In the world of mining, nickel stands as one of the most critical metals, essential for various industries, especially for the production of stainless steel and lithium-ion batteries. As demand for electric vehicles (EVs) and renewable energy technology grows, nickel mining has become a pivotal part of the global economy. For those looking to invest or work in the nickel mining industry, understanding how to build a comprehensive financial model is crucial.

A financial model for nickel mining helps businesses, investors, and analysts assess the economic feasibility and profitability of a mining operation. In this article, we’ll walk you through the essential steps to build a nickel mining financial model from scratch, providing a foundation that you can adjust to your specific needs. We have also built a ready-to-go Nickel Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their nickel mine financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their mine.

What is a Mining Financial Model?

A mining financial model is a tool used to simulate and forecast the financial performance of a mining project over time. It typically includes:

- Revenue projections based on expected metal prices and production rates

- Operating costs such as labor, equipment, and energy expenses

- Capital expenditures required for the development of the mine

- Financing and debt structures

- Sensitivity analysis to understand the impact of fluctuating commodity prices or costs

The model serves as the blueprint for understanding the cash flow, profitability, and financial health of the mining project.

Step 1: Understand the Key Inputs for a Nickel Mining Model

Before diving into creating the model itself, you need to gather essential data. These inputs form the backbone of your model, and their accuracy will significantly impact the results.

- Nickel Reserves and Resources

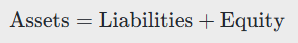

Estimate the amount of nickel the mine can produce, typically measured in tons of nickel contained in ore. This figure should be based on geological surveys and reserve reports. - Nickel Prices

Project the price of nickel over the life of the mine. While this can be influenced by market trends, forecasts, and historical data, you should also conduct sensitivity analysis to account for price volatility. - Mining Method and Production Rate

Determine whether the mine will use an open-pit, underground, or other method. Your production rate will depend on the mining method, ore grade, and scale of the operation. This figure will tell you how many tons of ore can be extracted annually. - Recovery Rate

The recovery rate refers to the percentage of nickel that can be extracted from the ore. High-grade ores tend to have higher recovery rates. This figure is essential for calculating how much nickel you will eventually sell. - Operating Costs

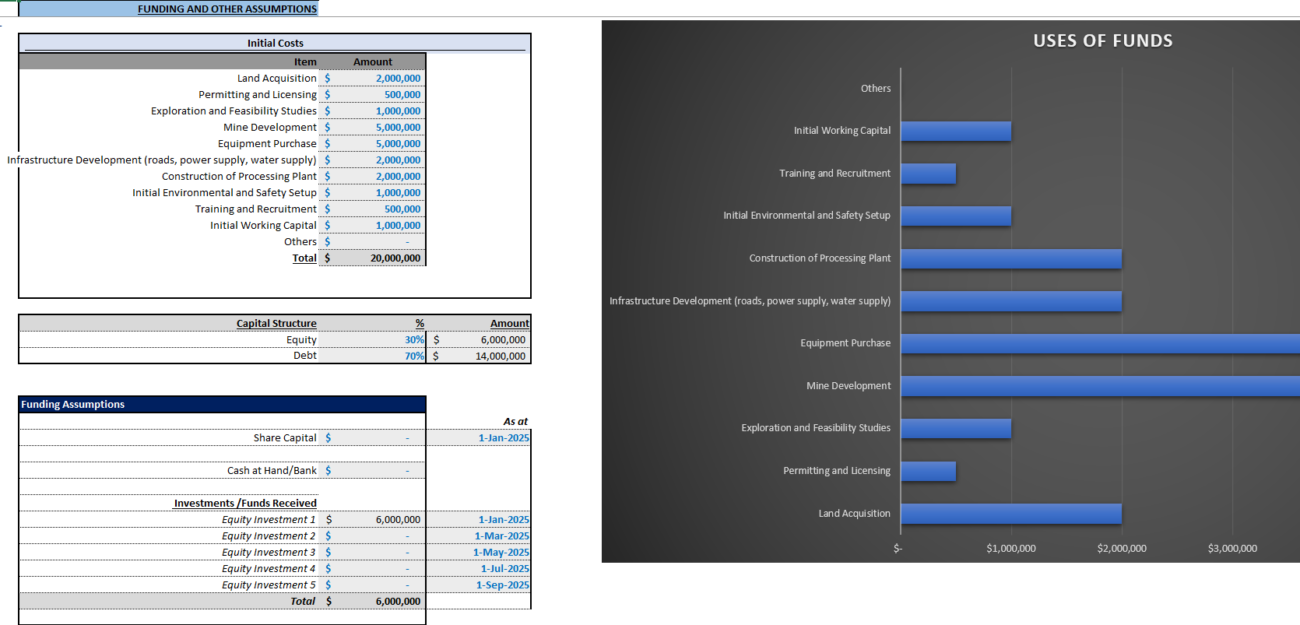

Operating costs include labor, utilities, maintenance, processing, and site overhead. Estimating these costs accurately is crucial for determining profitability. - Capital Expenditures (CapEx)

The initial investment to get the mine up and running includes purchasing equipment, constructing facilities, and any other infrastructure costs. CapEx also includes sustaining capital required to maintain operations. - Financing Structure

Identify how the project will be financed, whether through equity, debt, or a combination of both. Interest rates on debt, repayment schedules, and the cost of capital are important for projecting cash flows.

