R&D is one of the most powerful value-creation engines in any innovation-driven organization. It is also one of the most misunderstood. Many companies spend heavily on research and development, track activity obsessively, and still struggle to explain how today’s R&D investments translate into tomorrow’s growth.

The problem isn’t ambition or effort. It’s misalignment.

When R&D pipelines are managed as collections of projects instead of portfolios of long-term value bets, spending becomes inefficient, decision-making becomes political, and outcomes disappoint. Making R&D spend work harder requires a shift—from funding activity to funding value.

This article explores how organizations can link R&D pipeline decisions directly to long-term value creation, without slowing innovation or stifling creativity.

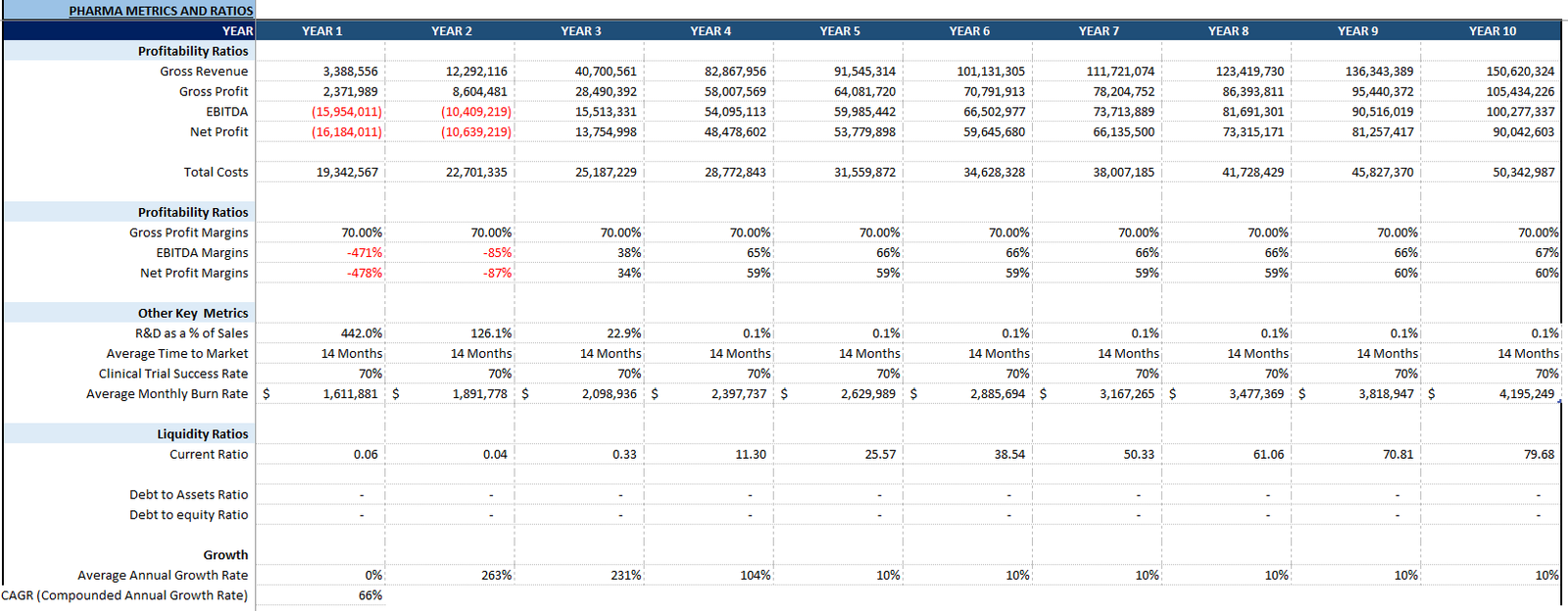

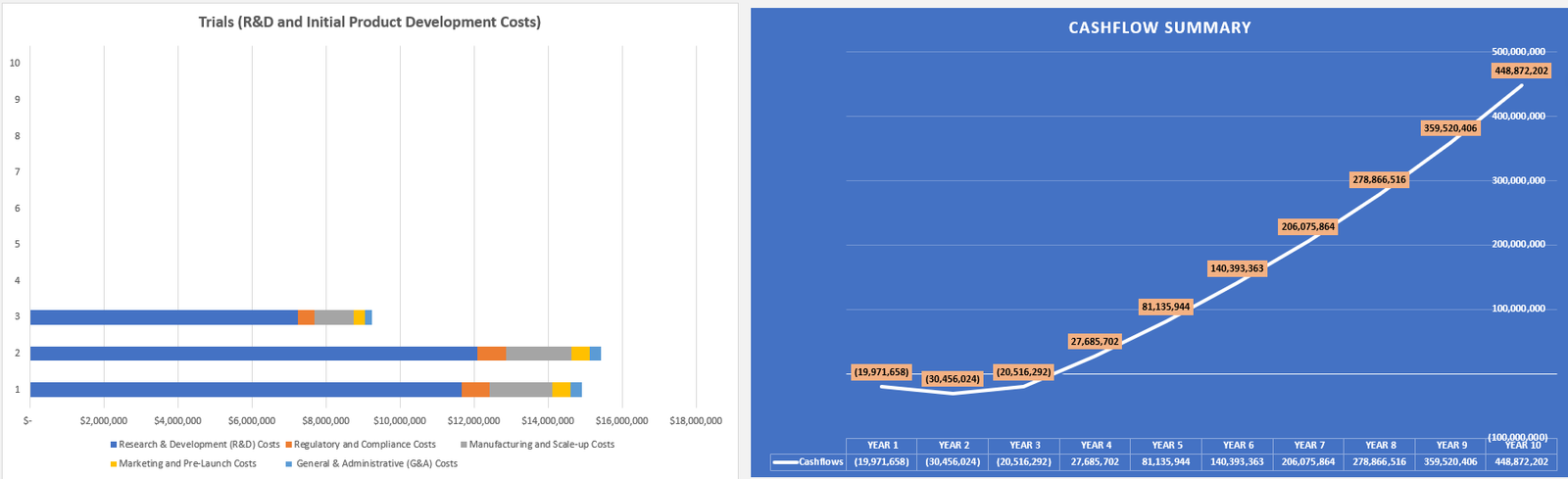

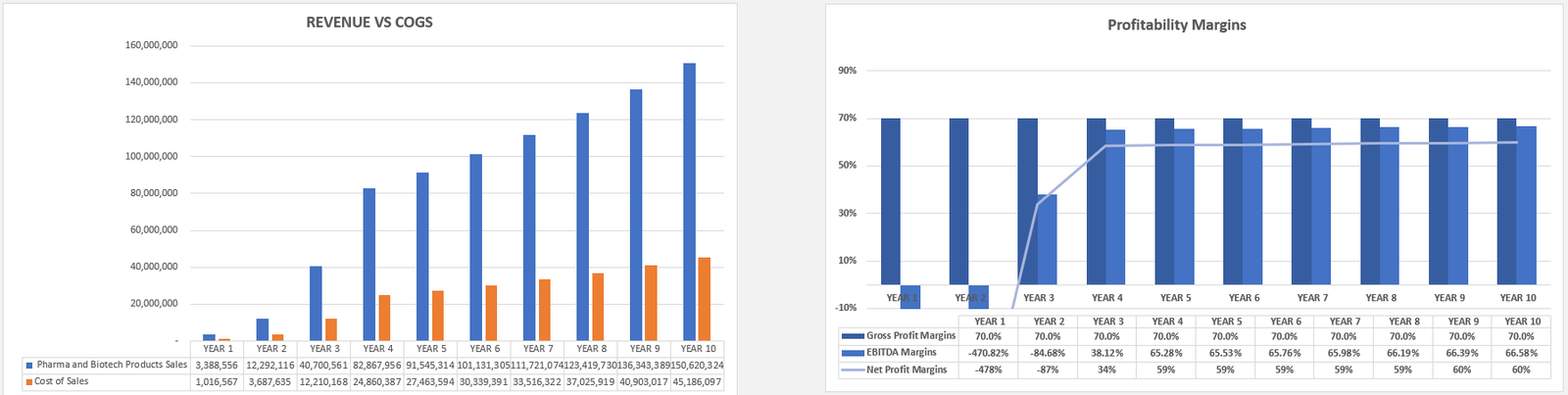

We have also built a ready-to-go Pharma and Biotech Valuation and Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their company’s financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their company.

Why R&D Spend Often Fails to Deliver Expected Value

Most organizations don’t underinvest in R&D—they misallocate it.

Common symptoms include:

- Too many projects chasing too few strategic priorities

- Legacy initiatives absorbing budget despite weak prospects

- Late-stage projects consuming resources because “we’ve come this far”

- Early-stage ideas starved of funding because ROI is unclear

These issues aren’t caused by poor science or weak teams. They’re caused by decision frameworks that favor momentum over merit. You can find an in-depth discussion on R&D Cost Reduction strategies.

