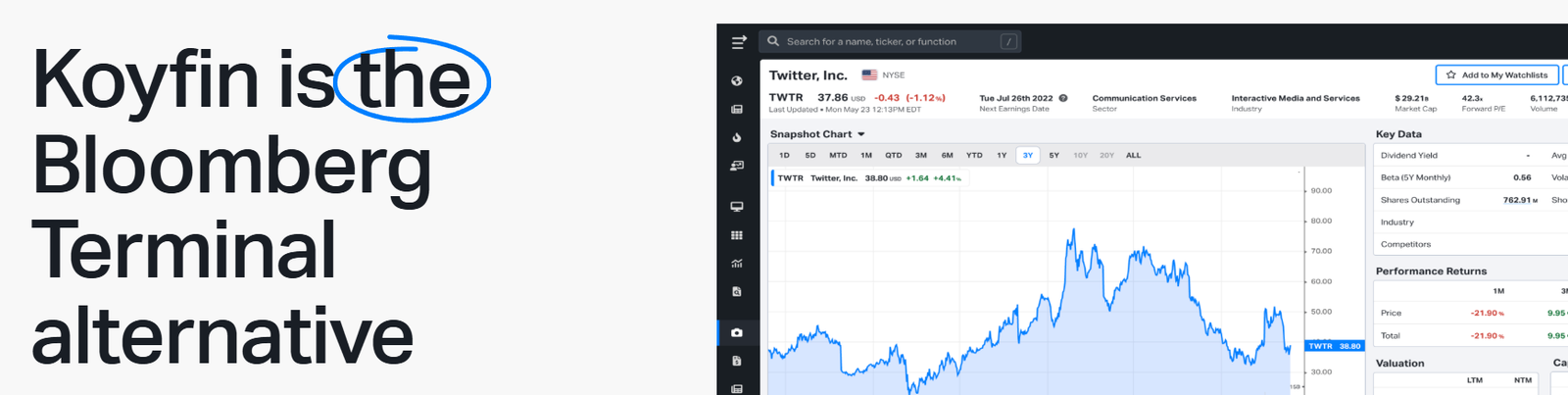

In the fast-paced world of investing, tools that deliver reliable data and streamline investment research are essential. Koyfin stands out among financial data platforms as an affordable, powerful option for portfolio management and market research. This comprehensive review explores Koyfin’s official site, its Koyfin features, Koyfin pricing, and how it excels in financial analytics and global market analytics.

Click HERE for 20% off the price of Koyfin subscription

What Is Koyfin?

Koyfin is an online financial data platform launched in 2018, designed for individual and institutional investors. It provides extensive data on stocks, ETFs, bonds, currencies, and economic indicators, making it ideal for day traders, swing traders, and long-term investors. With a focus on ease of use and an intuitive interface, Koyfin simplifies complex analysis without the high costs of platforms like Bloomberg.

Users praise its straightforward navigation, allowing quick access to portfolio analytics and client-ready reports. As noted in the Winter 2026 G2 report, Koyfin ranks first in financial analytics and investment portfolio management.

Key Takeaways

- Robust coverage of equities, macro data, and global assets.

- Customizable tools for spotting stock market trends.

- Affordable access to professional-grade insights.

Koyfin Pros and Cons

Koyfin balances advanced functionality with accessibility, but it’s not perfect. Here’s a breakdown of the pros and cons based on user feedback.

Pros

- Ease of use and intuitive interface with drag-and-drop customization.

- Comprehensive reliable data across markets, including real-time updates.

- Superior stock charting software and stock screeners for technical analysis.

- Cost-effective compared to traditional financial data platforms.

Cons

- Free plan limits historical data depth.

- Web-based only, lacking a dedicated mobile app.

- Fewer advanced tools like options flow.

For detailed user insights, check G2 reviews.

