In the world of private equity, managing capital calls and distributions efficiently is essential for ensuring the smooth operation of funds and maximizing investor returns. Cash flow models serve as a powerful tool, aiding fund managers and investors in projecting, managing, and optimizing the inflows and outflows of capital throughout a private equity investment’s lifecycle. These models enable fund managers to anticipate the timing and magnitude of capital calls (requests for additional capital from investors) and distributions (payouts from the fund to its investors), thereby ensuring that funds remain adequately capitalized while maintaining investor confidence.

This article explores the significance of cash flow models in overseeing capital calls and distributions, how these models function, and how fund managers can leverage them to optimize fund performance and effectively manage investor expectations.

Understanding Capital Calls and Distributions

Before delving into the intricacies of cash flow models, it’s vital to comprehend what capital calls and distributions entail and their role within private equity funds.

Capital Calls

In a private equity fund, investors, or limited partners (LPs), commit to contributing a specified amount of capital over the fund’s lifespan. However, they do not invest the entire sum upfront. Instead, fund managers, known as general partners (GPs), make capital calls—requests for additional capital—when needed to finance investments or fund operational expenses. Often, capital calls occur in response to specific investment opportunities or operational requirements.

For an in-depth understanding of capital call dynamics, you can refer to Moonfare’s comprehensive guide.

Distributions

Distributions signify the return of capital or profits to investors. Typically, these occur when the fund exits investments, such as through the sale of a portfolio company, dividend recapitalization, or an IPO. Distributions are the primary means by which funds return value to investors after successfully deploying capital and realizing returns.

Both capital calls and distributions are critical: capital calls inject capital into the fund, while distributions generate and return profits to investors. Careful planning and management of both elements are essential to ensure the fund’s liquidity, optimize investment strategy, and maintain strong investor relationships.

The Importance of Cash Flow Models in Private Equity

Cash flow models are indispensable in managing financial aspects related to capital calls and distributions. These models are financial tools that forecast the timing and magnitude of cash inflows and outflows for a private equity fund. By providing fund managers and investors with a detailed view of the fund’s liquidity, cash flow models enable informed decision-making regarding investment strategies, capital calls, and distributions.

For insights into how these models are utilized in the private equity sector, explore Arta Finance’s article.

Key Components of a Cash Flow Model

A robust cash flow model for private equity funds includes several critical components for accurately forecasting capital calls, distributions, and overall fund liquidity.

