Building a financial model for a beverage manufacturing business is crucial for understanding the prospective financial performance of your company. Whether you’re initiating a new venture, expanding an existing one, or seeking investments, a well-designed financial model can assist in forecasting revenue, managing costs, and assessing profitability and risks.

This guide will walk you through the process, tailored for beginners looking to delve into the financial intricacies of the beverage manufacturing industry. We have also built a ready-to-go Beverage Manufacturing Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their business.

Why is a Financial Model Important for Beverage Manufacturing?

A financial model maps out the financial outlook of your beverage manufacturing company. A robust model helps in:

- Forecasting Revenues: Anticipate the income generated from beverage sales.

- Estimating Costs: Account for all operational costs such as raw materials and packaging.

- Evaluating Profitability: Assess whether the business can achieve profitability.

- Attracting Investment: Engage stakeholders with clear financial projections.

- Risk Mitigation: Identify and plan for potential risks like pricing changes or production disruptions.

By building a comprehensive beverage manufacturing startup model, you can tackle industry challenges effectively.

Key Components of a Beverage Manufacturing Financial Model

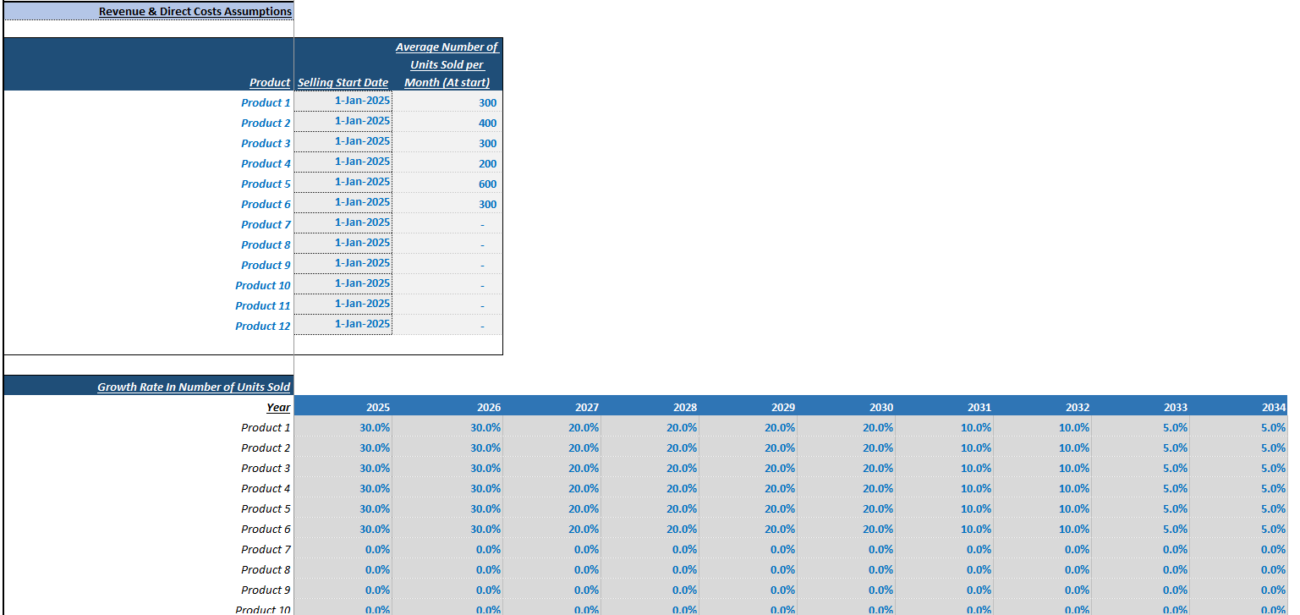

Revenue Streams

- Product Sales: Main source of income, possibly through various channels like retail or e-commerce.

- Pricing Strategy: Set competitive prices based on costs and market trends.

- Sales Volume: Estimate units sold, influenced by market demand and distribution.

