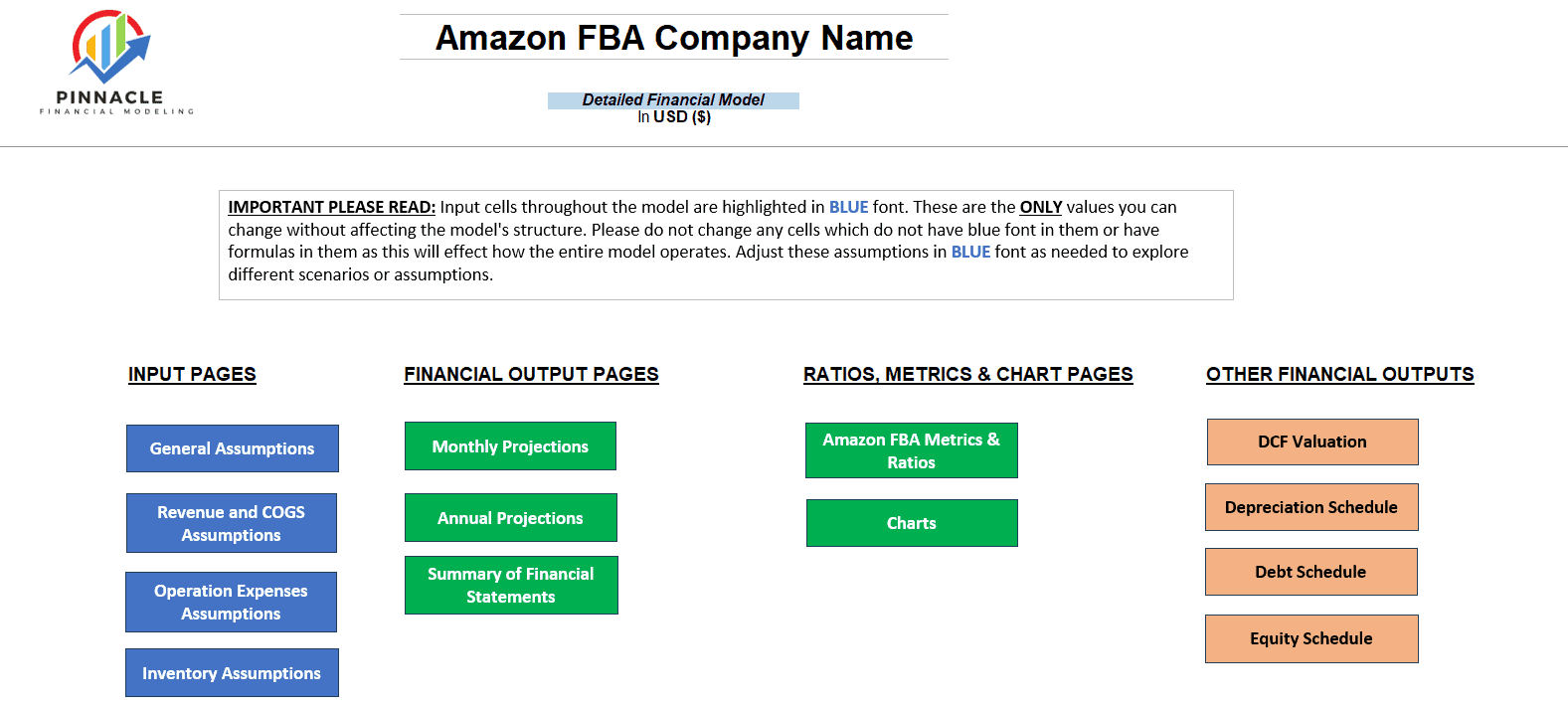

Featuring specific Amazon FBA metrics to track including Product Sales By Units, Average Selling Price Per Unit, Assumed Refund %, Product Cost Per Unit $, Freight Cost Per Unit, Amazon FBA Fees Per Unit, Advertising spend (PPC), Cost Per Click (CPC), Conversion Rate %, Customer Acquisition Cost (CAC), Paid and Organic Orders as a % of Total Orders, and more; users will easily be able to navigate the model with all input fields highlighted in Blue font. These models are designed to be the perfect financial tool for business owners to use to make decisions for their company and also to provide to investors to give a snapshot of how the business is currently performing and what the forecasts look like.