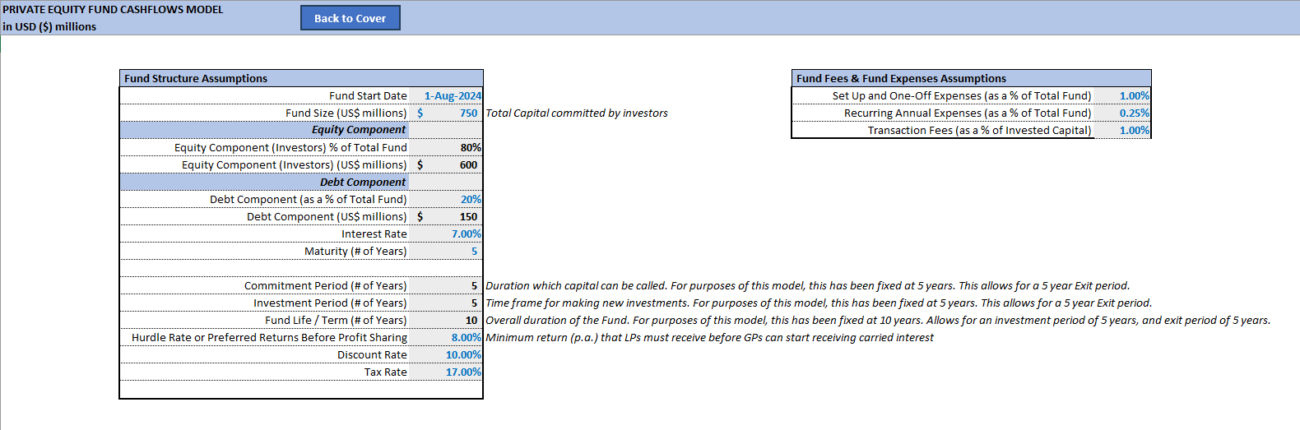

Investor Commitments and Contributions

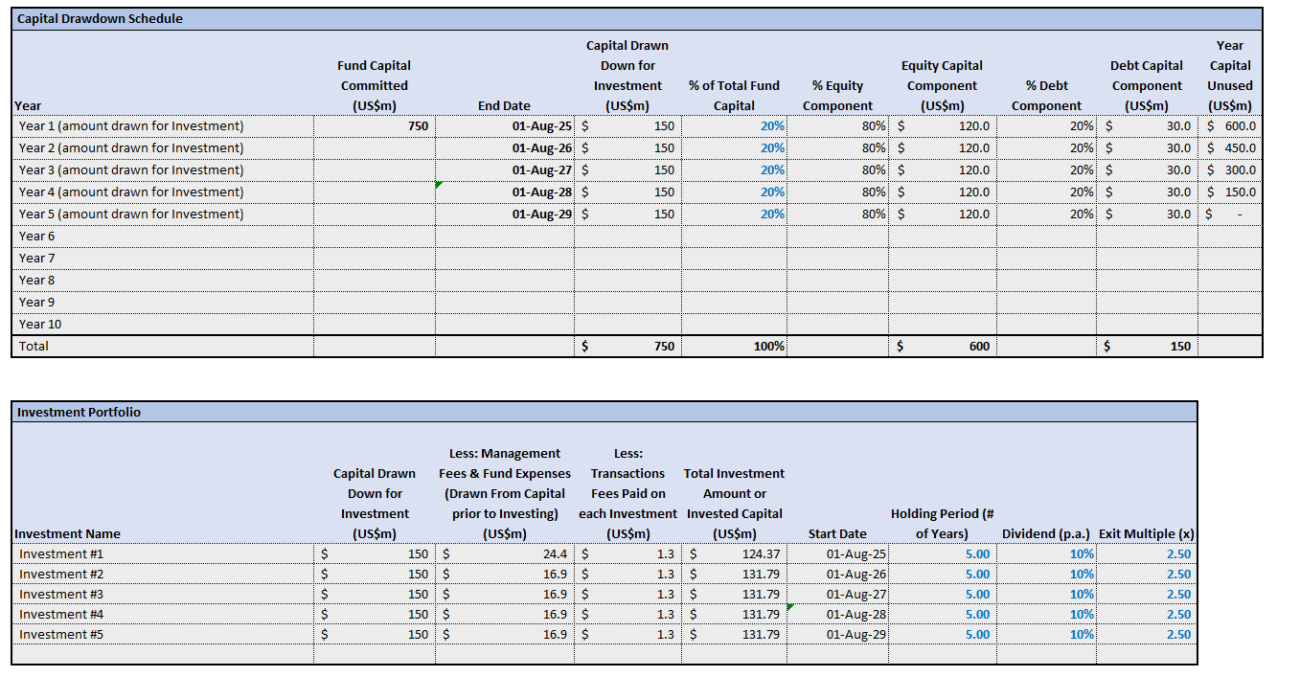

The model starts with the total commitments from investors, outlined in the fund’s limited partnership agreement (LPA). This commitment indicates the amount of capital LPs must contribute throughout the fund’s lifespan. The model tracks these commitments and the drawdown schedule, showing when and in what amounts capital will be called from investors.

Capital Call Schedule

The capital call schedule is a central feature of any cash flow model, outlining the timing and size of capital calls based on the fund’s investment needs. For example, a private equity fund may initiate a capital call in its first year to acquire an initial portfolio company, with subsequent calls for additional investments. This cash flow forecasting model is instrumental in anticipating these calls, ensuring the fund has adequate liquidity to meet investor obligations.

Investment and Operational Expenses

These expenses constitute the capital outflows associated with deploying the fund’s capital. They include:

- Investment Costs: Funds allocated to acquiring new portfolio companies.

- Management Fees: Compensation for the GP managing the fund’s operations, typically a percentage of committed capital or assets under management.

- Other Operational Expenses: Covering legal, accounting, administrative costs, and other fund-related expenses.

Accurate forecasting of these outflows in a cash flow model is essential for aligning capital calls with actual investment activities.

