Creating a robust hotel financial model is essential for evaluating hotel investment opportunities, planning development projects, and conducting financial performance evaluations. This guide walks you through the process of building a detailed financial model for a hotel, integrating key components such as forecasting, revenue projection, and expense calculation. It ensures adherence to high standards of financial analysis and planning.

We have also built a Hotel Financial Model Template for Founders and Entrepreneurs to use. Just input your assumptions, and our model does the rest! It’s a complete 3-way financial model with an Income Statement, Balance Sheet, Cash Flow Statement, hotel investment specific metrics, ratios, and more.

Understanding Hotel Financial Models

Hotel financial models are tools used to forecast cash flows, assess profitability, and guide investment decisions. They usually include components like debt financing, equity financing, and project finance. Real estate financial models are often employed to analyze hotel acquisition models and hotel development scenarios, offering critical insights into operational and financial aspects.

Importance of Hotel Financial Models

These models help in understanding financial dynamics by integrating steps from occupancy forecasting to revenue and expense calculations. Excel financial models provide structured templates that facilitate precise financial assessments and performance tracking.

Steps to Build a Hotel Financial Model

Forecast Nights Booked

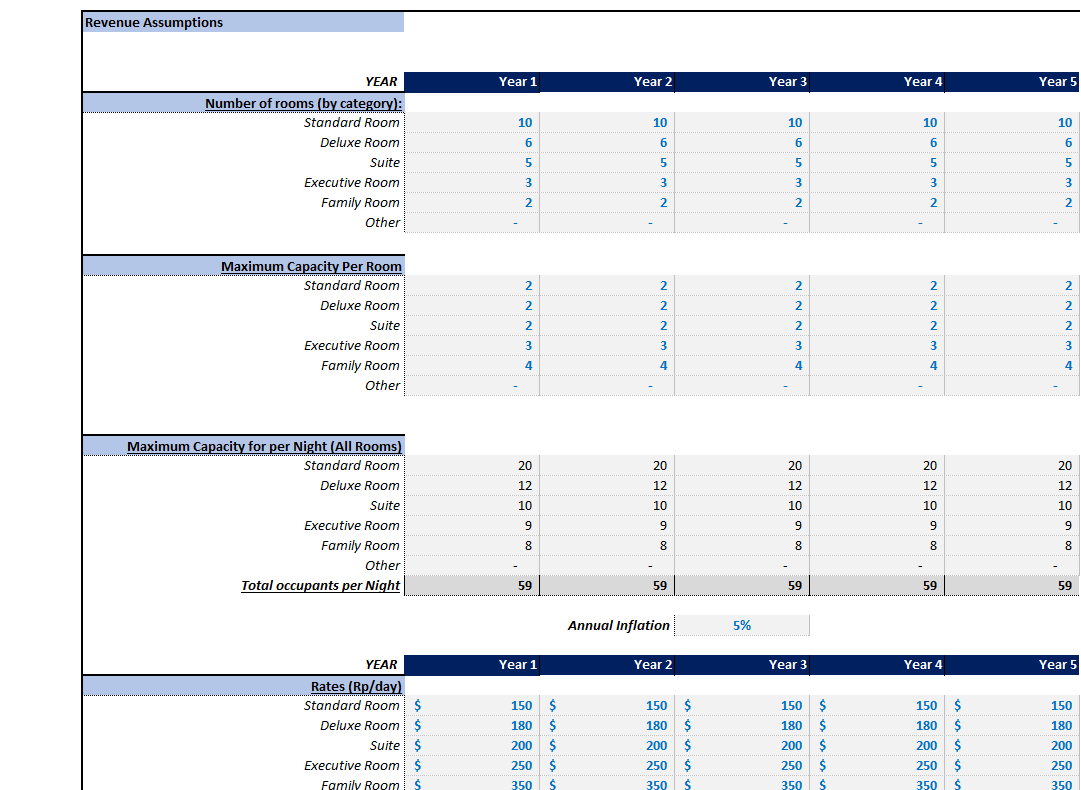

Forecasting booked nights is the first step in developing a hotel financial model. The calculation involves determining the number of available rooms, setting occupancy rates based on seasonality, and calculating total nights booked. Variables like room capacity increments and changing occupancy rates are pivotal in crafting an accurate forecast. For detailed insights, refer to the complete guide.

