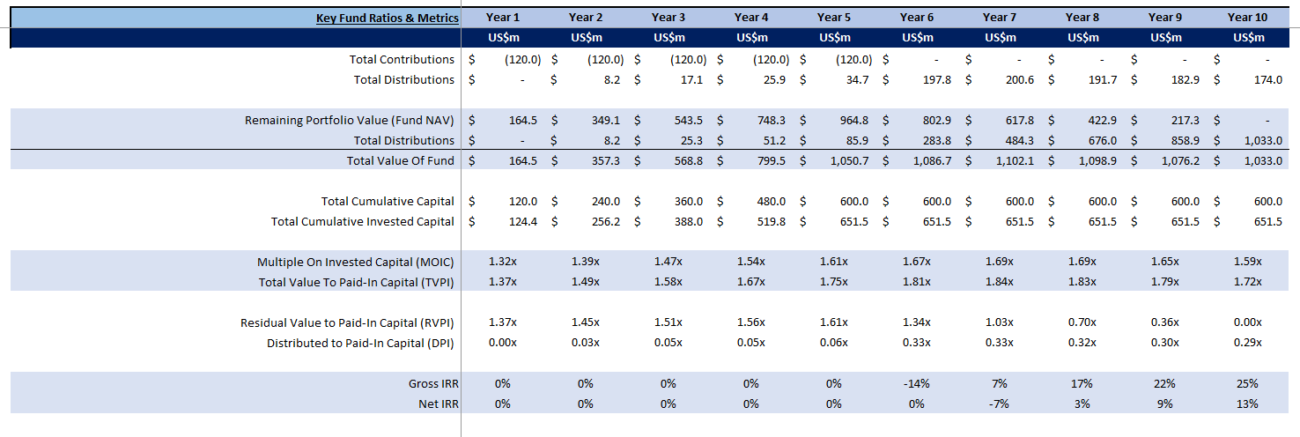

The PECFM monitors capital movement in and out of a fund throughout its lifecycle, considering elements such as capital calls, management fees, and distributions. Key metrics within this model are crucial for assessing the fund’s performance, evaluating risk, and ensuring financial goals are achieved. Not only do they measure returns, but they also provide strategic guidance to optimize performance.

Internal Rate of Return (IRR)

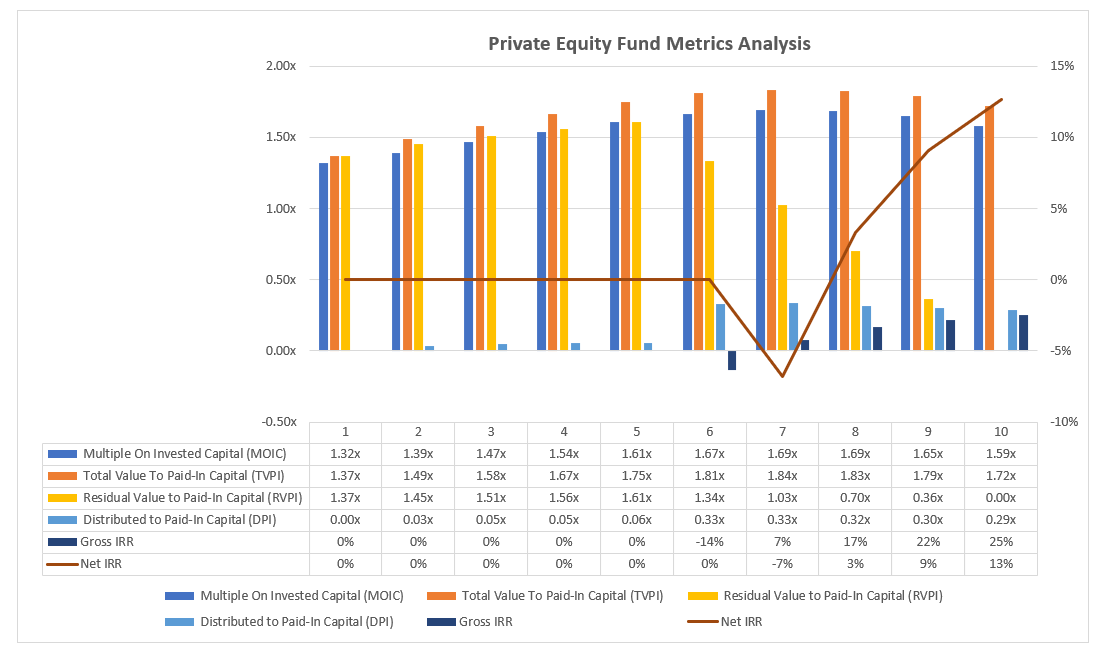

The Internal Rate of Return (IRR) is vital for any PE cash flow model, reflecting the annualized rate of return based on received and invested cash flows.

