Creating a successful café or coffee shop requires more than just a passion for brewing the perfect cup of coffee. Financial planning plays a crucial role in ensuring the sustainability and profitability of your business. This guide will walk you through the essentials of constructing a coffee shop financial model, whether you’re starting from scratch or looking to refine your existing plans. We have also built a ready-to-go Cafe Restaurant Financial Model Template and Coffee Shop Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their Cafe or Coffee Shop business.

Importance of a Coffee Shop Financial Model

A well-built financial model helps you project your business’s financial future, making informed decisions on crucial aspects like menu pricing, staffing, and inventory management. Here are key reasons why a financial model is indispensable:

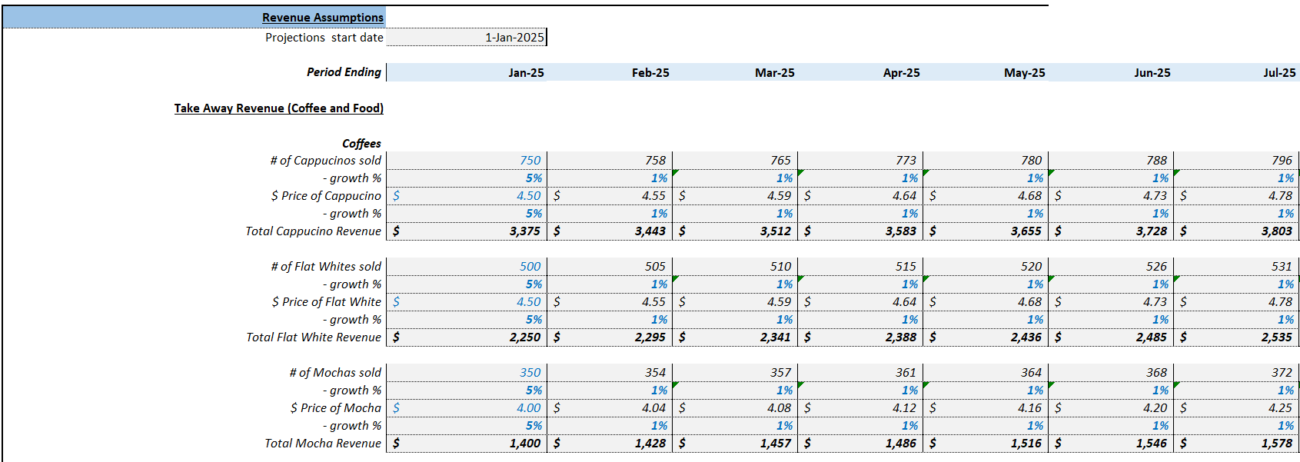

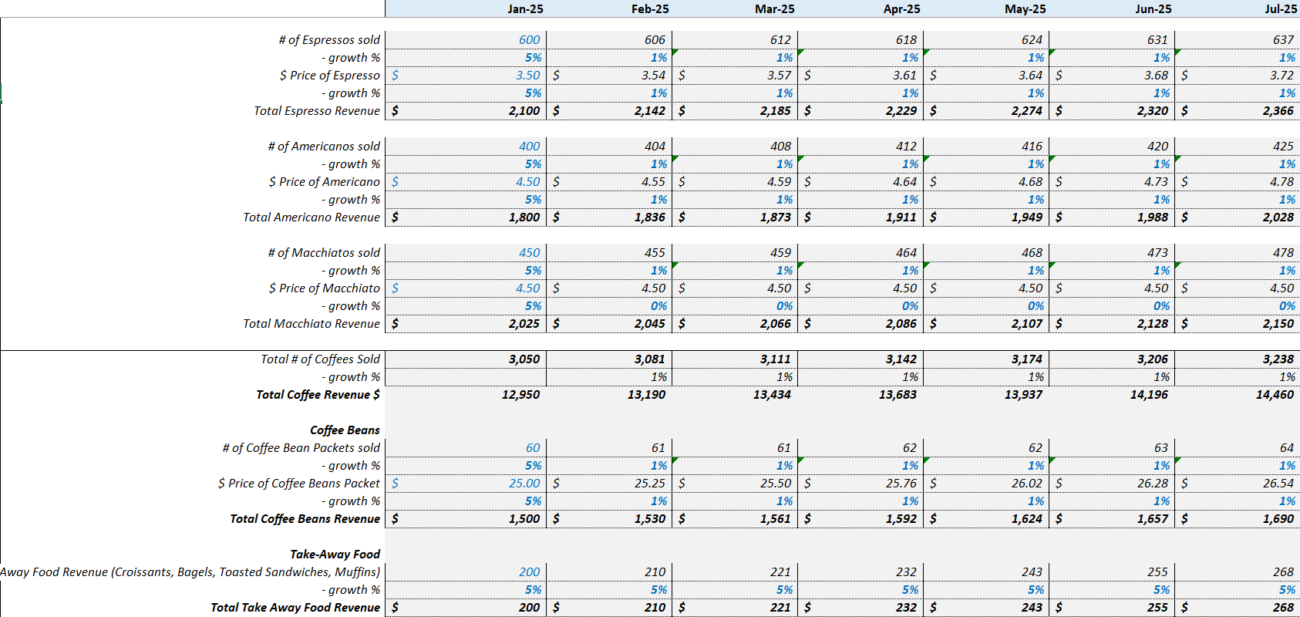

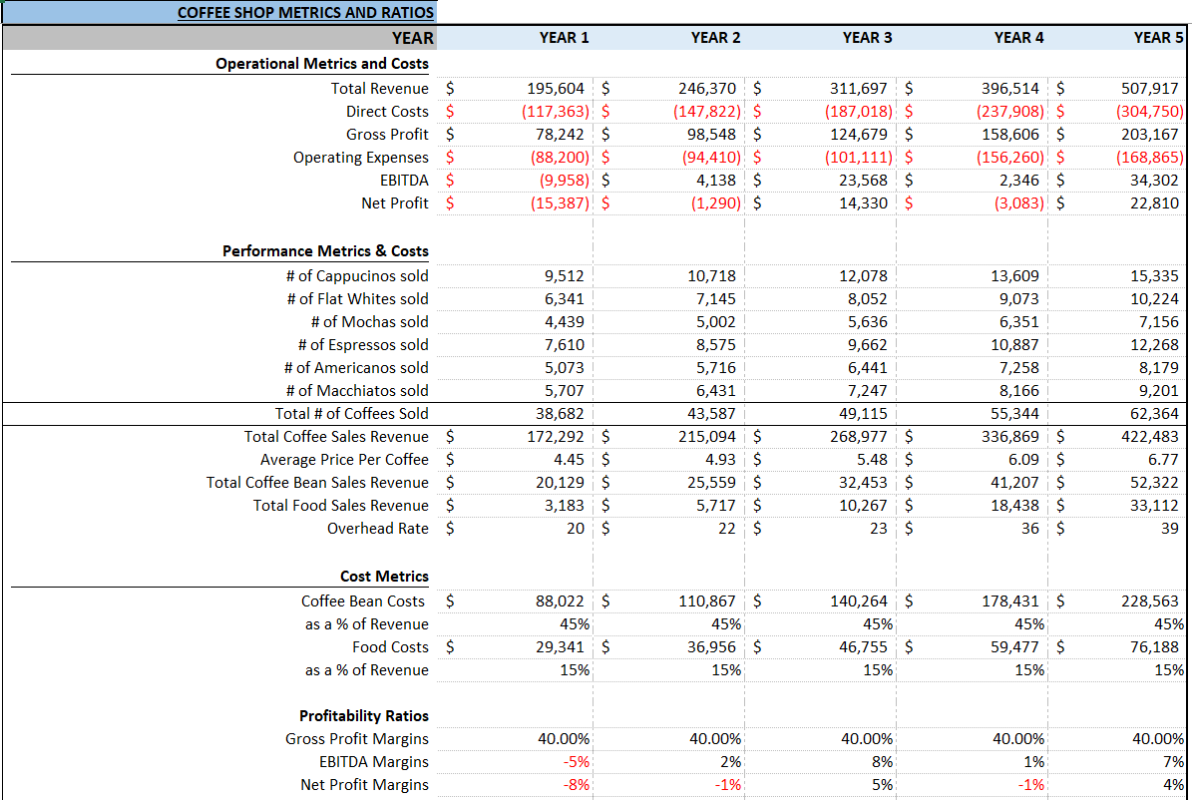

- Revenue Forecasting: Estimate the potential earnings based on the menu and predicted customer numbers.

