In the dynamic realm of pharmaceutical and biotechnology, financial models are indispensable for strategic decision-making, investment management, and ensuring enduring sustainability. Accurately forecasting revenue and costs forms the bedrock of these financial models. This article offers a detailed exploration into projecting revenue and expenses within the pharma and biotech sectors. We have also built a ready-to-go Pharma and Biotech Valuation Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their company’s financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their company.

Understanding the Financial Landscape

The pharmaceutical and biotech industries are marked by complex financial structures, characterized by extended development timelines, high research and development expenses, and regulatory challenges. Organizations within these sectors primarily derive revenue from the development, manufacturing, and distribution of drugs and medical devices.

Revenue Streams

- Pharma Biotech Valuation Model: Revenue typically stems from drug sales, royalty agreements, and licensing deals.

- Biotech Startup Financial Projections: In the biotech sector, revenue might also emerge from intellectual property sales or collaborations with larger entities.

Cost Structures

- Risk Adjusted DCF Valuation: Cost components encompass fixed and variable expenses tied to research, clinical trials, manufacturing, and marketing.

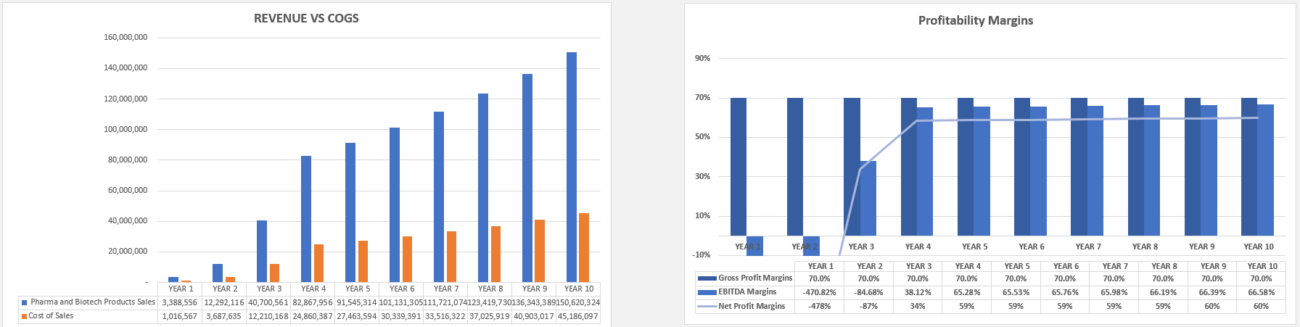

Step 1: Forecasting Revenue

Creating a robust revenue forecast necessitates a keen understanding of market dynamics and product lifecycle.

Estimate Market Size and Growth Rate

Start by assessing the market size for your product:

- Target Population: Analyze demographics and healthcare needs.

- Market Penetration: Evaluate potential market entry and expansion over time.

Utilize the formula:

Project Sales Volume

Revenue growth is gradual as products undergo commercialization phases. Initial sales might be minimal but can increase sharply during growth phases before stabilizing at maturity.

Pricing Strategies

Price setting should consider production costs, market competition, and regulatory influences. Scrutinize pricing strategies thoroughly.

Partnerships and Licensing

Revenue can also derive from joint ventures and licensing agreements. Structure forecasts around potential deals, incorporating upfront payments and royalties.

Regulatory and Market Risks

Given the uncertain landscape, risk management is crucial. Adjust forecasts for regulatory delays or shifts in market conditions.

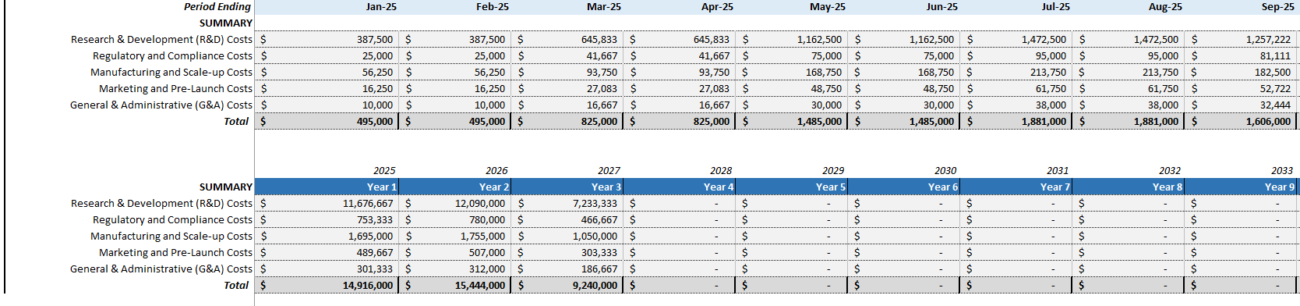

Step 2: Forecasting Costs

Properly projecting costs aids in creating accurate financial models.

