Wind energy continues to be a pivotal force within the renewable energy landscape, offering sustainable solutions to meet global energy demands. Building a detailed financial model for a wind farm is paramount to understanding potential financial returns and assessing project feasibility. This article will guide you through crafting a comprehensive financial model for wind farms, especially aimed at beginners. We have also built a ready-to-go Wind Farm Financial Model Template for anyone looking for an easy-to-use Financial model which will allow them to model out their financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their business; as well as a valuation analysis.

What is a Wind Farm Financial Model?

A wind farm financial model is a structural representation of a project’s financial performance across its lifecycle. It includes variables like capital expenditures (CAPEX), operational costs (OPEX), energy production forecasts, financing structures, and revenue projections, providing a foundation for making informed investment decisions.

Learn more about financial models for renewable energy as they help delineate:

- Investment Decision Making: Aids investors in understanding project profitability and risks.

- Project Viability: Determines if the project generates adequate revenue to cover expenses and yield returns.

- Sensitivity Analysis: Evaluates the impact of varying key assumptions on financial outcomes.

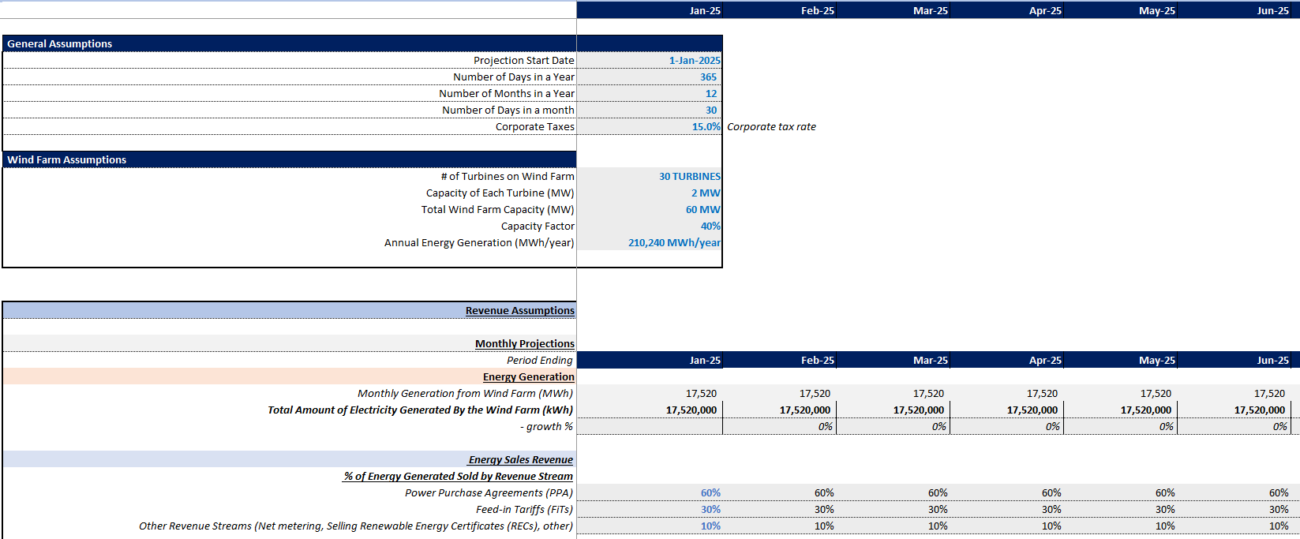

Step 1: Gather Key Assumptions and Data

Collecting precise data and assumptions is crucial for accurate projections, encompassing both technical and financial aspects.

Technical Data

- Wind Resource Assessment: Essential for estimating available wind energy, using tools like wind resource maps.

- Turbine Specifications: Consider turbine capacity and operational parameters critical for performance evaluation.

- Project Timeline: Durations for construction, commissioning, and operational phases.

- Location and Topography: Geographical factors impacting project design and grid connectivity.

Financial Data

- Capital Expenditure (CAPEX): Includes turbine purchase, infrastructure, and connection to the grid. Explore a cash flow model example for detailed insights.

- Operating Expenditure (OPEX): Covers maintenance, insurance, and labor.

- Energy Prices: PPA agreements or market prices guide energy sales forecasting.

- Financing Assumptions: Debt and equity structure influencing project funding.

- Tax Assumptions: Incorporate tax incentives and relevant regulations to optimize profitability.

