When assessing an investment or project, one of the most fundamental metrics that businesses and investors use is the payback period. The payback period formula helps determine how long it will take for an investment to recover its initial cost, i.e., the time it takes for the cumulative cash inflows to equal the initial investment. This metric is critical for businesses to evaluate the risk and profitability of potential investments, ensuring they make informed financial decisions.

In this article, we will explore the payback period formula in detail, its significance, how to calculate it, its limitations, and how businesses can use this information in their decision-making process.

What is the Payback Period?

The payback period is the amount of time it takes for a business to recover the cost of an investment through its cash inflows or savings. Simply put, it answers the question: How long does it take for an investment to break even? Once the payback period is over, any additional cash inflows or savings generated by the investment represent profits.

The payback period is especially useful for evaluating the risk of a project or investment. Shorter payback periods generally imply that the project is less risky because the invested capital is recovered quickly, thus reducing exposure to uncertainty. Conversely, longer payback periods often suggest higher risk.

The Formula for Payback Period

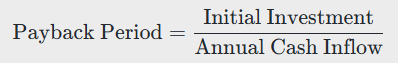

The basic formula to calculate the payback period is:

In this formula:

- Initial Investment is the upfront cost of the project or investment.

- Annual Cash Inflow is the expected or actual net cash inflow generated by the investment every year.

This formula is simple and is generally used when the cash inflows are expected to be constant each year. The payback period formula assumes that cash inflows are evenly distributed over time, which is often the case for projects with predictable cash flow. For more details, Investopedia provides a comprehensive guide on payback period calculations.

Step-by-Step Calculation of the Payback Period

- Determine the Initial Investment: This is the upfront cost required to undertake the project or investment. It could be the cost of equipment, installation, research, or any other capital expenditure associated with the investment.

- Identify Annual Cash Inflows: Estimate the annual net cash inflows that the project will generate. These cash inflows could be revenue from sales, cost savings, or other financial benefits directly attributed to the project.

- Apply the Formula: Divide the initial investment by the annual cash inflow to determine how many years it will take to recoup the initial investment.

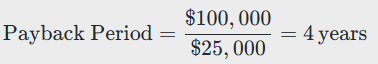

Example 1: Simple Payback Period Calculation

Suppose a company invests $100,000 in new software that will save the company $25,000 each year in operational costs. To calculate the payback period, we apply the formula:

In this case, it will take the company 4 years to recover its initial investment of $100,000 through the annual savings of $25,000.

The Payback Period with Uneven Cash Flows

In many real-world scenarios, cash inflows are not constant and may fluctuate over time. For example, a business may expect higher cash inflows in the first few years of a project and lower inflows later on. In this case, the payback period formula needs to be adjusted.

The approach for calculating the payback period when cash inflows are uneven is as follows:

- List the Cash Inflows: Identify the projected cash inflows for each period (usually year-by-year).

- Track the Cumulative Cash Flow: Start with the initial investment and subtract the cumulative cash inflows from it until the remaining investment is zero or positive.

- Identify the Payback Period: The payback period occurs when the cumulative cash inflows are equal to or exceed the initial investment.

Example 2: Uneven Cash Flows

Let’s consider a company that invests $100,000 in a project with the following expected cash inflows over five years:

- Year 1: $20,000

- Year 2: $30,000

- Year 3: $40,000

- Year 4: $10,000

- Year 5: $5,000

To calculate the payback period:

- After Year 1: $100,000 – $20,000 = $80,000 remaining

- After Year 2: $80,000 – $30,000 = $50,000 remaining

- After Year 3: $50,000 – $40,000 = $10,000 remaining

- After Year 4: $10,000 – $10,000 = $0 remaining

At the end of Year 4, the initial investment of $100,000 is fully recovered. Therefore, the payback period in this case is 4 years.

Importance of the Payback Period in Decision Making

The payback period serves as a quick and simple metric for evaluating the feasibility of an investment. It provides insight into how long it will take for a business to recover its initial outlay. However, the payback period is not the only metric that should be considered when making investment decisions.

