Financial modeling is an essential aspect of strategic planning and decision-making for businesses and financial analysts. This guide delves into the types of financial models, their purposes, and how they are used to forecast financial performance and facilitate informed financial decision-making. We offer a range of different financial model templates by industry in our shop .

What are Financial Models?

Financial models are abstract representations of a real-world financial situation, typically constructed in Microsoft Excel. They serve to simulate the financial performance of a business, project, or asset, allowing analysts to predict future financial outcomes based on historical financial performance.

Importance of Financial Models

Financial models are critical tools used for financial forecasting, economic performance forecasting, and financial decision analysis. They allow businesses to evaluate the potential impacts of strategic decisions and economic scenarios on their financial health. For more information, see the resources provided by the Corporate Finance Institute.

Common Types of Financial Models

Three-Statement Model

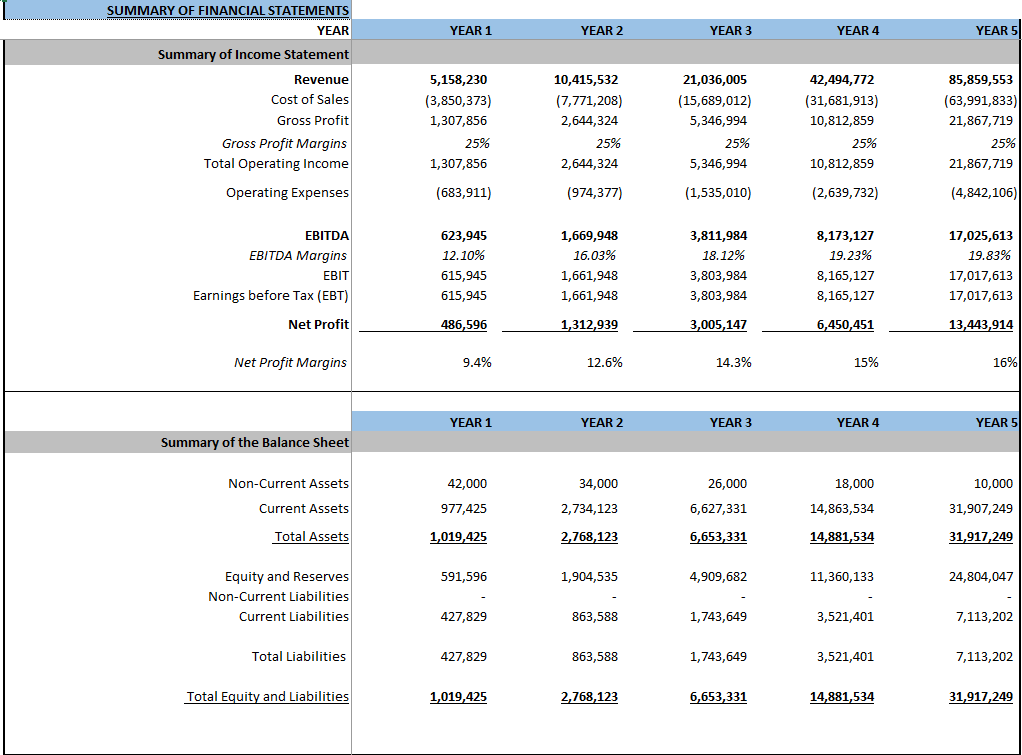

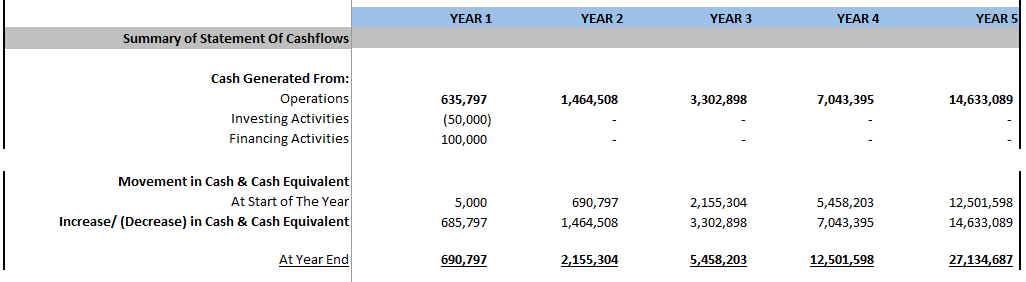

The Three-Statement Model is foundational as it integrates the income statement, balance sheet, and cash flow statement into one dynamically linked model. It is used to forecast a company’s financial performance based on various assumptions. Learn more about financial modeling with this guidance from the Australian Government Department of Finance.