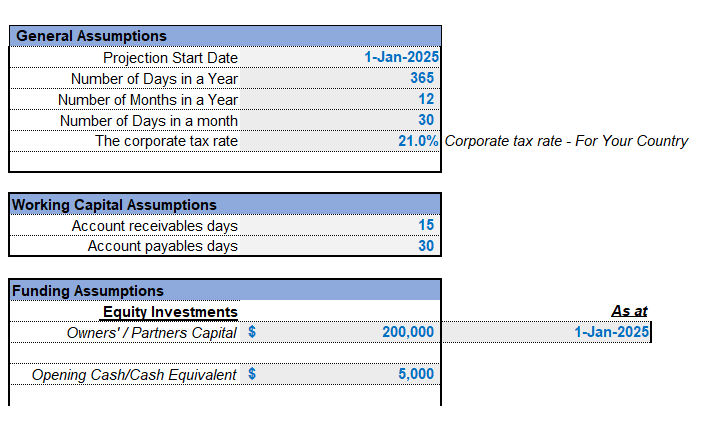

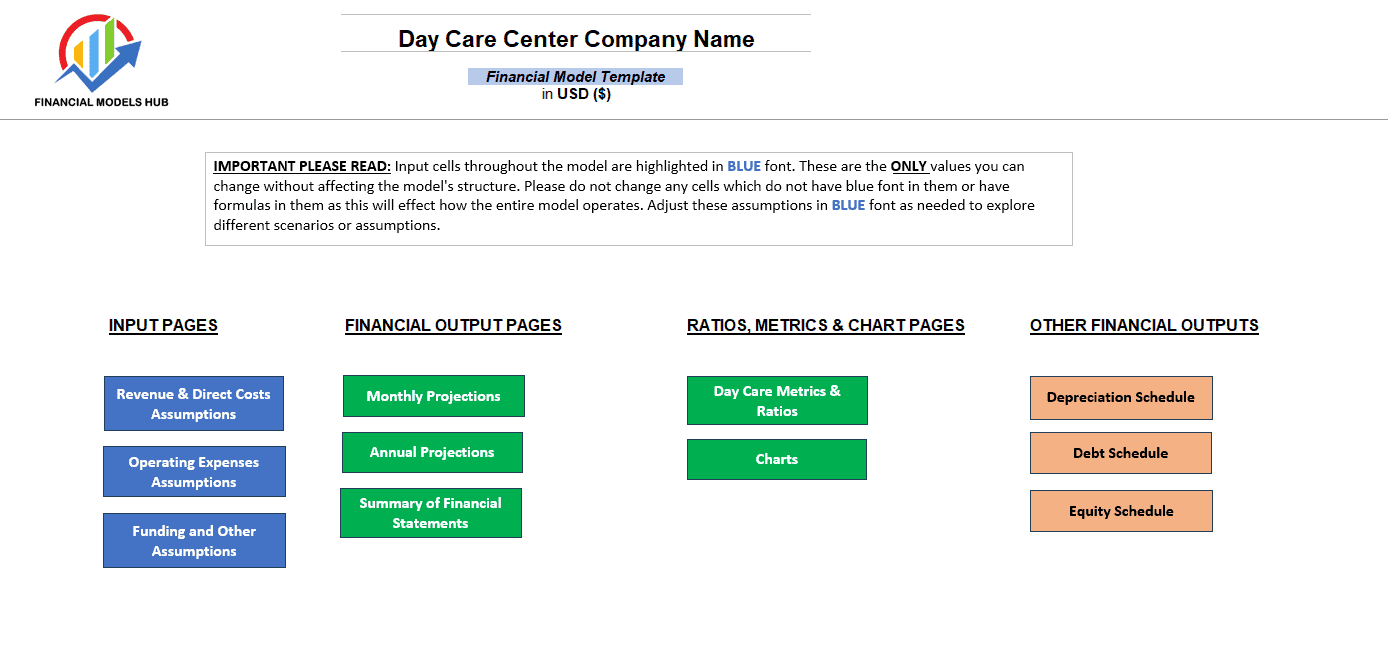

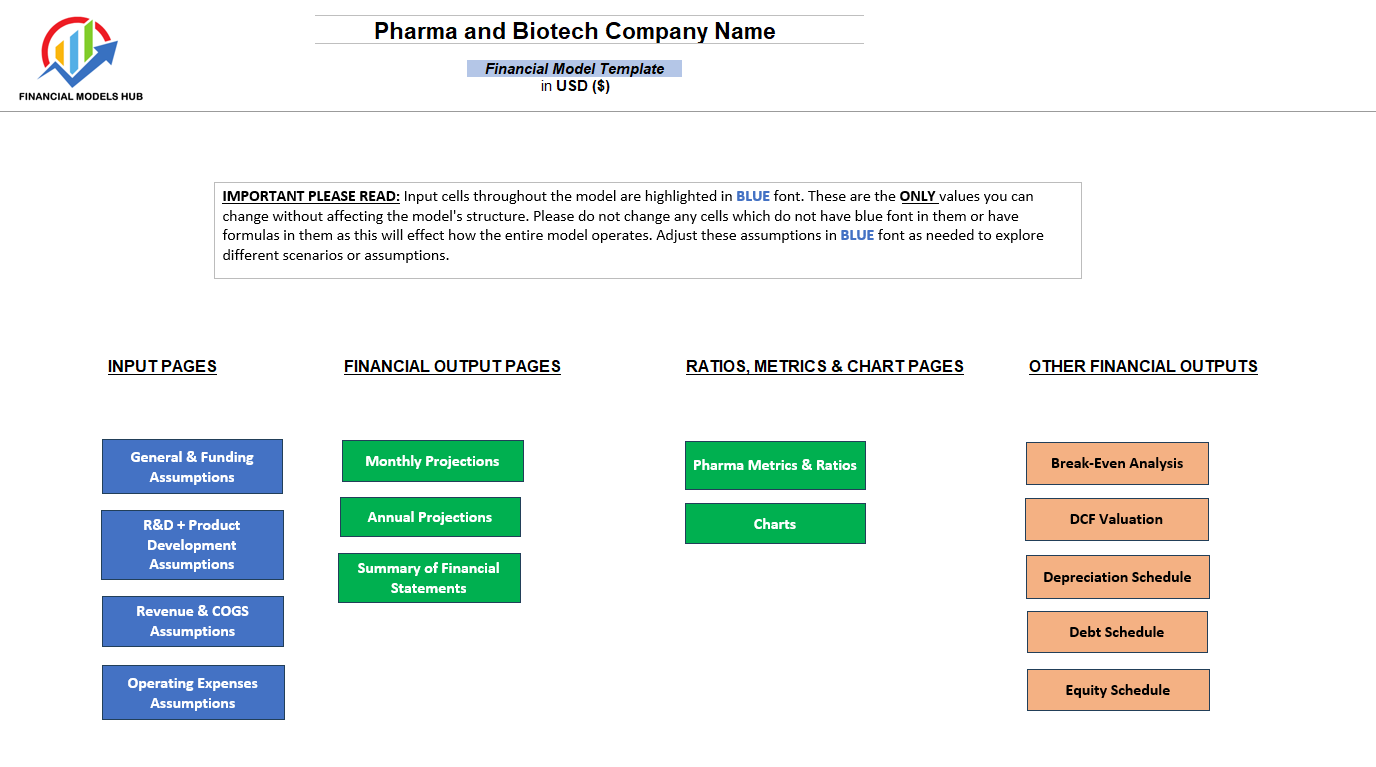

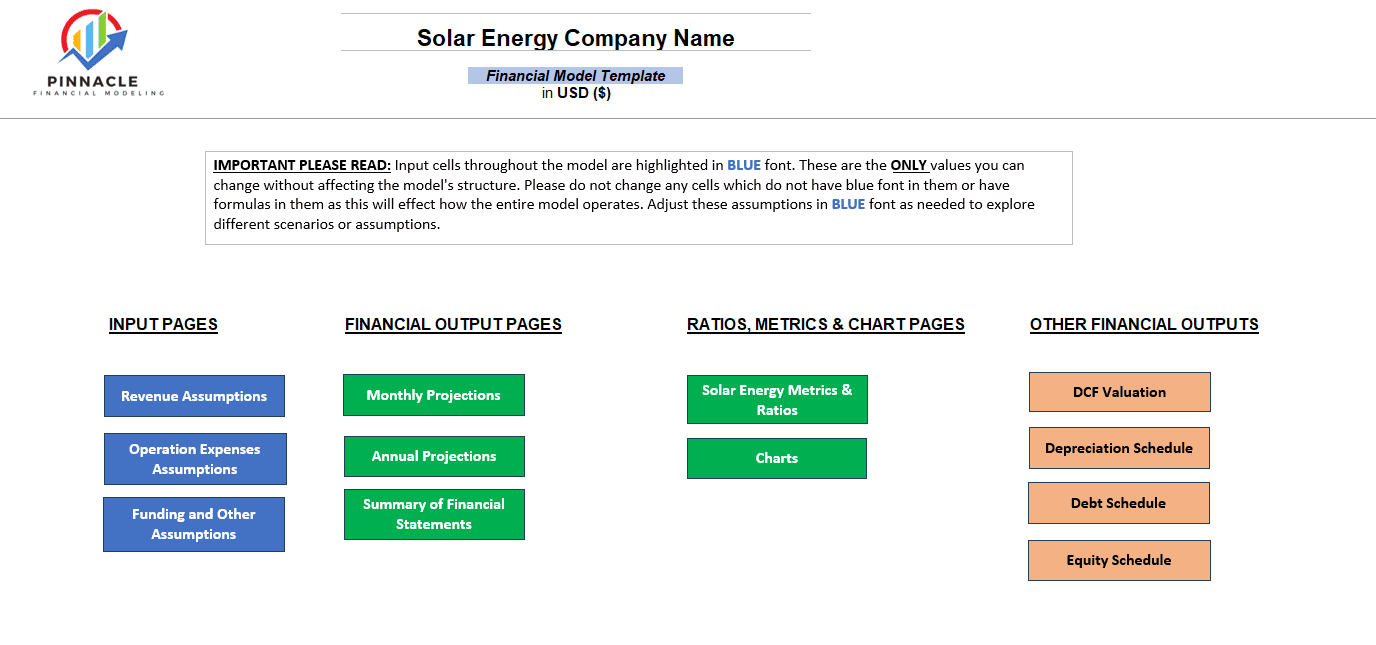

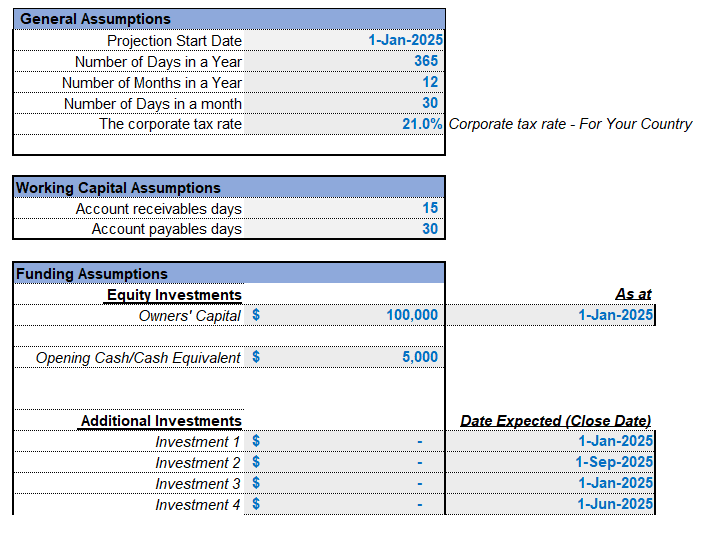

General Assumptions

Starts with basic model questions on start date of the model, tax rate assumption, working capital assumptions and funding assumptions behind the opening of the Amazon FBA business.

