Building a financial model for a gold mining project is crucial for investors, operators, and stakeholders looking to understand the potential profitability and risks of such an endeavor. The gold mining industry is capital-intensive, and the fluctuations in gold prices, operational costs, and various economic factors require a meticulous and detailed approach to financial modeling. A well-constructed model can provide insights into cash flow, capital expenditures, profitability, financing needs, and overall project viability.

This article will guide you through the process of creating a comprehensive financial model for a gold mining project, step by step.

We have also built a ready-to-go Gold Mining Financial Model Template that can be used by a Founder, Entrepreneur or Analyst to input their company assumptions.

Step 1: Define the Structure of the Financial Model

Before diving into the details, it’s important to define the structure and scope of your financial model. Gold mining projects often vary significantly in terms of scale, complexity, and location. Therefore, the model should be tailored to fit the specific characteristics of the project.

A typical gold mining financial model will include:

- Revenue Model: Estimation of the revenues generated by selling gold.

- Cost Structure: Breakdown of capital and operating costs.

- Capital Expenditure (CapEx): Initial and ongoing investment costs required for the project.

- Operational Expenditure (OpEx): Day-to-day costs associated with running the mine.

- Taxation and Financing: The impact of tax policies, royalties, and financing costs on the profitability.

- Cash Flow and Profitability: Projected cash flow, EBITDA, and net profit.

- Sensitivity Analysis: Understanding how sensitive the project is to changes in key variables like gold prices, costs, and production rates.

The financial model will be built in Excel or another spreadsheet program, where each of these components is linked together in a way that reflects real-world operations.

Step 2: Gather Relevant Data

Data is the backbone of your financial model, and it’s essential to collect accurate and reliable information before proceeding. The key inputs include:

Gold Price Assumptions

The price of gold is one of the most volatile factors affecting a mining project’s profitability. You need to forecast the future gold prices over the life of the mine. This could be based on historical trends, market predictions, or expert forecasts. You can include different price scenarios (base case, high case, low case) to perform sensitivity analysis later.

Production Profile

This includes:

- Ore Reserves: The total amount of ore available for extraction.

- Production Rates: The annual amount of gold that can be mined and processed (usually in ounces).

- Recovery Rate: The percentage of gold extracted from the ore.

- Mine Life: The expected number of years the mine will operate.

A key part of this is to gather a detailed and accurate resource estimate from geological reports.

Operating Costs

Operating costs include:

- Mining Costs: Labor, energy, equipment maintenance, etc.

- Processing Costs: Costs associated with milling, refining, and transportation.

- General and Administrative Costs (G&A): Overhead costs related to running the mine.

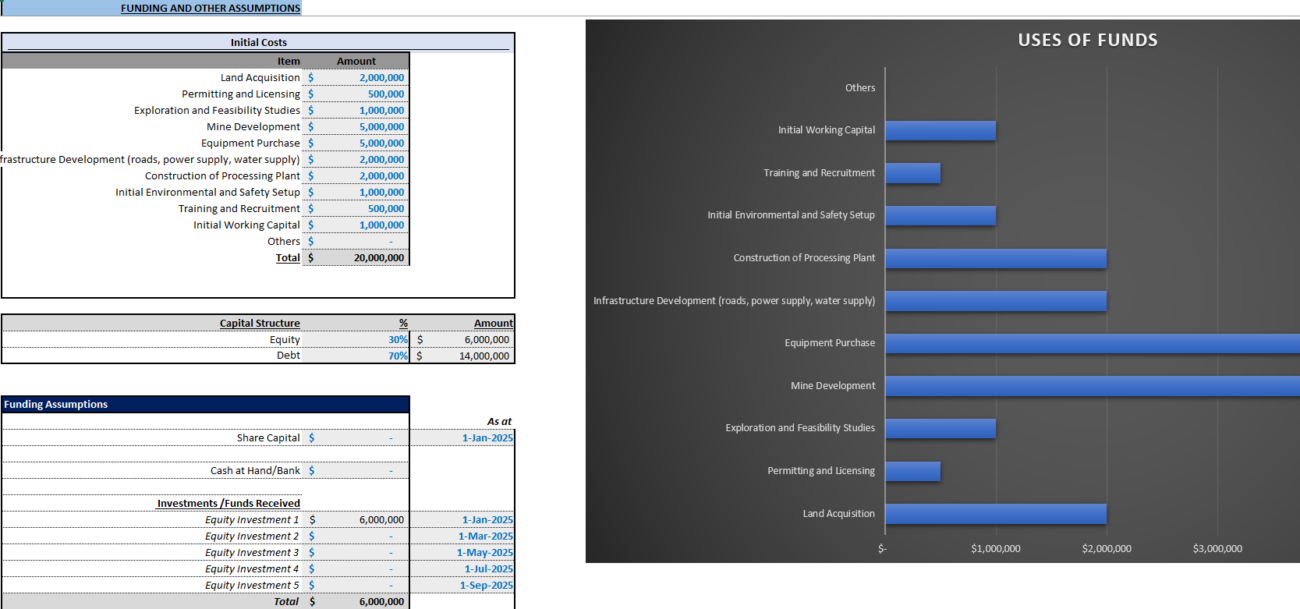

Capital Expenditures (CapEx)

These are the costs incurred to develop the mine, such as:

- Infrastructure (roads, power supply, water management)

- Mining equipment

- Processing plant construction

- Environmental mitigation measures

CapEx is usually front-loaded, with large expenditures made during the construction phase of the mine. Learn more in the Financial Model of a Mining and Processing Plant.

