Building a financial model for a medical clinic is a crucial step in ensuring that the practice operates smoothly, remains profitable, and achieves long-term sustainability. Whether you’re a new healthcare entrepreneur or someone managing an established practice, understanding the financial dynamics of your clinic is key to making informed decisions. This article will walk you through the process of building a comprehensive financial model for a medical clinic from scratch. We have also built a ready-to-go Medical Clinic Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their financials and provide an Income Statement, Balance Sheet and Cash Flow Statement as well as valuation analysis for their medical clinic.

What is a Medical Clinic Financial Model?

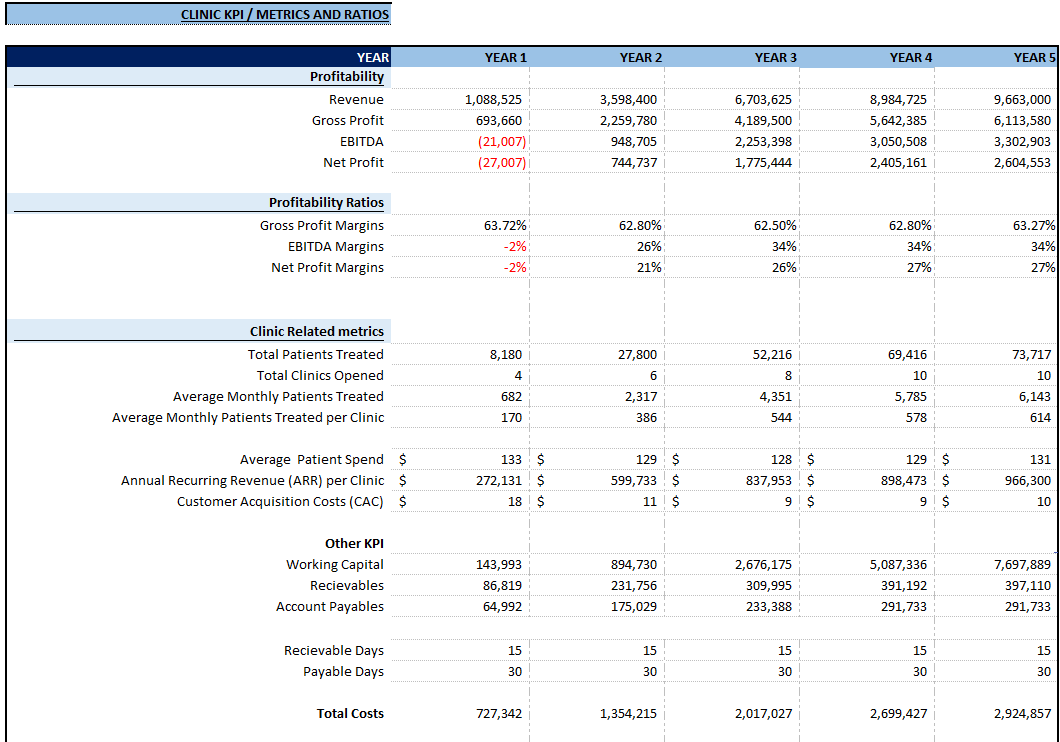

A financial model is a tool that allows you to forecast the financial performance of your clinic over time. It uses historical data, assumptions about future performance, and industry standards to project income, expenses, and profitability. A well-constructed financial model helps you evaluate the clinic’s financial health, plan for growth, and make decisions related to investments, hiring, and resource allocation.

Why is Building a Financial Model Important?

A financial model provides multiple benefits for a medical clinic:

- Informed Decision-Making: Helps owners and managers make data-driven decisions.

- Profitability Insights: Allows you to track income sources and expenses, helping you understand where money is being made or lost.

- Budgeting and Forecasting: Helps project future revenue and costs, which is essential for planning.

- Attracting Investors: A solid financial model can attract investors or lenders by demonstrating that you understand your clinic’s financial viability.

Now that we understand the importance of a financial model, let’s dive into the steps to build one.

Step 1: Collect and Organize Key Data

Before you can build a financial model, you need accurate data about your clinic’s operations. The quality of your model depends on the accuracy of the input data. Below are some key pieces of information you need to gather:

1.1 Historical Financial Data

If the clinic is already in operation, begin by collecting historical financial statements, including an Income Statement, Balance Sheet, and Cash Flow Statement. These documents will help you understand the clinic’s past performance and serve as the basis for your financial projections.

