Starting a vending machine business can be a rewarding endeavor, offering passive income with minimal overhead costs. However, the linchpin to success is having a robust vending machine financial model. This comprehensive tool guides you in making informed decisions and forecasting profits to ensure sustainable growth. We have also built a ready-to-go Vending Machines Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their vending machines business.

Understanding the Vending Machine Financial Model

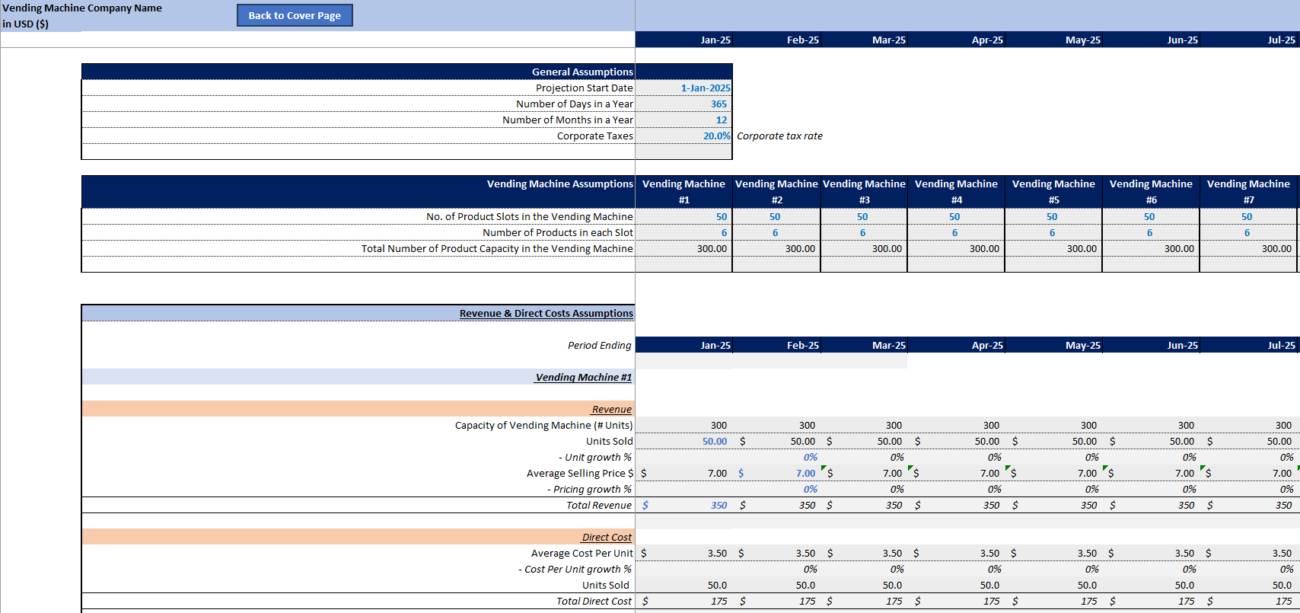

A vending machine financial model is an essential tool for tracking and forecasting the financial performance of your business. It breaks down the expected revenue, costs, and profits to provide a clear picture of your venture’s viability. With a structured approach, you can make informed decisions on pricing, inventory, and investments.

Discover a detailed example of how to build such a model from scratch with the Vending Machine Financial Model Example.

Importance of a Financial Model in a Vending Machine Business

Implementing a solid financial model is vital for several reasons:

- Forecast Profitability: Understand potential revenue and profitability in the long run.

- Identify Key Expenses: Track expenses such as machine purchase, maintenance, and stock to manage your budget effectively.

- Scale Your Operations: Utilize the model to make strategic decisions as you expand your vending machine network.

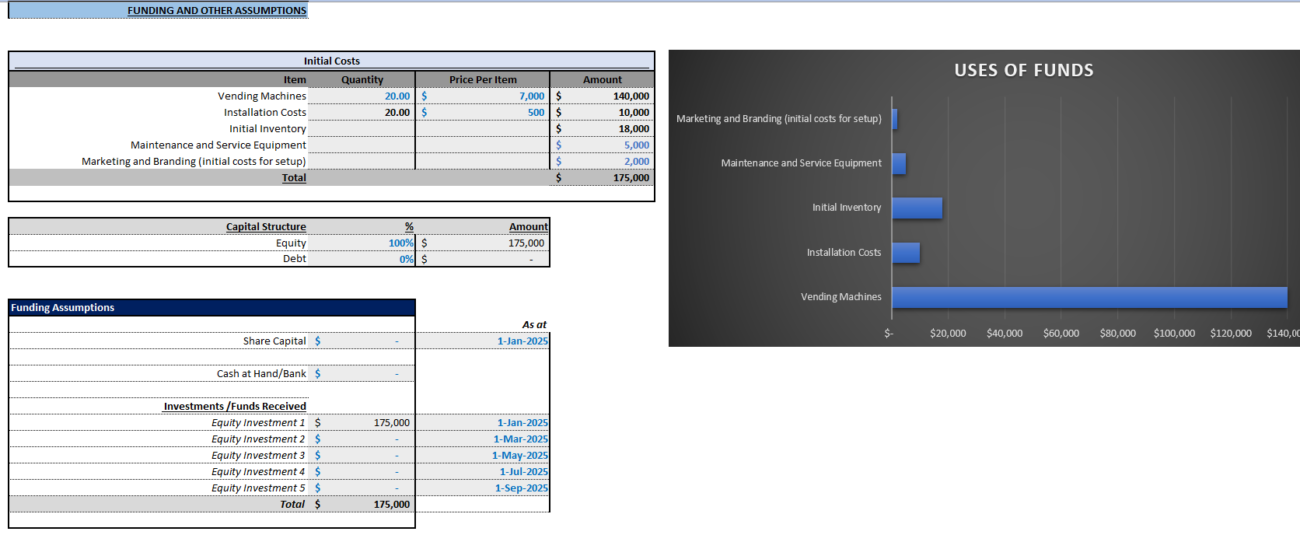

- Secure Financing: A well-developed model is crucial for attracting investors and securing business loans.

