As an Airbnb host, one of the most crucial aspects of running a successful business is understanding the financials. Whether you’re renting out a single room or managing multiple properties, tracking key financial metrics will help you make informed decisions, optimize your operations, and ultimately maximize your revenue. A well-structured financial model is not just about predicting income—it’s about creating a comprehensive view of your Airbnb business, considering both fixed and variable costs, and anticipating potential changes in the market.

In this article, we’ll discuss the essential metrics every Airbnb host should track and how they can help shape a winning financial model for your business. We have also built a ready-to-go Airbnb Financial Model Template for Owners looking for an easy-to-use Financial model which will allow them to model out their Airbnb financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their Airbnb property or multiple Airbnb properties.

Why Financial Models Matter for Airbnb Hosts

A solid financial model is the backbone of any successful Airbnb business. It’s essential for:

- Assessing profitability: Understanding whether your Airbnb property is profitable after accounting for all costs.

- Pricing strategies: Helping determine competitive yet profitable pricing for your property.

- Budgeting: Planning for future expenses and growth.

- Attracting investors: If you’re looking to expand your portfolio or raise capital, potential investors will want to see solid financial data.

Creating a financial model that takes into account all the moving parts of your business will help you forecast your cash flow, predict profits and losses, and identify areas of improvement. But first, let’s look at the key metrics every Airbnb host should track.

Occupancy Rate

What It Is: The occupancy rate refers to the percentage of time that your property is booked. It is a direct indicator of how often your Airbnb is rented out versus how much it sits vacant.

Why It Matters: A higher occupancy rate typically means more revenue. However, occupancy should be balanced with pricing—too low a price might result in high occupancy but reduced income, while too high a price might lower demand.

Learn more about the importance of occupancy rates in the Airbnb Metrics Every Host Should Track.

How to Calculate:

Example: If you have 30 available nights in a month and your property is booked for 20 of those nights, your occupancy rate would be:

What to Do with This Metric:

- Analyze trends and adjust your pricing and availability accordingly.

- Consider offering promotions, discounts, or additional services to increase your occupancy rate during low seasons.

Average Daily Rate (ADR)

What It Is: The Average Daily Rate (ADR) is the average income you earn per night booked on your property. It provides insight into your pricing strategy and helps assess whether your property is priced too high or too low.

Why It Matters: ADR impacts your overall revenue. While it’s important to be competitive in your pricing, it’s equally important to ensure you’re not undervaluing your property.

Explore more about ADR in the 6 key Airbnb performance metrics every host should track.

How to Calculate:

Example: If your property generates $2,000 in total revenue over 20 nights, your ADR would be:

What to Do with This Metric:

- Adjust your ADR based on demand, seasonality, and competitor pricing.

- Track how your ADR compares to similar properties in your area to ensure you remain competitive while maximizing revenue.

Revenue Per Available Room (RevPAR)

What It Is: RevPAR is a combination of both occupancy and ADR and is a key performance metric for measuring a property’s ability to generate revenue. It combines both the number of nights booked (occupancy) and the nightly rate (ADR) into a single metric.

Why It Matters: RevPAR helps you see how well your Airbnb is performing relative to both occupancy and pricing. It’s an essential indicator of overall performance and financial health.

You can find detailed insights on this metric in 27 Airbnb Metrics: Top KPIs Every Host Should Track.

How to Calculate:

Example: If your ADR is $100 and your occupancy rate is 66.67%, your RevPAR would be:

What to Do with This Metric:

- Compare your RevPAR to similar properties to understand whether you’re maximizing revenue potential.

- Use this metric to assess how effective your pricing strategy is at both filling rooms and optimizing rates.

Cleaning and Maintenance Costs

What It Is: These are the operational costs associated with maintaining the property, such as cleaning fees, repairs, utilities, and regular maintenance.

Why It Matters: While maintenance costs are necessary for keeping your property in top condition, they also directly affect your profit margins. Tracking these costs helps ensure you’re pricing your property in a way that covers expenses while remaining competitive.

How to Track:

- Track all cleaning and maintenance invoices and bills, and categorize them into regular maintenance, deep cleaning, and repair costs.

