Starting a manufacturing business can be a challenging yet rewarding endeavor. Whether you plan to create a product from scratch, assemble goods, or develop a new line of items, having a solid financial model is essential for success. A financial model serves as a blueprint for your business, helping you predict cash flows, estimate profits, determine investment needs, and make critical decisions. For entrepreneurs new to manufacturing, creating a financial model may seem daunting. However, with a step-by-step approach, even beginners can develop a functional and reliable model to guide their startup journey. We have also built a ready-to-go Manufacturing Startup Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their business; as well as a valuation analysis.

What is a Financial Model?

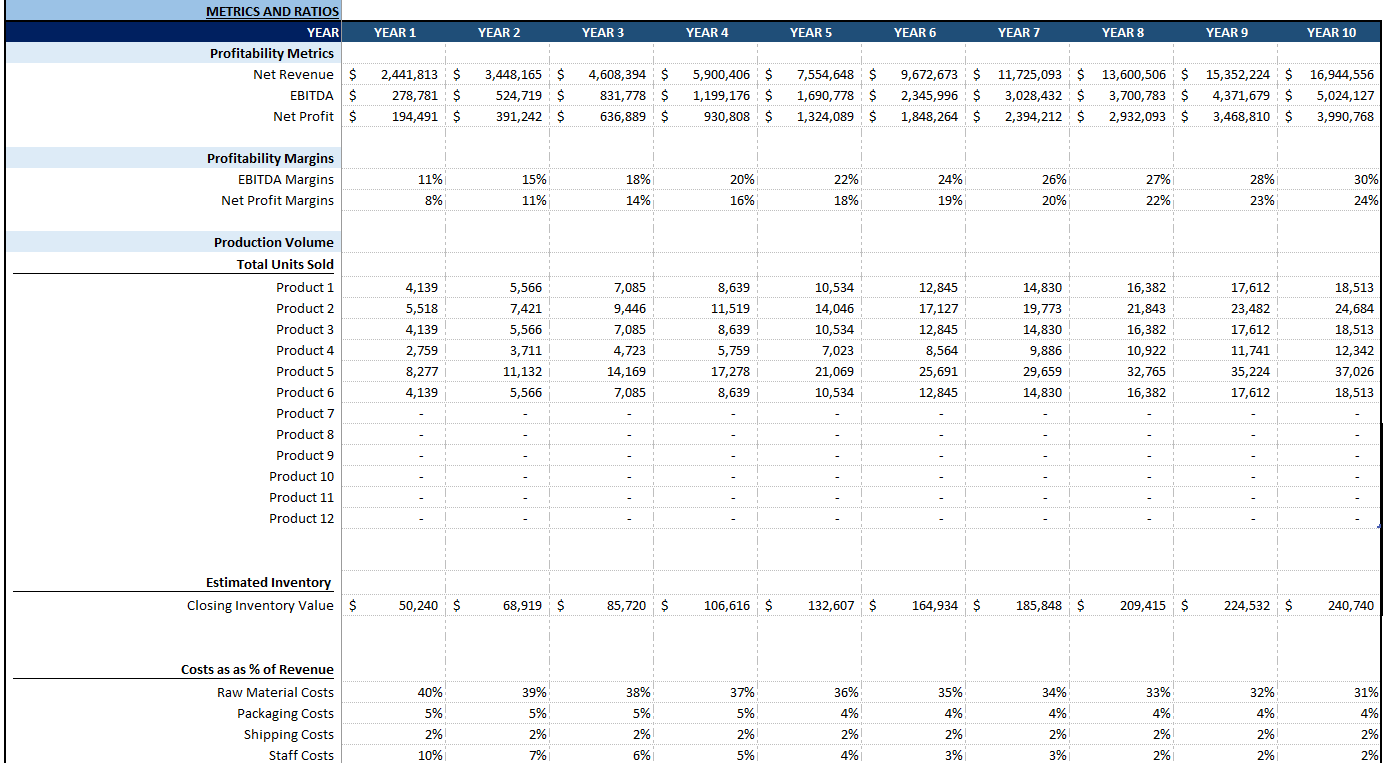

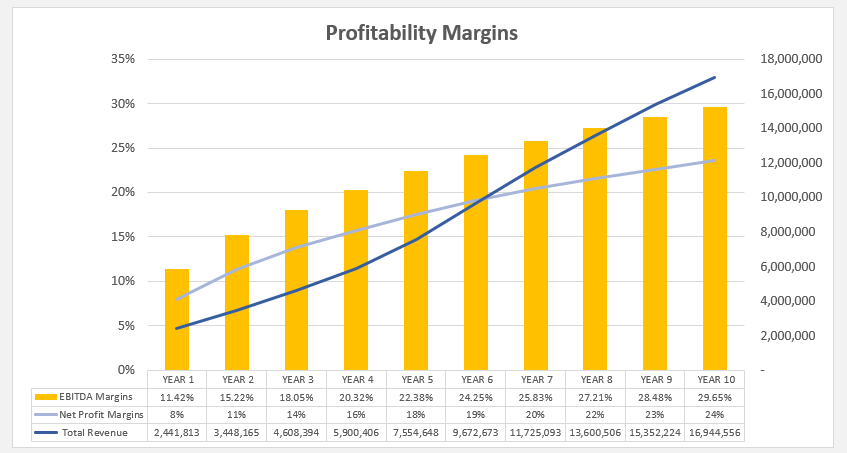

A financial model is a tool used to predict a company’s financial performance over time. It is built using assumptions, historical data, and forecasts to create financial statements such as income statements, balance sheets, and cash flow statements. For a manufacturing startup, this model helps forecast key metrics like revenue, expenses, and profits, providing insights into the sustainability and growth potential of the business.