1.2 Revenue Data

You’ll need detailed data on your clinic’s revenue streams, such as patient visits, services provided, and reimbursement rates.

1.3 Expense Data

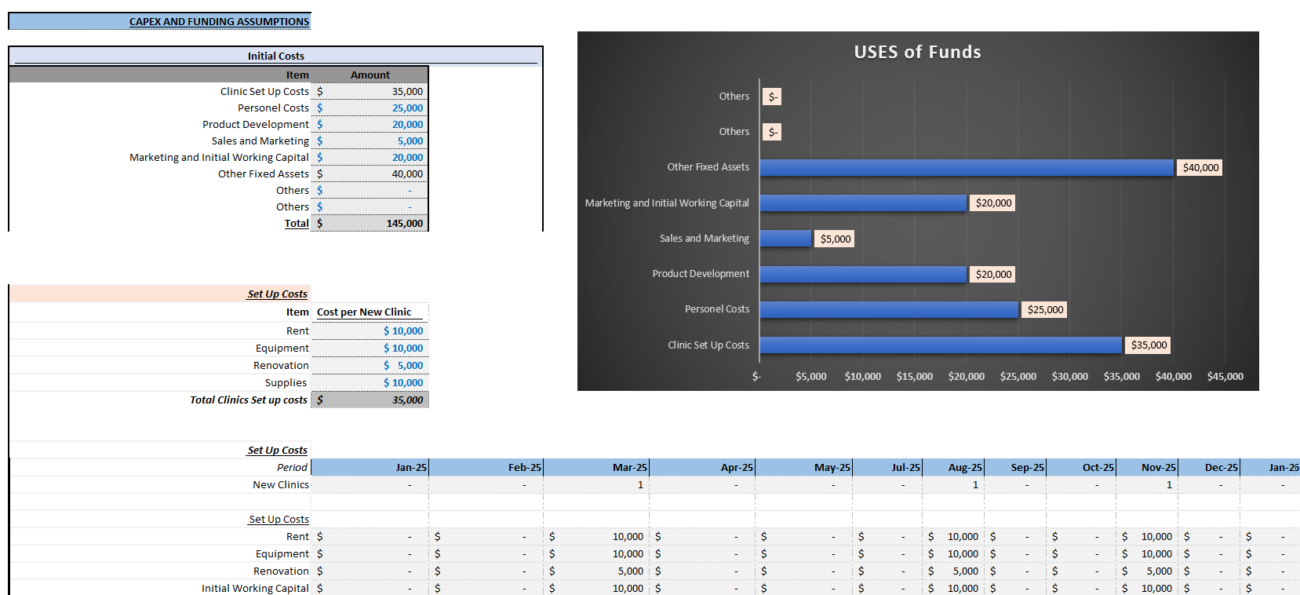

It’s equally important to gather information on the clinic’s expenses, including fixed costs, variable costs, and capital expenditures.