Step 2: Create the Basic Financial Model Structure

Once you have the necessary inputs, it’s time to build the structure of the financial model. Most mining financial models follow a similar format, typically with the following sections:

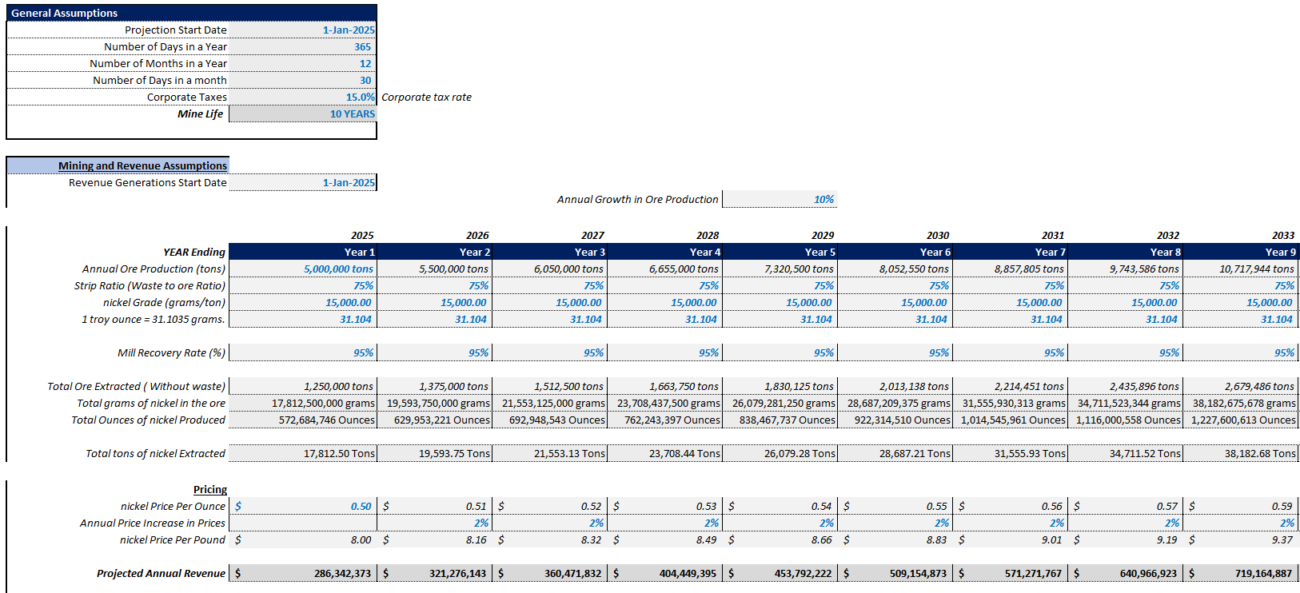

- Assumptions Sheet

This sheet contains all your inputs—nickel prices, production rates, costs, and so on. It is where you’ll define key metrics and variables for the model. For clarity, organize the assumptions logically, grouping them by categories such as revenue, costs, and financing. - Revenue Forecast

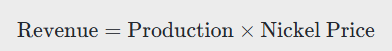

Revenue from the sale of nickel is a major component of your model. The calculation is generally straightforward: multiply the forecasted production (in tons of nickel) by the nickel price (in dollars per ton). Formula:

Consider factors like annual changes in production or metal prices, and factor in the expected production ramp-up period and any potential pricing fluctuations. - Operating Expenses

In this section, you’ll input all costs associated with running the mine. These typically include:

- Mining Costs: Labor, fuel, and materials

- Processing Costs: Ore handling, refining, and chemicals

- G&A Costs: Administrative, regulatory, and overhead expenses

- Maintenance Costs: Costs associated with maintaining equipment and infrastructure

- Capital Expenditures (CapEx)

Estimate both initial and sustaining capital expenditures. Initial CapEx might include purchasing mining equipment, construction of processing plants, and the development of roads or infrastructure. Sustaining CapEx accounts for the ongoing investment in maintaining the operation throughout the mine’s life. Typically, CapEx is accounted for in year one (initial) and spread across the remaining years for sustaining capital needs. - Financing and Debt

If you have debt financing, calculate the interest payments and debt repayments. These payments will be subtracted from your cash flows. In some models, equity financing might also come into play, which will affect ownership and share dilution.

