Starting a bakery can be a rewarding business venture, offering the opportunity to create delicious products while building a loyal customer base. However, turning a passion for baking into a sustainable and profitable business requires a deep understanding of the financial aspects of operation. A bakery financial model is crucial for forecasting revenues, estimating expenses, and understanding cash flows, helping you make informed decisions and secure potential investments. We have also built a ready-to-go Bakery Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their bakery’s financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their bakery.

What is a Bakery Financial Model?

A bakery financial model is a spreadsheet-based tool that assists bakery owners, investors, and managers in forecasting the business’s financial performance. It incorporates various factors such as expected revenue from sales, operating expenses, capital expenditures, and financing costs, serving as a roadmap for the bakery’s financial health. A solid bakery financial model typically includes:

- Revenue Forecast: Projections for potential earnings from sales.

- Operating Expenses: Costs for ingredients, labor, and utilities.

- Capital Expenditures (CapEx): Initial costs for equipment and renovations.

- Cash Flow Statement: Cash inflows and outflows tracking.

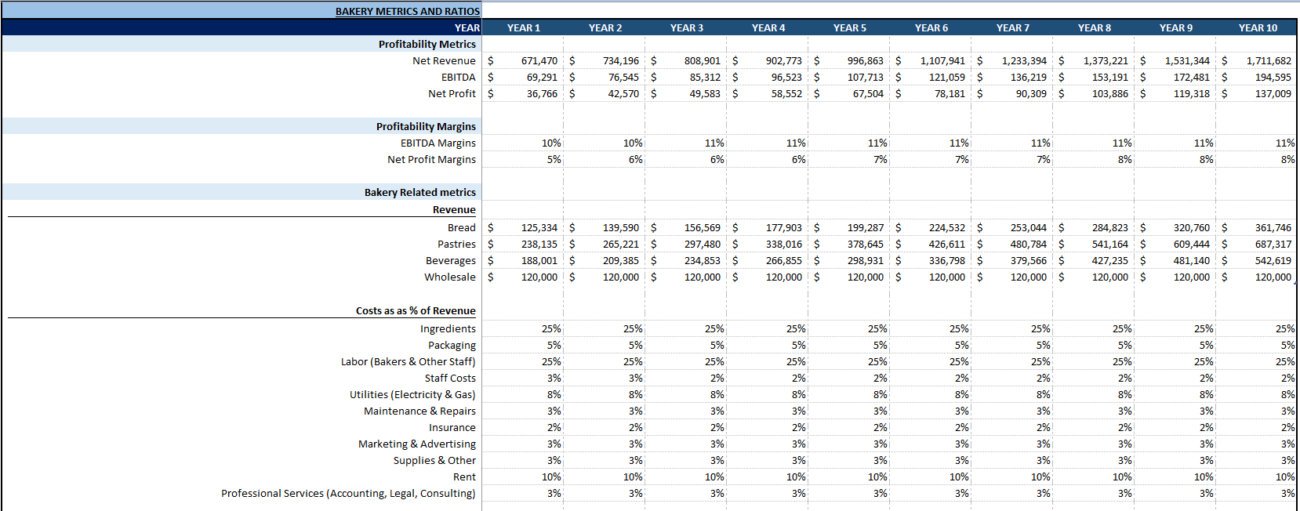

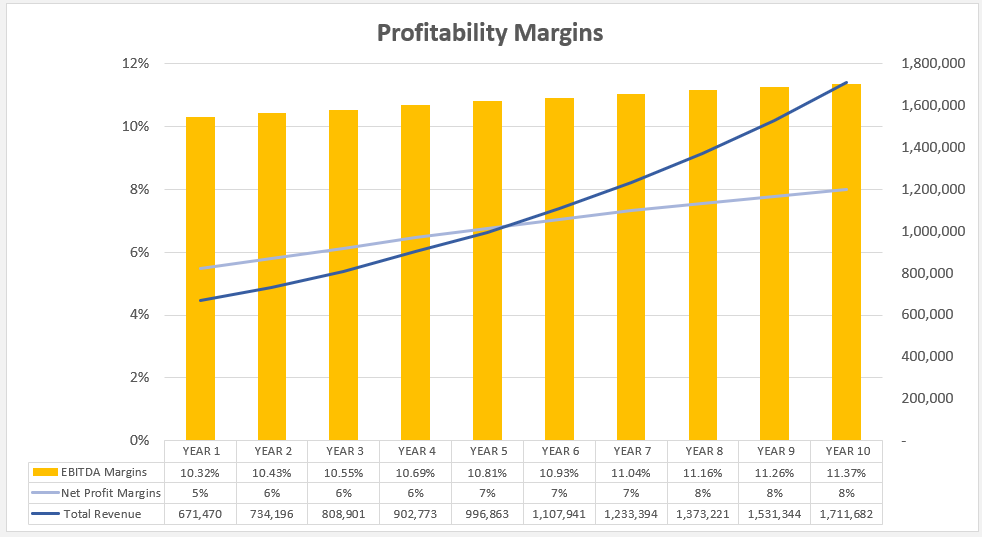

- Profitability Metrics: Indicators like net profit and gross margin.

Read more about building a financial model for a bakery.

Step 1: Gather Your Bakery’s Key Inputs

Before creating your financial model, gather critical data about your bakery operations, which will serve as the foundation of your model.

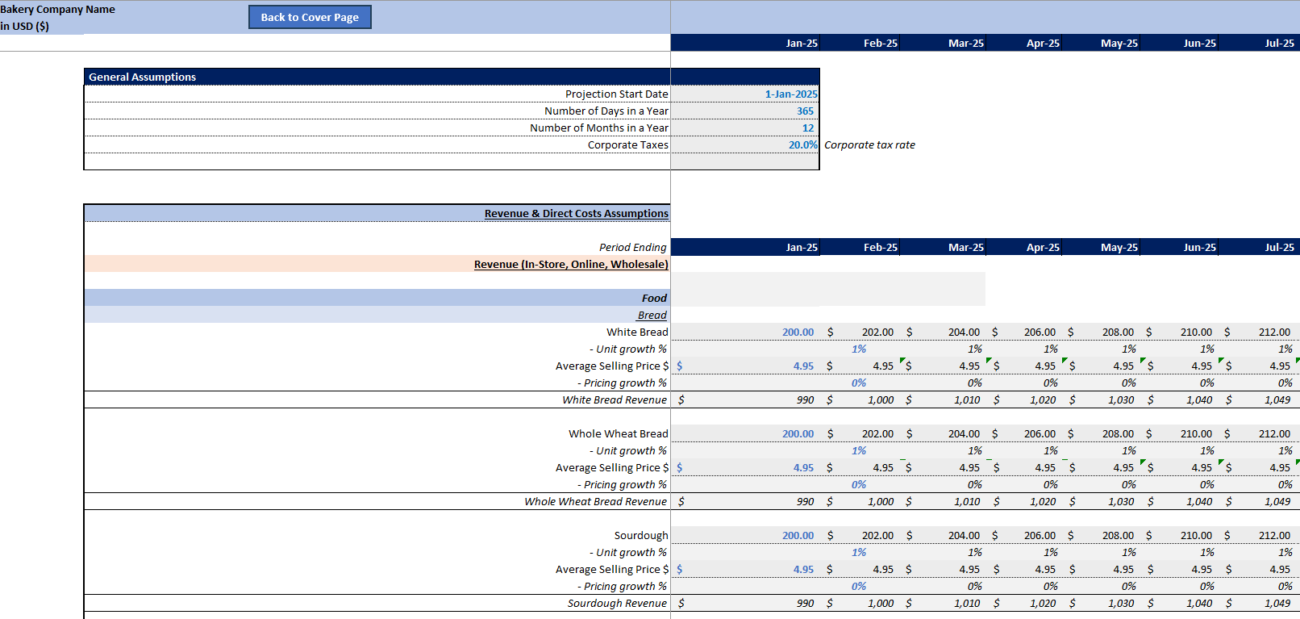

Product Assumptions

- Types of Baked Goods: Identify products such as bread, cakes, pastries, etc.