Taxation and Royalties

Understanding the tax environment is vital. Different countries have different tax regimes for mining companies, including:

- Corporate Tax Rates

- Royalties: A percentage of revenue or profit paid to the government or landowners.

- Additional Levies: Other costs like environmental fees or export duties.

Financing

Mining projects are often financed with a mix of equity, debt, and sometimes government subsidies. The financing structure impacts the model’s cash flows due to interest payments and repayment schedules. It is essential to define how the project will be funded.

Step 3: Build the Revenue Model

Revenue in gold mining comes from selling gold. The first step is to estimate the total amount of gold that will be mined over the life of the project. This is done by multiplying the estimated ounces of gold produced by the expected price of gold.

The formula for revenue is:

You can break it down year by year to account for changes in production rates or gold prices. It’s crucial to ensure that the gold price and production are updated regularly, especially in long-term models, as they can fluctuate due to various factors. Check out the IGF Financial Model for estimating tax incentives in mining operations.

Step 4: Estimate Operating Costs

Operating costs are typically divided into two categories: fixed costs and variable costs.

Fixed Costs

These are costs that do not change with production levels, such as:

- Salaries of senior management

- Lease payments

- Insurance

- Regulatory compliance costs

Variable Costs

These costs fluctuate depending on the volume of material being processed, including:

- Mining costs: Labor, equipment operation, and energy consumption.

- Processing costs: Crushing, milling, and refining.

- Transportation: Shipping the gold to refineries or customers.

It’s crucial to estimate these costs carefully because small changes in operational efficiency can have a large impact on profitability. Be sure to model these costs as line items in your spreadsheet.

Example:

If your mining operation produces 100,000 ounces of gold per year and your operating costs are $500 per ounce, the total operating costs would be:

Step 5: Calculate Capital Expenditures (CapEx)

Capital expenditures typically occur upfront and are amortized over the life of the mine. In the early years, CapEx may include:

- Infrastructure development (roads, utilities)

- Construction of the processing plant

- Acquisition of mining equipment

It’s essential to include detailed line items for CapEx, broken down by categories such as:

- Mine development costs

- Plant and equipment purchases

- Environmental and permitting costs

CapEx will usually be large in the first few years of the project and then taper off as the mine transitions to production. For detailed templates, see the Gold Mine Investment Model Template.

Example:

If the capital cost for building the mine and the processing plant is $200 million, you can amortize that over the life of the project (say 15 years) to calculate annual depreciation.

This depreciation expense will reduce taxable income and impact the financial model’s cash flow calculations.

Step 6: Build Cash Flow Projections

A detailed cash flow projection is one of the most important parts of any financial model. It reflects the ability of the mining project to generate profits over time.

Cash flow projections should include:

- Revenue: From the sale of gold.

- Operating Expenses: Both fixed and variable costs.

- Capital Expenditures: The initial investment and depreciation.

- Financing Costs: Interest payments on debt and any equity-based costs.

- Taxes and Royalties: Based on your tax assumptions.

The formula for cash flow is:

Cash Flow = Revenue – Operating Expenses – Capital Expenditures – Financing Costs – Taxes and Royalties

You can calculate this on an annual basis, taking into account changes in production, gold prices, and operating costs. Use detailed templates like the Gold Mining Company DCF Valuation Model for better precision.

Step 7: Perform Sensitivity Analysis

Given the volatility of gold prices, exchange rates, and other factors, it’s important to perform sensitivity analysis to understand how changes in assumptions will affect the project’s profitability.

Some key variables to test sensitivity include:

- Gold Price: How does the project perform under different price scenarios?

- Production Rate: What if the ore body has less or more gold than expected?

- Operating Costs: What happens if costs rise due to inflation or unexpected issues?

In Excel, you can use data tables or scenario analysis to test various combinations of these factors and their impact on cash flow, NPV, and profitability.

Step 8: Build a Financial Summary

The final step is to summarize the project’s financial health. Key metrics to include in the financial summary are:

- Net Present Value (NPV): The discounted value of future cash flows, used to measure the overall profitability.

- Internal Rate of Return (IRR): The rate at which the project breaks even in terms of its net present value.

- Payback Period: The time it takes to recover the initial investment.

- Cash Flow Forecast: A year-by-year breakdown of expected cash flows.

The NPV and IRR are particularly important for investors, as they help assess whether the gold mining project is a worthwhile investment.

Final Thoughts!

Building a gold mining financial model is a complex, multi-step process that involves careful consideration of various inputs, including production rates, costs, taxes, and financing structures. A robust financial model will allow you to project future cash flows, assess the viability of the project, and make informed investment decisions. By following these steps, you can ensure that your financial model accurately reflects the economic potential of the gold mining project, helping stakeholders make better decisions in an unpredictable and volatile industry.

Frequently Asked Questions

What is a gold mining financial model?

A gold mining financial model is a comprehensive representation of the financial dynamics involved in a gold mining project, including forecasting revenues, costs, and potential profitability.

Why is sensitivity analysis crucial in mining financial models?

Sensitivity analysis helps assess the impact of variable changes, such as gold prices and production rates, on the financial outcomes, providing a better understanding of risks and project feasibility.

How can I use a Mining Financial Model & Valuation course to improve modeling skills?

Courses on mining financial modeling provide essential skills and insights for building accurate models, enabling users to forecast and analyze financial outcomes effectively.

By mastering these steps and utilizing robust financial modeling techniques, you will ensure an accurate representation of your mining project’s potential, helping make sound investment decisions.