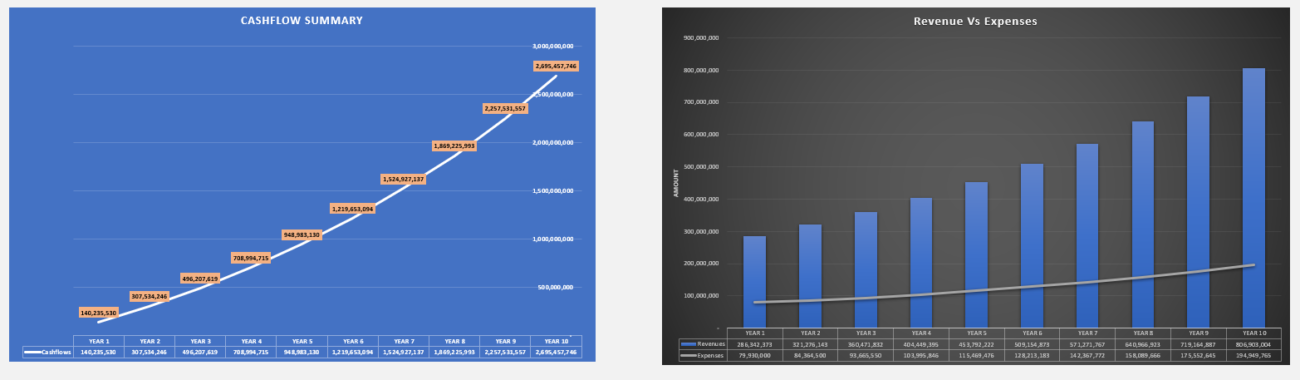

Step 3: Build the Cash Flow Statement

A critical component of your model is the cash flow statement. This shows the inflow and outflow of cash over time, which is vital for assessing the profitability and financial sustainability of the mine.

- Operating Cash Flow:

Start by calculating operating profit (earnings before interest and taxes, or EBIT). From there, adjust for non-cash items like depreciation and changes in working capital to arrive at operating cash flow. Formula:

- Investing Cash Flow:

Account for capital expenditures and any investments made during the year. These will typically be negative cash flows. - Financing Cash Flow:

Include cash inflows from new debt or equity funding and outflows for debt repayments or dividends paid. - Net Cash Flow:

Sum the operating, investing, and financing cash flows to calculate the net cash flow for each period (usually annually).

Step 4: Set Up Profit and Loss (P&L) and Balance Sheet

The P&L statement provides a snapshot of profitability, while the balance sheet shows the overall financial position of the mining operation. The key components of each are:

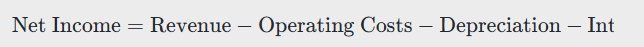

- Profit and Loss (P&L) Statement: Calculate revenues, subtract costs, and determine your net income. The formula is straightforward:

- Balance Sheet: Assets like equipment, inventory, and cash, liabilities such as debt, and equity will appear here. Ensure that your model follows the basic accounting equation:

Step 5: Sensitivity Analysis and Scenario Planning

One of the key benefits of financial models is that they allow you to test different scenarios. In the case of nickel mining, your model’s profitability could vary significantly based on fluctuating metal prices, changes in operating costs, or other external factors.

- Nickel Price Sensitivity: Vary the nickel price assumption to test the impact of price volatility on your project’s financial health.

- Cost Sensitivity: Analyze how different cost assumptions—such as labor costs, fuel costs, or equipment maintenance—affect profitability.

- Production Sensitivity: Assess how different production rates, recovery rates, or operational disruptions (e.g., equipment failure, labor strikes) influence the outcome.

This step helps you understand the risks and prepare for uncertainty in the market.

Step 6: Final Review and Model Output

Once your model is built, review it to ensure all variables and assumptions align logically. Ensure that your outputs are meaningful and clearly presented—most financial models include charts and graphs for easy interpretation.

- Break-even analysis: Calculate when the project will start generating positive cash flow.

- Net Present Value (NPV): Use discounted cash flow (DCF) analysis to calculate the NPV of your project, which will help assess whether the mine is a worthwhile investment.

- Internal Rate of Return (IRR): This metric helps assess the project’s profitability by calculating the rate of return at which NPV equals zero.

Frequently Asked Questions

What is the importance of a nickel mining financial model?

A nickel mining financial model is crucial for understanding the potential financial outcomes of a mining project. It helps in determining profitability, analyzing investments, and making informed decisions based on projected cash flows and market conditions.

How can I forecast nickel prices in my model?

Forecasting nickel prices can be challenging due to market volatility. Use historical data, market trends, and industry reports to develop price forecasts, and incorporate sensitivity analysis to account for potential fluctuations.

What are the key components of operating expenses in a nickel mine?

Operating expenses in a nickel mine include mining costs (labor, fuel), processing costs (ore handling and refining), general & administrative costs (administrative expenses), and maintenance costs (upkeeping equipment and infrastructure).

Final Thoughts!

Building a nickel mining financial model can be a complex but rewarding process, providing essential insights into the financial viability of a mining project. By following the steps outlined in this guide—gathering the necessary data, setting up the model structure, analyzing cash flow, and testing different scenarios—you can develop a robust model that helps you make informed decisions about investment or operations.

As you gain experience, you’ll be able to adjust the model and refine it for different types of mining projects, but the fundamental principles remain the same. Whether you are an investor, financial analyst, or mining engineer, mastering these steps is key to navigating the nickel mining industry effectively.