Navigating the landscape of private equity investments requires a profound understanding and strategic approach to cash flow modeling. This guide offers insights into creating a robust private equity fund cash flow model, helping finance professionals and beginners alike. We have also built a Private Equity Cash Flow Model Template which is being used by PE funds to model out their investment cash flows through to GPs and LPs via an American Waterfall distribution structure.

Understanding Private Equity Fund Structure

Before diving into model building, it’s essential to comprehend the structure of private equity funds. These funds acquire ownership stakes in private companies by pooling capital from investors. The cash flow models must accurately reflect the inflows and outflows within this framework.

Learn more about modeling private equity funds and their economic structures from this detailed guide.

Key Components of a Private Equity Fund

- Capital Commitments: Total capital pledged by investors.

- Capital Calls: Requests for funds from investors to finance investments or cover expenses.

- Distributions: Returns to investors from profits or asset sales.

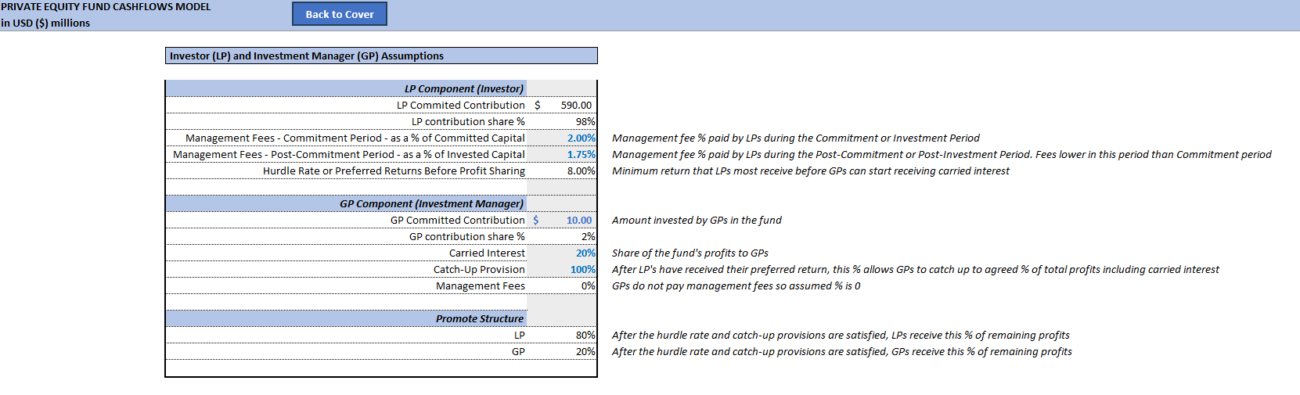

- Management Fees: Paid to fund managers for their services.

- Carried Interest: Performance-based share of profits for fund managers.

Explore various distributions examples and economic structures in private equity.