Step 2: Define Key Assumptions

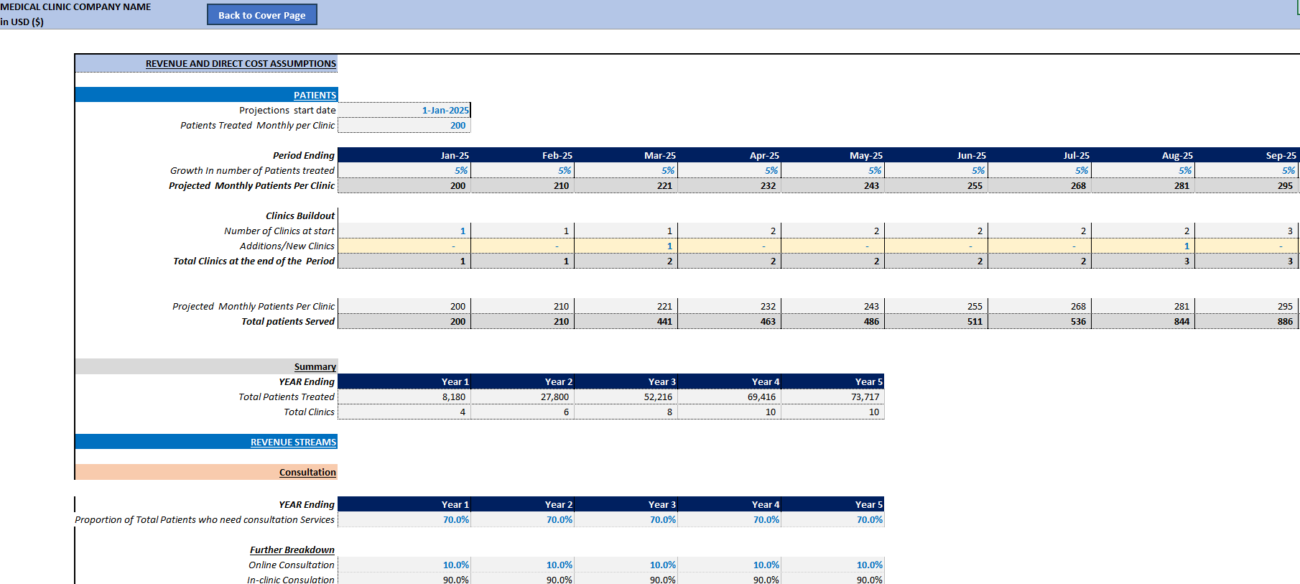

A financial model relies on assumptions about future performance. These assumptions are essentially educated guesses about how things will play out based on current data and industry trends. Common assumptions to make include patient growth rate, revenue per patient, cost growth rates, and utilization rates. Ensure realism by supporting assumptions with historical trends and market research.

Step 3: Build Your Income Statement (Revenue and Expenses)