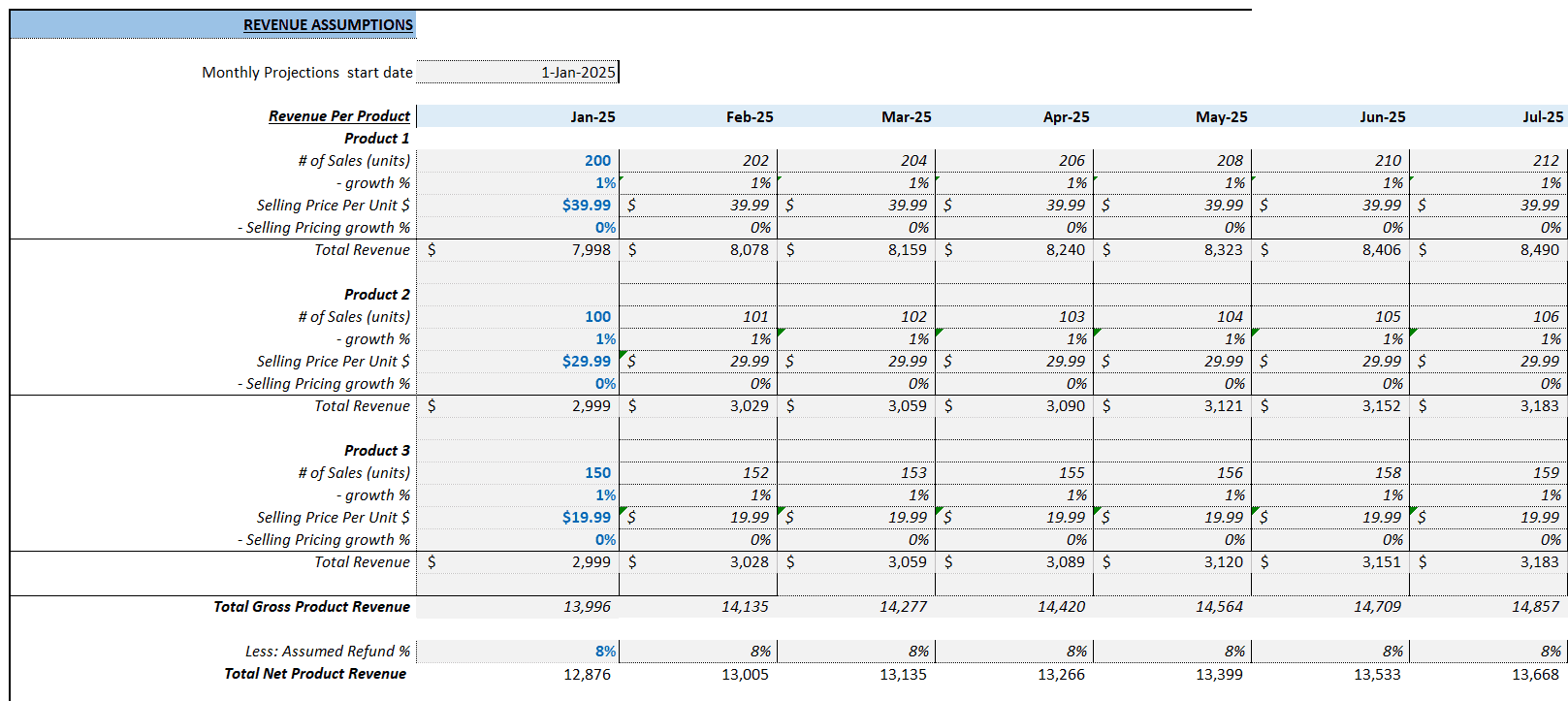

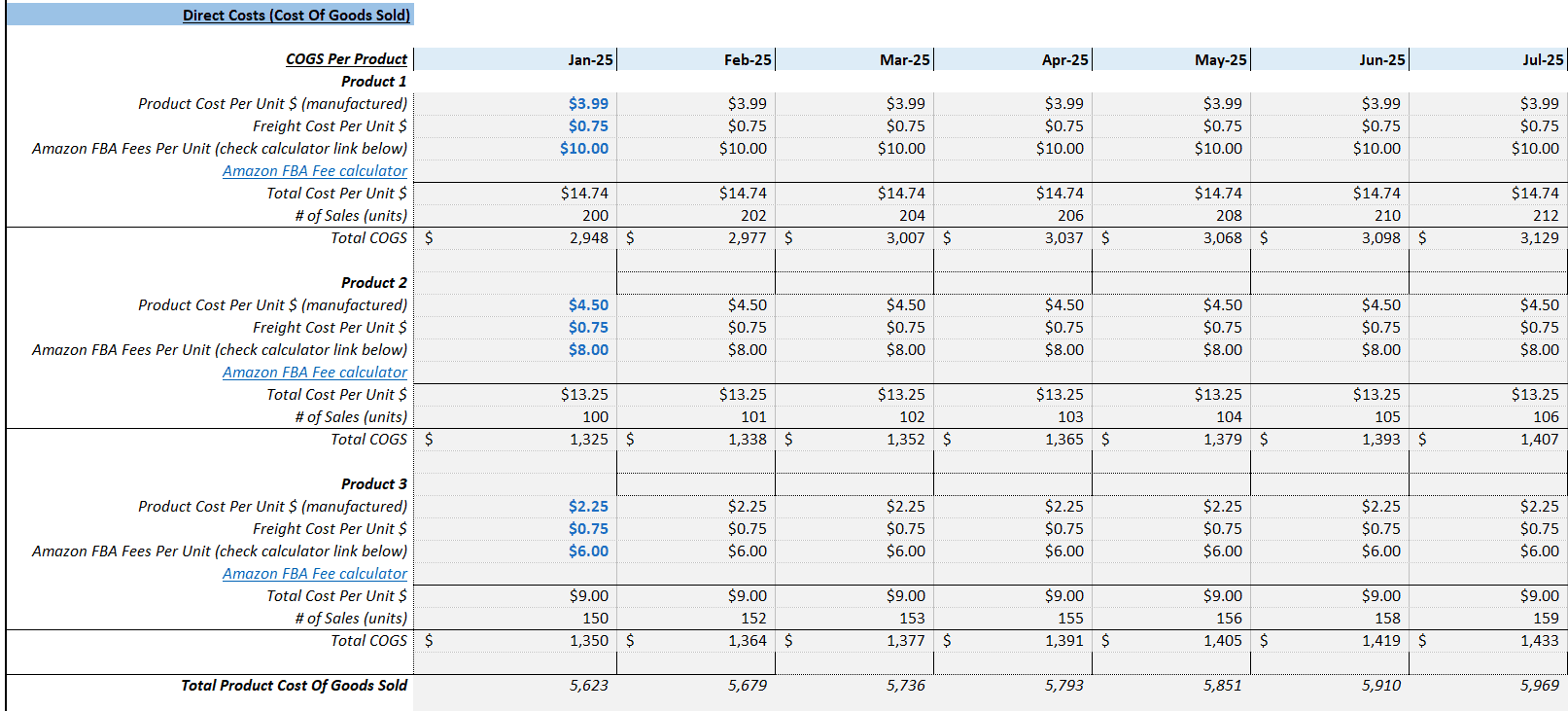

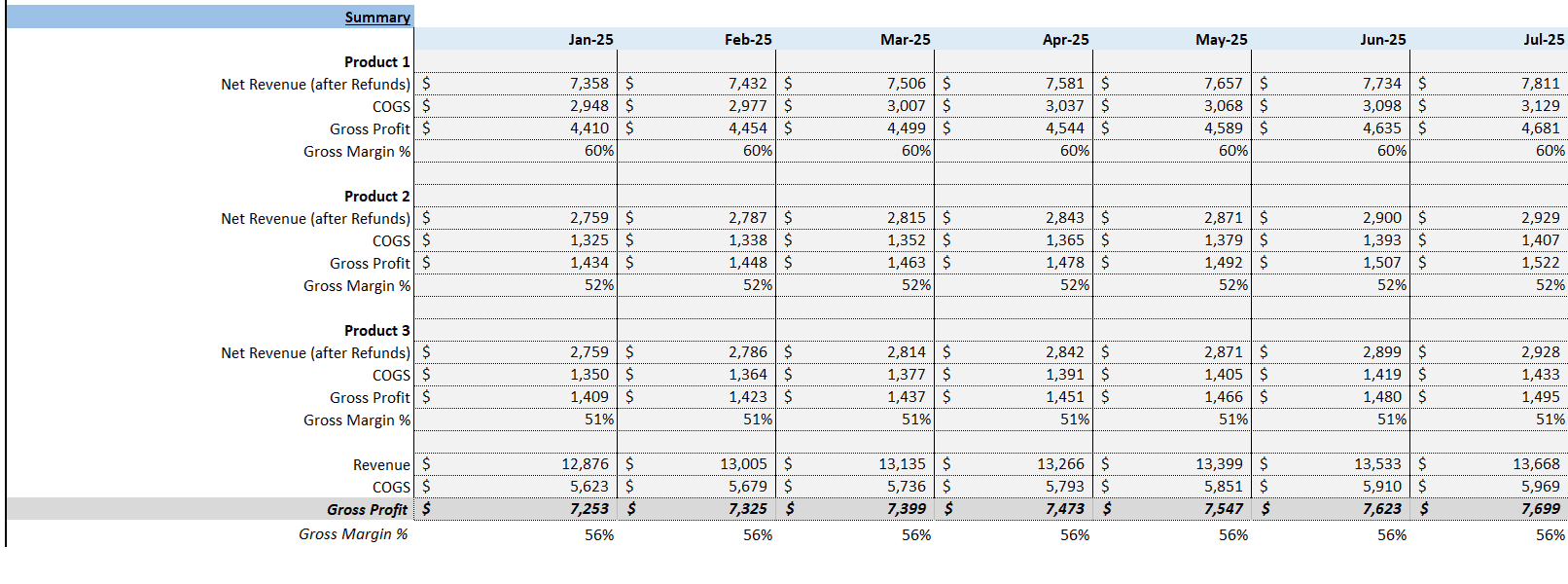

Revenue and COGS Assumptions

Revenue assumptions are the anticipated factors that drive a company’s income generation over a specific period. These assumptions form the basis for financial projections and are crucial for planning and decision-making. In our model we have included detailed inputs on Product Sales By Units, Average Selling Price Per Unit, Assumed Refund %.

Direct Costs or Cost Of Goods Sold assumptions are costs incurred in bringing a product to the point of sale. This includes the manufactured product cost quoted by the supplier, the freight cost incurred from bringing the goods to the country of sale as well as Amazon FBA fees incurred for fulfilling the Amazon order and the inventory and storage costs associated with handling and holding the inventory. We have included cost assumptions for Product Cost Per Unit $, Freight Cost Per Unit and also the Amazon FBA Fees Per Unit including a link to Amazon’s own FBA Fee calculator where you can either get a rival product ASIN to estimate what costs would look like for your product based on something similar, or use current Amazon FBA fees incurred by looking at Seller Central and inputting this into the model.

