Opening and running a dermatology clinic can be an incredibly rewarding venture, but like any business, it requires a firm understanding of financial management. A solid financial model is key to forecasting your clinic’s revenue, tracking your expenses, and ensuring long-term profitability. Whether you are starting a new clinic or looking to optimize your existing practice, learning how to build a dermatology clinic financial model is a vital step in achieving financial stability and growth.

This guide will walk you through the process of creating a financial model for a dermatology clinic. Even if you are a beginner, this step-by-step approach will help you understand the necessary components and key considerations to ensure your model is both accurate and effective. We have also built a ready-to-go Dermatology Clinic Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their clinic financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their clinic.

What is a Dermatology Clinic Financial Model?

A financial model is a structured framework that represents your dermatology clinic’s financial performance over time. It includes forecasts for revenue, expenses, capital expenditures, and profits based on a set of assumptions. A well-designed financial model helps you:

- Forecast clinic revenues and expenses

- Evaluate the financial viability of your clinic

- Plan for future growth or expansion

- Track key financial metrics

- Make informed decisions about investments, pricing, and operations

Components of a Financial Model

- Revenue Forecast: Projected income from patient services, treatments, and retail products.

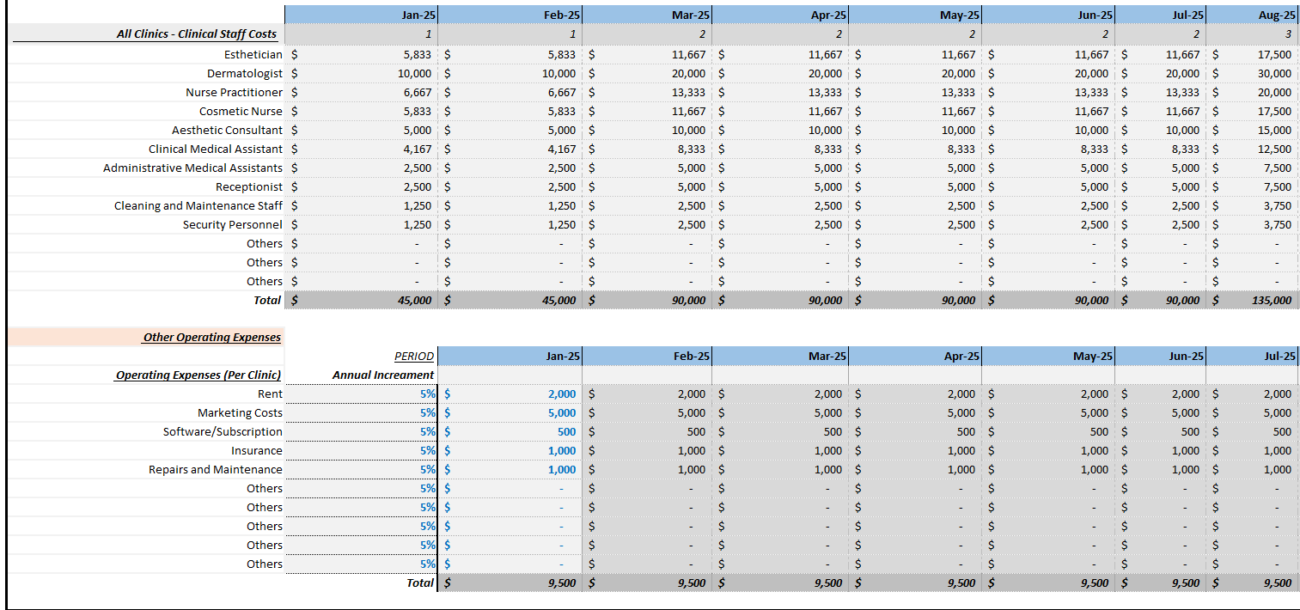

- Operating Expenses: Costs related to running your clinic, such as salaries, rent, and utilities.

- Cost of Goods Sold (COGS): Direct costs for services and products provided to patients (e.g., medications, treatments).