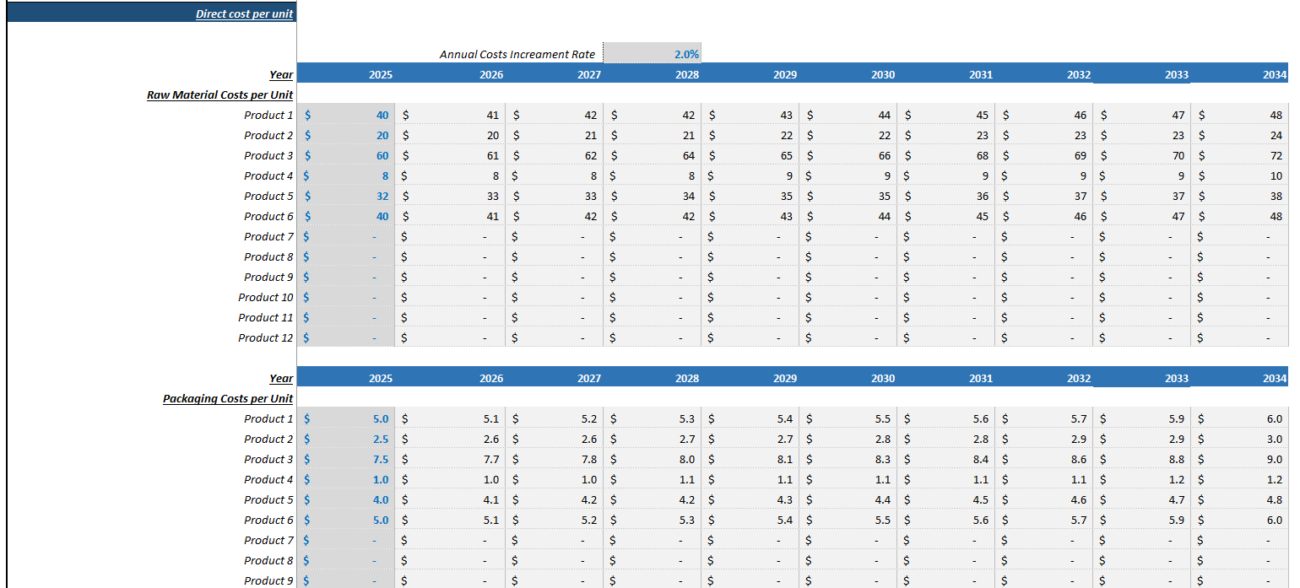

Costs and Expenses

- Raw Materials: Include water, sugars, and other essential ingredients.

- Production Costs: Cover labor and overhead expenses.

- Packaging Costs: Account for bottles, cans, and labels.

- Logistics and Distribution: Include warehousing and delivery costs.

- Sales and Marketing: Cover marketing campaigns and promotional expenses.

Capital Expenditures (CapEx)