Building a Cash Flow Model: A Step-by-Step Guide

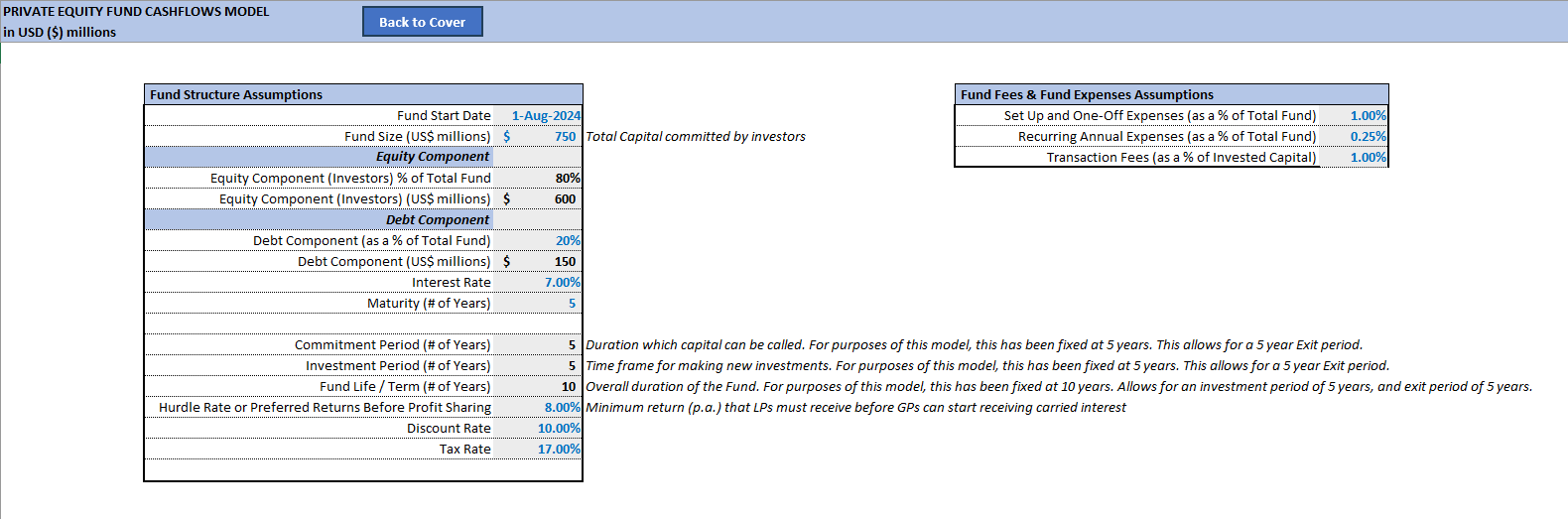

Step 1: Define Your Assumptions

Set the stage for your model by defining key assumptions such as fund size, investment periods, return targets, and management fee structures.

Step 2: Structure Your Model

Organize the model in sections, typically laid out in a spreadsheet, including input assumptions, capital calls, investments, and distributions.

For strategies on how to manage cash flow challenges, check out this resource on cash flow forecasting.

Step 3: Create the Input Assumptions Sheet

This forms the foundation of your model, where all assumptions are inputted and all related formulas are tracked and linked.