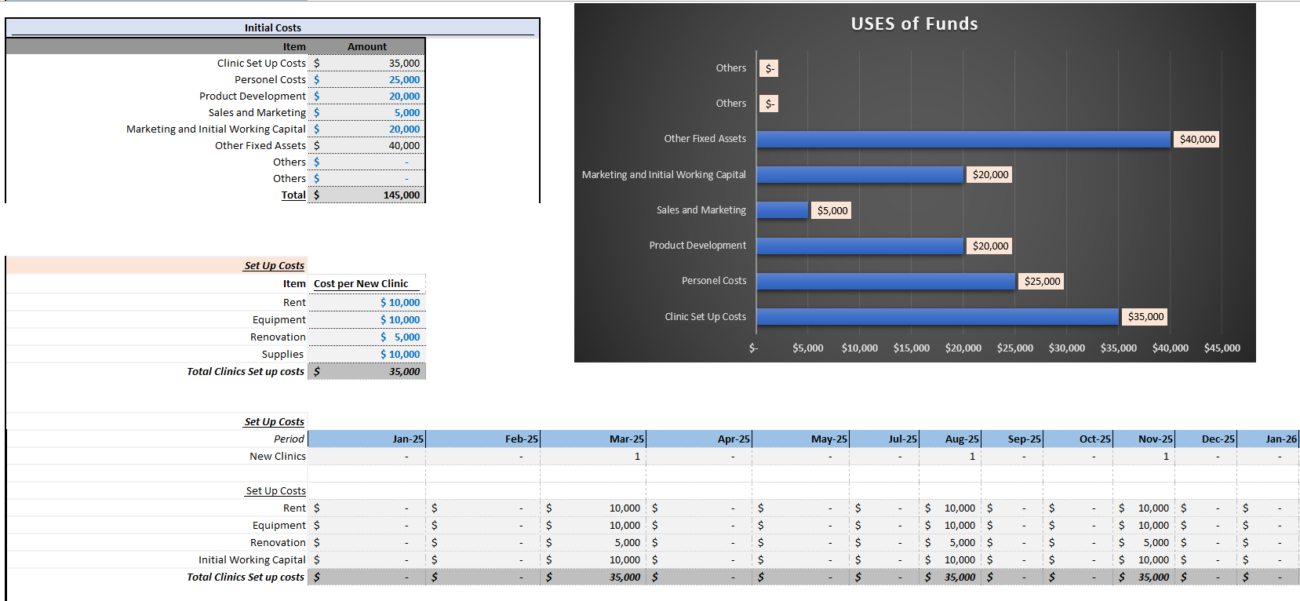

- Capital Expenditures (CapEx): Investments in long-term assets like equipment and property.

- Profit and Loss (P&L) Statement: A summary of income, expenses, and profits over a specific time period.

- Balance Sheet: A snapshot of the clinic’s financial position, showing assets, liabilities, and equity.

- Cash Flow Statement: Tracks the inflow and outflow of cash within the business.

Step 1: Gather Your Data and Make Assumptions

Before building your financial model, gather relevant data and set realistic assumptions. If your dermatology clinic is already operating, you can base your assumptions on historical performance. For new practices, research the dermatology industry, local market conditions, and patient demographics.

1.1. Historical Data (For Existing Clinics)

For existing clinics, analyze past financial records. Historical data provides a reliable foundation for future projections. Key data points include:

- Revenue: Income generated in the past year. Break this down by service (e.g., cosmetic treatments, general dermatology, skin cancer treatments).

- Expenses: Operating expenses like payroll, rent, supplies, and utilities. This helps estimate future costs.

- Profitability: Assess historical profitability to understand successes and areas for improvement.

1.2. Industry Benchmarks and Market Research (For New Clinics)

If you’re starting from scratch, gather industry benchmarks and conduct market research. Consider:

- Average patient volume: Patient visits per day or month for dermatology clinics.

- Pricing for dermatology services: Market rates for treatments (e.g., botox, skin checks, acne treatments).

- Competition: Study local clinics to understand services, pricing, and marketing strategies.

- Market growth: Projected growth in dermatology and any economic factors that may influence demand.