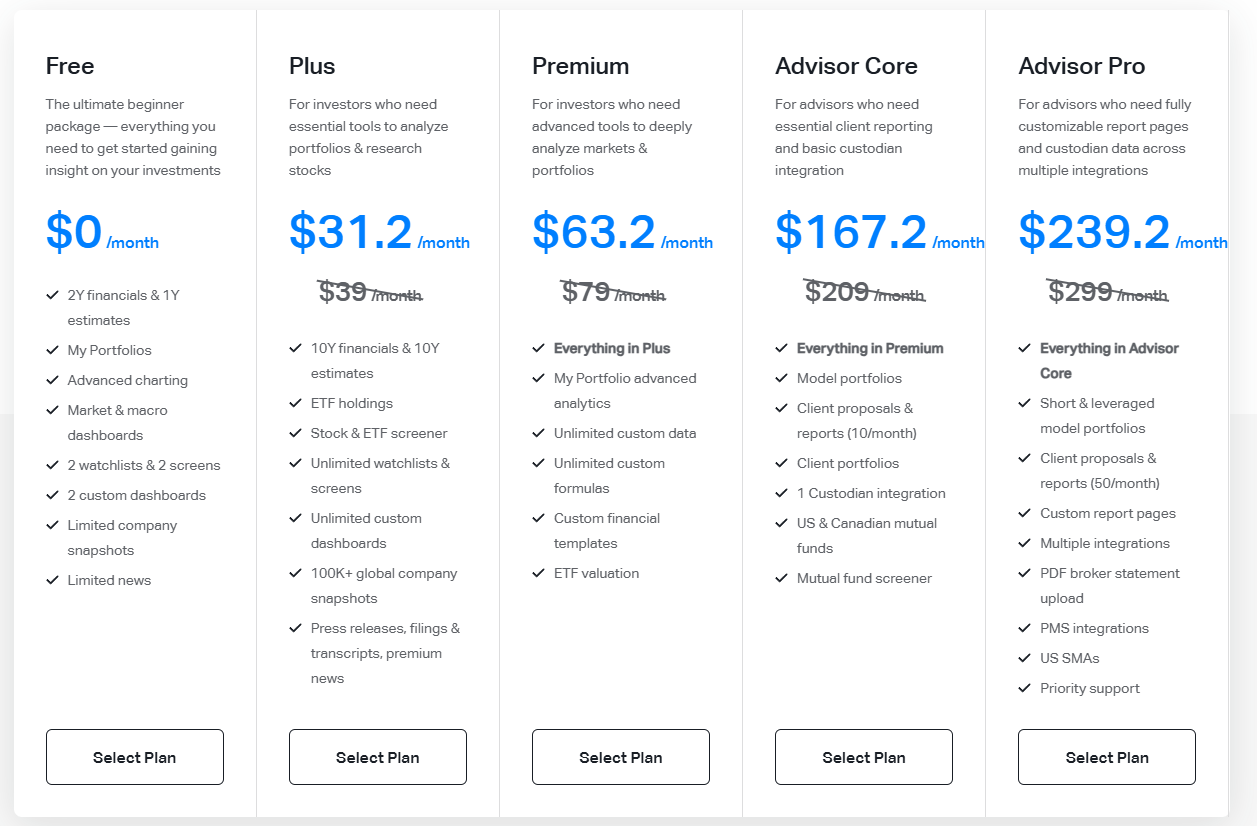

Koyfin Pricing Breakdown

Koyfin’s Koyfin pricing is a major draw, starting with a free tier and scaling affordably:

- Free Plan: Basic access for beginners.

- Plus: $39/month ($468/year) – Core features.

- Pro: $79/month ($948/year) – Advanced analytics.

- Advisor Core: $209/month ($2,508/year).

- Advisor Pro: $299/month ($3,588/year).

No long-term contracts allow flexibility.

Click HERE for 20% off the price of Koyfin subscription

Learn more about costs from Capterra Australia.

Essential Koyfin Features

Koyfin shines in delivering tools for investment research and portfolio management.

Comprehensive Financial Data Access

Access U.S. and international stocks, ETFs, commodities, bonds, inflation rates, and GDP growth. This supports informed decisions in volatile markets.

Customizable Dashboards

Tailor dashboards for straightforward navigation, focusing on earnings reports, sector performance, or watchlists. Ideal for portfolio analytics.

Advanced Charting Tools and Powerful Screener

Koyfin’s stock charting software offers candlestick patterns, moving averages, and over 500 metrics in its powerful screener. See why it’s listed among the 7 Best Stock Charting Software of 2026.

Comparative Analysis and Client-Ready Reports

Compare assets side-by-side and generate client-ready reports for advisors. Explore global market analytics effortlessly.

User experiences highlight these in TrustRadius ratings.

Customer Reviews from Verified Users

Verified users consistently rate Koyfin highly for ease of use and value. On GetApp Australia, it’s lauded as a “trusted resource” for market research. A detailed analysis appears in this Bullish Bears review, emphasizing its edge over pricier alternatives.

Top Alternatives to Koyfin

- TradingView: Strong charting community.

- Bloomberg: Premium data for pros.

- Yahoo Finance Premium: Budget-friendly basics.

- TipRanks and Morningstar: Focused research tools.

Koyfin excels in financial analytics balance for most users.

Is Koyfin Worth It?

For traders seeking reliable data, an intuitive interface, and tools like stock screeners and portfolio analytics, Koyfin delivers exceptional value. Its pros and cons favor active investors over institutions needing ultra-advanced features.

Frequently Asked Questions

Is Koyfin suitable for beginners?

Yes, its ease of use and intuitive interface make it beginner-friendly, with free access to core investment research tools.

Does Koyfin have a mobile app?

No, it’s web-based, prioritizing desktop portfolio management and global market analytics.

What makes Koyfin’s screener powerful?

The powerful screener offers 500+ metrics for fundamentals, technicals, and performance, outperforming many stock screeners.