Running a hotel means more than offering rooms and service. You also need to plan the money side of the business carefully. A financial model for hotel gives you a clear picture of income, expenses, and profit. It helps you see if your hotel idea is worth investing in and how much money it can make in the future.

What is a Hotel Financial Model

A hotel financial model is a detailed Excel sheet that forecasts how your hotel will perform. It uses data like:

- Number of rooms

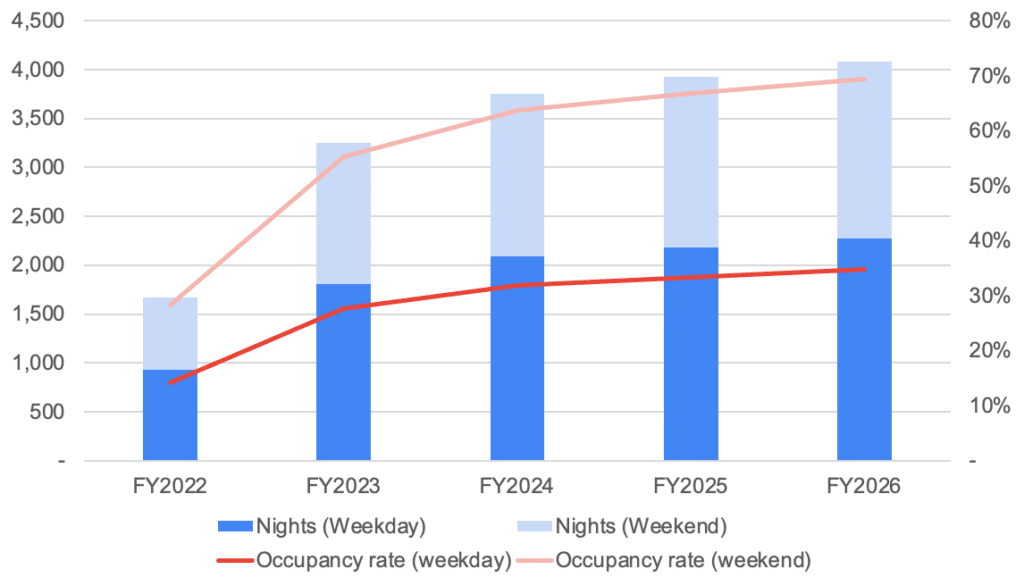

- Occupancy rate

- Average daily rate (ADR)

- Food and beverage sales

- Operating expenses

- Debt or loan payments

By entering numbers in the model, you can see how much revenue the hotel can generate, how much it costs to run, and what the profit could look like over time.

Why You Need One

Hotels face daily challenges with revenue and expenses. Without a clear financial plan, it’s hard to know if your project or current hotel is sustainable. Here’s what a financial model can help you with:

- Check feasibility – Find out if your hotel idea makes financial sense.

- Plan future growth – Forecast how occupancy and rates will impact income.

- Attract investors – Provide a professional financial plan to build trust.

- Manage cash flow – See when money comes in and when bills are due.

- Compare scenarios – Test best-case and worst-case projections before taking decisions.

Key Parts of a Hotel Financial Model

To make the model useful, it includes several key areas. These parts give you a full view of your hotel’s performance:

- Revenue Forecasting

Revenue usually comes from more than just room bookings. A strong model includes:

- Room revenue – Occupancy × ADR × number of rooms.

- Food and beverage revenue – Income from restaurants, bars, or catering.

- Other services – Spa, events, parking, or additional services.

- Operating Expenses

Hotels run daily with many costs. Common expenses include:

- Staff salaries and benefits

- Housekeeping and laundry

- Utilities such as electricity, water, internet

- Marketing and advertising

- Maintenance and repairs

- Capital Expenditure (CapEx)

This refers to money spent on building, renovating, or upgrading the hotel.

- Financing

If you use loans or outside funding, interest payments and repayment schedules are part of the model.

- Profit and Loss (P&L)

This section shows the difference between revenue and expenses, helping you see if the hotel is profitable.

- Cash Flow

Cash flow projections show how money moves in and out monthly, making it easier to handle bills and debt.

- Key Performance Indicators (KPIs)

Some of the most common hotel KPIs include:

- ADR (Average Daily Rate) – Average income per room sold.

- RevPAR (Revenue per Available Room) – Measures revenue across all rooms.

- GOPPAR (Gross Operating Profit per Available Room) – Tracks profitability per room.

Common Types of Hotel Financial Models

Different hotels have different financial structures. Models can vary depending on the type of property. Some examples are:

- Boutique hotel models – Smaller, unique properties focusing on a niche experience.

- Business hotel models – Focused on corporate travelers with steady occupancy.

- Resort models – Seasonal with revenue from multiple services like spa, events, and activities.

- Hostel or Airbnb models – Budget-focused with simple revenue streams.

- Luxury hotel models – High operating costs but higher room rates and added services.

How to Use a Hotel Financial Model

Using a model is not just about filling numbers. It’s about planning and testing different possibilities. Here’s how you can use it effectively:

- Input assumptions – Add room numbers, ADR, occupancy rates, and expenses.

- Run different scenarios – Test optimistic, average, and conservative forecasts.

- Check KPIs – Review metrics like RevPAR and GOPPAR to measure performance.

- Adjust for seasonality – Hotels often have high and low seasons. Reflect this in your numbers.

- Review cash flow – Make sure you have enough liquidity to cover costs even in low occupancy months.

Benefits for Hotel Owners

A ready-made Excel model saves time and reduces errors. For hotel owners, it:

- Simplifies forecasting and planning.

- Helps with investor presentations.

- Provides clarity on financing needs.

- Supports day-to-day decision-making.

Benefits for Investors

Investors want to see reliable numbers before funding a project. A professional model helps them by:

- Showing return on investment (ROI).

- Clarifying repayment timelines for loans.

- Reducing risk with clear assumptions.

- Comparing multiple hotel projects easily.

Mistakes to Avoid in Hotel Financial Models

While preparing financial models, many make common mistakes:

- Ignoring seasonality and assuming full occupancy all year.

- Underestimating operating costs like staff and maintenance.

- Overestimating room rates without market research.

- Not accounting for debt repayments and interest.

- Forgetting to include renovation or upgrade costs.

Avoiding these mistakes makes your model more accurate and useful.

Ready-Made Excel Models for Hotels

Building a model from scratch takes time and requires strong financial knowledge. Many hotel owners and consultants prefer using ready-made Excel templates. These templates already include:

- Structured revenue and cost breakdowns

- Pre-built KPI dashboards

- Cash flow and P&L sheets

- Scenario analysis features

All you need to do is enter your numbers. This helps save hours of work and gives a professional output ready for presentations.

Plan Your Hotel Growth with Confidence

A financial model for hotel is an essential tool if you want to understand how your hotel will perform financially. It helps you plan better, attract investors, and manage your cash flow with confidence. Instead of spending weeks building one from scratch, you can choose a professional Excel template designed for hotels.

Financial Models Hub offers ready-made hotel financial models that you can download, customize, and use immediately. They are practical, easy to use, and built with hotel industry needs in mind.