Learn about different financial projection models for vending machines from resources such as the Vending Machine Business 5-Year 3 Statement Financial Model.

Steps to Build Your Financial Model

Step 1: Gather Necessary Data

Start by collecting data for one-time capital costs and ongoing operational costs.

Capital Costs

- Vending Machines Purchase: Costs range from $1,000 to $4,000 per machine.

- Delivery and Setup Fees: Include potential fees for machine installation.

- Initial Stock: Calculate initial inventory costs.

- Licensing and Permits: Consider location-specific fees.

Ongoing Operational Costs

- Restocking and Inventory Management: Variable costs based on sales volume.

- Maintenance and Repairs: Budget for potential maintenance expenses.

- Rental Fees: Costs vary based on machine location agreements.

- Transportation Costs: Factor in fuel and maintenance costs for delivery vehicles.

Explore a Vending Machine Ramp Up Model for a structured approach to managing costs and operations.

Step 2: Create Revenue Projections

Estimate daily sales volume based on location, machine type, and product offerings. Calculate daily, monthly, and annual revenue to forecast financial outcomes.

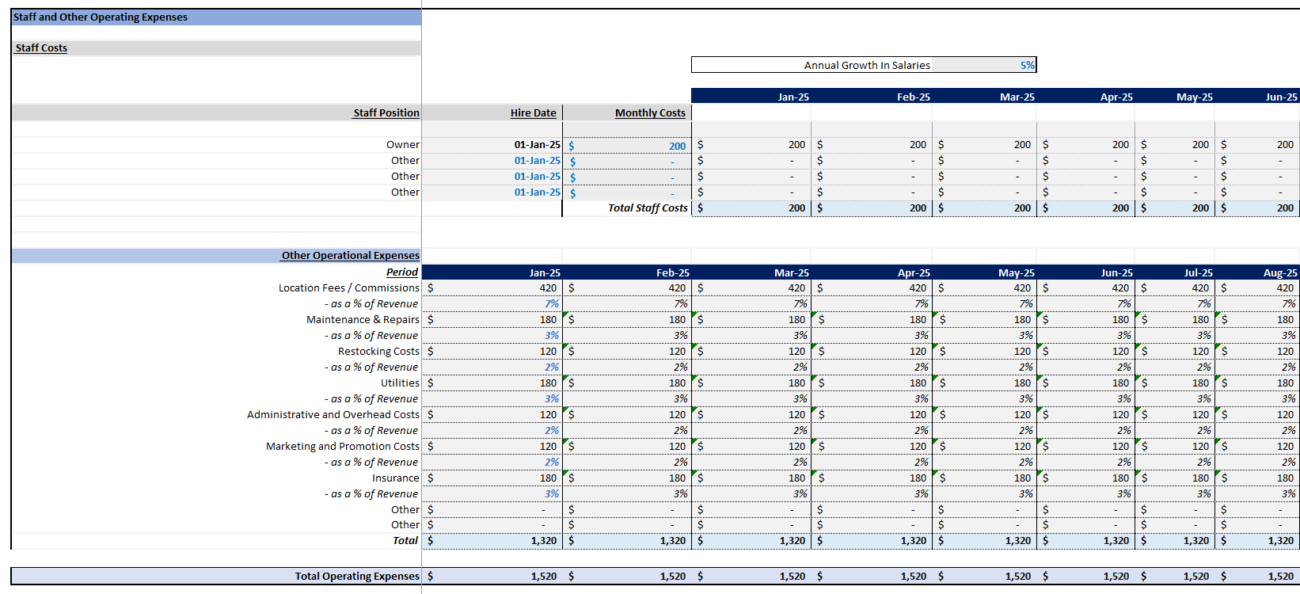

Step 3: Estimate Operating Expenses

Determine ongoing expenses such as restocking costs, maintenance fees, rental agreements, and transportation costs to manage your financial resources effectively.

Step 4: Calculate Profit Margins

Assess both gross and net profit margins by subtracting costs of goods sold and operating expenses from your revenue. A detailed Financial Model Template can provide further guidance on maintaining profitability.

Step 5: Construct a Cash Flow Statement

Track all cash inflows and outflows to ensure a healthy balance that covers operational expenses.

Step 6: Conduct a Break-Even Analysis

Determine the break-even point by calculating the number of units needed to cover fixed costs, ensuring a pathway to profitability.

Step 7: Continuous Monitoring and Review

Regularly update your financial model to reflect actual performance, adjusting forecasts and strategies for optimal outcomes.

For a comprehensive financial projection model, consider the Vending Machine Financial Model Template.

Frequently Asked Questions

What is the main purpose of a vending machine financial model?

The primary purpose is to forecast revenue, manage costs, and ensure profitability through data-driven decision-making.

How can I secure financing for my vending machine business?

A robust financial model demonstrates your business’s viability and potential for growth, aiding in securing investments or a business loan. Check out the Full Guide on Vending Machine Finance & Leasing for more information.

How often should I update my financial model?

Review and update your financial model regularly to maintain accuracy in forecasts and adapt to market changes.

Crafting a detailed vending machine financial model is crucial for steering your business toward success. By leveraging this structured approach, you can effectively manage investments, optimize operations, and ensure sustainable growth.