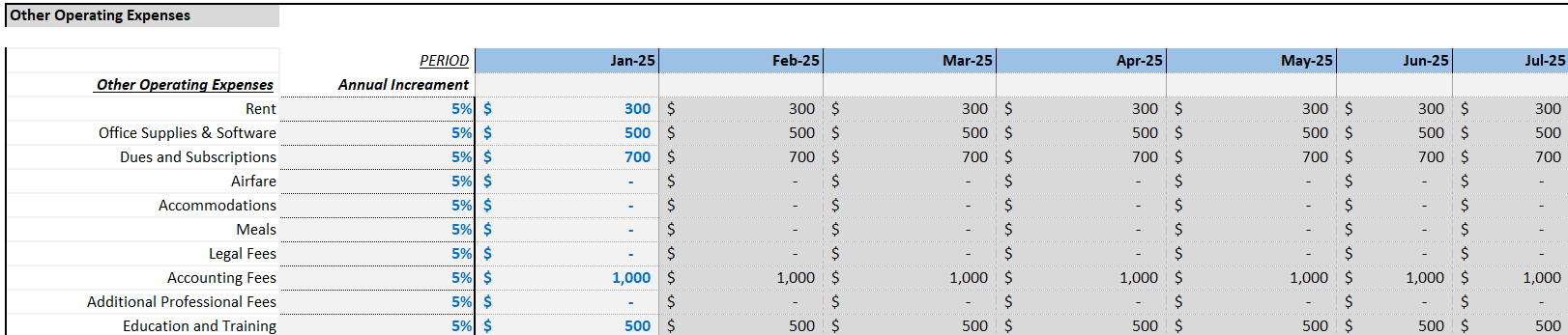

Operating Expenses Assumptions

Operating expense assumptions are typically based on historical data, industry benchmarks, market trends, and management’s judgment. They are crucial for estimating the total cost of running the business and for determining profitability. Like revenue assumptions, it’s important to regularly review and adjust operating expense assumptions to reflect changes in the business environment and ensure the accuracy of financial forecasts. In our model we have included detailed inputs on Staff Costs (Operations Manager, Advertising or PPC Agency, Social Media Team), typical Amazon FBA related Operational Expenditure items such as Advertising spend (PPC) with inputs including Advertising Budget, Cost Per Click (CPC), Conversion Rate %, Customer Acquisition Cost (CAC), Paid and Organic Orders as a % of Total Orders. We have also included general operational expense categories such as Rent, Office Supplies, Dues and Subscriptions however you can add any other expenses you think may be relevant to your business in this sheet.

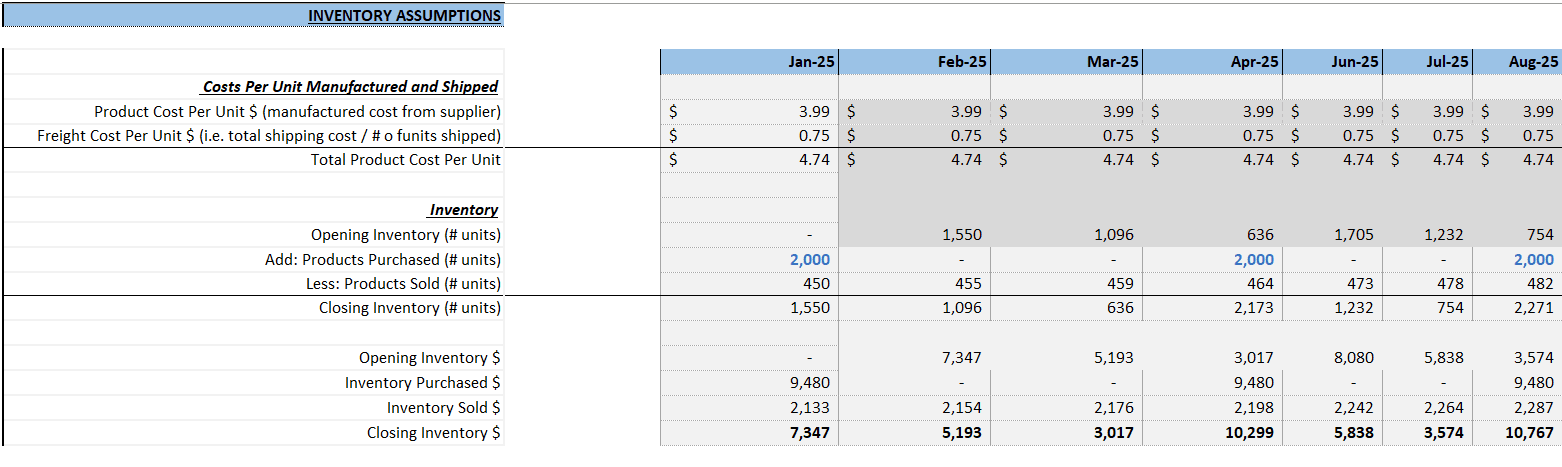

Inventory Assumptions

Inventory assumptions have been included to help you decide on how many units you need to Purchase based on existing sales volumes and anticipated sales volumes. We also include a re-order amount based on tracking when an inventory level gets to low volume, triggering a purchase and ensuring no disruption to your business.

Monthly Projections

We have broken down projections on a Month by Month basis when projecting Income Statement, Balance Sheet and Cash Flow Statement items. The monthly projections are provided over a 5 year time frame. This is particularly useful for businesses looking at month-on-month trends and insights in the business, which leads to better decision making and also better budgeting should there be a need to either raise more capital, pursue growth opportunities from excess capital or pay down interest bearing debt. Monthly projections also help a business ascertain what performance may be seasonal in nature when looking at growth projections on a month-over-previous-years-month basis.