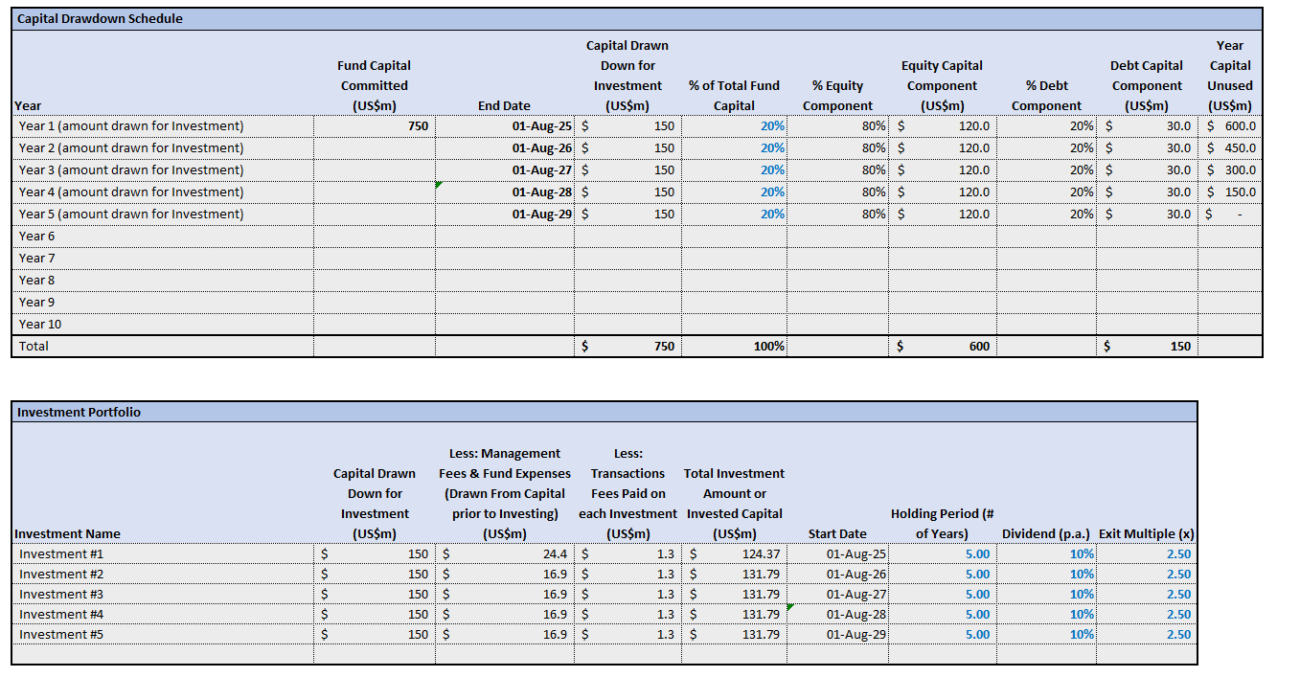

Step 4: Calculate Capital Calls

Develop a schedule that forecasts when and how much capital you will draw from investors.

Step 5: Document Investments

Record investment amounts, dates, and expected exit values to forecast cash flows and returns effectively.

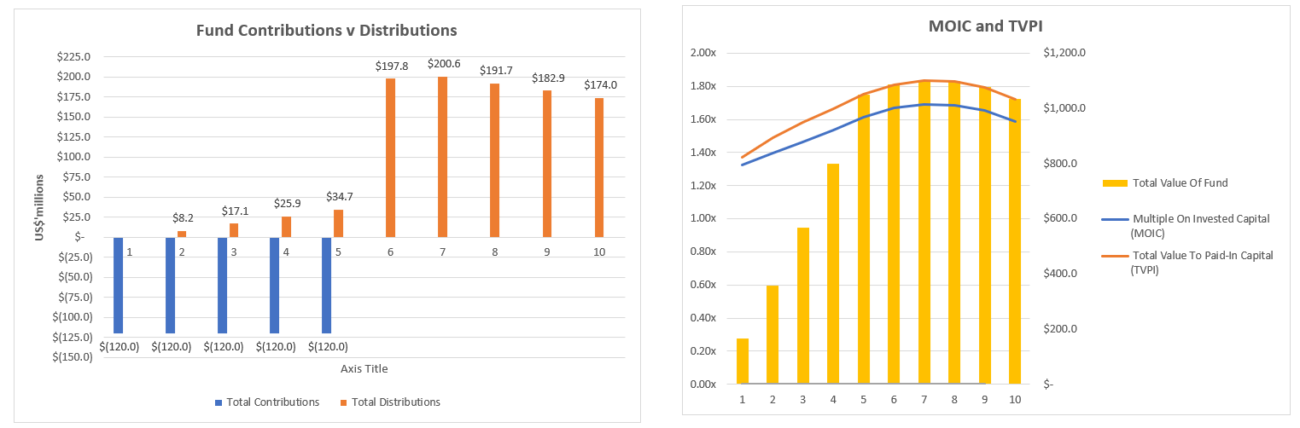

Step 6: Calculate Distributions

Factor the timing of exits and distribute profits by adhering to the carried interest structure.

Step 7: Calculate Management Fees

Management fees are often a fixed percentage of committed capital, calculated yearly.

Step 8: Track Cash Flows

Ensure your cash flow statement summarizes inflows and outflows, reflecting the financial health of the fund. Review cash flow dynamics with this in-depth exploration.

