Pharma and biotech companies, particularly startups, are often valued in unconventional ways compared to traditional businesses. Their value is not solely based on current revenue or profit, but largely on future growth potential, the success of clinical trials, intellectual property (IP), regulatory approvals, and the marketability of drug candidates or therapeutic innovations.

Building a valuation and financial model for a pharmaceutical or biotechnology company can be complex, especially for beginners. This article breaks down the process of constructing a pharma and biotech financial model from scratch, highlighting essential components, key assumptions, valuation methods, and step-by-step instructions. We also have a ready-made Pharma and Biotech Valuation and Financial Model template that is perfect for Founders, Company Executives or Analysts to use.

Why Pharma and Biotech Valuations Are Different

Unlike typical businesses, where valuation is often grounded in financial metrics like revenue, EBITDA, and profit margins, pharma and biotech companies are usually valued based on potential future revenues from drugs that may still be in the development pipeline. The key drivers of value in pharma and biotech companies include:

- R&D Pipeline: The value of the company’s drug candidates and their clinical development stages (preclinical, Phase 1, Phase 2, Phase 3).

- Regulatory Milestones: Approvals from regulatory agencies like the FDA or EMA, which are necessary for commercialization.

- Market Opportunity: The size of the target market for each product and its potential commercial success.

- Intellectual Property (IP): Patents and other proprietary technologies can be highly valuable.

- Partnerships and Licensing Deals: Collaborations with large pharmaceutical companies or out-licensing agreements that provide upfront payments, royalties, or milestone payments.

Building a solid financial model allows you to estimate the potential value of these future revenues and help secure investments, partnerships, or mergers/acquisitions.

Step 1: Understand the Key Components of Pharma and Biotech Financial Models

Pharma and biotech financial models typically consist of the following core components:

- Revenue Model:

- Product Sales: Forecasts of future drug sales once products are commercialized.

- Licensing Revenues: Revenue from licensing deals, royalty payments, and milestone payments.

- Grants or Government Funding: Income from public funding or grants to support R&D.

- R&D Costs:

- Clinical Trials: Expenses related to the preclinical research and various phases of clinical trials (Phase 1, Phase 2, and Phase 3).

- Manufacturing & Supply Chain: Costs of manufacturing drugs, including facility expenses, raw materials, and logistics.

- Capital Structure:

- Equity and Debt Financing: Capital raised from investors, as well as any outstanding loans or credit facilities.

- Licensing Fees and Milestones: Expected upfront payments, milestone payments, and royalties from licensing agreements.

- Valuation Metrics:

- Discounted Cash Flow (DCF): The primary method of valuing pharma and biotech companies, based on the projected free cash flows (FCF) of the business.

- Risk-Adjusted Net Present Value (rNPV): A more specific method used in biotech, considering the probability of success at each clinical trial stage and adjusting the value accordingly.

- Comparable Company Analysis: Using valuation multiples from similar publicly traded or acquired companies in the same sector.

- Precedent Transactions: Examining past M&A or licensing deal data to estimate value.

- Exit Strategy:

- Acquisition: The potential value of a pharma or biotech company is often linked to acquisition by a larger player in the industry.

- Public Offering (IPO): If the company plans to go public, the model may also estimate the IPO pricing based on market conditions and future projections.

Step 2: Gather Key Assumptions

Before diving into detailed financial projections, you’ll need to set the assumptions that will drive your model. These assumptions will vary based on the company’s product portfolio, stage of development, and market dynamics. Some essential assumptions to gather include:

- Clinical Development Timelines: The duration of each clinical trial phase (typically 1–2 years per phase), regulatory approval timelines, and expected market launch.

- Probability of Success (PoS): The likelihood that a drug candidate will progress from one phase to the next and eventually gain regulatory approval. For example, the probability of a Phase 1 trial transitioning to Phase 2 might be 60%, while the probability of a Phase 3 drug receiving FDA approval could be 80%.

- Market Size: The total addressable market (TAM) for the drug(s) once they reach the market.

- Pricing Strategy: Expected pricing per treatment, based on industry standards or comparable drugs in the same therapeutic category.

- Market Penetration: The expected market share the drug can capture once it is approved, typically based on competition, pricing, and the drug’s therapeutic value.

- Discount Rate: A discount rate (WACC – Weighted Average Cost of Capital) that reflects the riskiness of the business and the specific drug’s development process.

- Costs: R&D and clinical trial costs (which vary by trial phase), general and administrative (G&A) costs, sales and marketing costs, and production costs.

These assumptions will form the foundation for your revenue and cost projections.

Step 3: Create the R&D Pipeline and Revenue Model

The next step is to map out the development pipeline and revenue projections. This typically involves forecasting costs and potential revenues over several years or even decades. You will need to estimate when each product will enter clinical trials, when it will be approved, and when it will be commercially available. The most common stages to track are:

R&D Pipeline Stages

- Preclinical Development: The research and development phase before testing in humans.

- Phase 1: The first stage of human trials, typically focused on safety and dosage.

- Phase 2: Trials that assess the drug’s efficacy in treating the targeted condition.

- Phase 3: Large-scale clinical trials that provide robust data on safety and efficacy for regulatory approval.

- Commercialization: Once the drug is approved by regulatory agencies, it’s available for sale.

For more information on specific tools and templates, the Pharma Biotech Financial Model Template from eFinancialModels offers a robust framework.

