Pharma and biotech companies are operating in a paradox. On one hand, scientific innovation has never been stronger—cell and gene therapies, precision medicine, and biologics are transforming patient outcomes. On the other, margins are under pressure from every direction: rising R&D costs, complex manufacturing, pricing scrutiny, supply chain volatility, and increasingly demanding regulators.

In this environment, protecting margins is no longer about cutting costs in isolation. It’s about using data and AI to run fundamentally smarter operations—reducing waste, improving predictability, and making better decisions earlier.

This article explores how pharma and biotech companies can use AI and data not as experimental tools, but as practical margin protectors across R&D, manufacturing, supply chain, and commercial operations.

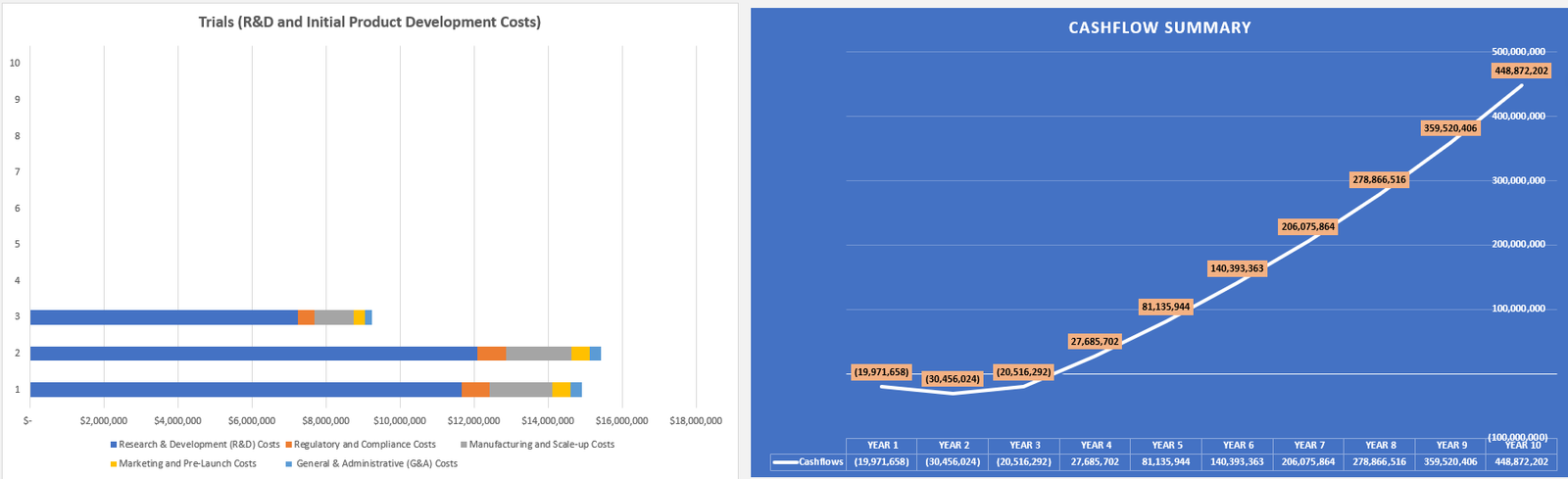

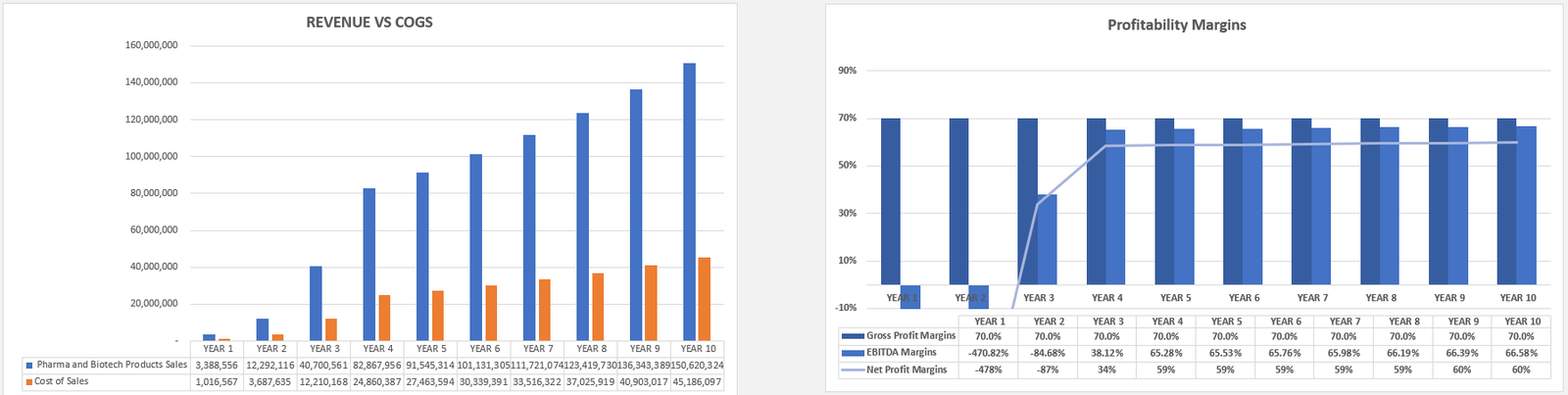

We have also built a ready-to-go Pharma and Biotech Valuation and Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their company’s financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their company.

Why Margin Pressure Is Structural, Not Cyclical

Before looking at solutions, it’s important to understand why margin pressure isn’t going away.

Key structural challenges include:

- Higher development costs driven by complex modalities

- Smaller, more targeted patient populations

- Increased regulatory and quality requirements

- Manufacturing processes that are less standardized than small molecules

- Greater payer scrutiny on pricing and value

These forces make traditional efficiency levers—headcount reduction, budget freezes, supplier renegotiation—insufficient and sometimes counterproductive.

Sustainable margin protection now depends on operational intelligence, not just operational discipline.

From Efficiency to Effectiveness: The Role of AI and Data

AI does not replace human expertise in pharma and biotech. It amplifies it by:

- Identifying patterns humans can’t see at scale

- Predicting problems before they become costly

- Optimizing complex systems with many variables

- Reducing variability in decision-making

The most successful companies don’t deploy AI everywhere. They focus on high-cost, high-variability processes where small improvements create outsized financial impact.

R&D Operations: Reducing the Cost of Uncertainty

R&D remains the largest and riskiest investment area for most biotech and pharma companies. While AI is often discussed in discovery, its biggest margin impact is increasingly in R&D operations.