- Pricing: Determine the average price for each product.

- Sales Volume: Estimate daily or monthly sales units, considering seasonal variations.

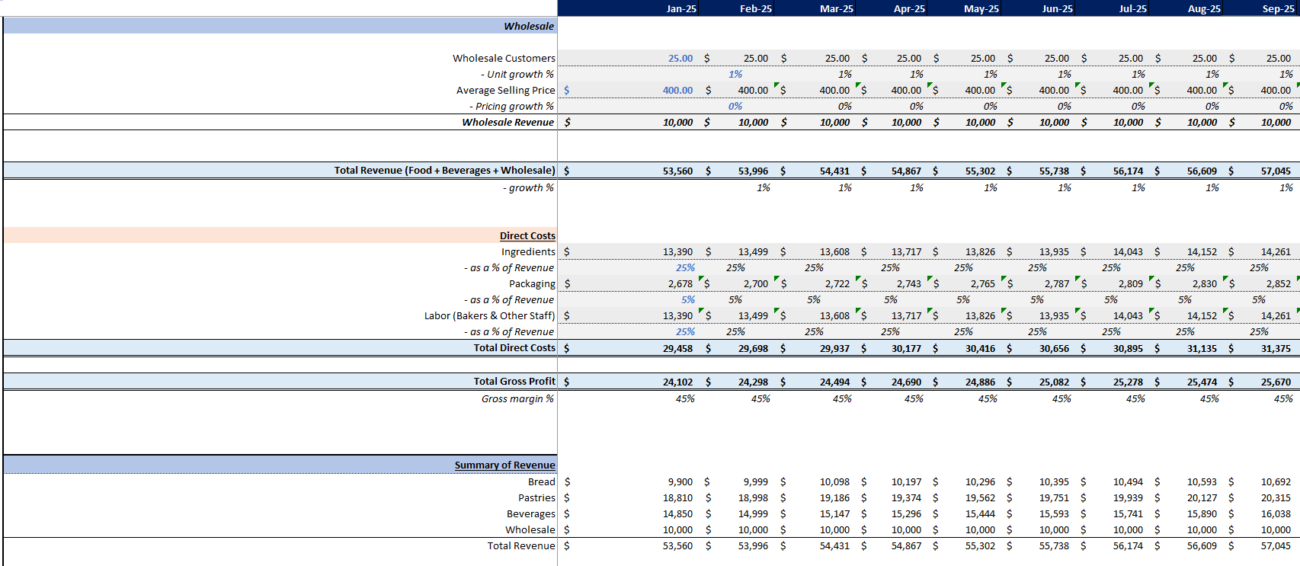

Cost of Goods Sold (COGS)

- Ingredient Costs: Costs for flour, sugar, and other raw materials.

- Packaging: Costs for packaging materials.

Operating Expenses

- Labor Costs: Wages for employees, including benefits.

- Utilities: Costs for electricity, water, and internet.

- Rent and Lease: Fixed costs for your location.

- Marketing and Advertising: Budgets for online and offline promotions.

- Insurance and Miscellaneous Costs: Insurance premiums and other expenses.

Explore an example of a detailed bakery financial model.