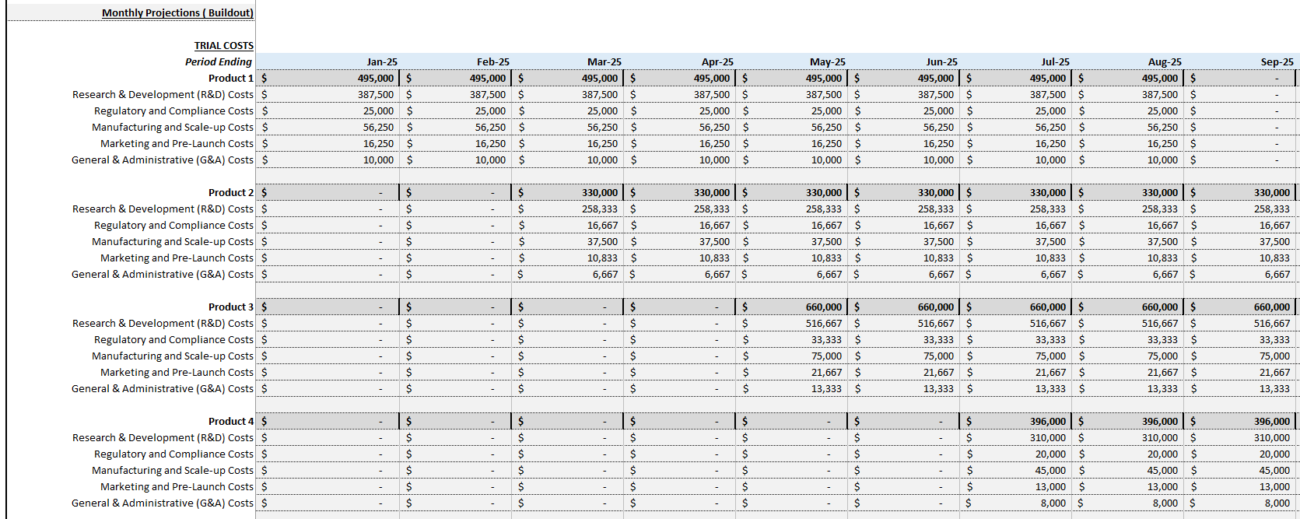

Step 4: Estimate Clinical Trial and Operating Costs

Next, estimate the costs associated with clinical trials and day-to-day operations.

Clinical Trial Costs

Clinical trials are typically the largest expense for biotech companies. Costs vary by phase:

- Phase 1: $1 million to $5 million

- Phase 2: $5 million to $30 million

- Phase 3: $20 million to $100 million

Estimate the costs for each phase based on the number of patients, trial locations, and the complexity of the drug. For a deeper understanding of financing and logistics, see how Pharmaceutical Forecasting & Financial Modelling can help refine projections.

Operating Costs

Aside from R&D, biotech companies have other operational costs:

- General & Administrative (G&A): Salaries, office space, legal fees, etc.

- Sales & Marketing: Once the product is commercialized, these costs include promotional activities, sales teams, and distribution.

You should include assumptions about how these costs grow as the company scales and commercializes drugs.

Step 5: Discounted Cash Flow (DCF) and Risk-Adjusted Net Present Value (rNPV)

Once you’ve estimated the future cash flows from sales and expenses, you can discount these cash flows to today’s value using a Discounted Cash Flow (DCF) or Risk-Adjusted Net Present Value (rNPV) model.

- DCF: Apply a discount rate (usually the company’s weighted average cost of capital or WACC) to adjust the future cash flows to their present value.

- rNPV: Used specifically in biotech, rNPV considers the probabilities of success at each development phase. Future revenues are adjusted based on the likelihood that each drug candidate will reach commercialization. Tools like the Pharma Biotech Financial Model including Risk-Adjusted DCF can guide these calculations.

Step 6: Create the Final Financial Model

Combine all these inputs — revenue projections, cost estimates, probabilities of success, and discount rates — to create a dynamic financial model. This model will provide you with key metrics like:

- Net Present Value (NPV): The value of future cash flows adjusted for risk and time value.

- Internal Rate of Return (IRR): The rate at which the company breaks even on its investments.

Use this model to evaluate various scenarios (e.g., what happens if a drug fails at Phase 2, or if commercialization takes longer than expected). To navigate potential pitfalls and optimize returns, refer to Biotech Valuation Idiosyncrasies and Best Practices.

Conclusion

Building a pharma and biotech valuation and financial model is a complex but essential task for understanding the future potential of a company. By assessing the development stages, estimating costs, calculating risk-adjusted revenues, and using methodologies like DCF and rNPV, you can create a comprehensive model that provides valuable insights for investors, partners, and management. For guidance on best practices, the 2024 Ultimate Pharma & Biotech Valuation Guide offers detailed insights.

Frequently Asked Questions

What is a Risk-Adjusted DCF Valuation?

A Risk-Adjusted DCF Valuation is a method that incorporates the probability of success at various stages of drug development to provide a more accurate valuation of biotech companies. It adjusts the projected cash flows according to the risk involved at each stage of development.

Why are Financial Projections crucial in Biotech?

Financial projections are vital as they help in forecasting future cash flows, securing investments, and making informed business decisions. They account for the potential profitability and sustainability of biotech ventures.

How do Biopharma Assets differ from traditional assets?

Biopharma assets often include intellectual property, ongoing studies, and pipeline drug candidates, focusing on future potential rather than current revenue. They entail high risk and require careful valuation techniques to estimate future success and profitability.