For hotel owners, cash flow isn’t just a financial metric—it’s the difference between surviving the low season with confidence or scrambling to cover payroll and supplier bills. Even profitable hotels can face cash shortages if income and expenses aren’t aligned throughout the year.

This guide breaks down how hotel cash flow really works, why low-season crises happen, and what you can do to stabilize your finances year-round—without cutting corners on guest experience.

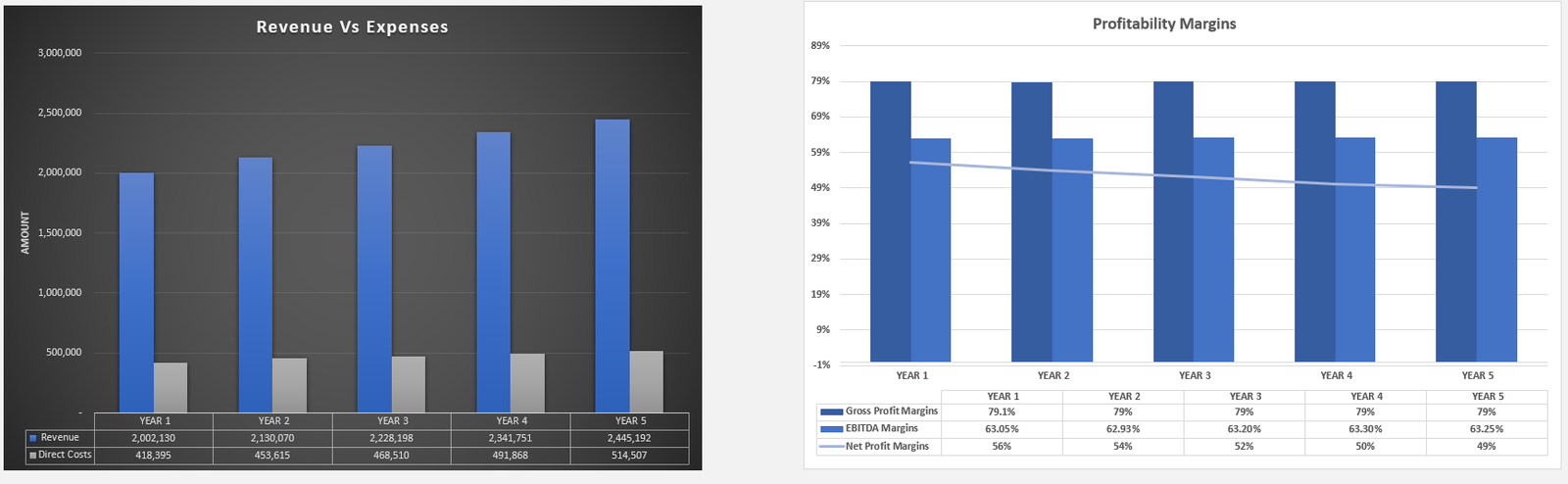

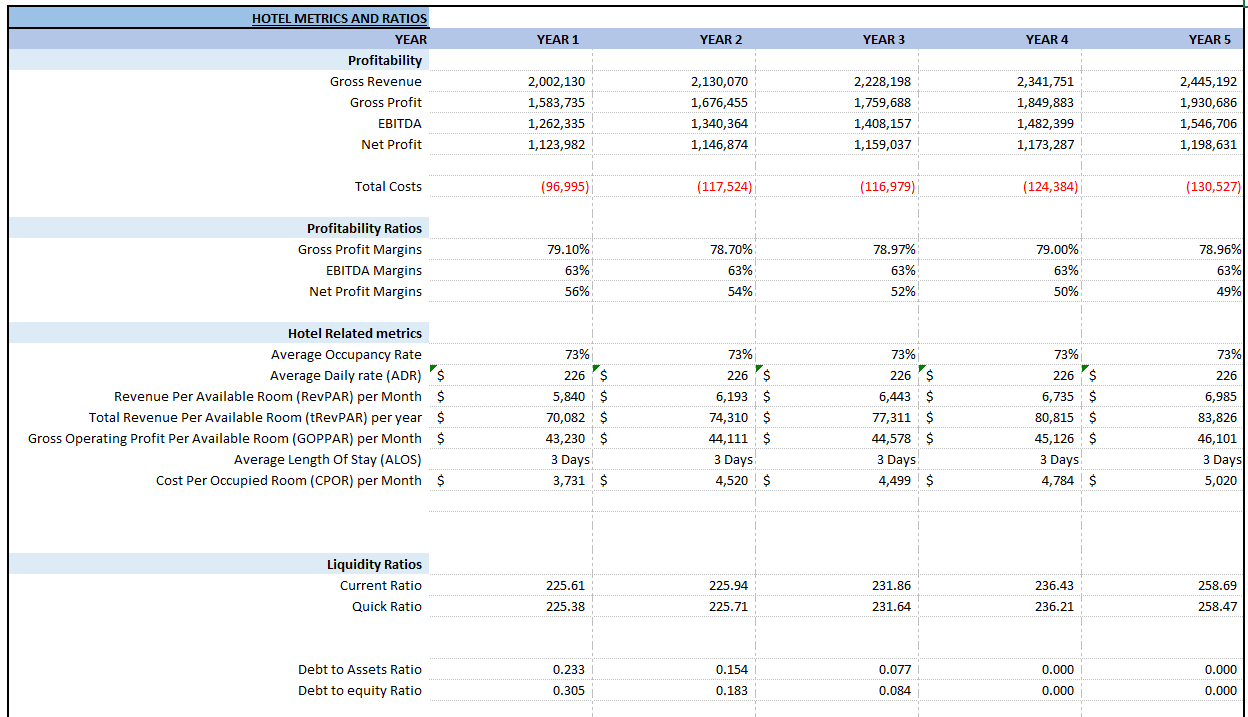

We have also built a Hotel Financial Model Template for Founders and Entrepreneurs to use. Just input your assumptions, and our model does the rest! It’s a complete 3-way financial model with an Income Statement, Balance Sheet, Cash Flow Statement, hotel investment specific metrics, ratios, and more.

Why Cash Flow Matters More Than Profit in Hospitality

Many hotel owners make the mistake of focusing on profitability alone. While profit is important, cash flow is what keeps the lights on. A hotel can be profitable on paper but still fail if:

- Revenue is seasonal

- Expenses are fixed or inflexible

- Payments arrive later than costs are due

Unlike many businesses, hotels have high fixed costs, perishable inventory, and strong seasonality, making cash flow management a core operational skill, not just an accounting task.

Understanding Your Hotel’s Cash Flow Cycle

To manage cash flow, you must first understand how money moves through your business.

Cash Inflows

Typical hotel inflows include:

- Room revenue

- Food and beverage sales

- Events, conferences, and weddings

- Ancillary services

- Advance deposits and prepayments

Cash Outflows

Common outflows include:

- Payroll and benefits

- OTA commissions

- Utilities and maintenance

- Rent or mortgage payments

- Supplier invoices

- Loan repayments

- Marketing and software subscriptions

The Timing Gap

The biggest issue is timing. If you don’t plan for this gap, low-season cash shortages are almost inevitable.

Why Low Season Causes Cash Flow Crises

Low season doesn’t usually cause problems by itself—lack of preparation does.

Revenue Drops Faster Than Costs

While occupancy may fall, most costs stay the same. Without disciplined saving and forecasting, extra cash often gets absorbed. By the time low season arrives, reserves are gone. Learn more about cashflow management techniques.

Build a 12-Month Cash Flow Forecast (Not Just a Budget)

A budget shows planned income and expenses, but a cash flow forecast shows when money actually moves.

What a Good Forecast Includes