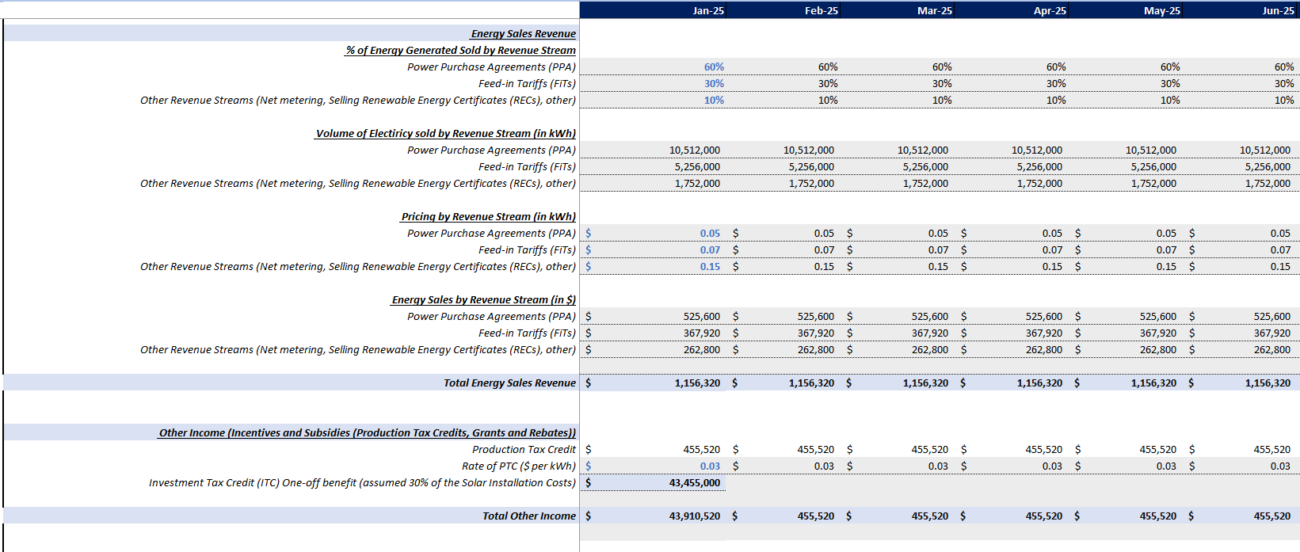

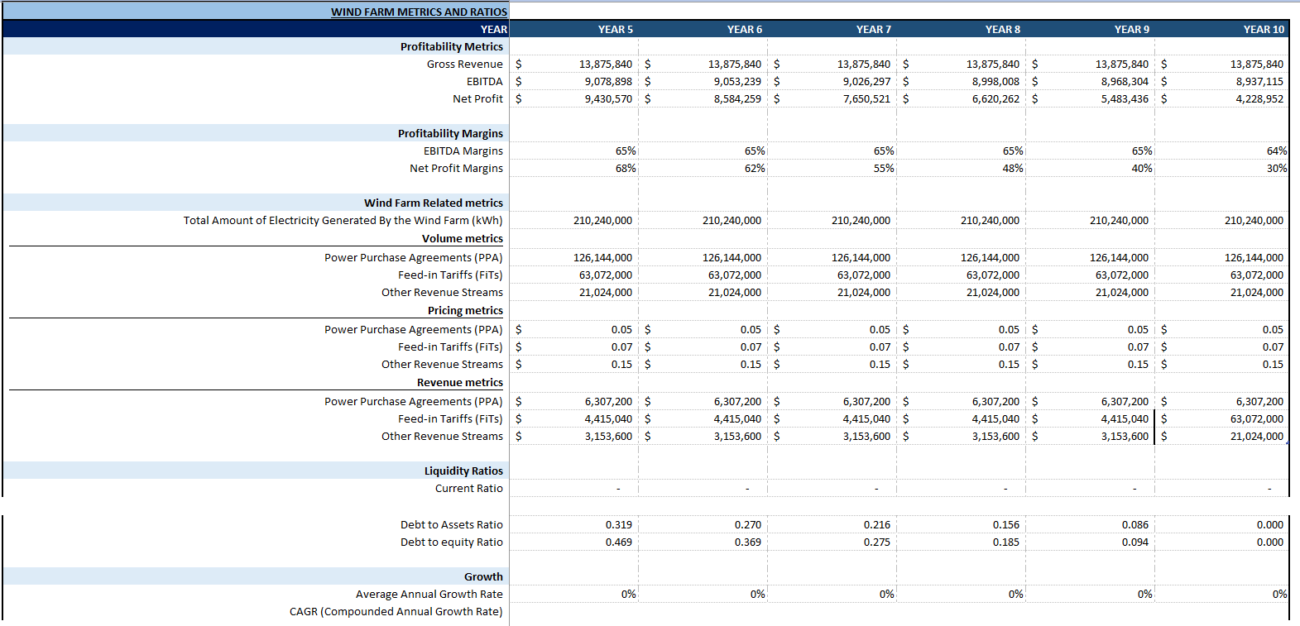

Step 2: Build the Revenue Model

Revenue from a wind farm arises mainly from electricity sales. Calculate this by forecasting energy production and anticipated electricity prices.