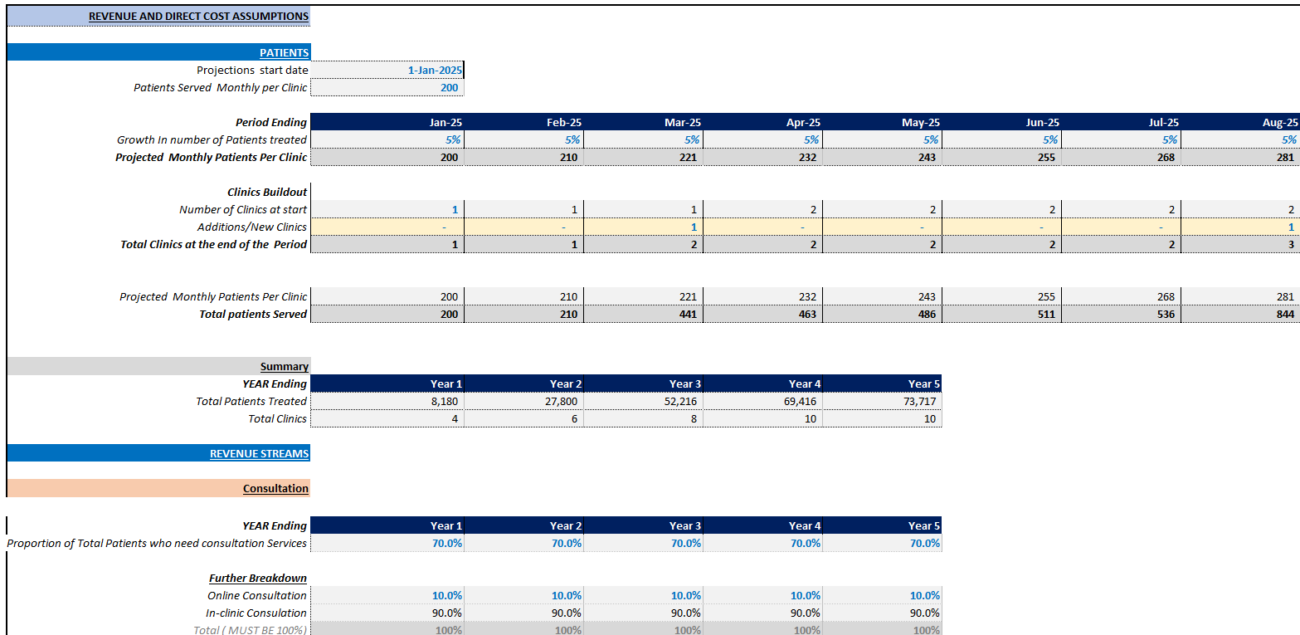

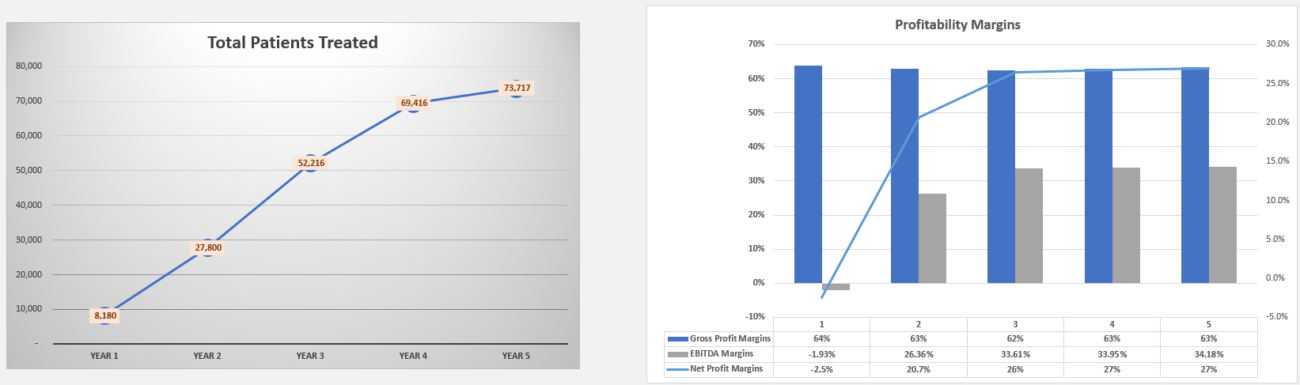

1.3. Growth Assumptions

Estimate expected growth over time. Assume a percentage increase in monthly patient numbers or plan to add new services, like cosmetic dermatology, to drive growth. Adjust these assumptions periodically for realism.