Predict Hotel Revenue

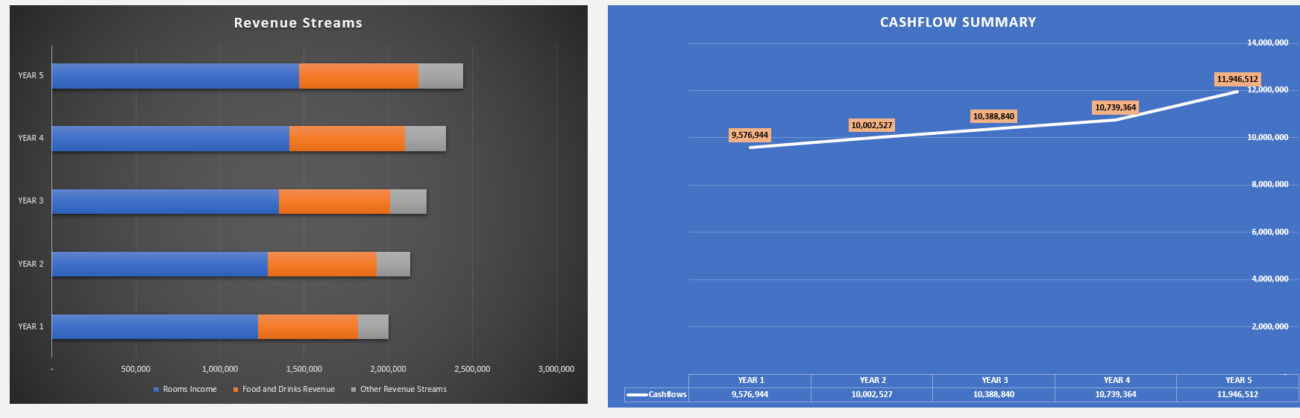

Hotel revenue can be projected by determining daily rates for rooms, accounting for seasonal variations, and considering additional revenue streams such as services and amenities. These projections are essential for creating a comprehensive financial model that aligns with market conditions and business goals. Explore available financial model templates for efficient planning.

Calculate Hotel Expenses

Expense calculation is crucial for profitability analysis. It includes fixed costs like salaries and variable costs such as operating expenses. Properly assessing payment processing fees and operational costs ensures a realistic financial outlook. Learn more about expense structuring here.

Develop P&L and Cash Flow Projections

Building a profit-and-loss statement and forecasting cash flow are essential for gauging financial health. This involves accounting for revenue, expenses, and financing activities to present an overview of financial status and future needs. For further guidance on managing financing activities, view resources on hotel project finance.

Enhancing Your Hotel Financial Model

Utilizing Debt and Equity Financing

Strategic financing decisions can drive hotel development and acquisition success. Debt financing and equity financing are pivotal in supporting hotel projects and sustaining growth. Utilize hotel investment models to optimize investment frameworks and funding opportunities.

Crafting a Forward-Looking Investor Framework

An investor framework should include forecasts that accommodate market trends and changes. It should emphasize adaptability and strategic planning to manage investments effectively. Check resources on real estate models for enhanced financial planning.

Frequently Asked Questions

What is the typical structure of a hotel financial model?

A typical hotel financial model includes segments for forecasting booked nights, revenue calculations, expense evaluations, and financial statements like P&L and cash flow projections. Templates are readily available to streamline this process.

How do occupancy rates impact hotel revenue projections?

Occupancy rates directly influence revenue calculations as they determine the potential room bookings over time. Varying rates due to seasonal patterns or targeted customer segments can significantly affect projected earnings.

Why are hotel financial models necessary for hospitality investments?

Hotel financial models provide comprehensive insights into financial health and performance, guiding strategic decisions in hospitality investments. They are essential for risk management and optimizing returns.

Final Thoughts

Building a detailed hotel financial model involves strategic planning, accurate forecasting, and comprehensive financial assessments to support successful hotel ventures. Incorporating best practices in debt schedules, cash flow forecasts, and financial evaluations enhances the efficacy of these models. By leveraging available resources and templates, you can construct a robust financial framework for your hospitality investments.