Forecast Energy Production

Efficiency, turbine specs, and local wind conditions determine production capabilities. The Capacity Factor (CF) quantifies output against potential capacity, serving as a critical metric in energy analysis.

Revenue Projections

Revenue is calculated by multiplying forecasted energy output by the price per MWh. If a long-term PPA is in place, this simplifies price forecasting. Explore more on energy models to enhance your understanding.

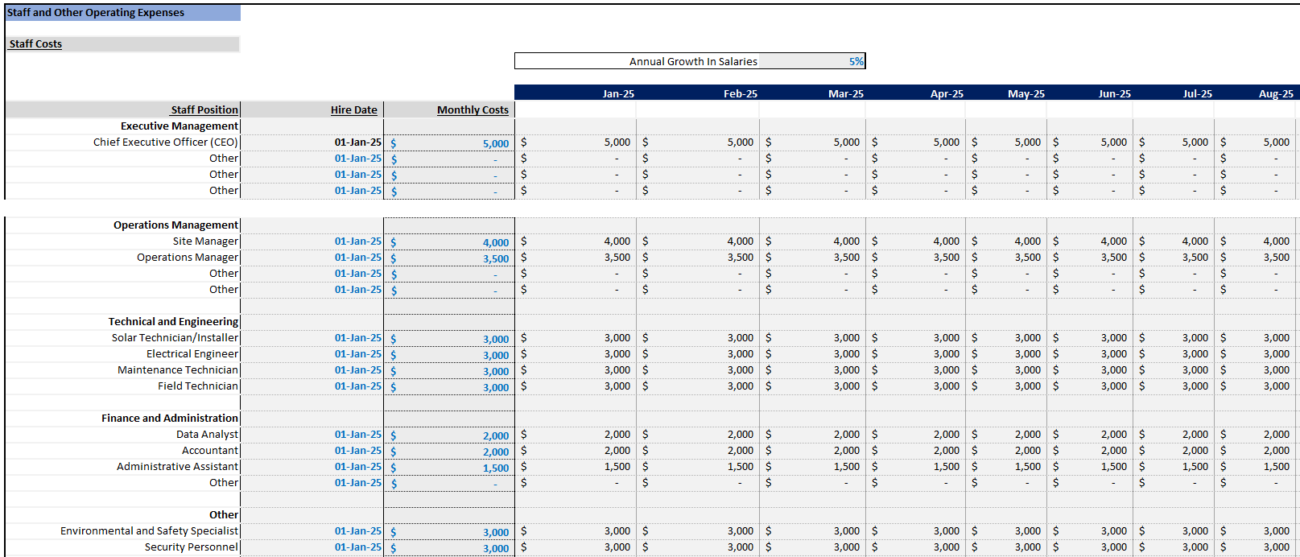

Step 3: Estimate Operating Costs (OPEX)

Maintaining a wind farm involves several cost components:

- Maintenance Costs: Regular servicing and repairs.

- Insurance: Protection against environmental and operational risks.

- Labor Costs: Staffing for operations and management.

Factor these expenses annually, accounting for inflation and equipment aging.

