In the realms of private equity and venture capital, measuring investment performance accurately is critical. Among the many financial metrics, Multiple on Invested Capital (MOIC) stands out as a straightforward and transparent indicator of how much value an investment has generated compared to its initial capital. We have also built a Private Equity Cash Flow Model Template which is being used by PE funds to model out their investment cash flows through to GPs and LPs via an American Waterfall and European Waterfall distribution structure.

What is MOIC?

MOIC, or Multiple on Invested Capital, is a financial metric that quantifies the total value of an investment relative to the capital invested. It essentially answers the question: “How many dollars did we make for every dollar we invested?” This metric is invaluable for assessing investment performance across various financial endeavors.

MOIC Calculation

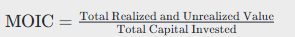

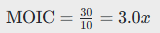

The formula for calculating MOIC is simple:

For example, if a venture fund invested $10 million and the exit proceeds or current value amounts to $30 million, the MOIC would be:

This means that the investment has tripled in value.

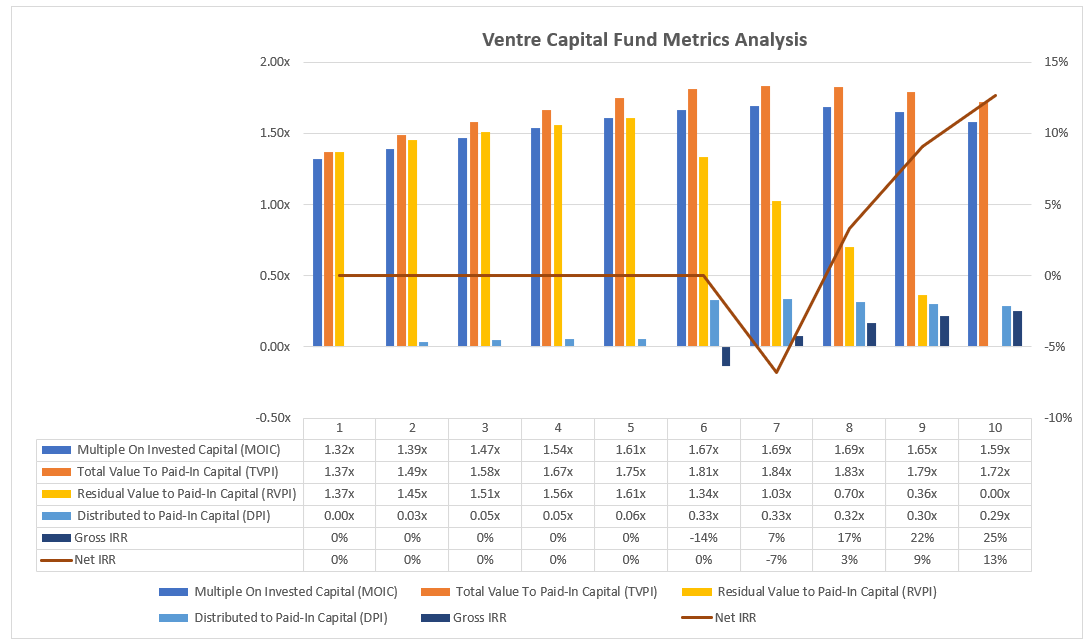

MOIC vs. IRR

While MOIC measures how much was earned, the Internal Rate of Return (IRR) indicates how rapidly the returns were realized. Both metrics provide important insights but differ in scope. You can learn more about these distinctions here.

Key Differences

| Metric | MOIC | IRR |

|---|---|---|

| Type | Multiple | Annualized rate (%) |

| Time-Sensitive? | No | Yes |

| Use Case | Absolute value creation | Speed of value creation |

| Sensitivity | Non-penalizing for long durations | Penalizes longer durations |

| Simplicity | Straightforward | More complex |

MOIC provides an absolute value indication, while IRR gives a time-adjusted performance measure.

Gross vs. Net MOIC

Like IRR, MOIC can be displayed either gross or net of fees, carried interest, and expenses:

- Gross MOIC: Reflects total generated value before deductions.

- Net MOIC: Reflects the actual value received by investors after expenses.

For example, a fund achieving a 3.0x gross MOIC might result in a 2.4x net MOIC after expenses.

Why MOIC Matters

Clear Value Indicator

MOIC indicates the return value vs. original investment, making it easy to comprehend and benchmark across varied portfolios.

Useful for Early/Mid-Stage Investments

Due to potential misleading IRR effects like the J-curve, MOIC provides a clearer snapshot of early value creation.

Fund Performance and Construction

MOIC helps offset underperformance among individual investments, where managers target MOICs of 3x+ to balance their funds.

Understanding MOIC and Cash Flow Distribution

To truly leverage MOIC, understanding its role in the cash flow distribution waterfall is paramount. Here’s a brief look into the stages:

The Cash Flow Waterfall

- Return of Capital: Investors initially receive the capital invested.

- Preferred Return: Promised minimum annual return (e.g., 8%) before profit sharing.

- Catch-Up: Post-preferred returns, GPs receive a portion of profits to align with interest shares.

- Carried Interest: Remaining profits split between LPs and GPs, commonly at 80/20.

Each phase impacts MOIC realization. For more detailed information on equity internals, follow this link.

Interpreting MOIC

Each asset class comes with its own target range:

- Venture Capital: 3.0x – 10.0x+

- Private Equity: 2.0x – 3.5x

- Growth Equity: 2.5x – 4.0x

MOIC also has its limitations. It’s non-time-sensitive and may not capture interim volatility, making it prudent to pair it with other metrics like IRR. Learn about asset class expectations here.

Limitations and Best Practices

Limitations

⚠️ MOIC doesn’t account for time duration—making a fast return equally valuable as a slow one under this metric.

⚠️ It ignores interim investment volatility and unrealized vs. realized gains.

Best Practices

✅ Use MOIC alongside IRR for comprehensive evaluation.

✅ Break down metrics by deal and track both gross and net figures. In the context of evaluations, consider this advice.

Frequently Asked Questions

What is MOIC?

MOIC, or Multiple on Invested Capital, represents the total value of an investment relative to initial capital. It reflects both realized and unrealized gains.

Why is MOIC important?

MOIC provides a clear picture of absolute returns without accounting for the time factor, which is crucial for assessments in private equity and venture capital.

How does MOIC differ from IRR?

While MOIC shows how much has been earned, IRR reflects the speed of earning. Thus, they fulfill different evaluation roles in investment performance.

Final Thoughts!

MOIC is a potent, clear metric for understanding the wealth generated by investments, especially within private equity and venture capital. It complements other metrics, offering crucial insights into distribution models and performance evaluations.