- Calculate your cleaning and maintenance costs per booking to get an average cost for each stay.

What to Do with This Metric:

- Include cleaning and maintenance fees in your financial model to ensure they’re accounted for in your pricing strategy, as outlined in Key Metrics For Airbnb Investment.

- Identify areas where you can cut costs, such as negotiating better rates with cleaning services or performing minor repairs yourself.

Customer Acquisition Cost (CAC)

What It Is: Customer Acquisition Cost (CAC) refers to the amount of money spent on marketing and advertising to acquire a new guest. This includes paid ads, discounts, promotions, and other marketing expenses.

Why It Matters: Knowing how much it costs to acquire each guest helps you assess the effectiveness of your marketing campaigns and determine whether your guest acquisition strategy is sustainable.

For strategies on optimizing CAC, refer to Is Airbnb Profitable? How Much Can Hosts Earn in Australia?.

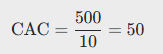

How to Calculate:

Example: If you spend $500 on advertising and acquire 10 new bookings, your CAC would be:

What to Do with This Metric:

- Track your CAC to ensure you’re not overspending on customer acquisition.

- Invest in strategies that reduce CAC, such as leveraging organic channels like social media or word-of-mouth.

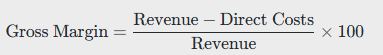

Gross Margin and Net Profit Margin

What They Are: Gross margin is the difference between revenue and direct costs (such as cleaning and maintenance), while net profit margin accounts for all expenses, including operating costs, taxes, and interest.

Learn how to incorporate these financial indicators into your business model with the Airbnb Financial Model Example.

Why They Matter: These margins provide insight into the profitability of your Airbnb business, helping you assess whether your revenue is sufficient to cover all expenses and generate a profit.

How to Calculate:

- Gross Margin:

- Net Profit Margin:

What to Do with This Metric:

- Use these margins to track your overall profitability.

- Adjust pricing, reduce costs, or streamline operations to increase both your gross and net profit margins.

Guest Reviews and Ratings

What It Is: While not a financial metric, guest reviews and ratings play a significant role in determining your Airbnb revenue. Positive reviews can drive more bookings, while negative reviews can reduce your occupancy rate.

Why It Matters: High ratings lead to higher visibility on the platform, greater trust from potential guests, and potentially higher rates. Tracking reviews also helps you identify areas of improvement in your property or hosting style.

Discover strategies to enhance your guest experiences in Airbnb KPIs.

What to Do with This Metric:

- Respond promptly to guest reviews and use feedback to improve the guest experience.

- Strive for consistent 5-star reviews to increase your chances of being featured in search results, ultimately boosting bookings and revenue.

Conclusion: The Power of Financial Metrics for Airbnb Hosts

Tracking key financial metrics is essential for any Airbnb host aiming to run a profitable and sustainable business. By focusing on occupancy rate, ADR, RevPAR, cleaning and maintenance costs, CAC, profit margins, and guest reviews, you can gain a comprehensive understanding of your financial health and make informed decisions that drive growth.

A well-structured financial model that incorporates these metrics will help you optimize your Airbnb operations, refine your pricing strategies, and ensure that you’re generating the maximum possible revenue from your property. Whether you’re a new host or managing multiple listings, these metrics are the foundation of a successful Airbnb business.

Frequently Asked Questions

What is the importance of occupancy rate for Airbnb hosts?

Occupancy rate helps hosts understand how often their property is booked. It is crucial because higher occupancy usually leads to increased revenue, provided the pricing strategy is balanced. More on this can be read in 6 Key Airbnb Metrics Investors Should Know.

How can hosts reduce cleaning and maintenance costs?

Hosts can negotiate better rates with cleaning services, perform minor repairs themselves, or invest in routine maintenance to prevent costly future repairs. These strategies help in maintaining profitability and can be part of their financial model strategies.

How do guest reviews impact Airbnb bookings?

Positive guest reviews can lead to higher visibility on Airbnb platforms, attract more potential guests, and allow hosts to command higher rates. This is an essential aspect of driving growth through guest satisfaction.