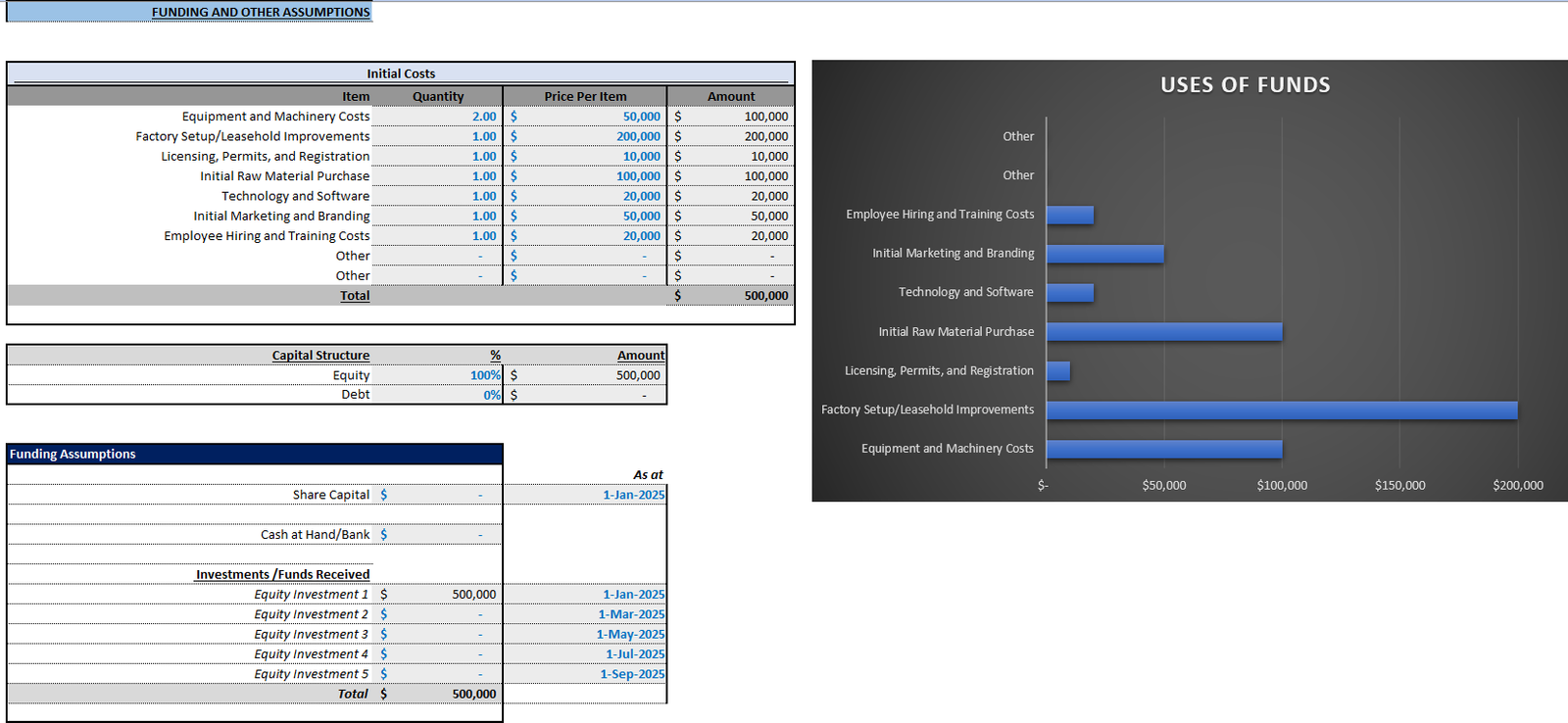

The financial model can also assist in making informed decisions about pricing, inventory management, production schedules, and fundraising. Moreover, it can be used to attract investors, secure loans, or plan for growth. For more detailed guidance, refer to How to Build a Financial Model for a Manufacturing Business.

Step 1: Gather Basic Information and Data

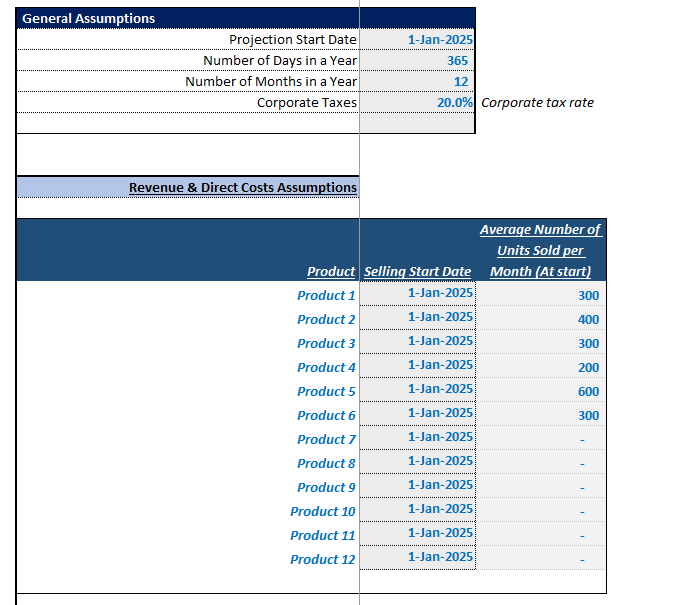

Before creating a financial model, gather all the necessary data to build realistic assumptions. This data ensures the accuracy of your model, serving as its foundation.

Key Assumptions:

- Product Type: Define what you are manufacturing, whether it’s a single item or a range of products.

- Production Process: Outline the steps involved in making your product — from design to shipping.

- Market Size and Demand: Estimate demand based on market research, industry reports, or competitor analysis.

- Pricing Strategy: Define your pricing, considering production costs, competitor pricing, and market willingness.

- Location: Consider location costs like rent and wages, which vary by region.

- Staffing Requirements: Estimate needed employees across various roles like production and administration.

Data to Collect:

- Start-Up Costs: Equipment, initial inventory, facility leasing, and legal fees.

- Fixed Costs: Recurring costs like rent, salaries, and utilities.

- Variable Costs: Costs fluctuating with production volume, such as raw materials and shipping.

- Revenue Projections: Expected sales units, average selling price, and additional revenue streams.

