Lithium mining has become one of the most lucrative industries in the world, driven by the surge in electric vehicles, renewable energy, and portable electronics. With growing demand, understanding how to create a comprehensive lithium mining financial model is crucial for new ventures, investor attraction, and project feasibility assessment. This guide will walk you through constructing such a model, covering key concepts, specific factors, and detailed instructions to forecast revenues, manage costs, and analyze project profitability. We have also built a Lithium Financial Model Template which you may find useful, which is the perfect tool for Founders or Analysts to use to model out their lithium company’s financials.

Step 1: Understand the Key Components of a Lithium Mining Financial Model

1.1 Assumptions

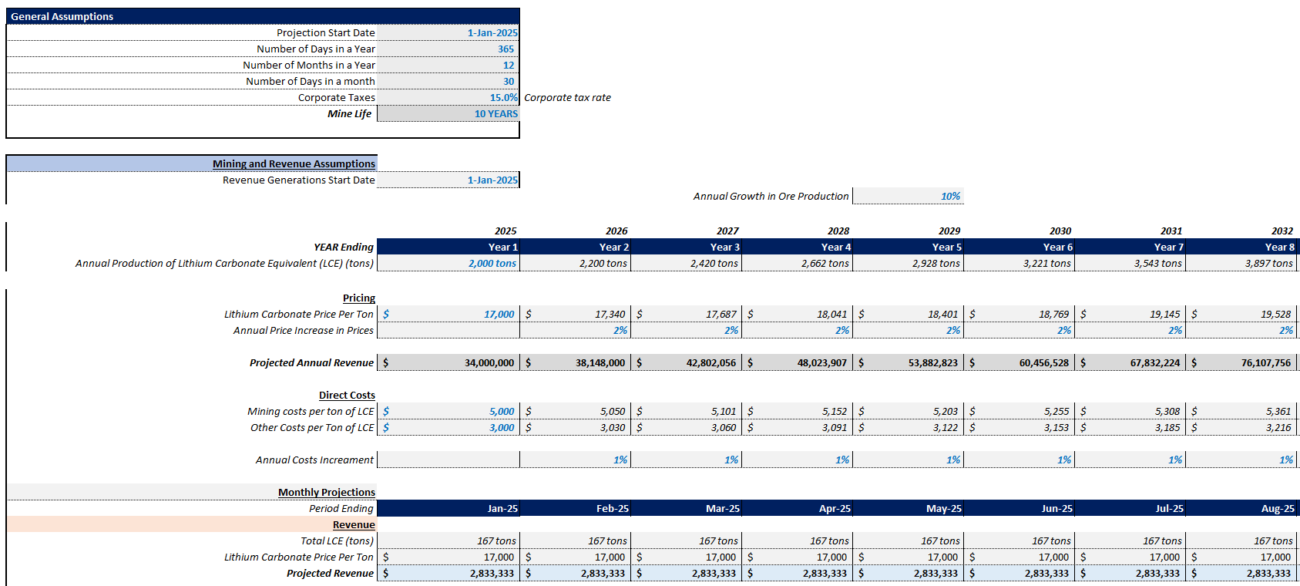

A well-structured lithium mining financial model starts with thoroughly defined assumptions. These include:

- Production Rates: Estimated annual output of lithium concentrate.

- Mining Life: Projected operational duration of the mine.

- Ore Grade: Lithium concentration within the ore.

- Recovery Rates: Efficiency of lithium extraction from ore.

- Product Prices: Fluctuating market costs of lithium.

- Capital and Operational Costs: Initial and ongoing financial obligations.

1.2 Revenue Model

Revenue generation stems from selling lithium concentrate or chemicals. Key considerations include:

- Lithium Sales Price: Market-driven selling price of products.

- Quantity of Product Sold: Based on production and recovery rates.

