If you are considering starting an Amazon FBA (Fulfillment by Amazon) business, understanding your financials is vital. A well-structured financial model can help you assess business feasibility, forecast growth, manage cash flow, and secure financing. Creating one can be daunting if you’re new to e-commerce and financial modeling.

In this guide, we will walk through the process of creating a comprehensive Amazon FBA financial model step by step to enhance your business’s financial mechanics and decision-making.

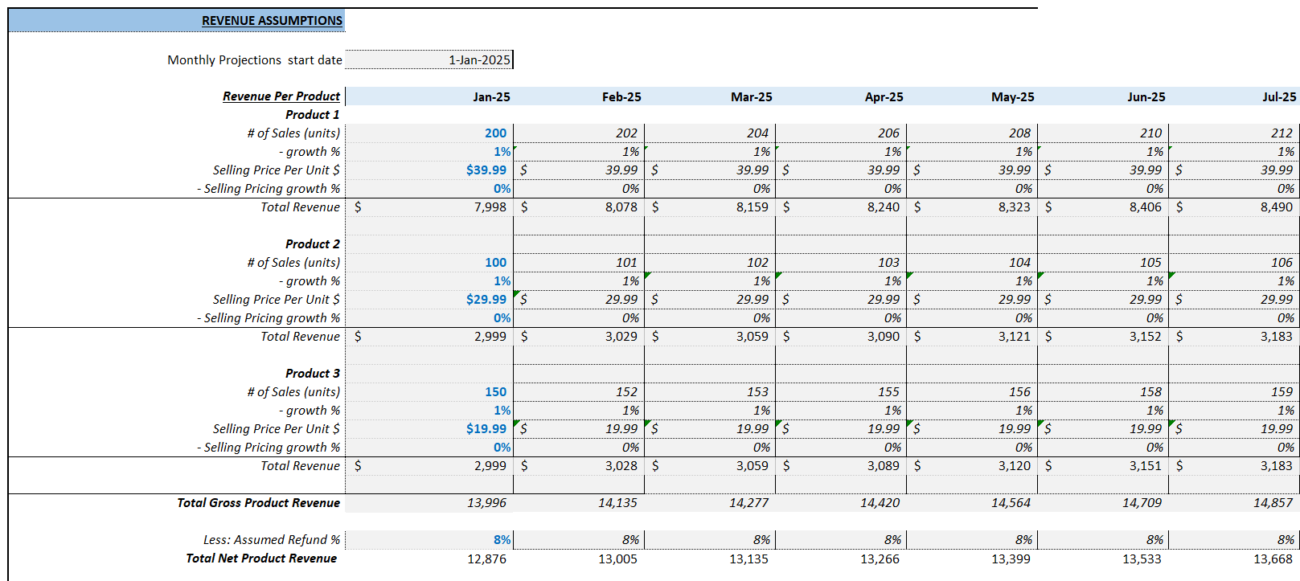

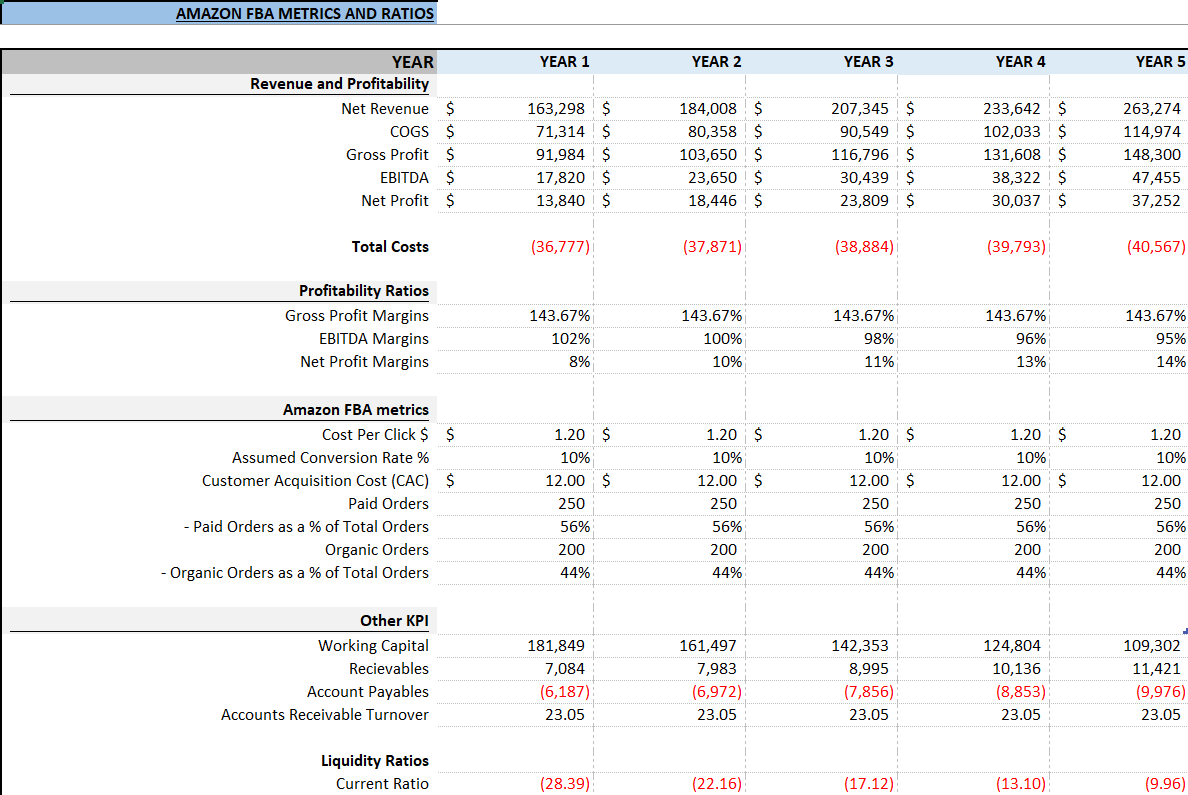

We have also built an Amazon FBA Financial Model template for those looking for a ready-to-go financial model for their business. Just input your businesses assumptions including product details (price, costs etc), and our model will do the rest. Our complete three-way financial model includes an Income Statement, Balance Sheet, and Cash Flow Statement, along with an Inventory Statement to effectively track all your inventory movements too.

Understanding the Amazon FBA Business Model

Before diving into the financial model, it’s essential to understand the Amazon FBA business model. Fulfillment by Amazon (FBA) allows sellers to store their products in Amazon’s fulfillment centers, handling storage, packaging, and shipping to customers. Amazon charges fees for these services, presenting both conveniences and costs for sellers. For more details, visit Finale Inventory’s understanding page.

Setting Key Assumptions

Sales Assumptions

- Sales Volume: Project monthly sales based on demand, marketing efforts, and product competitiveness.

- Price Per Unit: Determine your product’s sale price, accounting for Amazon’s referral fees, typically 6-45% of the sale price.

- Sales Growth Rate: Estimate sales growth over time, considering initial slow growth as you establish your brand.

Cost Assumptions

- Cost of Goods Sold (COGS): Include costs such as product purchase, shipping, and customs fees.

- Amazon FBA Fees: These include storage, fulfillment, and additional Amazon charges.

- Advertising Spend: Plan your budget for Amazon’s PPC platform advertising.

- Miscellaneous Costs: Warehouse fees, returns, and packaging costs may apply.

Financing and Time Horizon

- Startup Capital: Define your initial investment needs for inventory and operational costs.

- Time Horizon: Focus on monthly projections, particularly in the first 12-18 months due to fluctuations.

