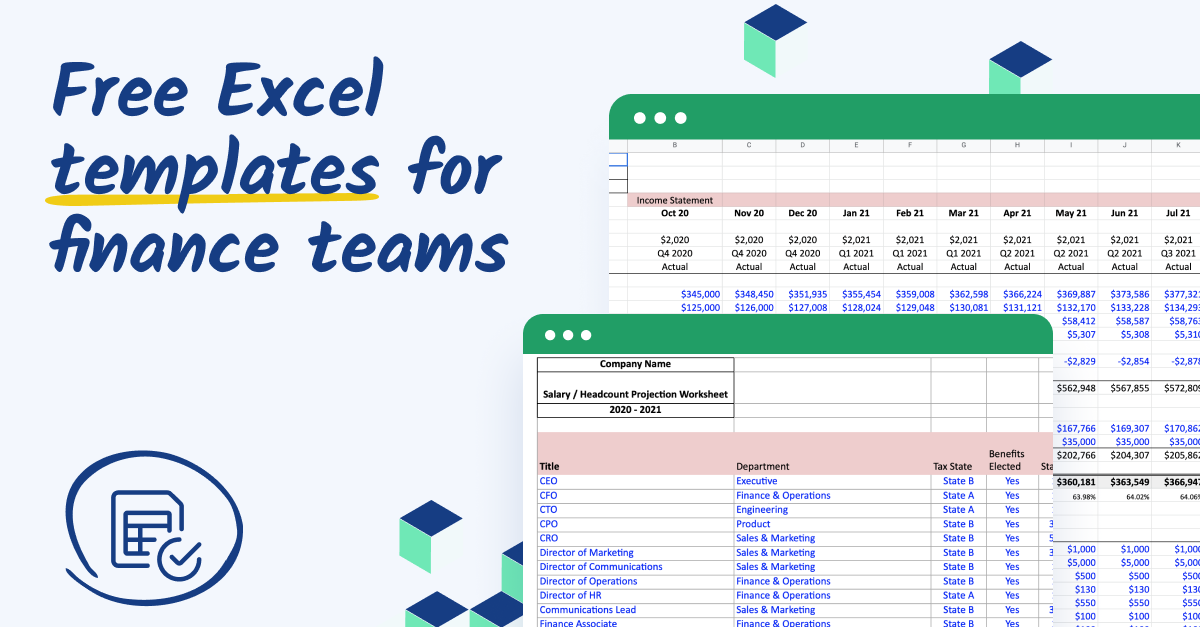

Creating business forecasts in Excel often takes more time than it should. You may find yourself building endless formulas, fixing errors, or searching for a ready file online. A financial model template excel helps you save that time by giving you a structured file where all the main calculations are already set up. You only add your own numbers, and the model does the rest.

Instead of wasting hours on complex spreadsheets, you can start with a solid foundation that’s already built for you. A financial model template makes forecasting easier, faster, and far more reliable.

What Is a Financial Model in Excel?

A financial model is a spreadsheet that predicts the future performance of a business. It links together expected sales, expenses, investments, and funding to give you an idea of how much profit or loss you may see in the future.

In Excel, these models often include:

- Income statement – records revenue and expenses.

- Cash flow statement – tracks how cash enters and leaves the business.

- Balance sheet – lists assets, liabilities, and equity.

When these three are linked, the model provides a clear picture of the company’s health.

Who Uses These Models?

Different groups of people use Excel financial models for different reasons:

- Startup founders – to show investors how their business can grow.

- Small business owners – to check if they can afford expansion or hiring.

- Finance students – to practice calculations and forecasting.

- Consultants and advisors – to guide clients on budgets and planning.

- Investors – to test if a company’s numbers make sense before funding.

Common Problems Without a Template

If you try building a model from scratch, you may face:

- Too much time spent building formulas instead of analyzing results.

- Errors in links that make the forecast unreliable.

- Inconsistent formats that confuse readers.

- Lack of clear outputs for investors or decision-makers.

These challenges are why ready-made templates are popular.

What Makes a Good Excel Template

Not all templates are equal. A strong one should:

- Be easy to edit with clear input cells.

- Include all three financial statements linked correctly.

- Allow scenario planning like best case and worst case.

- Have charts and tables that summarize key numbers.

- Work for different industries such as SaaS, restaurants, or real estate.

When these parts are present, you can trust the numbers and share them with others.

Examples of Use Cases

For Startups

Founders preparing for a pitch often need to explain revenue growth, funding needs, and runway. A ready model can display these numbers in minutes.

For Small Businesses

Owners may want to know how a new branch, a new machine, or extra staff will affect cash. Templates help test different plans without guesswork.

For Consultants

Instead of spending days making a model, consultants can adjust a template and present insights faster to their clients.

Free vs. Paid Templates

When you search online, you find both free and paid files.

Free templates

- Good for practice or learning basics.

- Usually limited in detail.

- May not have valuation or industry-specific features.

Paid templates

- Often built by finance experts.

- Cover more detail, with clean design.

- Include dashboards, charts, and scenario testing.

- Save time when preparing for real business use.

If you are just learning, free files may be enough. If you are raising funds or preparing board reports, paid templates are more reliable.

How to Use an Excel Model Template

Using one is simple if you follow clear steps:

- Download the file from a trusted source.

- Read the guide tab if provided. Many files explain where to enter data.

- Fill in assumptions like sales, expenses, or pricing.

- Review outputs on income statement, cash flow, and balance sheet.

- Adjust scenarios to test how changes affect the results.

- Share with investors or partners once you are confident.

Key Features to Look For

When choosing, pay attention to these features:

- Color-coded input cells (usually blue) so you know where to type.

- Automatic calculations that update across all sheets.

- Graphs and summaries for quick reading.

- Valuation section to estimate company worth.

- Flexible time periods (monthly or yearly).

These make the file easier to use even if you are not a finance expert.

Free vs. Paid

| Feature | Free Template | Paid Template |

| Income Statement | Basic only | Full detail linked |

| Cash Flow | Sometimes missing | Always included |

| Balance Sheet | Often missing | Fully linked |

| Valuation | Rare | Included |

| Charts & Dashboards | Simple or none | Professional design |

| Industry-Specific | No | Yes (SaaS, real estate, etc.) |

| Support/Guide | No | Often provided |

Questions People Ask

- Do I need finance knowledge to use one?

Not much. Most templates are designed with clear instructions. - Can I edit the formulas?

Yes, you can. But for most people, only the input cells matter. - Are templates accepted by investors?

Yes, if they are well-structured and show realistic numbers. - Can I use the same model for different industries?

You can, but industry-specific versions are more accurate. - How often should I update it?

At least monthly, or whenever your business assumptions change.

How a Template Saves You Time

- You spend minutes entering numbers instead of weeks building formulas.

- You avoid the risk of broken links.

- You get investor-ready charts and summaries.

- You can test multiple scenarios quickly.

For anyone running a business, these time savings make a big difference.

Turn Your Numbers into Insights in Minutes

If you often spend hours building forecasts, it may be time to switch to a ready-made financial model template excel. It helps you work faster, cut errors, and share clear numbers with your team or investors.

A trusted partner like Financial Models Hub offers files built by experts that are easy to use and cover many industries. With the right template, you can focus more on running your business and less on fixing spreadsheets.

With a financial model template, you don’t need to start from scratch—just plug in your numbers and get instant insights. It’s a simple way to save time, avoid mistakes, and make smarter business decisions.