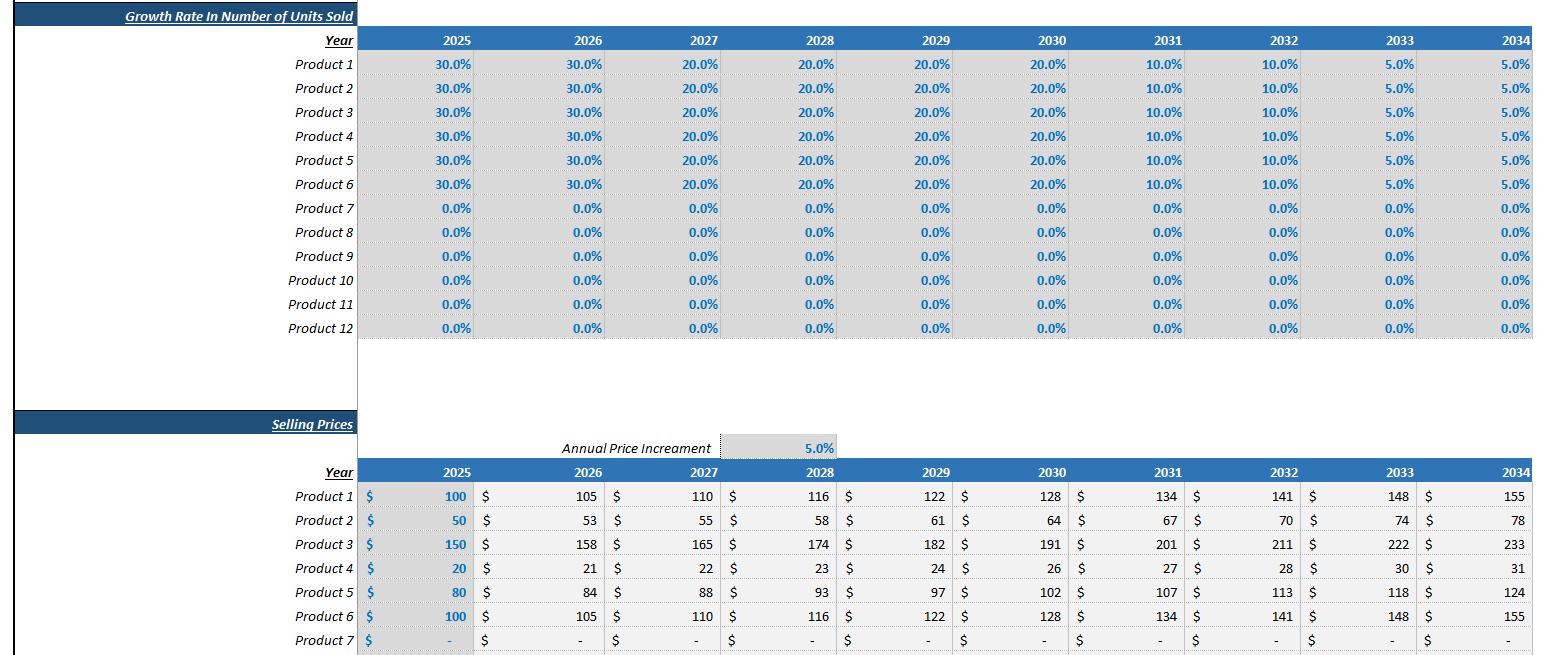

Step 2: Define Your Revenue Streams

In manufacturing, the primary revenue source is usually the sale of goods. However, there can be multiple income streams. To accurately forecast earnings, break down your revenue strategies.

Product Sales

Product sales are generally the main revenue stream. Estimate monthly or annual unit sales and multiply by price per unit to forecast revenue. For insight, explore Three-way financial modelling for manufacturers.

Bulk Orders

If selling large quantities to wholesalers or other businesses, include bulk orders in your model. Account for volume-based pricing.

Service Revenue

Consider revenue from services like product customization, installation, or maintenance.

Licensing or Royalties

Leverage intellectual property like patents for additional income through licensing or royalties if applicable.

