Private equity funds serve as investment vehicles that aggregate capital from various investors to invest in privately held companies. These funds are designed to yield substantial returns through strategic acquisitions and eventual exits of portfolio companies. A crucial element within these funds that governs the relationship between limited partners (LPs) and general partners (GPs) is the preferred return.

The preferred return, also known as the hurdle rate, sets a minimum threshold of return for investors. It’s a key part of the distribution structure that must be met before GPs can earn their share of profits, referred to as carried interest. This article delves into the preferred return’s function, structure, impact on cash flows, and significance for LPs and GPs.

What is a Preferred Return?

The preferred return designates the minimum return a private equity fund must generate for its LPs before the GP can receive a share of profits. Expressed as an annual rate, it ensures LPs are compensated for their capital commitment prior to the GP receiving carried interest. For instance, if a fund has an 8% preferred return, this means LPs receive an 8% return on their capital before the GP can participate in profit sharing.

To learn more about preferred returns, you can explore Preferred Returns in Private Equity and Real Estate on Yieldstreet.

How Preferred Return Works

Here’s an in-depth look at the preferred return mechanics via a typical private equity fund structure:

Investor Contributions and Fund Structure

Private equity funds are commonly structured as limited partnerships, where the GP manages the fund, while the LPs invest capital. The preferential treatment to the LPs through the preferred return mechanism ensures they receive priority in profit sharing. For further details, refer to Learn the Lingo of Private Equity Investing on Investopedia.

Capital Contributions

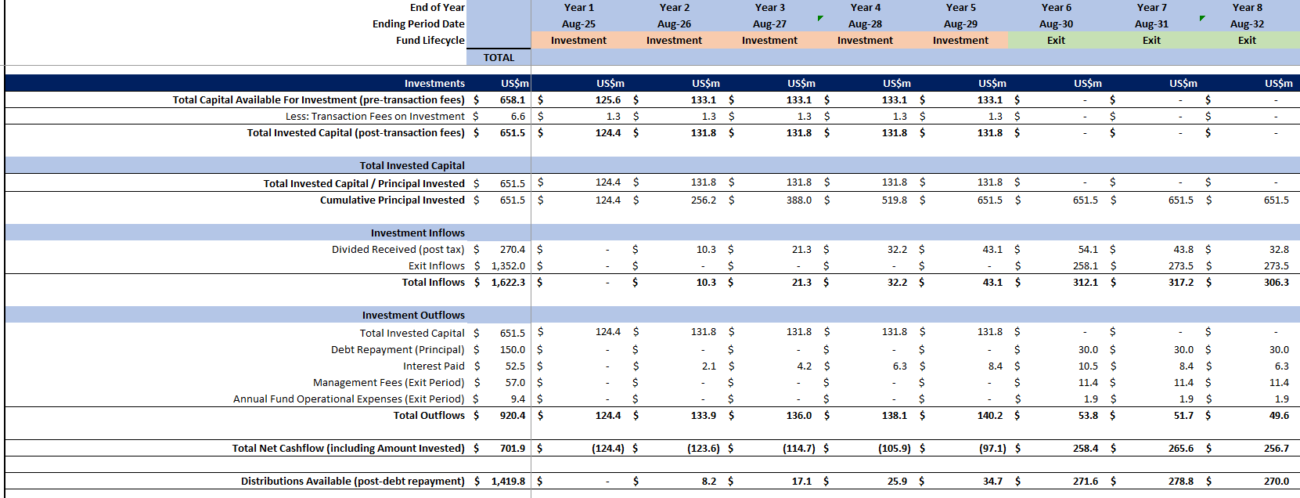

Funds request capital from LPs through capital calls to make or manage investments. As exits occur and profits are realized, distributions are made, starting with returning the original capital to investors. The preferred return follows this procedure before any carried interest is allocated to the GP.

The Distribution Waterfall

Distributions follow a structured sequence:

- Return of Capital: Return of the original investment to LPs.

- Preferred Return: LPs receive their agreed return (e.g., 8%).

- Catch-Up Period (if applicable): GP receives a larger share to catch up with the carried interest structure.

- Carried Interest: Profits are split, typically with 20% to the GP and 80% to the LPs.

To dive deeper, the Hurdle Rate (Preferred Return) in Private Equity page on Moonfare explains these concepts further.

Impact on Cash Flows

Prioritization of LP Distributions

The primary function of the preferred return is to prioritize LP cash flows, aligning distributions with fund performance. For example, strong early performance permits rapid LP returns, while weaker or slower exits can delay GP profit sharing. Refer to Private Equity Cash Flow Distribution Examples by CalPERS for distribution models.

Timing of Distributions

Preferred returns impact the timing of LP distributions since profits must cover the preferred return before GPs receive carried interest. The multi-step distribution process ensures funds are effectively allocated to meet LP expectations before profit-sharing.

Liquidity Management

To meet preferred return obligations, funds must maintain robust liquidity management. Synchronizing capital calls, investments, and liquidity sources like debt financing is essential. Such practices aid in balancing cash flow needs without impacting future investment strategies.

Fund Performance and Profitability

Preferred returns align GP and LP incentives by tying GP compensation to fund performance. Success results in quicker preferred return thresholds, benefiting both LPs and GPs. Conversely, underperformance delays returns and strains the GP-LP relationship.

For guidelines on fund setup and management, view STARTING A PRIVATE EQUITY FUND on Capital Fund Law Group.

The Role of Preferred Return in Aligning GP and LP Interests

Implementing a preferred return structure fosters trust by ensuring LPs receive priority compensation, thus aligning GP performance incentives with investor interests. This risk-mitigating approach encourages optimal fund management and enhances overall success.

Frequently Asked Questions

What is a preferred return in private equity?

A preferred return, or hurdle rate, sets a minimum return percentage that funds must achieve for investors before the general partner receives carried interest. It’s a safeguard for LPs ensuring priority in profit sharing.

How does the preferred return impact cash flow distribution?

Preferred returns determine the order of cash distributions, ensuring LPs receive their return first. This impacts cash flow timing, aligning it with investment profitability.

Why is the preferred return significant in private equity?

It aligns GP efforts with LP interests, connecting GP compensation to fund performance. This encourages strategic fund management and prioritizes investor returns.

In conclusion, mastering the preferred return concept within private equity is fundamental to managing investor expectations and optimizing fund performance. By ensuring LPs receive prioritized returns before the GP earns carried interest, funds create an aligned, mutually beneficial structure that maximizes investment potential.