- Monthly (or weekly) inflows by revenue stream

- Fixed vs variable costs

- Debt repayments

- Tax obligations

- Seasonal patterns from past years

A 12-month view allows you to spot low-cash months early and adjust accordingly.

Create a Low-Season Survival Fund

Every hotel should operate with a cash buffer for low season.

How Much Should You Hold?

A common benchmark is 3–6 months of fixed operating expenses. Think of this fund as self-insurance against seasonality.

Optimize Revenue Timing (Not Just Revenue Amount)

Improving cash flow is about getting paid faster.

Encourage Advance Payments

Use non-refundable rates, deposits, and prepaid packages. Optimize invoicing and payments to improve liquidity.

Diversify Beyond OTAs

Promote direct booking incentives and monetize the low season. Some income is always better than none.

Control Costs Without Damaging the Guest Experience

Cost-cutting in hospitality must be strategic.

Focus on Flexible Costs

Adjust staffing schedules, cross-train employees, and reduce energy usage with smart systems. Review subscriptions and services to cut unnecessary costs.

Use Debt Carefully to Smooth Cash Flow

Debt isn’t inherently bad—poorly structured debt is. Use it to cover predictable seasonal gaps, but avoid reliance year-round.

Track the Right Cash Flow Metrics

Monitor cash on hand, net cash flow per month, and other key metrics regularly to stay informed on your financial health. Explore traditional financial ratios to aid in understanding your position.

Turn Cash Flow Management Into a Habit, Not a Crisis Response

The most successful hotel owners treat cash flow as a weekly review item and a core part of strategic planning. When cash flow is under control, opportunities can be seized instead of feared.

Final Thoughts: Stability Beats Stress

Low season doesn’t have to mean sleepless nights. With proper forecasting, saving, revenue timing, and cost control, hotel owners can achieve proactive financial stability. Cash flow mastery ensures that when bookings slow down, your business doesn’t.

Frequently Asked Questions

Q1: What are the benefits of improving cash flow?

Improving cash flow enhances financial flexibility and independence, allowing for better planning and fewer disruptions during low seasons.

Q2: How can I monitor cash flow effectively?

Implement managing finances tools and review cash flow statements regularly to track business payments and cash flow outflows.

Q3: Why is a cash flow statement essential?

A cash flow statement provides a detailed view of cash inflows and outflows, aiding in business payments planning and ensuring financial health.