Understanding and controlling your restaurant’s Cost of Goods Sold (COGS) is crucial for maximizing profitability. Dive into the core of COGS, learn how to calculate COGS, and explore strategies to optimize this essential financial metric. We have also built a Restaurant Financial Model Template for Founders and Entrepreneurs to use. Effortlessly input your assumptions into our complete 3-way Financial Model. It generates an Income Statement, Balance Sheet, Cash Flow Statement, restaurant-specific metrics and ratios, plus a valuation page to determine your business’s worth. We also have over 20 different types of Restaurant models which you can also see here.

What is Cost of Goods Sold in Restaurants?

Cost of Goods Sold (COGS) refers to the direct costs attributed to the production of food and beverages in the restaurant industry. It includes all the expenses involved in preparing menu items, such as ingredients and food supplies. Monitoring COGS is vital as it fluctuates with market prices and seasonal changes, impacting restaurant profitability. Learn more about how restaurant COGS works.

Components of COGS for Restaurants

Typically, COGS for a restaurant includes:

- Food Costs: The expense of raw ingredients like vegetables, meats, and dairy.

- Beverage Costs: Both alcoholic and non-alcoholic drinks.

- Condiments & Spices: Often overlooked, these can impact overall costs.

- Packaging: For takeout and delivery services.

COGS plays a significant role in net profit calculations. Discover detailed analysis on determining and managing COGS.

Calculating COGS: A Step-by-Step Guide

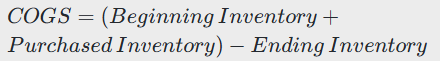

To calculate COGS, you need to track beginning inventory, purchased inventory, and ending inventory.

COGS Formula:

For instance, at Johnny’s Burger Bar, the calculation for February might be:

- Beginning Inventory: $3,000

- Purchased Inventory: $2,000

- Ending Inventory: $500

Thus, the COGS for February would be:

Explore recipes for COGS success that help in tracking and managing costs.

Optimizing Food Costs: Strategies to Lower COGS

Lowering COGS is essential for boosting profitability. Here are effective strategies:

- Bulk Buying: Save through bulk discounts on staple items.

- Vendor Comparison: Ensure you’re getting the best price without sacrificing quality.

- Seasonal Ingredients: Utilize locally available, in-season products to cut costs.

- Portion Control: Innovation in portion sizes can prevent wastage and ensure maximum value.

- Leverage Technology: Implement automated systems for inventory and cost management. Learn innovative ways to manage COGS.

Understanding COGS Ratio and Targets

The COGS ratio is the percentage of sales revenue attributed to COGS, often aiming for 30-35%. Improve your COGS ratio for higher profitability by monitoring sales and adjusting inventory strategies. Access resources to enhance profitability.

FAQ Section

1. What are restaurant operating costs besides COGS?

Operating expenses include rent, utilities, wages, and marketing. Balancing these with COGS can enhance financial health.

2. How can menu engineering lower COGS?

Strategically designing the menu encourages the purchase of high-margin items, indirectly affecting COGS balance.

3. Why track COGS regularly?

Regular monitoring helps maintain competitive pricing, adapt to market changes, and optimize inventory management. Explore this insightful guide to restaurant costs.

Final Thoughts!

Effectively managing Cost of Goods Sold can transform your restaurant’s financial landscape, ensuring sustained profitability. By calculating accurately, utilizing smart strategies, and refining inventory practices, your establishment can achieve significant success.