Discounted Cash Flow (DCF) Model

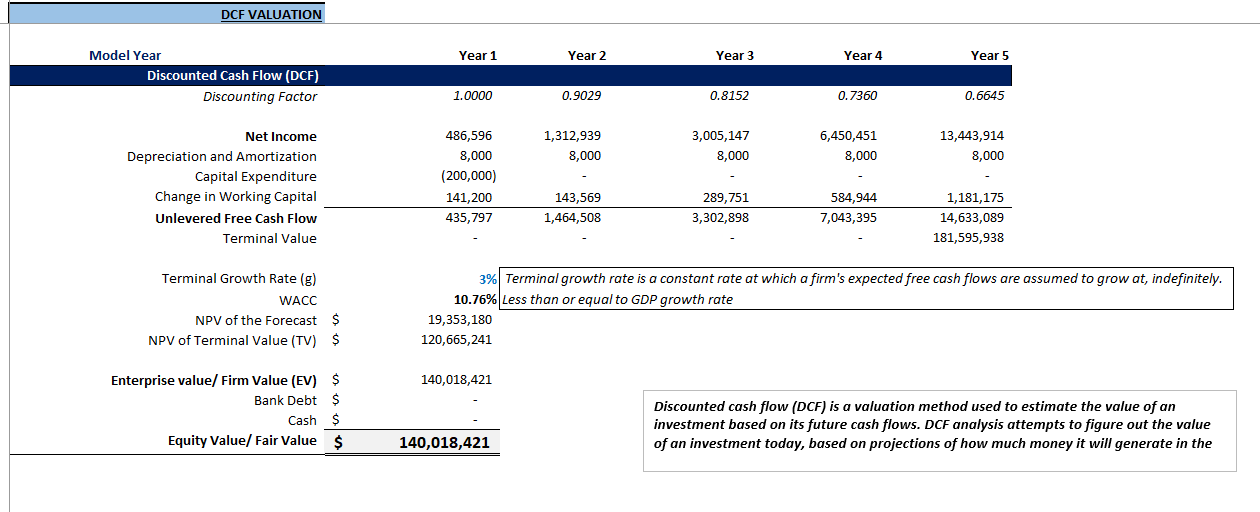

The DCF Model values a company by projecting its future cash flows and discounting them back to their present value using a discount rate. It’s widely used for valuing companies and investment opportunities. Investopedia offers an insightful explanation of financial modeling and its uses.

Merger Model

Used primarily in mergers and acquisitions, the Merger Model analyzes the financial profile of a combined company post-acquisition. It involves evaluating synergies, accretion/dilution, and other factors that influence the new entity’s financial health. For a detailed guide, check Wall Street Prep’s tutorial on financial modeling.

Initial Public Offering (IPO) Model

An IPO Model helps assess the potential value of a company before it goes public. It combines various data points, including market comparisons and investor sentiment, to gauge expected public valuation. More insights can be found in Oracle’s explanation of financial modeling.

Essential Skills for Financial Modeling

To effectively utilize financial models, one must possess robust Excel skills, an understanding of accounting principles, and the ability to interpret financial statements. These skills enable analysts to manipulate models and extract actionable insights.

Frequently Asked Questions

What is the purpose of financial modeling?

Financial modeling is used to forecast a company’s future financial performance, evaluate financial scenarios, and guide strategic business decisions. It assesses a company’s viability and predicts its likely financial outlook.

How does a Three-Statement Model work?

A Three-Statement Model integrates a company’s financial documents to project its future financial state. It links the income statement, balance sheet, and cash flow statement, providing a comprehensive view of financial performance.

Why is the DCF Model important?

The DCF Model is crucial for investment analysis as it determines the present value of expected future cash flows, aiding in making informed investment decisions and assessing the intrinsic value of companies.

Final Thoughts!

Financial modeling is an indispensable tool in the finance sector, allowing for comprehensive analysis and forecasting of financial performance. Understanding the nuances of various models can significantly enhance decision-making and strategic planning processes. For further exploration, visit Wikipedia’s section on financial modeling.