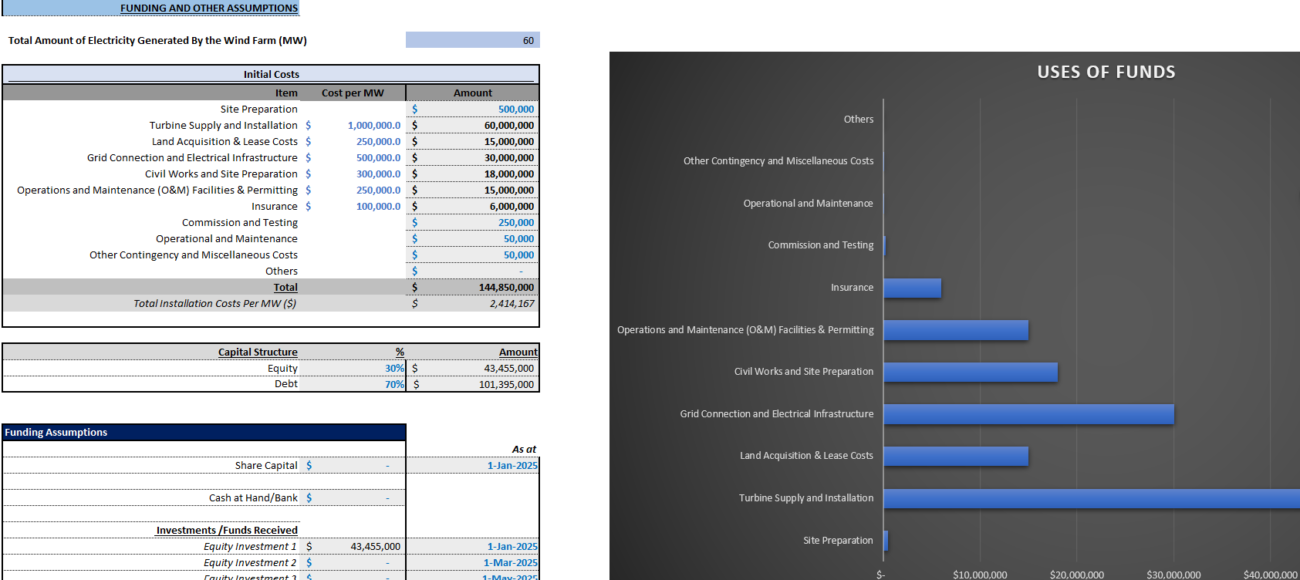

Step 4: Determine Capital Expenditures (CAPEX)

CAPEX includes:

- Turbine Costs

- Construction and Site Preparation

- Grid Connection

- Permitting Fees

Such costs occur during construction, impacting the project’s financial structure.

Step 5: Create the Financing Structure

Financing involves debt and equity sources, critical for optimizing cash flows and project returns.

Loan Repayment and Interest

Detail loan terms, including rates and schedules, as debt service impacts financial predictions significantly.

Return on Equity (ROE)

Calculate equity returns using metrics like IRR and NPV, which help evaluate profit potential against investor expectations.

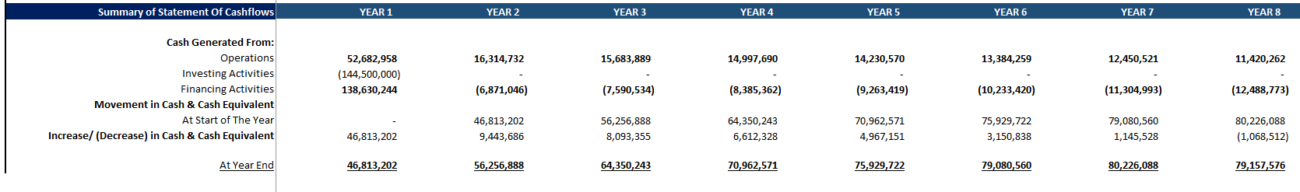

Step 6: Build the Cash Flow Statement

Your cash flow statement encapsulates:

- Operating Cash Flow: Revenue minus OPEX.

- Investing Cash Flow: Outlays like CAPEX.

- Financing Cash Flow: Debt/equity flows.

Project cash flows over the wind farm’s lifespan to ensure financial robustness.

Step 7: Perform Sensitivity Analysis

Evaluate project risks through sensitivity tests on variables like:

- Wind resource variability.

- Energy price volatility.

- Adjustments in operating costs.

Step 8: Evaluate Project Viability

Use the model to gauge viability through metrics like:

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Payback Period

Explore project modeling tools to enhance the evaluation process.

Final Thoughts!

Crafting a financial model for a wind farm is essential for project success. By following the outlined steps, investors and developers can assess viability, optimize funding approaches, and mitigate risks effectively. Supported by real data and sensitivity analysis, your project will be positioned advantageously within the renewable energy market. For further insights, consider tools like the Wind Farm Development Excel Model.

Frequently Asked Questions

What is a capacity factor in wind energy?

The capacity factor is a measure of actual output against maximum potential output over time, essential for energy production forecasts.

How can I ensure accurate revenue projections for my wind farm?

Secure PPA agreements or comprehensively analyze market energy prices over the expected project lifespan for precise projections.

Why is sensitivity analysis important in wind farm financial modeling?

It allows identification of the project’s susceptibility to changes in key assumptions, aiding risk management.