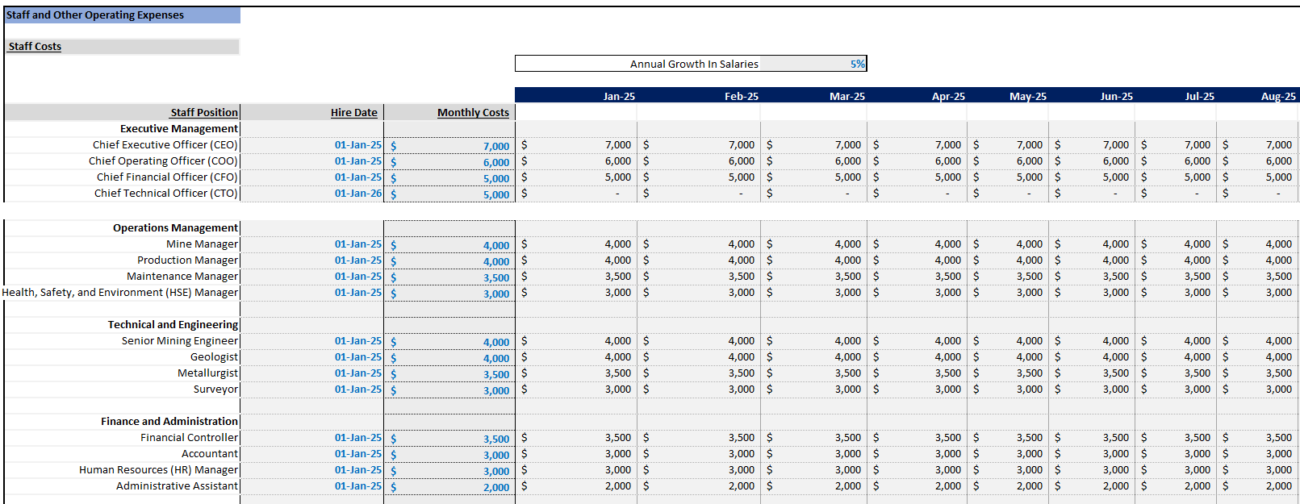

1.3 Expense Model

The expense model includes:

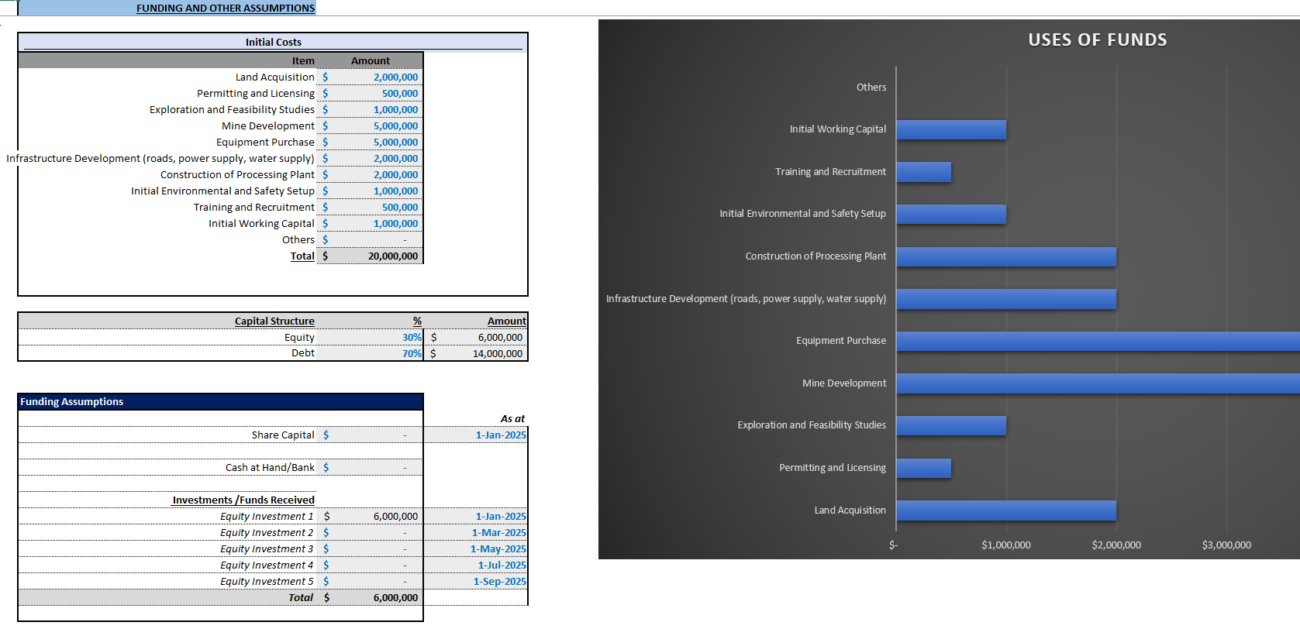

- Capital Expenditures (CapEx): Setup costs like land and infrastructure.

- Operating Expenditures (OpEx): Continuous operational expenses.

- Processing Costs: Expenses for converting ore to lithium products.

- Transportation and Logistics: Costs to move products to clients or ports.

- Environmental and Regulatory Costs: Compliance-related expenses.

1.4 Cash Flow Statement

Analyzing cash flow involves:

- Operating Cash Flow: Generated from lithium sales.

- Investing Cash Flow: Used for capital investments.

- Financing Cash Flow: Sourced from loans or equity.

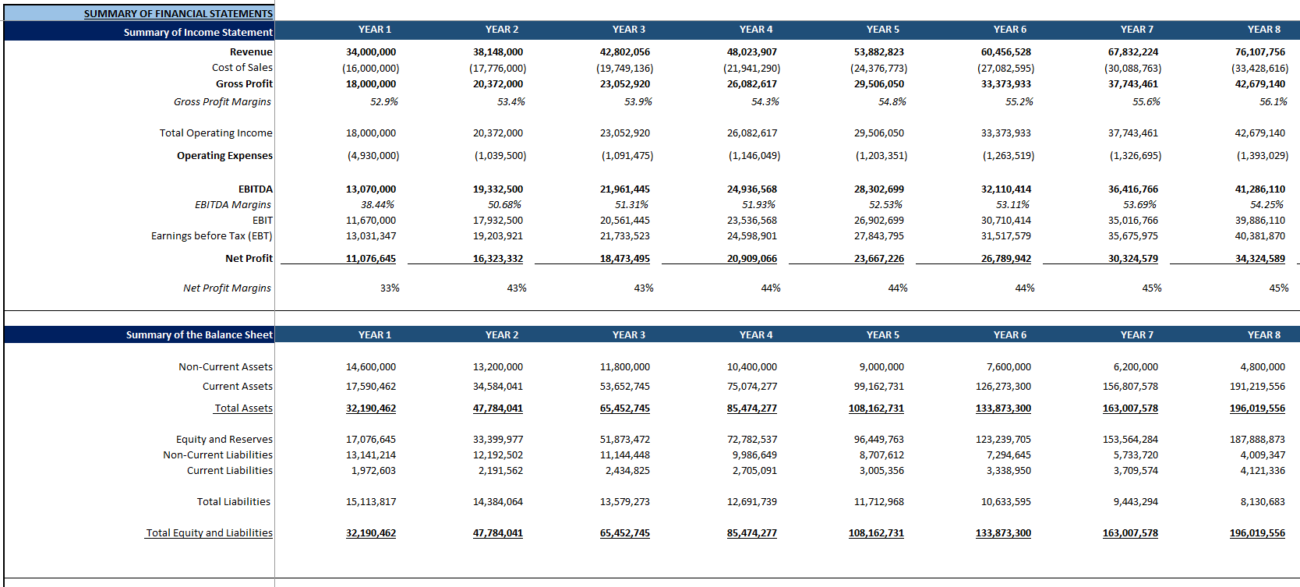

1.5 Profit and Loss (P&L) Statement

The P&L statement captures:

- Revenue: Income from sales.