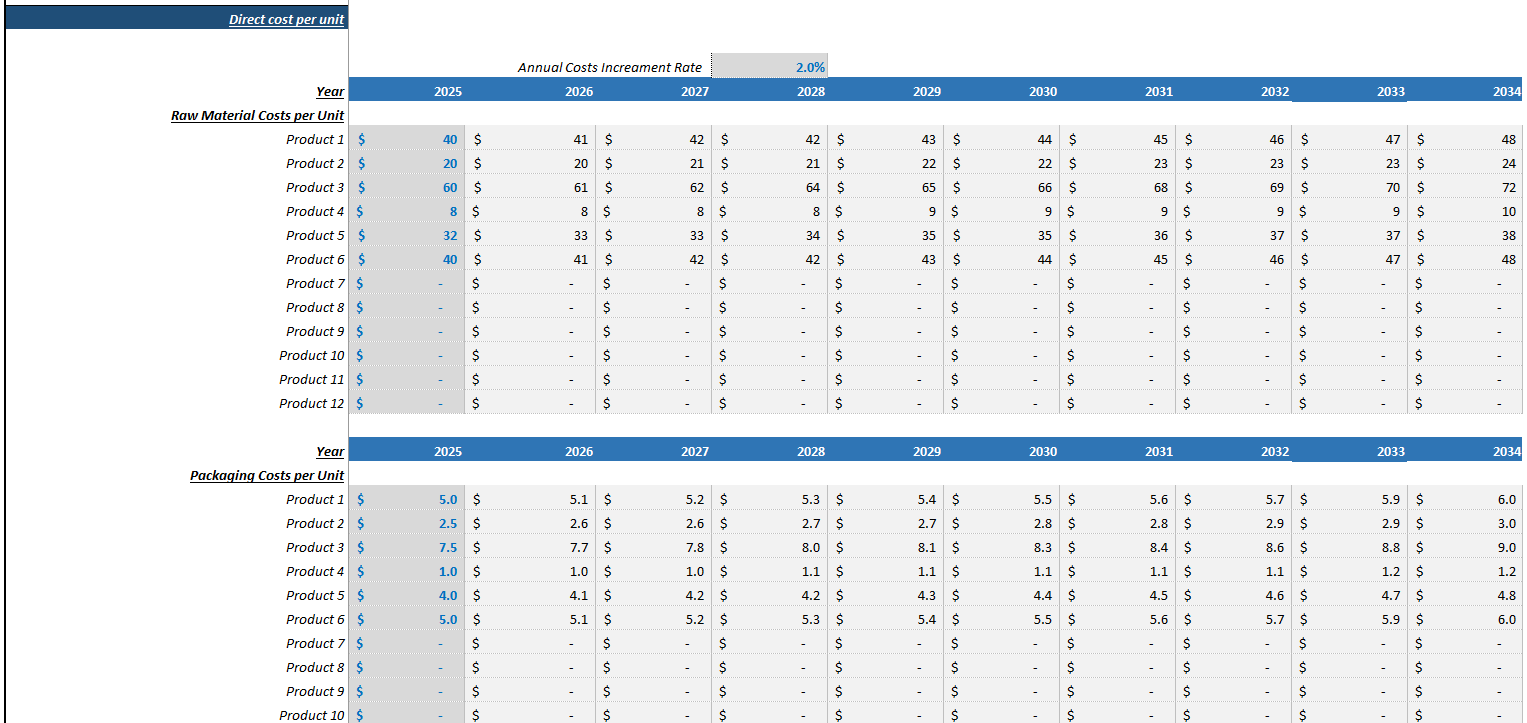

Step 3: Estimate Your Costs

Estimating costs is crucial in financial modeling. Manufacturing businesses incur both fixed and variable costs.

Fixed Costs

Fixed costs are constant and independent of production volume. Common fixed costs include:

- Rent or lease payments

- Salaries for permanent staff

- Utilities

- Insurance

- Depreciation on machinery

Variable Costs

Variable costs fluctuate based on production. Key variable costs include:

- Raw materials

- Labor costs

- Packaging

- Shipping and distribution

- Maintenance and repairs

Project variable costs based on production estimates.

Step 4: Build the Financial Model

Now, build the model with your gathered data. Key statements include:

Income Statement

The income statement covers revenues, costs, and profits over time. Components include:

- Revenue

- Cost of Goods Sold (COGS)

- Gross Profit

- Operating Expenses

- Operating Profit

- Net Profit

For additional insights, check the Manufacturing Company Financial Model.

Cash Flow Statement

Tracks cash inflow and outflow, ensuring startup liquidity. Includes:

- Cash inflows from sales and financing.

- Cash outflows to suppliers and for operational costs.

- Net cash flow as the difference between inflows and outflows.

Balance Sheet

Summarizes assets, liabilities, and equity at a given time.

Step 5: Perform Scenario Analysis

Manufacturing startups face demand fluctuations and uncertainties. Scenario analysis prepares for varying conditions by altering key assumptions.

Example scenarios:

- Best Case: High demand, low costs.

- Worst Case: Low demand, high costs.

Plan for these to make informed decisions, minimizing business risks.

Step 6: Refine and Update Regularly

Regular updates keep your financial model accurate and relevant. Revisit assumptions and projections to reflect new data and market changes.

Final Thoughts!

Building a financial model for a manufacturing startup is crucial for understanding financial health, predicting cash flows, and making informed decisions. Following these steps—from gathering data to conducting scenario analysis—will help create a reliable model guiding your startup’s success. By regularly refining the model, you can navigate business challenges and seize growth opportunities. Learn more about Robust Startup Financial Model creation.

Frequently Asked Questions

What is the difference between fixed and variable costs?

Fixed costs remain constant regardless of production volume, including rent and salaries. Variable costs change with production volume, like raw materials and packaging.

How do I estimate revenue for a manufacturing startup?

Estimate unit sales, multiply by price per unit, and consider additional revenue streams like bulk orders or service revenue. Resources like the Your Guide to Manufacturing Financial Modeling can help.

Why is scenario analysis important in financial modeling?

Scenario analysis prepares you for various future conditions by altering assumptions, helping to plan for demand fluctuations and cost changes effectively. For comprehensive guidance, see The ultimate guide to financial modeling for startups.