1.4. Pricing Assumptions

Determine pricing for services like:

- Routine consultations

- Skin cancer screenings

- Cosmetic procedures (e.g., botox, laser treatments)

- Retail products (e.g., skincare lines)

Factor in market competition, industry standards, and local pricing to estimate future revenue.

Step 2: Forecast Your Revenues

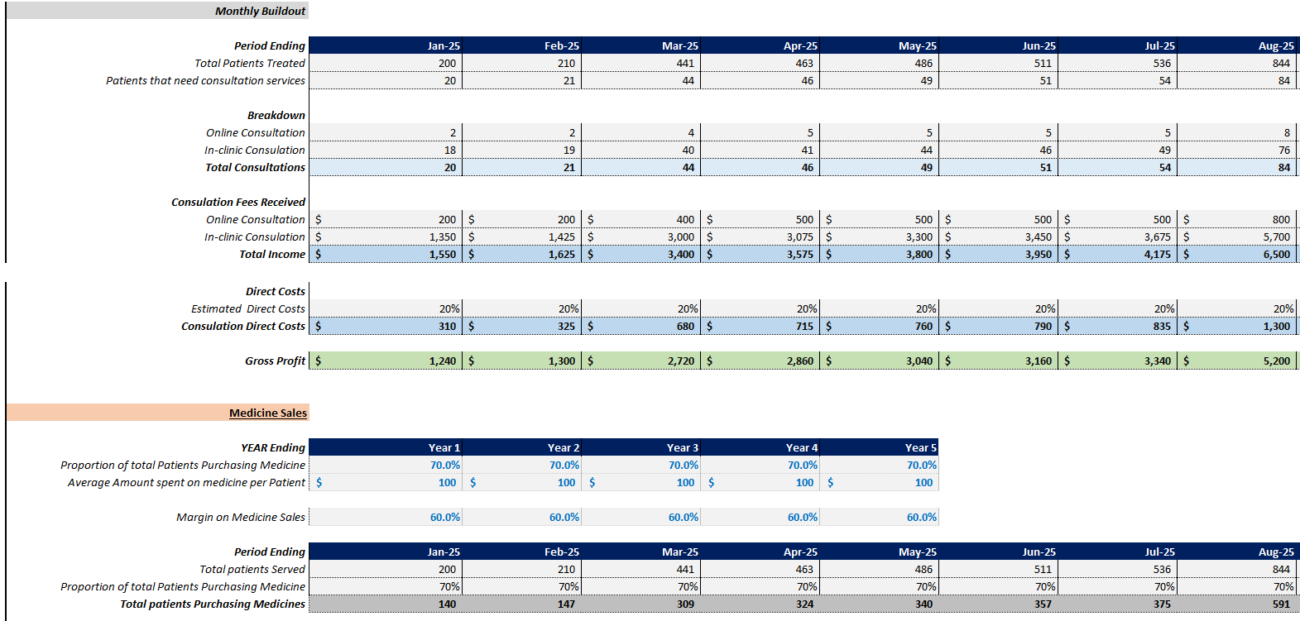

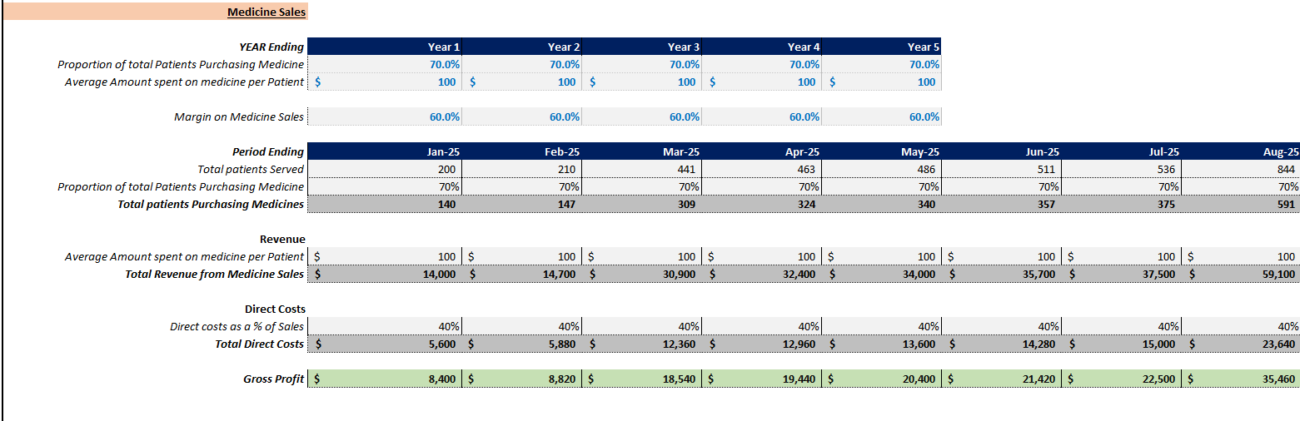

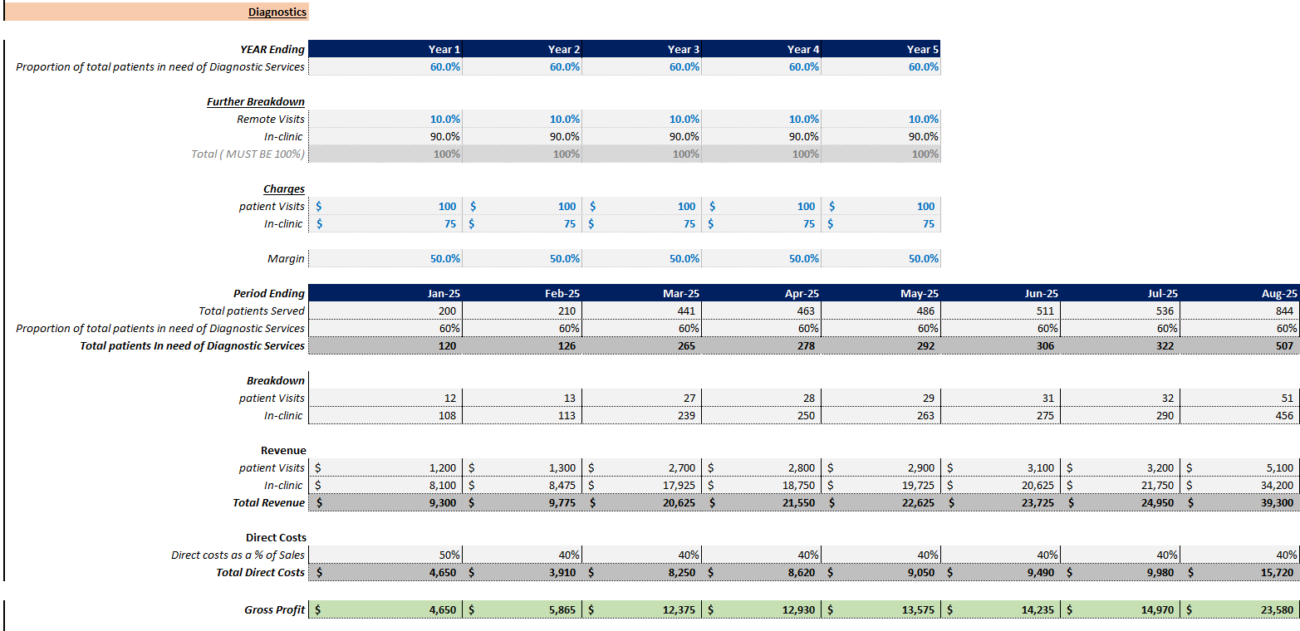

Revenue is the cornerstone of your financial model. Forecasting it is essential for planning success. Dermatology clinics generally generate income from several sources:

- Consultations and Treatments: Income from patient visits, medical procedures, and consultations.

- Cosmetic Dermatology: Revenue from elective procedures like botox, laser treatments, and chemical peels.

- Retail Products: Many clinics sell skincare and other dermatological goods to patients, as detailed in the Aesthetics & Dermatology Clinic 5 Year Financial Model.