Importance of Tracking IRR

- Profitability Assessment: IRR evaluates investment profitability; a high IRR indicates effective return generation.

- Time-Weighted Performance: As a time-sensitive metric, IRR accounts for investment and exit timing, which significantly affect returns.

- Benchmarking: By comparing IRRs, investors can gauge fund performance against industry standards or peers.

IRR Tracking Mechanism

IRR calculation requires aligning future cash flows’ present value with the initial investment. Tracking cash inflows, outflows, and fees is essential for accurate IRR determination across the fund’s lifecycle.

Multiple on Invested Capital (MOIC)

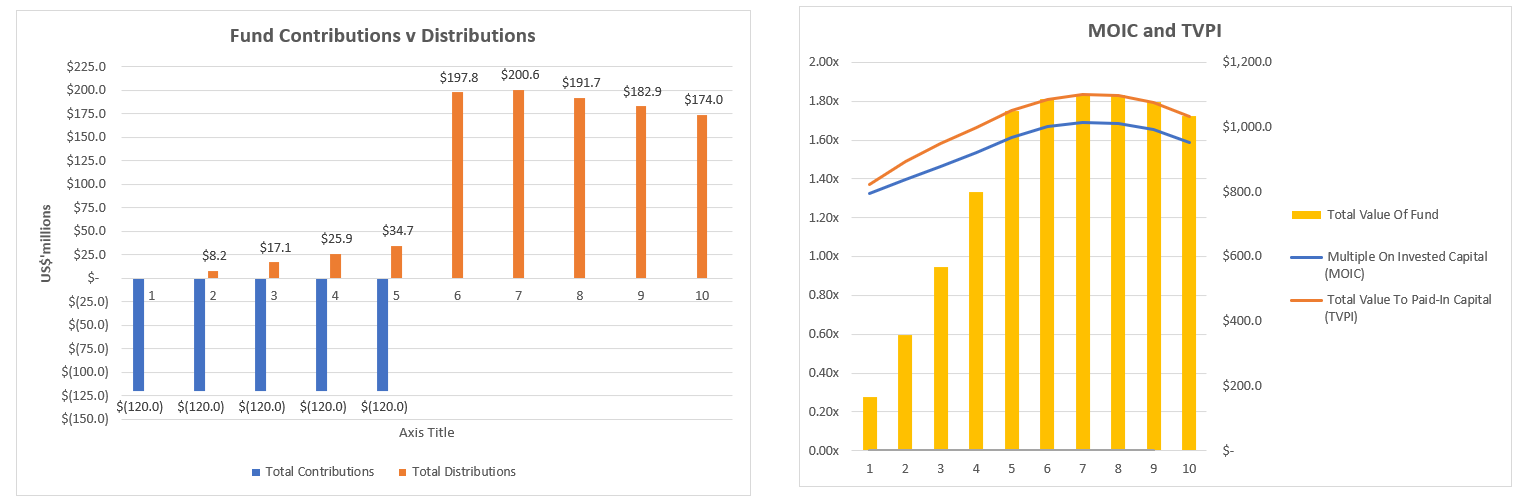

MOIC measures total distributions relative to invested capital, offering a straightforward look at total returns.

Tracking MOIC Benefits

- Capital Efficiency: Understanding capital utilization becomes straightforward; a higher MOIC denotes efficient capital use.

- Fund Performance Evaluation: Unlike IRR, MOIC reflects absolute return magnitude, ignoring timing.

- Exit Strategy Analysis: MOIC helps assess exit success, indicating capital growth to meet expectations.