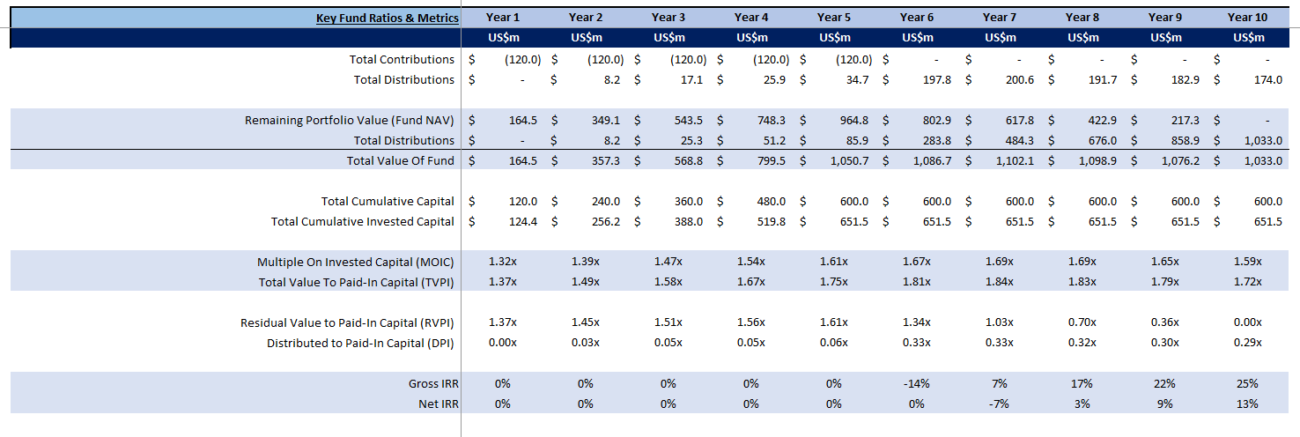

Distributions from Exit Events

Distributions occur when the fund exits investments and realizes returns, typically distributed back to investors. The cash flow model tracks the timing and magnitude of these distributions, often resulting from the sale of portfolio companies, refinancing activities, or dividend recapitalizations.

Carried Interest and Fees

Besides the return of capital and profits, private equity funds allocate a portion of profits as carried interest to the GP, generally around 20% of the fund’s profits. Management fees, paid to the GP for managing the fund, are also factored into the cash flow model. Accurate tracking of fees and carried interest prevents conflicts between GPs and LPs by ensuring profit-sharing terms are respected.

Managing Capital Calls with Cash Flow Models

Cash flow models are invaluable in managing capital calls by forecasting future capital needs and facilitating effective planning to minimize risks of capital shortfalls.

Anticipating Investment Needs

By providing insights into when the fund requires capital for new investments, cash flow models help GPs determine the optimal timing for capital calls. This ensures capital calls occur only when necessary and investors are prepared for these obligations.

Timing of Capital Calls

Cash flow models aid fund managers in scheduling capital calls to align with liquidity requirements and investors’ ability to meet them. By coordinating the capital call schedule with the pace of investments, fund managers can avoid over- or under-calling capital.

For strategies on managing capital calls, Forbes provides valuable insights.

Minimizing Liquidity Risk

Cash flow models help ensure the fund maintains adequate liquidity to meet capital needs, minimizing liquidity shortfall risks and preventing investment delays or negative impacts on overall performance.

Investor Communication

By providing transparency regarding capital call timing and amounts, cash flow models manage investor expectations, maintaining confidence in fund managers’ cash management capabilities.

Managing Distributions with Cash Flow Models

Effective management of distributions is vital for maintaining investor satisfaction and ensuring fund success. Cash flow models are essential tools in managing distributions, providing the necessary visibility to time distributions appropriately and allocate profits effectively.

Timing Distributions

Cash flow models assist managers in determining when distributions can be made, based on the realization of exit events and target returns. This prevents premature payouts that could strain fund liquidity.

Optimizing Profit Sharing

Distributions often involve profit sharing between LPs and GPs, with the latter receiving a share of profits after satisfying LPs’ capital and preferred return. The cash flow model ensures adherence to the distribution waterfall, preventing conflicts and maintaining trust.

For guidelines on best practices in distribution management, refer to the ILPA’s detailed PDF.

Communicating Distribution Schedules

Similar to capital calls, cash flow models enable clear distribution schedule communication to investors, enhancing satisfaction and trust between fund managers and investors.

Final Thoughts!

Cash flow models are essential tools for managing capital calls and distributions in private equity funds. These models provide insights into cash inflow and outflow timings, ensuring adequate liquidity, fulfilling investor obligations, and optimizing returns. Effective cash flow modeling enables private equity funds to better anticipate capital needs, time distributions accurately, and maintain investor confidence, ultimately leading to improved fund performance and strengthened investor relationships.

Frequently Asked Questions

What is a capital call in private equity?

A capital call is a request by a private equity fund’s general partner to its limited partners for additional capital, often needed for new investments or operational expenses.

How do cash flow models help in private equity?

Cash flow models assist in projecting and managing the timing and magnitude of capital inflows and outflows, enabling private equity funds to plan investments, capital calls, and distributions effectively.

Why are distributions important in private equity?

Distributions are critical as they return capital and profits to investors, reflecting the success of the fund’s investments and maintaining investor satisfaction and confidence.