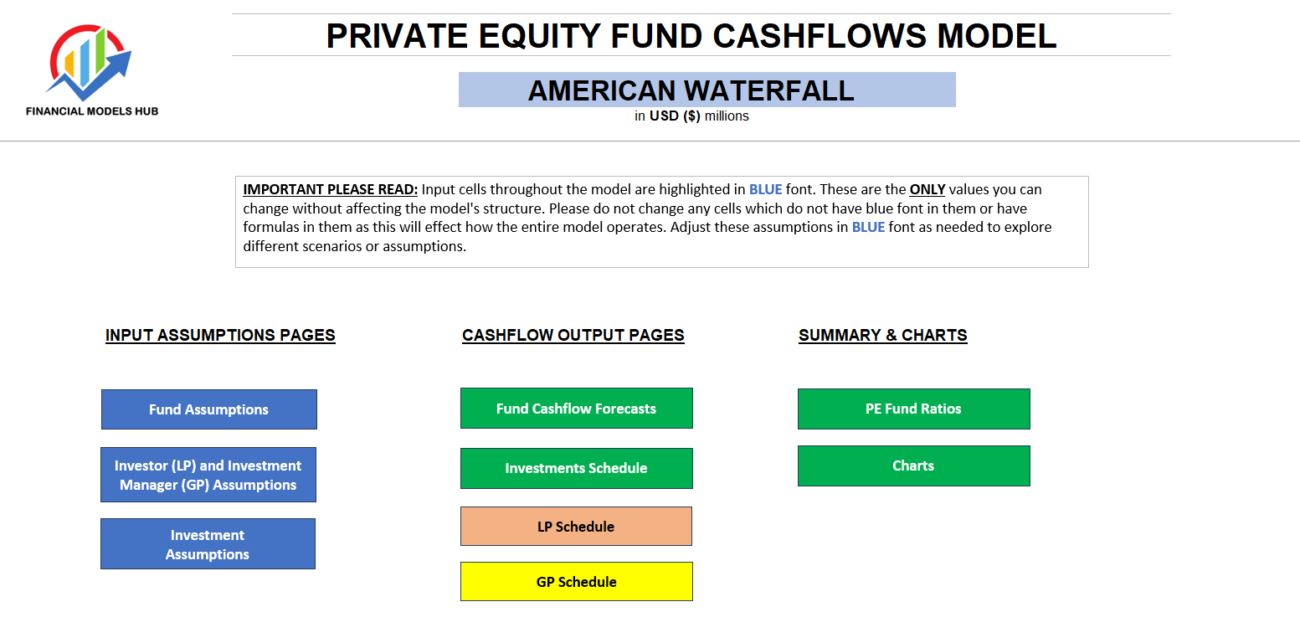

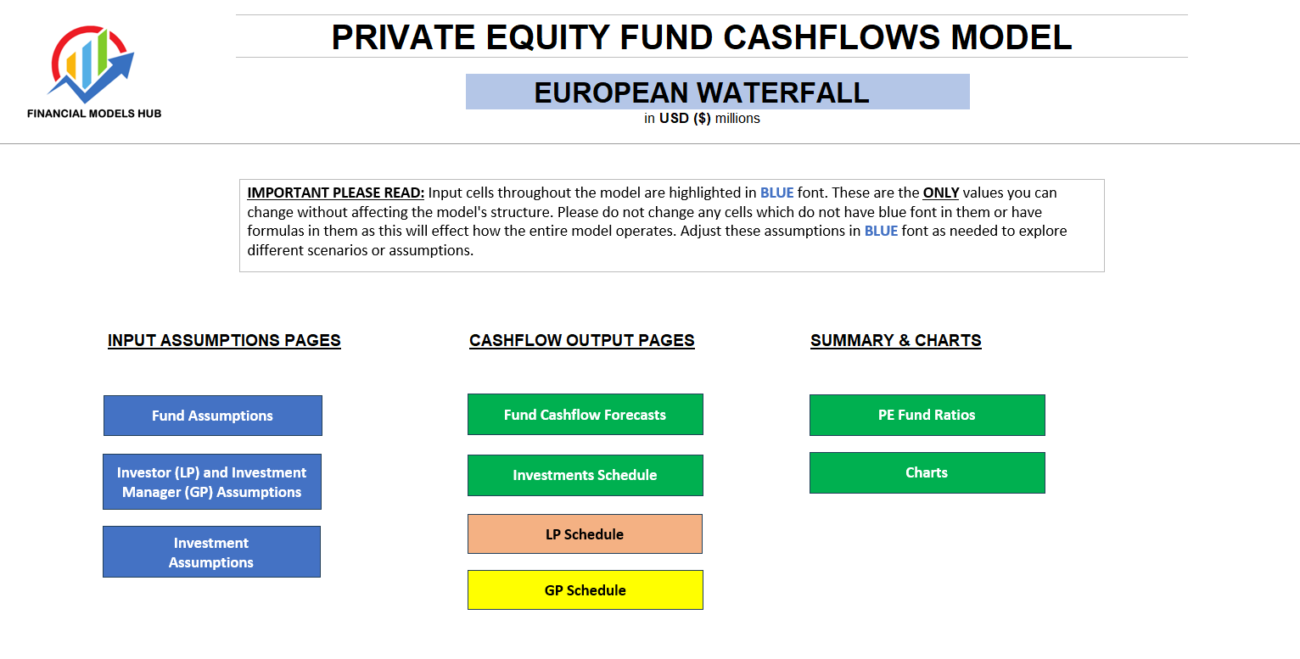

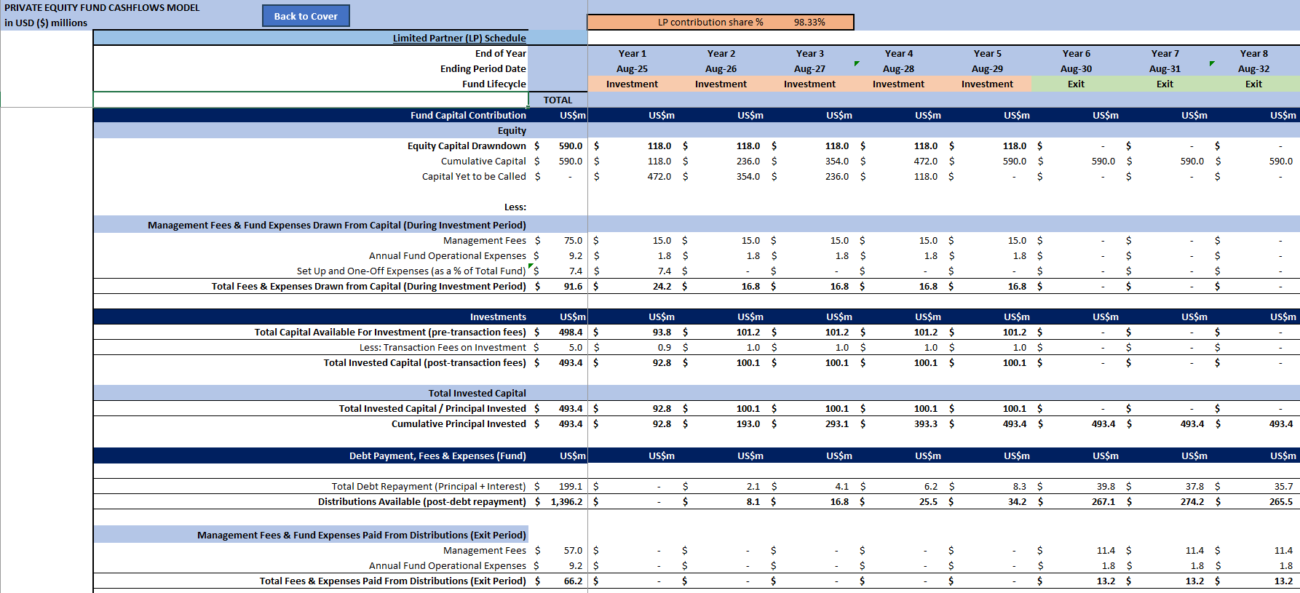

In the realm of private equity and venture capital, comprehending the intricacies of equity waterfall models is crucial. Both the American and European waterfall models influence how and when general partners (GPs) receive carried interest, a core element in these investment domains. This article delves into these models to understand their structure, advantages, and implications. We have a ready-to-go Private Equity Fund Cashflows Model (Investor Cashflows) – American Waterfall Distribution Template and a European Waterfall Distribution Template for those looking for an easy-to-understand PE Fund Model Template to use for their PE Funds or to understand the flow of investment cash flows to a GP and LP.

What is Carried Interest?

Carried interest is a share of the profits that general partners earn from the fund’s returns, usually around 20%. It serves as a key incentive for GPs, aligning their interests with those of the limited partners (LPs) who fund the investments. The structure governing the distribution of carried interest is known as the waterfall model.

For a detailed exploration, the American vs. European Equity Waterfall Structures from FNRP provides an excellent starting point.

Understanding Waterfall Models

The waterfall model outlines how investment returns are distributed between LPs and GPs. It sets the precedence for financial distributions, ensuring LPs receive a preferred return before GPs claim their carried interest. Two prevalent models are:

- American Waterfall Model: Pays carried interest deal-by-deal.