Step 9: Analyze Returns

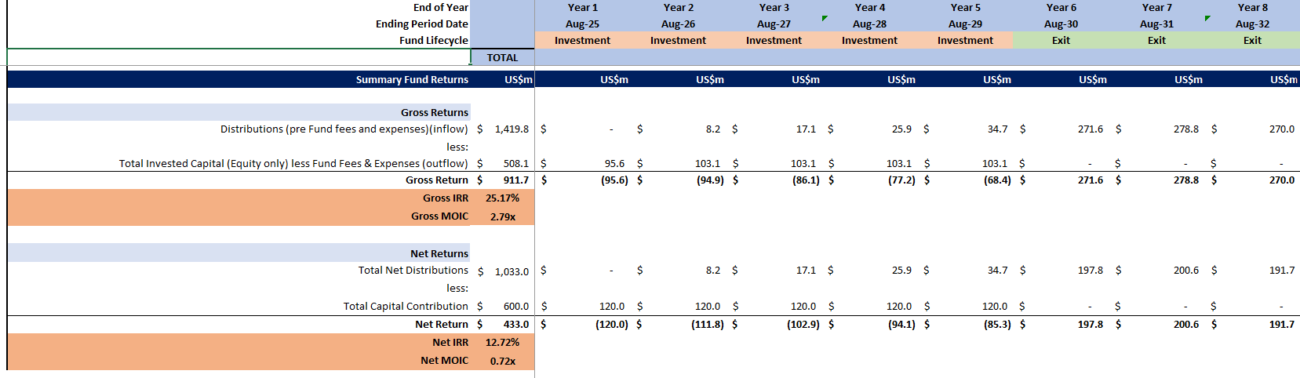

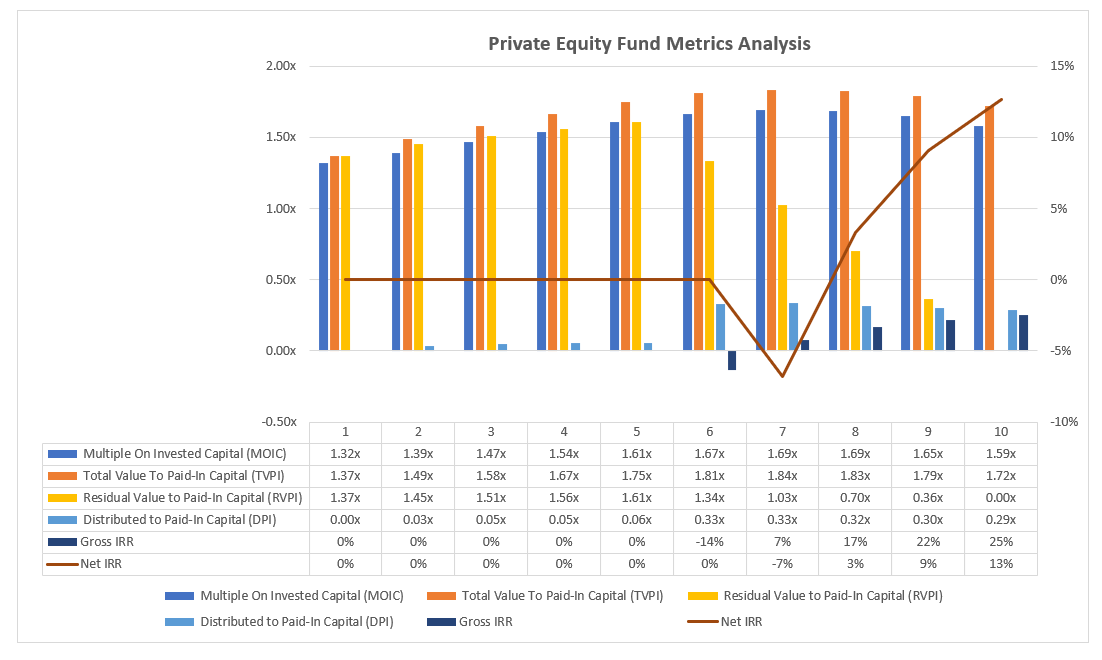

Use metrics such as Internal Rate of Return (IRR) and Multiple of Invested Capital (MOIC) to assess performance.

Step 10: Create Sensitivity Analyses

Perform analyses to understand how changes in key assumptions affect overall returns.

Step 11: Review and Refine

Continuously ensure model accuracy and logical coherence, seeking feedback from industry peers.

Further dive into private equity investment strategies by understanding return profiles and diversification in private equity.

Frequent Asked Questions

What is a private equity model?

A private equity model evaluates potential investment returns, including key metrics like IRR and MOIC.

What are the key components of a private equity model?

These include transaction assumptions, financial projections, debt schedules, returns estimation, and sensitivity analysis.

What is free cash flow (FCF)?

Free cash flow is the cash remaining after capital expenditures, utilized for business expansion, debt repayment, or investor distributions.

For detailed approaches on managing future cash flows, discover the private equity pacing model.

Build a comprehensive and insightful private equity cash flow model to ensure strategic planning and successful investment outcomes. With continued practice, finance professionals will adeptly maneuver the complexities of private equity finance.