Annual Projections

The model has Annualized Financial Projections of Income Statement, Balance Sheet and Cash Flow Statement over a 5 year time frame. Annual projections provide an excellent overview of expected revenues, expenses, profits, cash flow, and other key financial metrics for the upcoming year. Annual projections are essential for strategic planning, budgeting, fundraising, and performance evaluation for any company at any stage of their business cycle.

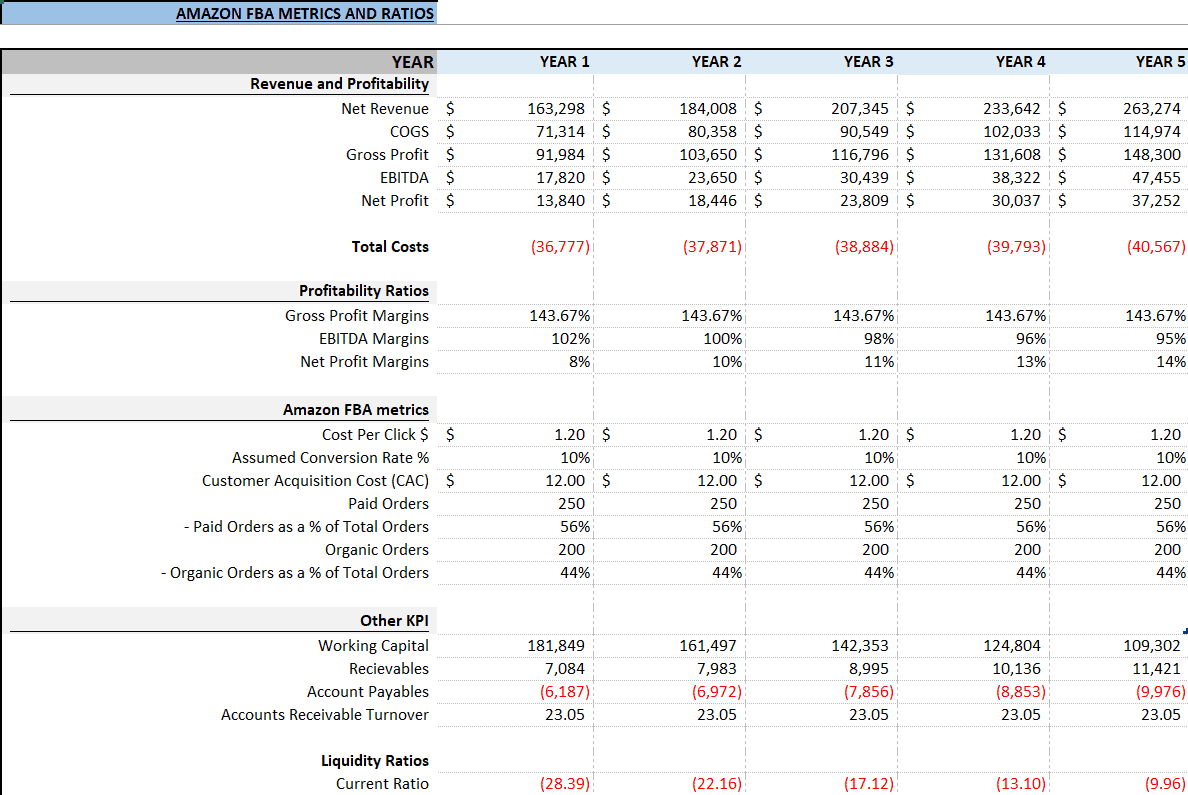

Amazon FBA Metrics & Ratios

Amazon FBA specific metrics (Cost Per Click, Assumed Conversion Rate %, Customer Acquisition Cost (CAC), Paid Orders and Organic Orders as a % of Total Orders as well as Profitability Ratios and Liquidity Ratios.

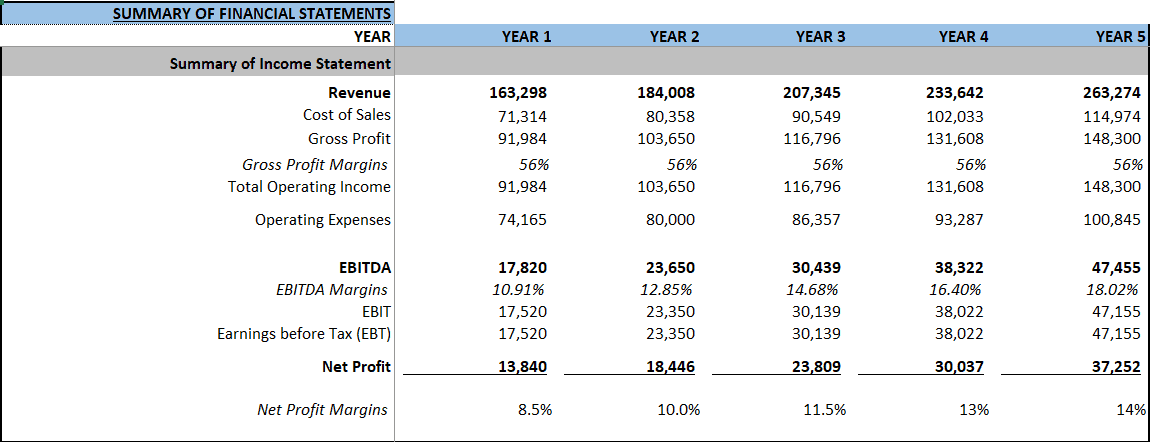

Summary of Financial Statements

Summarized Financial Statements over a 5 year time frame helps for better snapshots of financial performance. Income Statement, Balance Sheet and Cash Flow Statement all provided.