Building Your Revenue Model

Projecting Sales Volume and Revenue

Start with a realistic sales volume and apply a growth rate. For example, if initial sales are 100 units with a 20% growth, sales will increase each month.

Price Per Unit

Calculate net revenue per unit by subtracting Amazon’s referral fee from the sale price. For instance, a $25 product with a 15% referral fee results in $21.25 net revenue per unit.

Seasonal Trends

Account for sales fluctuations due to market trends or seasonality. For example, fitness products could spike in January.

Cost Model Construction

Calculating COGS and Fees

The COGS includes supplier costs, scaled with sales volume. Calculate Amazon’s fulfillment and storage fees based on product size and weight.

Advertising and Operational Costs

Estimate monthly advertising spend, perhaps 10-15% of monthly revenue, for PPC campaigns. Include other expenses like shipping, returns, and software tools.

Profit and Loss (P&L) Statement

Build a P&L statement summarizing your revenue, costs, and net profits. For instance:

Revenue – COGS = Gross Profit

Gross Profit – Operating Expenses = Net ProfitIf revenues are $2,125, COGS $1,000, and expenses $1,000, your net profit is $125.

Cash Flow Forecast

A cash flow forecast tracks cash inflows and outflows, crucial for managing finances as sales grow. It should include sales revenue and expenses like COGS, advertising, and FBA fees.

Frequently Asked Questions

What are the essential components of an Amazon FBA financial model?

An Amazon FBA financial model includes key assumptions, revenue and cost projections, and a P&L statement.

How do I account for Amazon FBA fees in my financial model?

Include fulfillment and storage fees, calculated based on product specifications. For a detailed guide, visit eFinancialModels.

Why is a cash flow forecast important for Amazon FBA businesses?

A cash flow forecast helps manage finances effectively, ensuring you can cover growing expenses with incoming revenue.

Final Thoughts

Building an effective financial model for your Amazon FBA business is a critical step. By accurately projecting revenues, costs, and profits, you lay a foundation for informed business decisions and sustainable growth. For structured templates, refer to Reason Automation’s Excel resources.

Enhance your Amazon FBA business strategy with a detailed financial model, ensuring long-term success and profitability.