When R&D decisions are disconnected from long-term value logic, spending grows while impact stagnates.

The Pipeline Is a Portfolio, Not a To-Do List

The first mindset shift is recognizing that an R&D pipeline is not a linear process—it’s a portfolio of risk-adjusted investments.

Each project represents:

- A probability of technical success

- A probability of market success

- A time horizon to value realization

- A capital and capability requirement

Treating all projects equally—or judging them only on near-term milestones—distorts decision-making. Building an R&D Strategy becomes critical here.

Value-focused organizations ask different questions:

- What role does this project play in our future business model?

- How does it diversify or concentrate our risk?

- What is its potential upside relative to its resource demand?

This portfolio lens is the foundation for smarter R&D spend.

Defining Long-Term Value Before Allocating Budget

One of the most common mistakes in R&D governance is trying to measure value after money has already been committed.

Instead, organizations should define what long-term value means before making pipeline decisions.

Long-term value may include:

- Revenue growth in new markets

- Margin expansion through differentiation

- Platform capabilities that enable future products

- Strategic optionality against market disruption

- Intellectual property that strengthens competitive barriers

Not every project needs to score highly on every dimension—but every project should clearly contribute to at least one. See how effective R&D strategy helps to clarify these targets.

If a project can’t articulate its long-term value logic, it doesn’t deserve long-term funding.