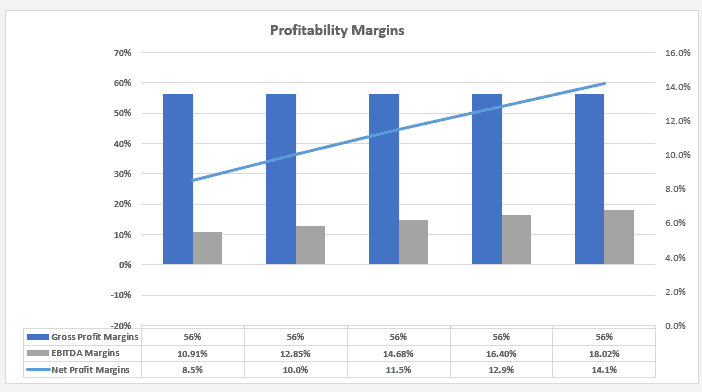

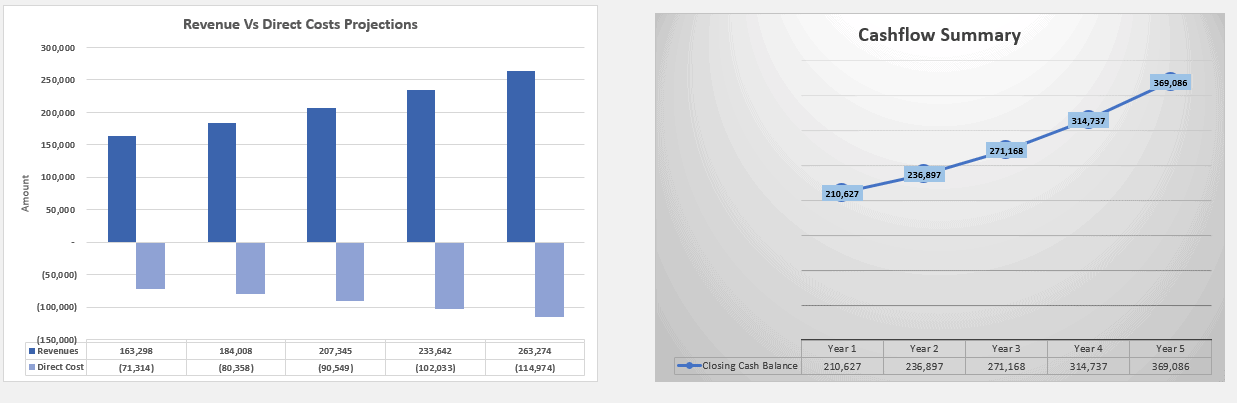

Charts

Charts available including Revenue vs Direct Costs, Cashflow Summary and Profitability Analysis.

DCF Valuation

We have included a Discounted Cash Flow (DCF) Valuation model showing the Net Present Value (NPV) of the Business based on a series of growth rates and assumptions. Weighted Average Cost of Capital Assumptions also provided including Risk Free rate, Beta, Risk Premium and Equity Risk Premium. A DCF valuation is a method used to estimate the value of an investment, business, or asset by discounting its expected future cash flows to present value. It is based on the principle that the value of an investment is determined by the present value of its future cash flows. The DCF valuation technique is widely used in finance, investment analysis, and corporate finance for making investment decisions, determining the fair value of securities, and evaluating the worth of businesses.

Depreciation Schedule

Detailed Depreciation Schedule shows additions / disposals to the Fixed Asset Register of the business. Sections included for Computer Equipment, Furniture & Fittings, Others.

Debt Schedule

Debt schedule provided with interest rate assumptions and payback period assumptions included.

Equity Schedule

Equity schedule provided with assumptions on all investments into the business by investors or owners.

M.B. –

Really easy to understand FBA model that was perfect for our business. Thank you!!

Gary K –

this is honestly the best model i’ve seen out there. and for this price, its a no-brainer. you’ll see how good it is in tracking everything you need and also gives you a valuation of your busienss too

RidsK –

This is an excellent Amazon FBA model and just what I was looking for! I really like the FBA specific inputs included in the model and how easy it is to fill in everything! I just get the info from my Amazon Seller Central account and the model does the rest. So good! This would have taken me so long to build myself and very happy to have bought this!

Ashley P –

Built my entire 12 month plan off this model! huge help!

M.B. –

I’m using this for my Amazon FBA business and it has helped me understand a lot of my forecasts and costs. Also really like the inventory page in helping me decide when to re-order. Great model !

Josh –

Very user friendly even if you’re not a numbers person.

Eli T –

Just what i was looking for! It breaks down fees, storage costs, and ad spend better than I could have done myself creating it from scratch.

Luiz –

best model i’ve seen and really helps with forecast inventory orders to make sure i have enough cash flow

Derek V –

So happy i bought this! It breaks out Amazon referral fees, FBA fulfillment, and storage costs perfectly and also i like the PPC and CPC stuff in there too!

Carlos –

Really good model! Detailed but still easy to use. perfect for FBA sellers.

John G –

Highly recommend this if you’re looking to model out your FBA business but don’t have the time to build something yourself

Jenna C –

This is so much better than my excel model I built! mine was a disaster and took me hours.

Arthur –

thank you to whoever made this model ! just what i needed and saved so much time

Sebastian –

Highly recommend for anyone doing Amazon FBA. Unless you’ve had someone build you a model or using an accountant, I would suggest everyone get this model. It’s amazing. So easy to use and tracks everything you need to understand your business