Smarter Portfolio and Pipeline Decisions

AI-driven analytics can:

- Model probability of technical and regulatory success

- Simulate portfolio trade-offs across time horizons

- Identify projects consuming disproportionate resources relative to expected value

By improving capital allocation discipline, companies avoid overfunding weak assets and underfunding promising ones—one of the biggest hidden margin drains in R&D. For a deeper dive, related concepts can be explored in this ScienceDirect article.

Optimizing Clinical Trial Operations

Clinical trials are a major cost driver, and delays are especially expensive.

AI and advanced data analytics can:

- Improve site selection using historical performance data

- Predict patient recruitment bottlenecks

- Identify protocol complexity that increases dropout risk

- Monitor trial execution in near real-time

Even modest reductions in trial duration or rework can translate into tens or hundreds of millions in preserved value. More insights on how AI can transform clinical trials are discussed here.

Manufacturing: Turning Variability into Predictability

Manufacturing margins in pharma and biotech are often destroyed by variability—batch failures, yield losses, deviations, and unplanned downtime.

Predictive Process Control

AI models trained on historical batch data can:

- Predict deviations before they occur

- Identify subtle process drift

- Optimize critical process parameters in real time

This reduces:

- Batch failures

- Rework and scrap

- Investigation and remediation costs

In biologics and advanced therapies, where a single failed batch can mean millions lost, the margin impact is immediate. Starmind discusses AI’s role in reducing such costs.

Predictive Maintenance for Critical Assets

Traditional maintenance schedules are either too conservative or too risky.

AI-enabled predictive maintenance:

- Anticipates equipment failures based on sensor and performance data

- Reduces unplanned downtime

- Extends asset life

This improves asset utilization while lowering maintenance and quality risk—an important margin lever in capital-intensive facilities.

Quality and Compliance: Reducing the Cost of Being Safe

Quality is non-negotiable in pharma and biotech—but the cost of quality can vary dramatically.

AI in Quality Monitoring

AI can help:

- Detect anomalies in quality data earlier

- Prioritize investigations based on risk

- Identify systemic root causes across sites or products

This reduces lengthy investigations and repeat deviations, as explained by McKinsey & Company.