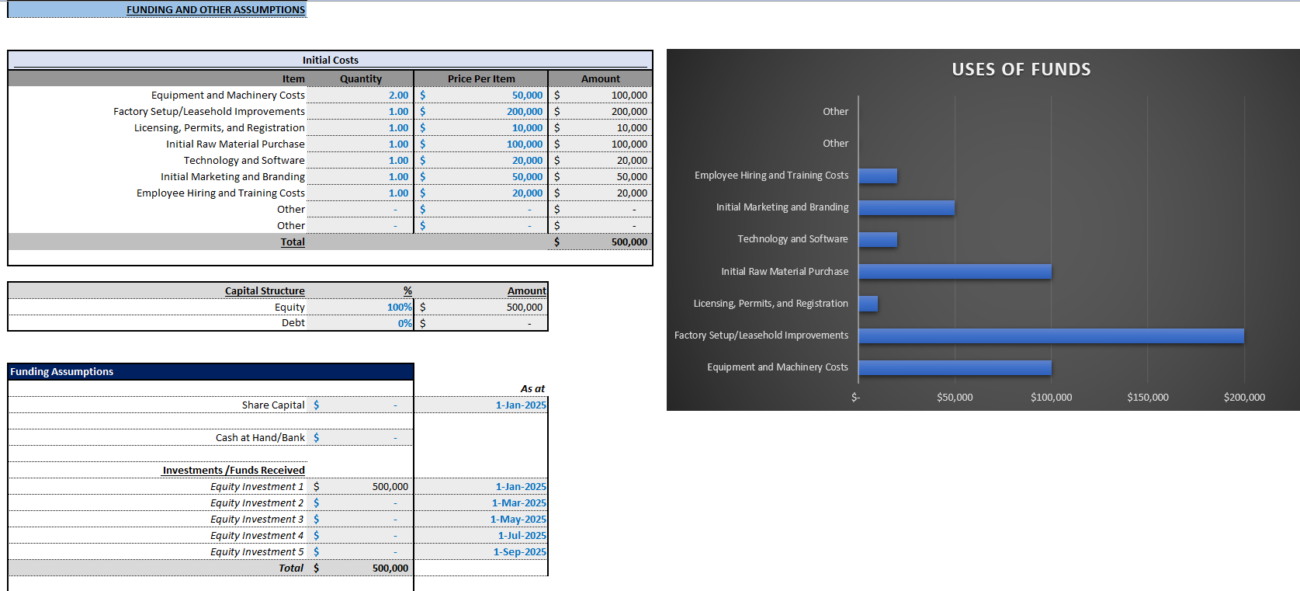

Investments in production equipment and facility setup should be factored as they contribute to long-term business growth.

Financing and Funding

- Debt Financing: Loans for operational needs.

- Equity Financing: Investment in exchange for business ownership.

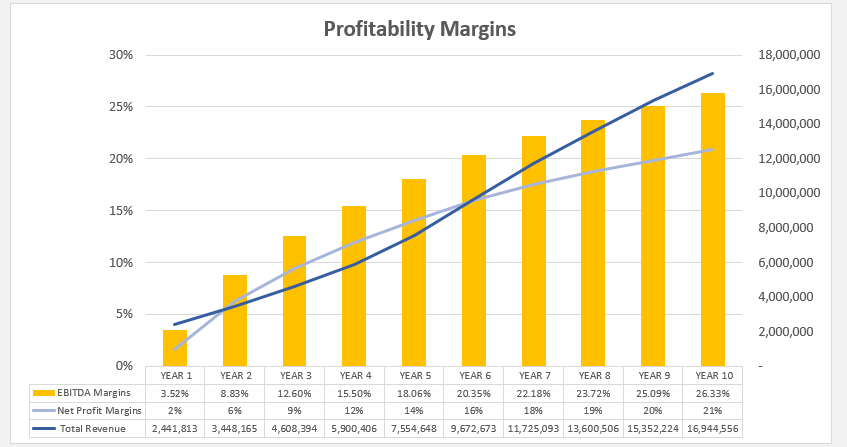

Key Performance Indicators (KPIs)

Measure success with indicators like gross profit margin, operating profit margin, and return on investment (ROI).

Step-by-Step Guide to Building a Beverage Manufacturing Financial Model

Step 1: Define the Scope of Your Business

Define product type, production capacity, target market, and sales channels to set a foundation for revenue forecast models.

Step 2: Estimate Revenue

Determine sales volume, pricing strategy, and revenue calculations to project your business income.

Step 3: Estimate Costs and Expenses

Assess costs involved in raw materials, production, packaging, logistics, and marketing to understand your financial aspects beverage business.

Step 4: Capital Expenditures (CapEx)

Include costs for machinery, facility setup, and other major investments.

Step 5: Forecast Profit and Loss (P&L)

Calculate gross profit, operating profit, and net profit to evaluate business health.

Step 6: Conduct Sensitivity Analysis and Scenario Testing

Use scenario testing for craft food beverages to understand how key assumption changes affect profitability.

FAQs

What is a beverage manufacturing financial model?

It’s a blueprint that outlines expected revenues, costs, and profits for a beverage business, allowing for financial planning and analysis.

Why is it important to conduct scenario testing?

Scenario testing helps anticipate how changes in market conditions or operational variables impact financial outcomes, enabling proactive strategy adjustments.

How can a financial model attract investors?

A comprehensive financial model provides clarity on business financial health, helping instill investor confidence and facilitating informed investment decisions.

Crafting a beverage manufacturing financial model involves detailed revenue, cost estimation, and forecasting to ensure informed decision-making and business sustainability. Adapt and refine your model regularly to align with changing market dynamics.