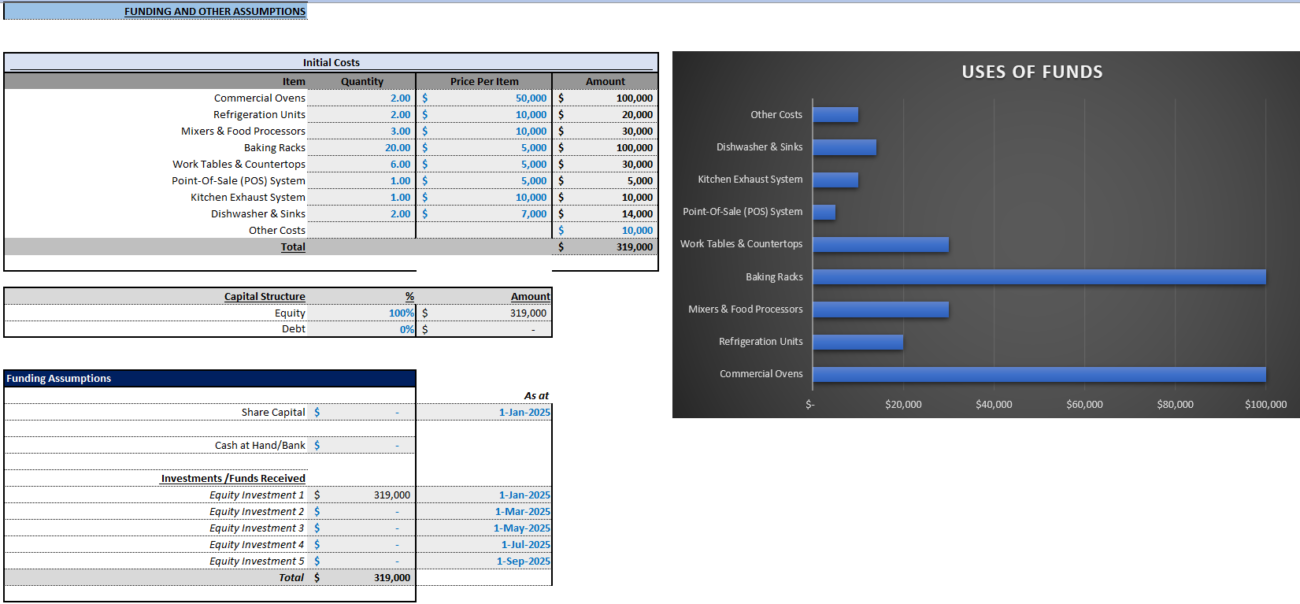

Capital Expenditures (CapEx)

- Baking Equipment: One-time costs for ovens, mixers, etc.

- Renovations: Costs for remodeling.

- Furniture and Fixtures: Costs for a cafe-style bakery setup.

Financing Assumptions

- Loans and Investments: Loan amounts, interest rates, and repayment.

Step 2: Set Up Your Bakery’s Financial Model Structure

With your data in hand, set up the structure of your financial model in a spreadsheet.

Assumptions Sheet

This sheet contains input data like product prices, sales volumes, and cost categories, serving as the model’s backbone.

Download a bakery financial model template.

Revenue Forecast

Calculate monthly revenue by multiplying daily sales volume by price and then by 30.

Cost of Goods Sold (COGS)

The direct cost of production, largely ingredients, is determined by multiplying units sold by the cost per unit.

Operating Expenses

Include fixed and variable costs identified earlier.

Capital Expenditures (CapEx)

Account for one-time startup costs and depreciate these expenses over time.

Cash Flow Statement

Tracks cash movement, comprising operating, investing, and financing cash flows.

Get insights on bakery business calculations.

Step 3: Analyze Break-Even and Profitability

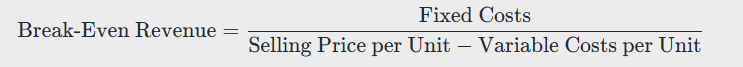

A break-even analysis determines when revenue will cover expenses. Calculate it using:

This helps set realistic sales goals to cover costs.

Check out a 5-year bakery financial model.

Step 4: Conduct Sensitivity Analysis

Understand the impact of changes in variables like ingredient prices on profits by conducting a sensitivity analysis.

Learn the basics of a 3-statement financial model for bakeries.

Final Thoughts!

Building a bakery financial model is essential for managing and growing your bakery business. It enables better decision-making, helps attract investors, and ensures long-term success. By following these steps and using accurate inputs, you can establish a robust financial strategy for your bakery.

Check our comprehensive bakery financial plan template.

Frequently Asked Questions

What is the main purpose of a bakery financial model?

A bakery financial model helps in forecasting financial performance and making strategic business decisions based on projected profits and cash flows.

How often should I update my bakery financial model?

It is advisable to update your financial model regularly, typically monthly or quarterly, to reflect actual performance data and future expectations.

Can a bakery financial model assist in securing funding?

Yes, a detailed financial model can demonstrate the bakery’s potential profitability and financial health, aiding in attracting investors and securing loans.