Here are some reasons why the payback period is important:

- Risk Assessment: Projects with shorter payback periods are considered less risky because they return the initial investment more quickly. This is particularly relevant for businesses operating in uncertain or volatile markets.

- Cash Flow Planning: The payback period helps businesses plan their cash flows by indicating when the initial investment will be recouped. This can be particularly helpful in ensuring liquidity.

- Quick Decision Making: The payback period is easy to calculate and provides a straightforward basis for making decisions, especially when dealing with multiple investment opportunities.

- Prioritizing Investments: The payback period can be used to prioritize investments. A company might choose to invest in projects with a shorter payback period, especially when cash flow is a concern. You can find more insights on utilizing the payback period here.

Limitations of the Payback Period

While the payback period is a useful tool, it does have limitations that businesses must consider:

- Ignores Time Value of Money: The payback period does not take into account the time value of money. Cash inflows received in the future are considered equally valuable as cash inflows received today, which is unrealistic. In reality, $1 received today is worth more than $1 received a year from now due to inflation and opportunity costs. Solution: To overcome this limitation, businesses can use discounted cash flow (DCF) techniques, such as Net Present Value (NPV) or Internal Rate of Return (IRR), which account for the time value of money.

- Does Not Consider Cash Flows Beyond the Payback Period: The payback period focuses only on the time it takes to recover the initial investment and ignores any cash flows that occur after the payback period. A project with a long payback period but significant long-term benefits may be overlooked if only the payback period is considered. Solution: For a more comprehensive analysis, businesses should also consider the overall profitability of the project by evaluating metrics like NPV and IRR, which capture the entire lifespan of the investment.

- Does Not Address Profitability: While the payback period tells you when you’ll recover your investment, it doesn’t tell you anything about the overall profitability of the investment. A short payback period does not necessarily equate to high profits, and a longer payback period may still yield significant profits. Solution: Use the payback period alongside other profitability metrics such as NPV, IRR, or return on investment (ROI) to get a more complete picture of the investment’s potential.

Alternatives to the Payback Period

To address some of the limitations of the payback period, businesses often turn to other financial metrics, including:

- Discounted Payback Period: This is a variation of the payback period that takes into account the time value of money. It discounts future cash flows to present values before calculating how long it will take to recover the initial investment. A detailed explanation can be found here.

- Net Present Value (NPV): NPV calculates the total value of a project by summing the present values of its cash inflows and outflows. NPV takes into account the time value of money and provides a clearer picture of an investment’s profitability.

- Internal Rate of Return (IRR): IRR is the discount rate that makes the NPV of a project equal to zero. It provides an estimate of the return generated by the investment, helping to evaluate its potential profitability.

Frequently Asked Questions

What is the importance of the payback period?

The payback period is significant because it helps businesses assess the risk and liquidity of investments. It provides a straightforward method for estimating how long it will take to recoup an initial investment, which is crucial for financial planning and risk management.

How is the payback period calculated?

The payback period is calculated by dividing the initial investment cost by the annual cash inflow. This simple formula allows businesses to estimate the time it takes to recover their investment. For a step-by-step guide, visit How to calculate the payback period.

What are the limitations of the payback period?

The primary limitations of the payback period are that it ignores the time value of money, does not consider cash flows beyond the payback period, and does not directly address profitability. Alternative metrics such as NPV and IRR can provide a more comprehensive financial evaluation.

Final Thoughts!

The payback period formula is a simple yet important tool for evaluating investment opportunities, particularly in terms of risk and liquidity. By calculating the time it takes to recover an initial investment, businesses can make more informed decisions about where to allocate resources. However, it is crucial to understand the limitations of the payback period and use it in conjunction with other financial metrics, such as NPV and IRR, to get a comprehensive view of an investment’s financial viability. Ultimately, a well-rounded financial analysis will help businesses make better decisions and ensure the long-term success of their projects.