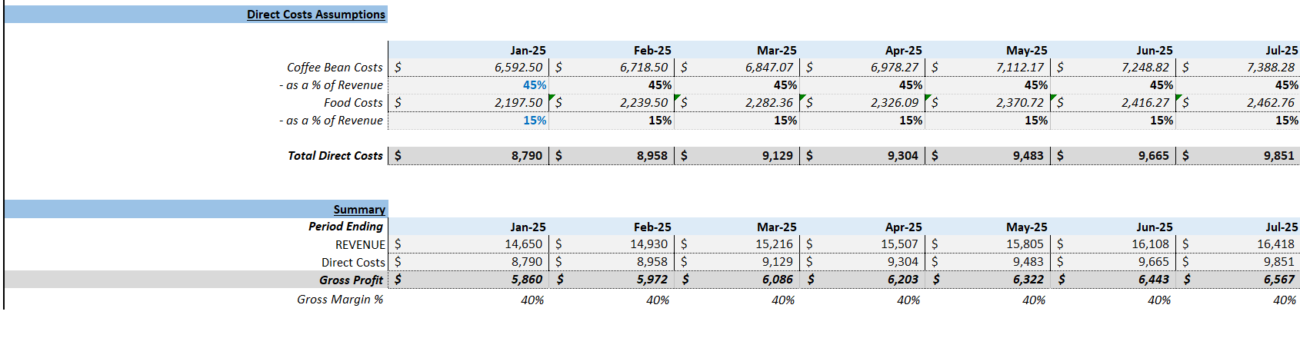

- Cost Management: Identify fixed and variable expenses to optimize operations.

- Profitability Assessment: Determine if and when your coffee shop will break even or turn a profit.

- Investment Attraction: A financial model provides prospective investors with insight into potential ROI.

- Cash Flow Projection: Predict cash inflows and outflows to maintain liquidity.

- Strategic Decision-Making: Facilitate data-driven decisions on expansion and other business aspects.

Key Components of a Café Financial Model

Revenue Streams

- Food and Beverage Sales: Primary income from coffee, other drinks, and snacks.

- Additional Services: Income from catering or special events.

- Retail Products: Sale of packaged coffee and branded merchandise.

Costs and Expenses

- Fixed Costs: Include consistent expenses like rent and salaries.

- Variable Costs: Fluctuate based on sales, including ingredient costs and hourly wages.

- Operating Expenses: Ongoing costs such as marketing and supplies.