How to Track MOIC

MOIC involves dividing distribution totals by invested capital. For instance, returning $300 million from a $100 million investment yields a 3.0x MOIC.

Explore detailed examples through Private Equity Pacing Model.

Net Asset Value (NAV)

NAV represents a fund’s current asset value minus liabilities, crucial for ongoing financial health assessment.

Why Monitor NAV?

- Value Assessment: NAV illustrates the total market value, offering a precise fund performance snapshot.

- Performance Trends: NAV changes reflect portfolio evolution, vital for tracking unrealized investment values.

- Liquidity Planning: A high NAV facilitates future investment attraction and distribution planning.

NAV Calculation

NAV calculation involves summing asset values and subtracting liabilities, with valuation often reliant on metrics like earnings multiples or discounted cash flow (DCF) models.

Understanding these concepts further can be facilitated by resources like Understanding private equity cash flows and exposure.

Distributions to Paid-In (DPI)

DPI evaluates cash returned to LPs against total committed capital, serving as a liquidity measure.

DPI Significance

- Return Evaluation: DPI shows the extent of capital returned as distributions. A DPI above 1.0x typically signifies full capital return.

- Liquidity Insight: Gauging fund liquidity and distribution timing helps investors understand return expectations.

- Exit Success Evaluation: DPI provides valuable insights into exit-generated cash contributions.

DPI emphasizes actual distributions versus investments, a key liquidity insight resource supported by Private markets commitment pacing and cash flow modeling.

Residual Value to Paid-In (RVPI)

RVPI gauges a fund’s unrealized value relative to LPs’ committed capital, focusing on investments not yet exited.

RVPI Tracking Benefits

- Unrealized Gains: RVPI reveals future return potentials based on unreleased portfolio value, aiding investment maturity evaluations.

- Health Monitoring: Understanding the remaining asset value assists forecasting future liquidity events, such as sales or IPOs.

Track RVPI by dividing residual value by paid-in capital, essential for funds with long-term horizons.

Further insights are detailed within Stochastic Modelling of Cash Flows in Private Equity.

Cash-on-Cash Return (CoC)

CoC focuses on cash returns relative to the invested capital, excluding unrealized returns.

CoC Utility

- Performance Analysis: Highlights short- to mid-term performance devoid of unrealized gains, focused on liquidity.

- Investor Relations: CoC clarifies cash distribution speed and magnitude, providing a tangible return metric to investors.

CoC involves dividing total distributions by invested capital, simple yet powerful for liquidity assessments.

Investigate further within Modeling the Cash Flow Dynamics of Private Equity Funds.

Preferred Return (Hurdle Rate)

Preferred Return ensures LPs receive a minimum return before GPs earn carried interest, significantly influencing profit allocation.

Preferred Return Relevance

- LP Protection: Guarantees LP compensation for capital use before profit-sharing begins.

- GP Incentive Alignment: Sets performance thresholds to motivate GPs, aligning interests with LPs.

- Carried Interest Implications: Determines carried interest timing and allocations.

Preferred Return tracking integrates into broader PECFM cash flow analyses, balancing capital distribution and profit-sharing.

Dive deeper into private equity cash flow strategies and outcomes with Cash Flow Forecasting for Private Equity Fund Allocators.

Frequently Asked Questions

What is the primary role of a Private Equity Cash Flow Model?

A PECFM monitors and manages cash flows within PE funds, helping stakeholders assess financial health and make strategic decisions based on comprehensive financial data.

How does MOIC differ from IRR in performance measurement?

MOIC reflects the total return on investment, ignoring timing, while IRR focuses on annualized performance considering cash flow timing, providing a time-weighted return metric.

Why is it important to track the Preferred Return?

Tracking the Preferred Return ensures that LPs receive a baseline return before the GP earns carried interest, aligning incentives and ensuring investor protection.

Final Thoughts!

A robust Private Equity Cash Flow Model is essential for evaluating fund performance, optimizing strategies, and maximizing returns. By emphasizing key metrics such as IRR, MOIC, NAV, DPI, RVPI, CoC, and Preferred Return, investors and fund managers can gain invaluable insights and foster data-driven decision-making. These metrics provide both historical performance insights and strategic roadmaps for future success.