- Cost of Goods Sold (COGS): Direct processing costs.

- Operating Expenses: General business expenses.

- Net Profit: Profitability after all deductions.

1.6 Balance Sheet

A snapshot of the company’s financial health, covering:

- Assets: Current and long-term holdings.

- Liabilities: Financial obligations and debts.

- Equity: Stakeholder interests.

Step 2: Gather and Input Your Key Assumptions

2.1 Research the Lithium Market

To build reliable assumptions, study market trends and lithium price indexes. Learn how lithium prices impact your model by incorporating data from industry reports, such as those from Fortune Business Insights detailing the lithium market’s growth projection.

2.2 Estimate Production and Recovery Rates

Determine potential lithium output using geological surveys and analyze facilities’ capacities for accurate recovery rate estimates.

2.3 Determine Capital and Operating Costs

Consult with industry experts to assess the initial capital expenditures needed for establishing a lithium mine, along with regular operational costs.

2.4 Plan for Environmental and Regulatory Costs

Account for necessary expenditures to stay compliant with environmental measures, including reclamation and waste management.

2.5 Financing Assumptions

Draft financing strategies, from equity to debt options, and integrate these into your cash flow model, perhaps utilizing insights from EquitiesFirst‘s approach for financing solutions.

Step 3: Build Your Financial Statements

3.1 Build the Revenue Model

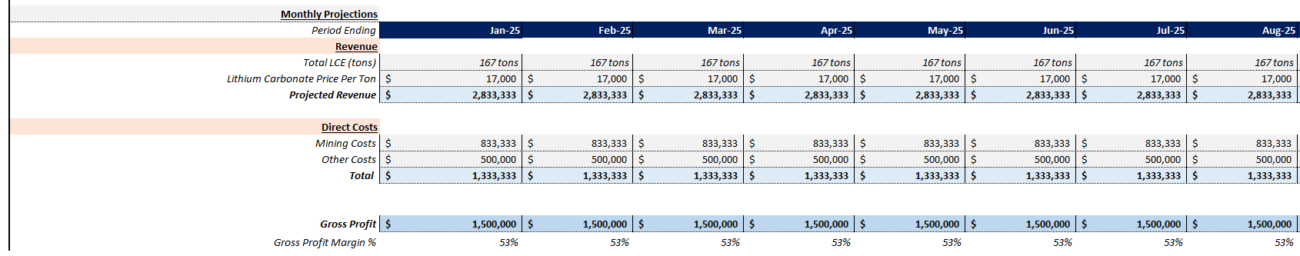

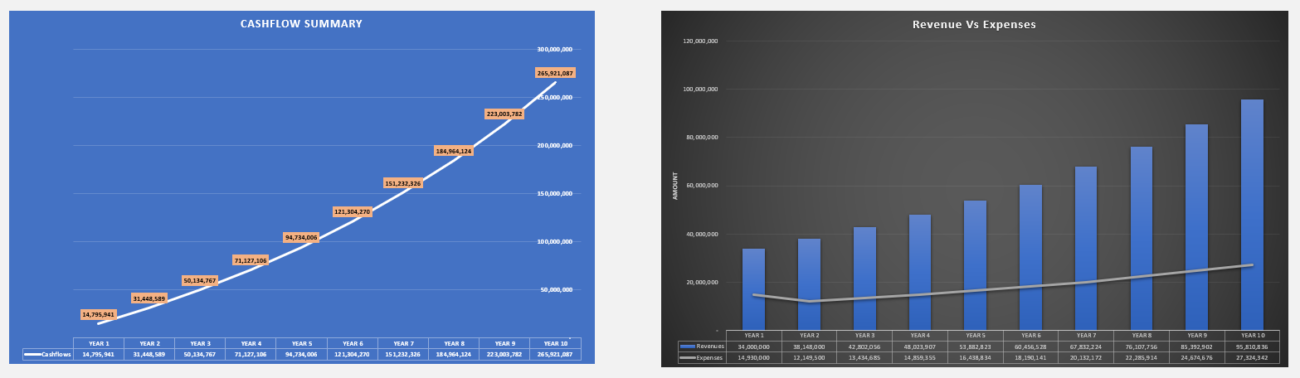

Use estimated sales prices and annual production quantities to forecast how much revenue your lithium products will generate each year.