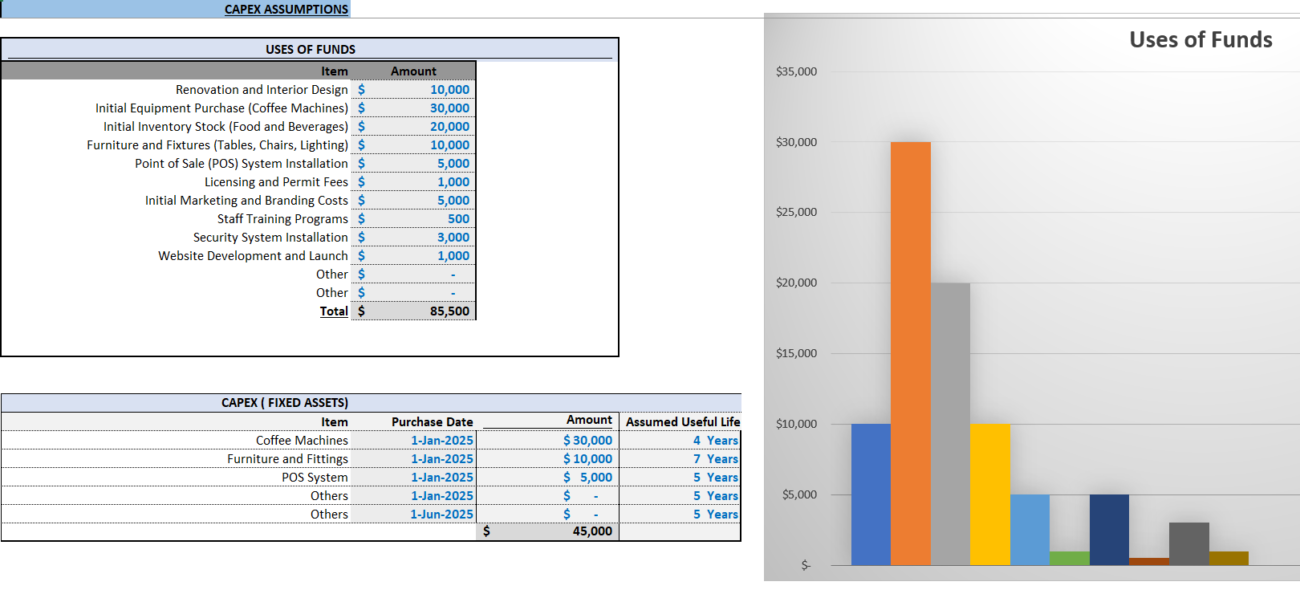

Capital Expenditures

Investments for purchasing equipment and renovating space are crucial one-time expenditures.

Building Your Financial Model

Step 1: Define Your Café’s Scope

Determine the type of establishment you’re launching, its size, location, and target market. For detailed insights, check out How To Build a Financial Model For a Coffee Shop.

Step 2: Estimate Revenue

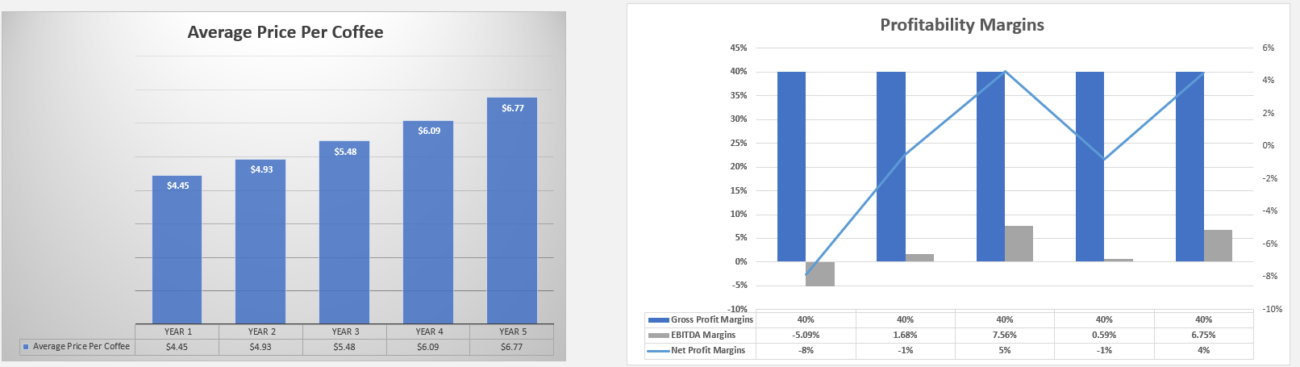

- Menu Pricing: Competitive analysis helps set fair prices.

- Sales Volume: Predict customer numbers based on location and seating capacity.

- Average Customer Spend (ACS): Estimate spending per customer visit.

For nuanced forecasting, see this Restaurant Cash Flow Statement.

Step 3: Estimate Costs and Expenses

Knowing your costs is essential for maintaining profitability:

- Fixed Costs: Such as rent and utilities.

- Variable Costs: Include food, labor, and utilities.

- Operating Expenses: Ongoing business costs like marketing.

Step 4: Calculate Profitability

Leverage key performance indicators to ensure profitability:

- Gross Profit Margin: Revenue minus Cost of Goods Sold.

- Operating Profit: Gross profit less operating expenses.

- Net Profit: Final profit after non-operational costs.

Explore more on building your financial model.

Step 5: Break-Even Analysis

Identify when your coffee shop will start making a profit. Use this framework:

For templates, visit Cafe Restaurant Financial Model.

Step 6: Sensitivity Analysis

Conduct an analysis to understand the impact of variable changes, aiding in strategic adjustments.

Frequently Asked Questions

What is a restaurant profit loss statement?

A profit and loss statement summarizes the revenues, costs, and expenses incurred during a specific period. Learn more about creating one here.

How do I create a comprehensive restaurant business plan?

Our Business Plan Financial Models guide helps you design a structured and effective business plan.

What is the importance of a restaurant cash flow statement?

Understanding cash flow helps ensure liquidity to cover daily operations and strategic expansions. Learn more in our guide on Restaurant Financial Insights.

In crafting a robust financial model, your coffee shop can thrive, adapting to market changes and ensuring sustained profitability. By following these detailed steps and utilizing available resources, you’ll be well-equipped to manage and grow your café business.