Moving Beyond ROI: Using Value Narratives

Traditional financial metrics struggle in R&D environments, especially early in the pipeline. Net present value (NPV) and internal rate of return (IRR) are useful—but insufficient on their own.

High-performing R&D organizations complement financial metrics with value narratives.

A strong value narrative explains:

- The future problem the project solves

- Who will pay for the solution, and why

- How the solution fits the company’s strategic direction

- What capabilities or assets it builds along the way

These narratives don’t replace numbers—they contextualize them. An article on strategic decision-making provides a great example.

When leadership understands how value will be created over time, funding decisions become clearer and more consistent.

Stage Gates Should De-Risk Value, Not Just Technology

Many R&D pipelines rely on stage-gate processes. In theory, these gates ensure discipline. In practice, they often focus too narrowly on technical milestones.

This leads to a dangerous pattern:

- Projects pass gates because they work technically

- Market assumptions remain untested

- Value questions are deferred until it’s too late

To make R&D spend work harder, each gate should explicitly reduce value uncertainty, not just technical uncertainty.

For example:

- Early stages should test problem relevance and customer willingness to pay

- Mid stages should validate differentiation and scalability

- Late stages should confirm economic viability and strategic fit

Projects that de-risk value early free up resources faster—and prevent costly late-stage failures. Learn more about the impact of R&D investment on economic growth.