- European Waterfall Model: Waits until full fund performance before distributing carried interest.

More on the difference can be found on BullpenRE’s insights.

American Waterfall Model

The American model, or deal-by-deal model, allows GPs to receive carried interest with each individual investment exit.

Key Features:

- Deal-by-Deal Distribution: Each exited deal enables GPs to claim their share.

- Preferential LP Treatment: LPs receive their preferred return first, usually about 8% annually.

The article on American vs. European waterfall in private equity highlights this approach’s effects.

Advantages and Disadvantages:

Advantages include faster payout and motivation for GPs to perform well early. However, it also poses a disadvantage of potential unequal distributions, as GPs may get substantial payouts from early exits even if the overall fund underperforms.

European Waterfall Model

Conversely, the European model waits to distribute carried interest until the fund’s full performance is validated, after offsetting LPs’ investment and preferred returns.

Key Features:

- Whole-of-Fund Approach: Carried interest follows complete fund performance.

- LP Priority: Ensures LPs enjoy full returns and preferred gains first.

For more on these distinctive features, refer to Understanding European vs. American Distribution Waterfalls.

Advantages and Disadvantages:

This model aligns interests more evenly across the fund’s life, promoting portfolio growth and diversification. However, the challenge remains in the delayed payouts for GPs, potentially causing dissatisfaction.

Comparing the Models

Here’s a quick comparison:

| Aspect | American Waterfall Model | European Waterfall Model |

|---|---|---|

| Carried Interest Payment | Paid deal-by-deal once LPs receive preferred return | Paid after the full fund is realized and LPs recoup full capital and return |

| Incentive for GPs | Encourages early deal exits | Fosters long-term fund success |

For a comprehensive understanding, see Distribution Waterfall Definition explained by Investopedia.

Impact on Carried Interest

The American model offers early realization of carried interest from individual deals, creating quicker, potentially larger payouts. The European model ensures payout is tightly linked to fund-wide performance, decreasing the potential for uneven distributions.

Final Thoughts!

Choosing between these models impacts carried interest distribution and strategy alignment. The American model suits those favoring rapid rewards, while the European model benefits those seeking alignment with long-term fund success. Ultimately, understanding these nuances is vital for optimizing investment strategies.

Explore further distinctions among equity waterfall structures in the private market.

Frequently Asked Questions

What is the main difference between American and European waterfall models?

American models distribute carried interest deal-by-deal, while European models wait for total fund realization before distribution.

How does the waterfall model affect LP returns?

LPs receive preferred returns before GPs can claim carried interest, ensuring they get compensated first under both models.

Why might GPs prefer the American model?

The American model allows for quicker payouts from individual successful deals, which could incentivize faster performance.