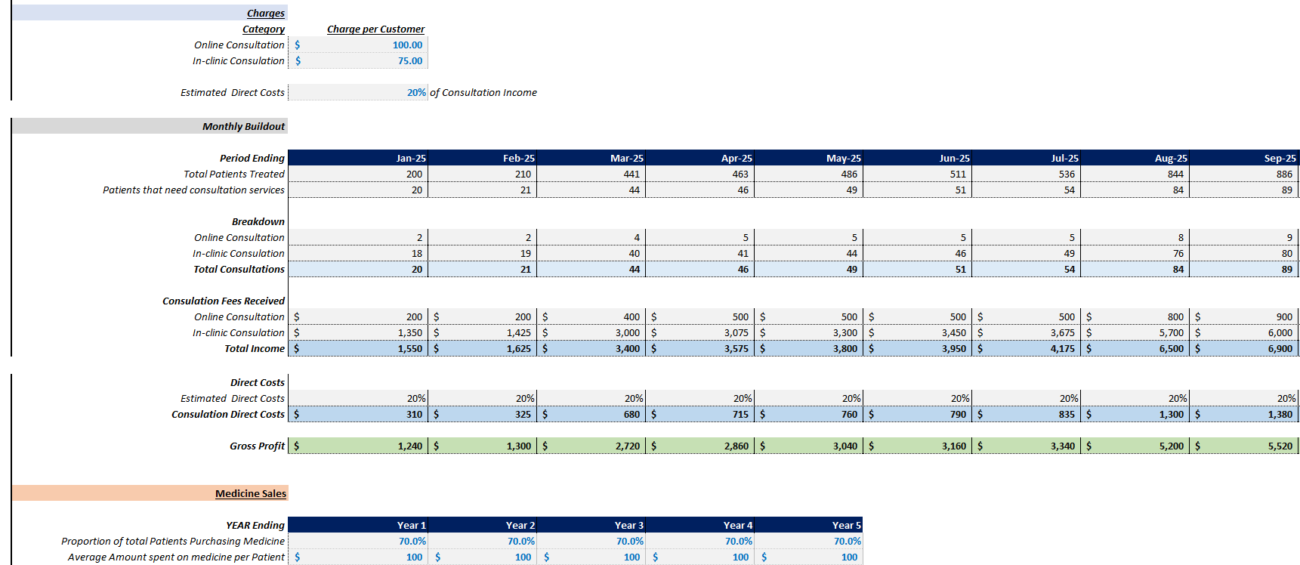

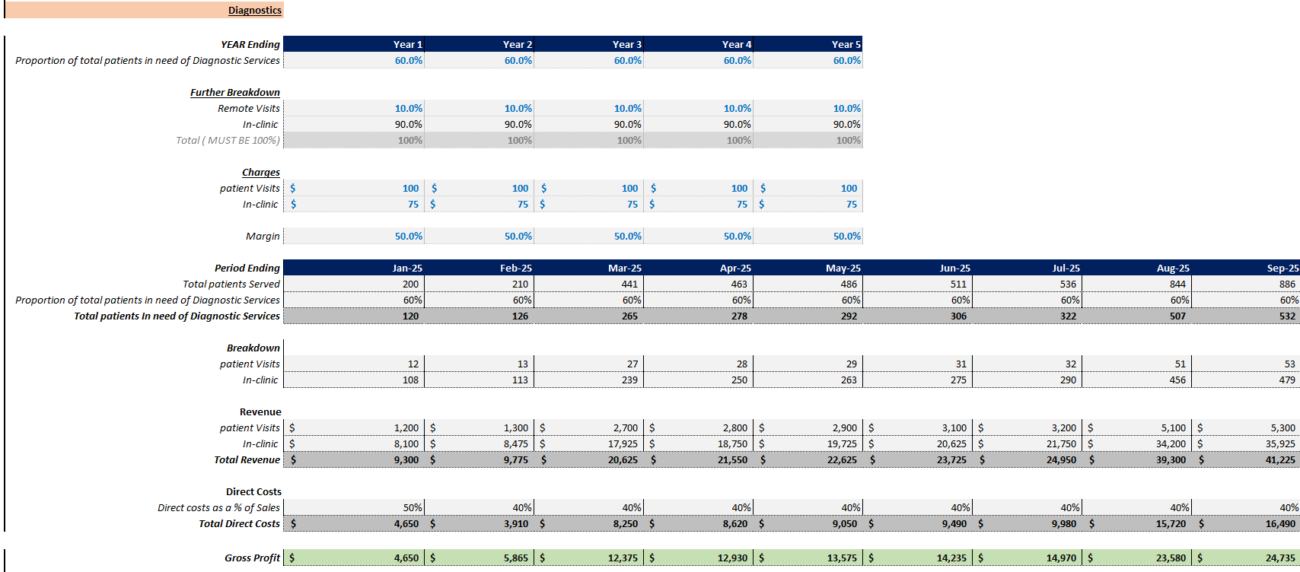

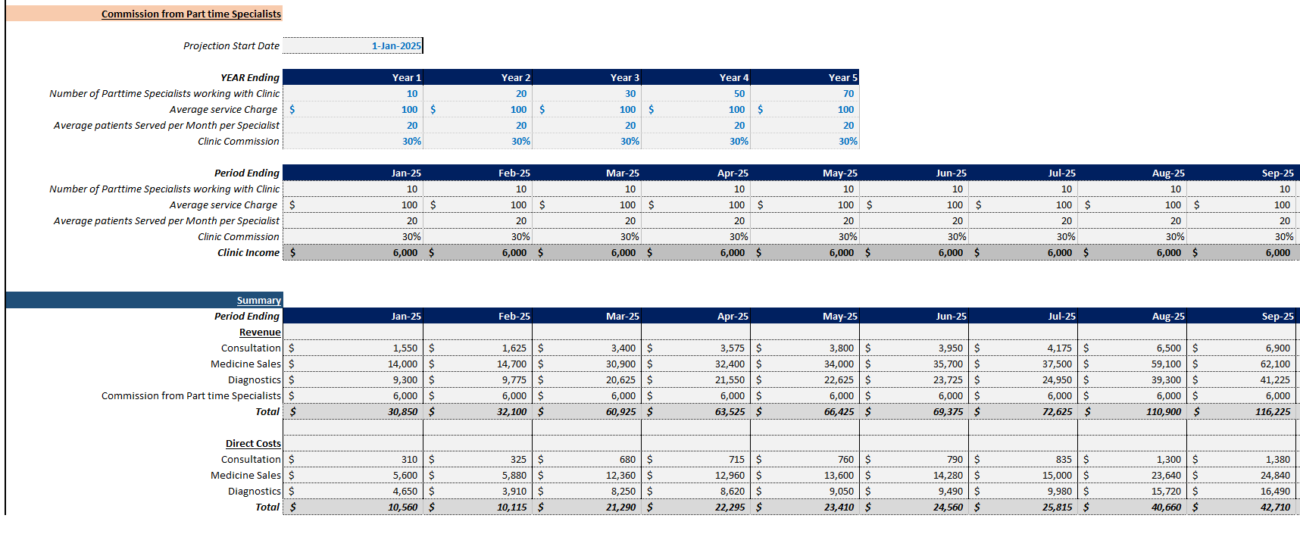

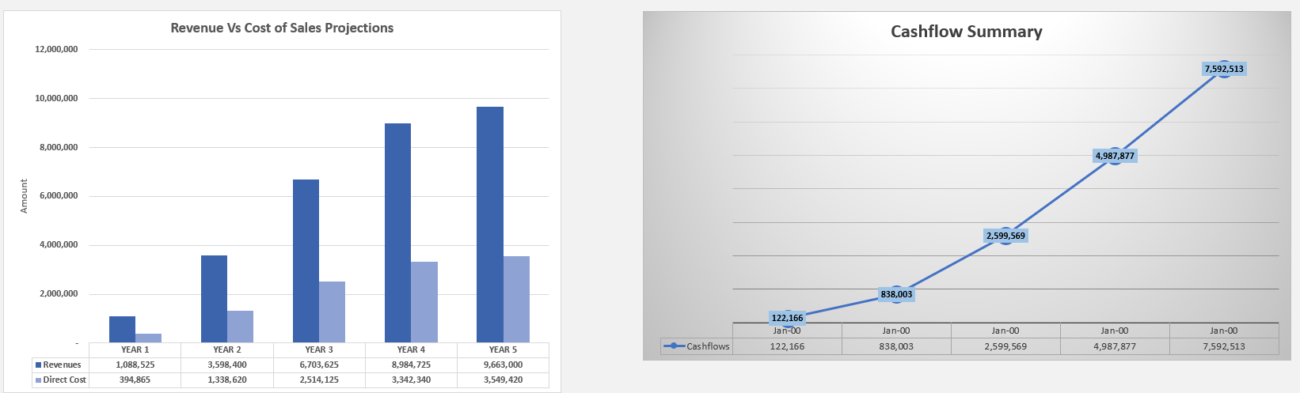

3.1 Projecting Revenue

Revenue is driven by patient visits and the services provided. For more details on projecting revenue, you can refer to helpful resources, such as those available on Etsy.

3.2 Estimating Costs

Costs are divided into fixed and variable expenses. Learn more about managing and estimating these costs at Oak Business Consultant.

Step 4: Build a Cash Flow Statement

A cash flow statement tracks the inflow and outflow of cash in your clinic. It’s essential for ensuring liquidity and covers operating, investing, and financing cash flows.

Step 5: Build the Balance Sheet

The balance sheet is a snapshot of your clinic’s financial position at a particular moment in time. It lists all of your assets, liabilities, and owner’s equity. For guidance, see tools on Financial Models for Healthcare Industry.

Step 6: Perform Sensitivity Analysis

Testing your clinic’s financial performance sensitivity to changes in key assumptions is vital. It helps you understand risks and prepare for unexpected changes, offering insights into how adjustments in assumptions affect overall outcomes.

Step 7: Monitor and Update Your Financial Model

Building the model is just the first step. It’s important to regularly monitor actual performance against your projections. Updating your financial model frequently keeps you prepared for new developments.

Final Thoughts!

Building a financial model for your medical clinic may seem daunting, but it’s a valuable tool for ensuring efficiency and profitability. By collecting accurate data, defining key assumptions, projecting income and expenses, and regularly updating your model, you’ll manage your clinic’s finances effectively and plan for future growth.

Frequently Asked Questions

1. Why is a financial model essential for a medical clinic?

A financial model provides insights into profitability, helps in budgeting and forecasting, and can attract investors by demonstrating financial viability.

2. What are the key components of a financial model for a medical clinic?

Key components include revenue projections, expense estimations, cash flow statements, and balance sheets.

3. How often should a financial model be updated?

Financial models should be updated every few months or whenever significant changes occur.