2.1. Estimate Patient Volume

Estimate monthly patient visits. For new clinics, assume gradual increasing patient volume. Established clinics should use historical data to project consultations and treatments. Consider:

- New patient acquisition: Expected new patients monthly

- Repeat patients: Existing patients returning for follow-ups or consultations

2.2. Service Breakdown

Services will generate varying revenues. For example, a routine consultation might generate $100, while a botox treatment might cost $500. Break down revenue by service offered. Estimate patients needing each service and multiply by service price. For example:

- Routine consultations: 200 patients at $100 = $20,000

- Cosmetic treatments: 100 patients at $500 = $50,000

- Retail sales: $5,000 in monthly product sales

Forecasting each service category helps estimate total revenue.

Step 3: Estimate Your Costs and Expenses

With revenue forecasted, estimate expenses. Primary categories are:

- Variable Costs (Direct Costs): Fluctuate based on patient volume or services provided.

- Fixed Costs (Operating Expenses): Regular, constant costs regardless of patient volume.

3.1. Variable Costs (COGS)

Variable costs relate directly to care delivery. These include:

- Medical Supplies: Consumables like bandages, treatments, and anesthetics.

- Labor Costs: Salaries for medical staff providing treatments.

- Cosmetic Treatment Costs: Costs for cosmetic services (e.g., botox, laser equipment).

3.2. Fixed Costs (Operating Expenses)

Your clinic’s ongoing regular expenses include:

- Rent or Mortgage: Monthly payment for clinic space.

- Salaries and Wages: Non-medical staff payments, such as receptionists and office managers.

- Utilities: Electricity, water, internet, and other essentials.

- Insurance: Professional liability, property, and employee health insurance.

- Marketing and Advertising: Online marketing, social media, and local advertising.

- Office Supplies and Technology: Computers, patient records software, and office supplies.

3.3. Capital Expenditures (CapEx)

CapEx are one-time investments in the clinic, such as:

- Medical Equipment: Dermatology equipment (e.g., lasers, microscopes) as seen in the Dermatology Center Financial Model Excel Template.

- Furniture and Fixtures: Waiting room and examination furniture.

- Technology: Electronic health record systems and diagnostic tools.

Step 4: Build Your Financial Statements

With estimated revenue and expenses, build core financial statements for your clinic.

4.1. Profit and Loss (P&L) Statement

The P&L statement summarizes revenue, expenses, and profit over a specific period, monthly or annually. It includes:

- Revenue: Total income from all services.

- Cost of Goods Sold (COGS): Direct service provision expenses.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Non-direct costs like rent and marketing.

- Net Profit: Final amount after all expenses, taxes, and interest.

4.2. Cash Flow Statement

The cash flow statement tracks cash inflows and outflows, ensuring liquidity for obligations like bills and salaries. It features:

- Operating Activities: Patient payments and insurance reimbursements.

- Investing Activities: CapEx for equipment and property.

- Financing Activities: Loans or raised capital inflows.

4.3. Balance Sheet

The balance sheet gives a snapshot of financial position, showing:

- Assets: Cash, equipment, furniture, and receivables.

- Liabilities: Loans, debts, and payables.

- Equity: Owner’s stake in the clinic (Assets minus Liabilities).

Step 5: Regularly Review and Update Your Financial Model

After building your model, review and adjust it regularly. Changes in patient volume, service offerings, or market conditions impact financial performance. Update your model to reflect evolving circumstances and long-term goals, as exemplified in various dermatology practice templates.

Final Thoughts!

Building a financial model for a dermatology clinic is crucial for ensuring financial health and sustainability. By forecasting revenue, estimating costs, and creating key financial statements like the P&L statement, cash flow statement, and balance sheet, you’ll make informed, data-driven decisions to drive your clinic’s success. Regular updates to your model will ensure alignment with your clinic’s growth and profitability objectives in the ever-evolving dermatology industry.

Frequently Asked Questions

What is a financial model template?

A financial model template is a pre-designed framework that assists in structuring and predicting financial performance over time, such as the Aesthetics & Dermatology Clinic – 5 Year Financial Model.

How can discounted cash flow (DCF) benefit a dermatology clinic?

Discounted cash flow (DCF) evaluates the clinic’s potential investment returns and helps guide financial decisions by considering the present value of expected future cash flows.

Why is revenue forecasting essential for a dermatology practice?

Revenue forecasting helps estimate future income from patient services, guiding business planning and ensuring that the clinic can cover costs and achieve profitability, as highlighted in the Dermatology Center 5-Year Monthly Financial Projection.