Killing Projects Is a Value-Creation Skill

Organizations often talk about innovation culture—but quietly punish teams when projects are stopped.

As a result:

- Weak projects linger

- Resources are spread too thin

- Stronger ideas move more slowly

In reality, stopping the right projects early is one of the highest-return R&D activities.

Leading organizations:

- Celebrate evidence-based termination decisions

- Reassign talent quickly

- Capture learnings systematically

- Reinvest savings into higher-potential initiatives

When teams trust that stopping work won’t damage their careers, pipeline quality improves dramatically.

Aligning R&D Spend with Strategic Time Horizons

Not all R&D is meant to pay off at the same speed.

A balanced pipeline includes:

- Core improvements (short-term, low risk)

- Adjacent innovations (mid-term, moderate risk)

- Transformational bets (long-term, high risk)

Problems arise when spending drifts too heavily toward one horizon—usually the short term.

Linking spend to time horizons forces intentional trade-offs. A strategic examination of R&D issues provides deeper insights into aligning these investments.

Resource Allocation: People Matter More Than Budget Lines

Budgets alone don’t determine R&D effectiveness—talent allocation does.

High-potential projects fail when:

- Senior expertise is spread thin

- Key skills are locked into legacy programs

- Teams are reshuffled too frequently

Organizations that extract more value from R&D:

- Assign top talent to the most strategically important initiatives

- Maintain stable teams through critical phases

- Match capability depth to project ambition

In this sense, pipeline decisions are really people decisions disguised as budget choices.

Linking R&D Metrics to Value Creation

What gets measured shapes behavior. If R&D metrics focus only on:

- Spend vs budget

- Milestone completion

- Number of projects

Then teams will optimize for activity, not impact.

Value-oriented metrics may include:

- Percentage of spend aligned to priority growth areas

- Portfolio risk balance across time horizons

- Learning velocity (how quickly key assumptions are tested)

- Value at risk and value upside across the pipeline

These metrics don’t require perfect forecasting—they require disciplined thinking.

Governance That Enables, Not Constrains

Heavy governance slows innovation. Weak governance wastes money. The goal is smart governance.

Effective R&D governance:

- Sets clear strategic boundaries

- Defines decision rights at each stage

- Separates scientific review from investment decisions

- Uses data to inform—not replace—judgment

Most importantly, governance should focus leadership attention on the few decisions that matter most, rather than micromanaging everything. You can explore R&D performance management for relevant strategies.

Turning Insight into Action

Making R&D spend work harder doesn’t require radical restructuring. It requires consistency and courage.

Start by asking:

- Which projects would we fund again today, knowing what we know now?

- Where are we confusing progress with value?

- Which assumptions are we avoiding testing?

- Where is long-term value being crowded out by short-term comfort?

Answering these questions honestly is often more powerful than any new framework.

Final Thoughts: R&D Is a Bet on the Future—Make It a Smart One

R&D will always involve uncertainty. That’s not the problem. The problem is unexamined uncertainty.

When pipeline decisions are explicitly linked to long-term value:

- Spending becomes more disciplined

- Innovation becomes more focused

- Teams gain clarity and confidence

- Leadership earns credibility with stakeholders

Making R&D spend work harder isn’t about spending less. It’s about spending with intent—on the ideas, capabilities, and futures that truly matter.

The organizations that win tomorrow are not the ones with the biggest R&D budgets, but the ones that make the clearest, most courageous pipeline decisions today.

Frequently Asked Questions

What is an R&D pipeline?

An R&D pipeline is a portfolio of risk-adjusted investments that include a series of research and development projects aimed at creating new products or services that align with long-term value.

How can R&D spend drive economic growth?

Effective R&D spend supports economic growth by driving innovation, creating high-value intellectual property, and developing new market opportunities that expand the business.

How should R&D projects be prioritized?

Projects should be prioritized based on their strategic alignment, potential for long-term value creation, risk diversification, and capability requirements.