3.2 Build the Cost Model

Identify capital and operating costs and forecast expenses aligned with production timelines.

3.3 Build the Cash Flow Statement

Project liquidity by analyzing your revenue models alongside costs, investments, and loan services to get net cash flow.

3.4 Profit and Loss (P&L) Statement

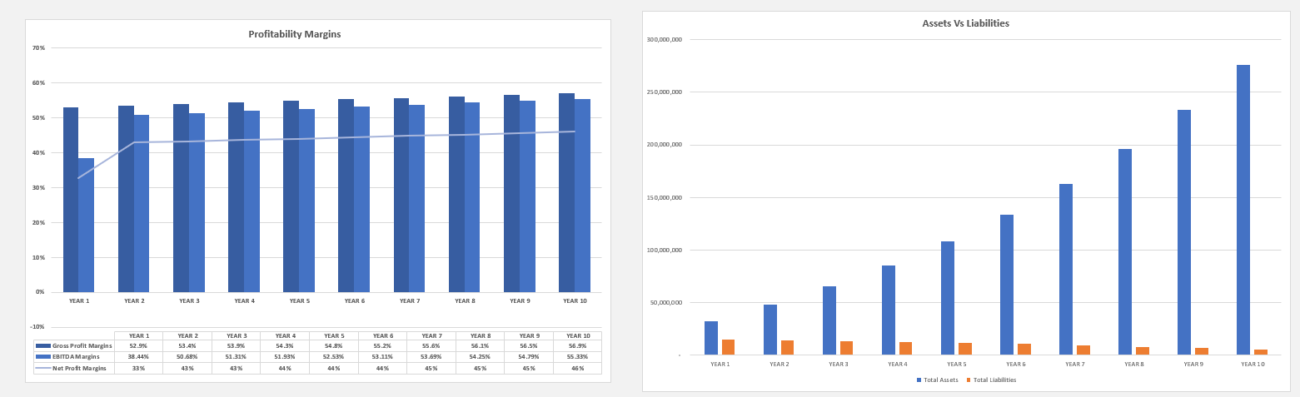

Deduct costs from revenue to gain a comprehensive view of profitability and set baselines for financial valuations.

3.5 Balance Sheet

Maintain a clear and accurate representation of your mining operation’s financial standing, from equipment to liabilities.

Step 4: Sensitivity Analysis and Refinement

Conduct sensitivity analyses to understand how changes in key assumptions impact your financial outcomes. Use tools like Excel to simulate different scenarios and optimize for variability in key factors.

Step 5: Presenting the Model

Effectively illustrate your findings using charts and visual data, highlighting potential ROI and risk factors to secure stakeholder buy-in.

Frequently Asked Questions

What is a lithium mining financial model?

A lithium mining financial model predicts the financial feasibility of a lithium mining project, allowing stakeholders to foresee profitability and cash flow.

How do I calculate production rates in a lithium mining model?

Production rates should be based on geological surveys and pilot testing, often projected per year or by total mineable reserves.

Why is a cash flow statement important in mining?

It provides critical insights into liquidity and financial health, ensuring that operations are sustainable amidst expenditures and investments.

Final Thoughts

Creating a robust lithium mining financial model requires detailed planning and thorough analysis of various financial components. By following this structured guide, you can piece together accurate financial projections, aiding in informed decision-making and investor engagement.