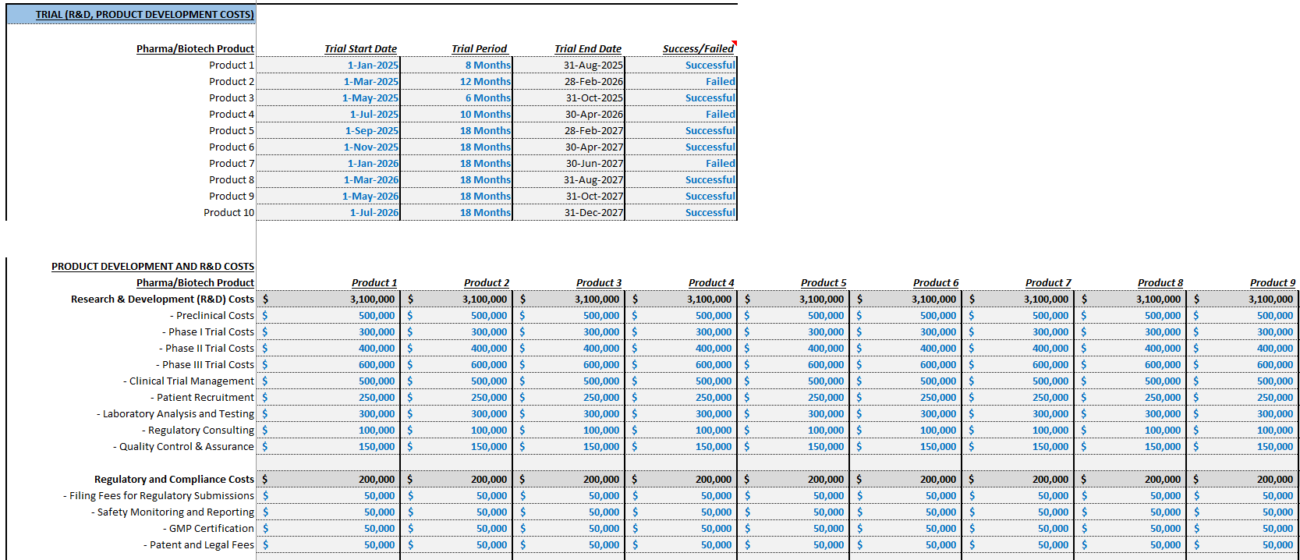

R&D Costs

R&D remains a significant expenditure, from initial drug discovery through clinical trials and regulatory compliance. Consider the full R&D lifecycle costs.

Manufacturing Costs

Factor in raw materials, facility maintenance, and packaging expenses. Manufacturing strategies often include specialized production processes.

Marketing and Sales Costs

Expenses in this category range from sales team salaries to promotional efforts, encompassing advertising and distribution costs.

General and Administrative Costs

These are necessary overheads including executive salaries, legal fees, and operational expenses.

Milestone Payments

Include milestone payments in forecasts when entering licensing or strategic alliances.

Step 3: Sensitivity Analysis and Risk Management

Sensitivity analysis highlights how variations in key assumptions affect financial outcomes. Scenario planning (best, base, and worst-case scenarios) is vital in risk assessment, providing insights into potential impacts on profitability.

Final Thoughts!

Accurate revenue and cost forecasting are pivotal in constructing effective biotech company financial models. By leveraging market insights, development stages, and pricing evaluations, the models aid strategic planning and investor engagement. These models must remain adaptable to industry shifts through continuous sensitivity analysis. Ultimately, robust financial modeling is a fundamental tool for guiding development and ensuring growth.

Frequently Asked Questions

What is the significance of accurate financial modeling in pharma and biotech?

Accurate financial modeling helps in strategic decision-making, securing investments, and guiding company growth while accounting for industry risks and dynamics.

How do partnerships affect revenue forecasts?

Collaborative agreements provide additional revenue streams through licensing fees and milestone payments, crucially impacting overall projections.

Why is risk management integral to financial modeling in these industries?

Given the high uncertainty and regulatory hurdles in pharma and biotech, incorporating risk management ensures financial projections remain realistic and actionable.