What is the NVIDIA Valuation Model?

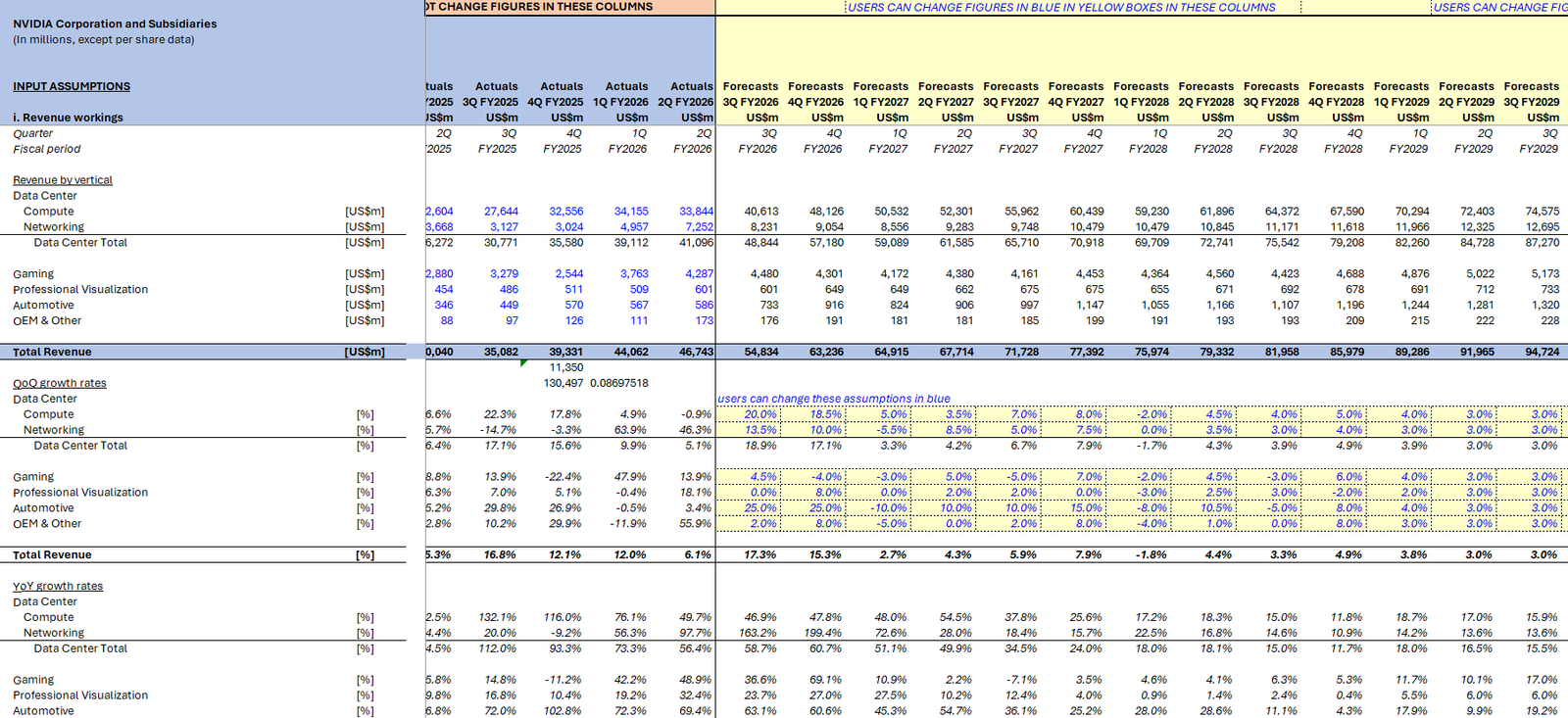

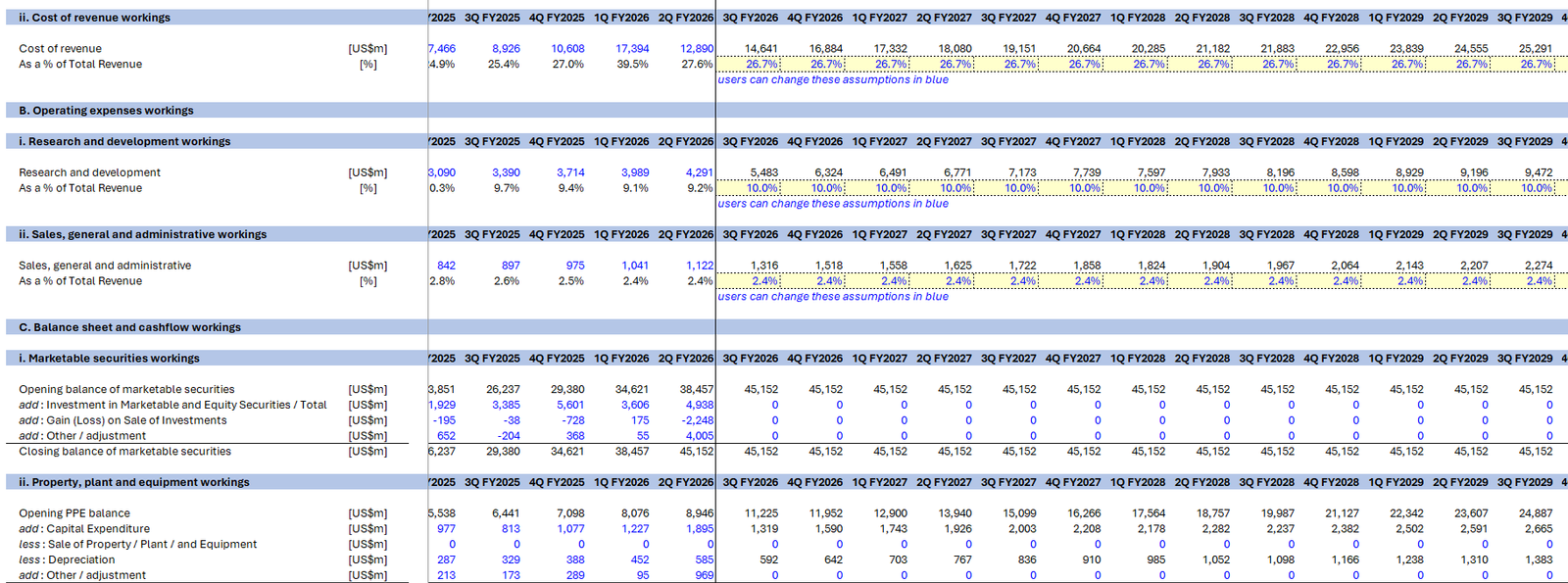

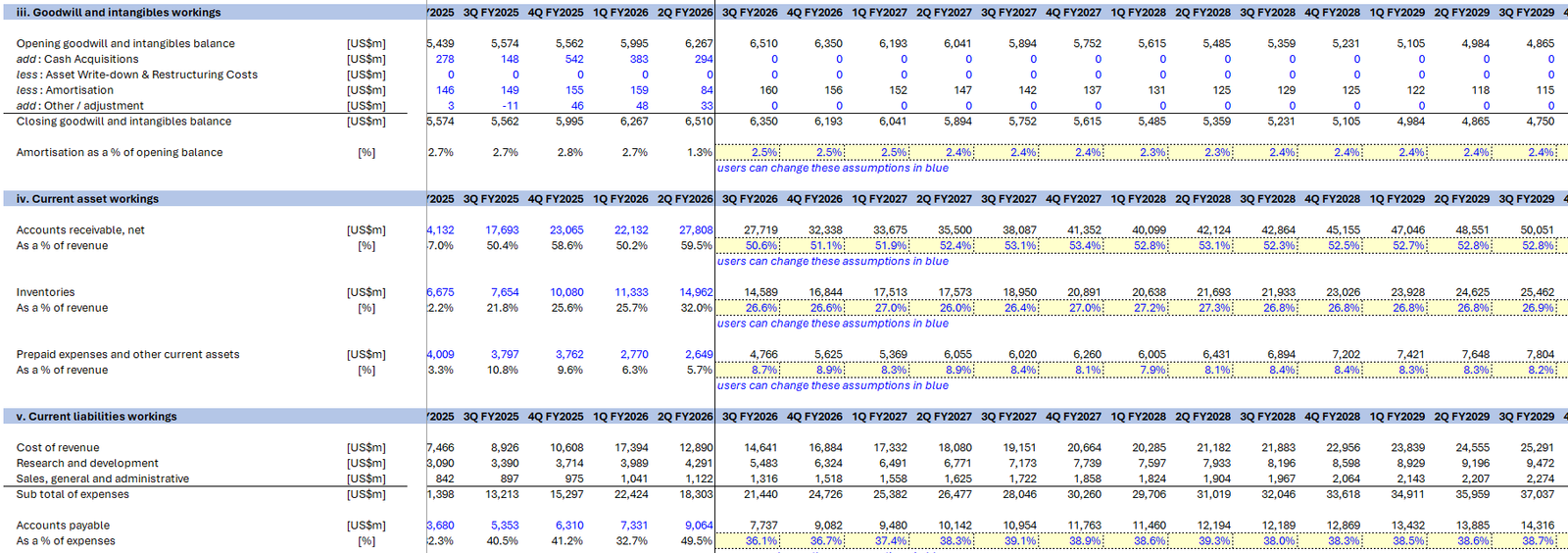

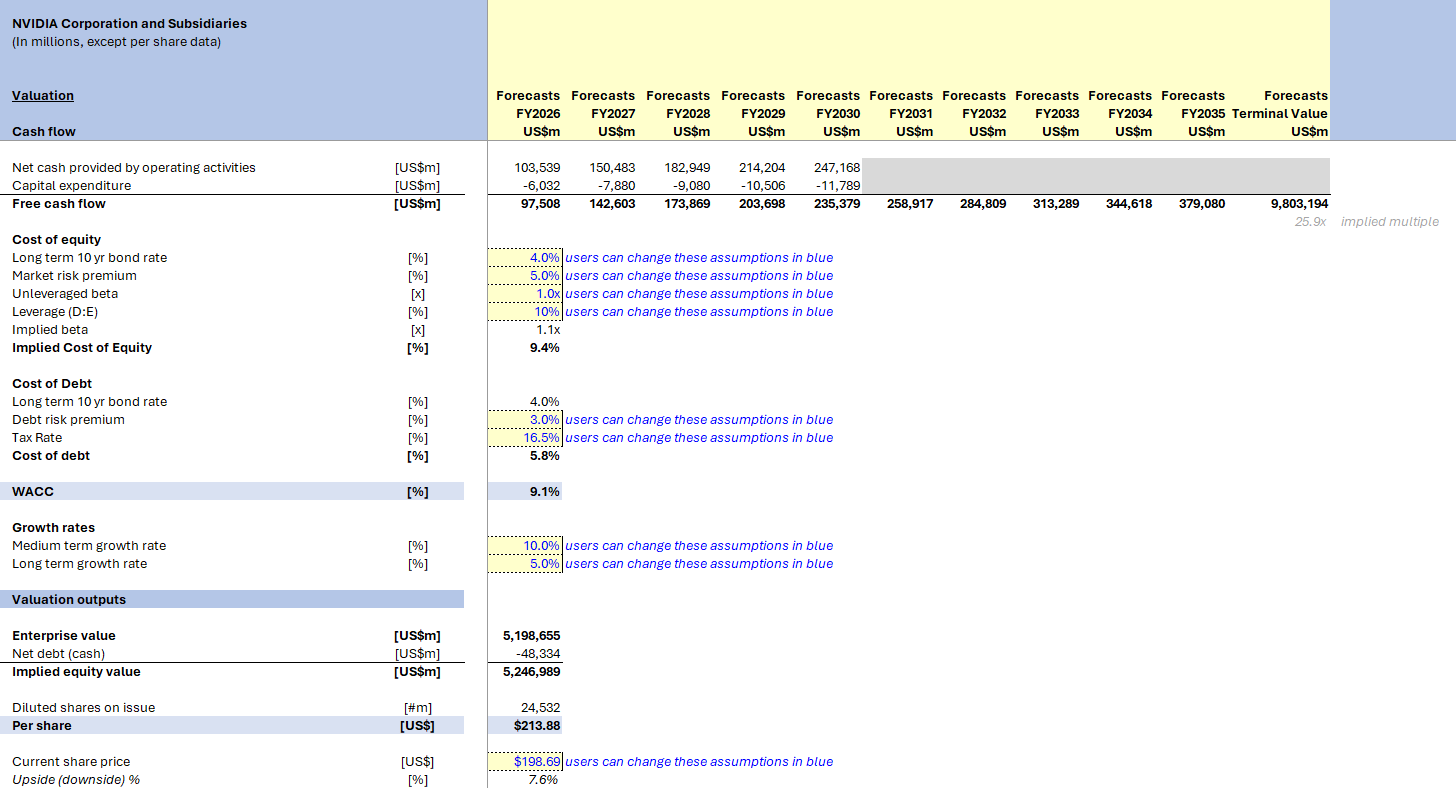

The NVIDIA Valuation Model employs a Discounted Cash Flow (DCF) approach to accurately estimate the intrinsic value of NVIDIA (NASDAQ: NVDA). This model helps in determining the company’s implied share price and its financial health. NVIDIA, a leader in graphics processing units, operates in sectors such as data center computing and visualization. We have also provided an NVIDIA Financial Model Template anyone looking to analyze NVIDIA and input custom assumptions (such as revenue growth rates by key divisions (Data Center Compute, Data Center Networking, Gaming, Professional Visualization, Automotive, OEM & Other), Operational costs (Cost of Revenue (ie. COGS), R&D, SG&A), capital expenditure, depreciation and amortization, balance sheet assumptions, cash flow assumptions and other assumptions) over a 5 year forecast period to determine an estimated valuation for the company using a DCF approach.

Introduction to the DCF Valuation Model

Developing the DCF Model

Creating a comprehensive DCF model necessitates a deep understanding of NVIDIA’s financial reports and its various business segments. These reports include essential data points like the Balance Sheet Forecast, which are crucial for accurate forecasting.

Financial Assumptions and Inputs

Accurate assumptions are critical when building a DCF model. They include growth projections, discount rates, and profitability measures such as profit margin. These data points are used to calculate the present value of NVIDIA’s future cash flows.

Components of the NVIDIA DCF Model

Income Statement and Balance Sheet Analysis

Forecasting NVIDIA’s revenue growth is a primary focus of the model. This involves analyzing historical data to establish trends for revenues and operating margins, supported by insights from comparable company analysis. The historical cash flow statement also plays a significant role in understanding cash-generated dynamics.

Debt and Cost of Capital

Creating a debt schedule helps in understanding NVIDIA’s debt obligations more clearly. The cost of capital, particularly the weighted average cost of capital (WACC), is vital for discounting cash flows to their present value.

NVIDIA’s Intrinsic Value and Implied Share Price

Calculating the Implied Share Price

With the DCF model’s completion, the implied share price and intrinsic value can be determined. This helps investors understand how NVIDIA’s stock price reflects its actual market value versus its market position.

Impact of Growth Projections

Forecasting involves growth rates pertinent to NVIDIA’s segments, particularly data center revenue growth, which affects the entire financial projection.

Frequently Asked Questions

What is the NVIDIA Valuation Model used for?

The model assists investors in assessing the intrinsic value of NVIDIA using DCF, determining the implied share price based on projected cash flows.

How is the Discount Rate significant in the DCF model?

The discount rate represents the risk-adjusted rate of return, influencing the present value of projected future cash flows.

What constitutes NVIDIA’s growth projections?

Growth projections are drawn from historical performance and future forecasts, primarily affecting revenue and profit margins.