Document and Data Management Efficiency

Natural language processing (NLP) tools can:

- Automate document review and classification

- Flag inconsistencies in submissions

- Speed up change control and validation processes

Given the volume of documentation required, even incremental efficiency gains protect margins over time.

Supply Chain: Protecting Margins Through Resilience

Supply chain disruptions are expensive—not just operationally, but financially.

Demand Forecasting and Inventory Optimization

AI improves forecasting by:

- Integrating commercial, clinical, and market data

- Accounting for uncertainty and scenario variability

- Continuously learning from actual demand

Izertis elaborates on how AI facilitates better forecasts, leading to lower excess inventory and reduced write-offs.

Supplier Risk and Cost Management

AI-enabled analytics can:

- Identify supplier performance patterns

- Predict risk of delays or quality issues

- Support smarter sourcing and dual-supply decisions

This reduces costly last-minute interventions and strengthens negotiating leverage.

Commercial Operations: Precision Instead of Volume

Margin protection doesn’t stop at the factory gate.

Smarter Sales and Marketing Spend

AI can optimize:

- Targeting of high-value physicians or centers

- Resource allocation across territories

- Channel mix effectiveness

This shifts spend from broad coverage to precision engagement, improving return on investment rather than simply reducing budgets.

Pricing and Contract Analytics

Advanced analytics can:

- Model net price erosion across markets

- Simulate contract scenarios

- Identify leakage in rebates and discounts

In an era of pricing pressure, protecting net realized price is often more important than increasing list price. IntuitionLabs analyzes the skills gap necessary to implement these strategies effectively.

Cross-Functional Efficiency: Breaking Silos with Data

One of the biggest margin drains in pharma and biotech is organizational fragmentation.

AI and integrated data platforms enable:

- Shared visibility across R&D, manufacturing, quality, and commercial teams

- Faster, better-aligned decisions

- Reduced rework caused by miscommunication

When everyone works from the same data foundation, inefficiency drops—even without changing headcount.

Common Pitfalls That Undermine ROI

Despite the promise of AI, many initiatives fail to deliver margin impact.

Common mistakes include:

- Starting with technology instead of a business problem

- Piloting endlessly without scaling

- Treating AI as an IT project instead of an operational transformation

- Underinvesting in data quality and governance

- Ignoring change management and user adoption

Margin protection requires operational ownership, not just technical capability.

How to Prioritize AI Use Cases for Margin Impact

Not all AI projects are equal. High-impact use cases typically share three traits:

- They address high-cost or high-risk processes

- They reduce variability or uncertainty

- They integrate directly into decision-making workflows

Leadership teams should ask:

- Where do we lose the most money when things go wrong?

- Which decisions are repeated often and made with incomplete data?

- Where does variability create outsized financial risk?

These questions point directly to margin-protecting opportunities.

Measuring Success: Beyond Cost Savings

Traditional ROI metrics often undervalue AI’s impact.

In addition to direct cost savings, measure:

- Reduction in variability and volatility

- Faster cycle times

- Lower risk exposure

- Improved capital allocation decisions

Margin protection is as much about avoiding losses as it is about cutting expenses.

Final Thoughts: AI as a Margin Discipline, Not a Silver Bullet

AI will not solve every operational challenge in pharma and biotech. But when applied thoughtfully, it becomes a powerful tool for protecting margins in an increasingly complex industry.

The companies that succeed will:

- Focus on operational efficiency, not experimentation for its own sake

- Embed AI into core processes, not side projects

- Treat data as a strategic asset, not an afterthought

In a world of high-cost therapies and intense scrutiny, margin protection is no longer optional. Using AI and data intelligently is not about being more futuristic—it’s about being more resilient, more predictable, and more disciplined.

And in pharma and biotech, discipline is what ultimately funds the next breakthrough.

Frequently Asked Questions

What role does AI play in improving clinical trial efficiency?

AI enhances trial efficiency by predicting patient recruitment issues, optimizing site selection, and monitoring trial execution in real-time. These capabilities reduce costly delays and improve overall trial success rates.

How can AI help in reducing manufacturing costs?

By employing predictive process control and predictive maintenance, AI can minimize batch failures and unscheduled downtimes, significantly cutting manufacturing costs and improving yield.

Why is operational efficiency critical in the pharmaceutical industry?

With enduring structural challenges like high R&D costs and regulatory demands, operational efficiency becomes crucial for maintaining profitability. AI and data optimization enable companies to streamline operations, thus protecting margins effectively.