The capitalization rate (commonly referred to as the cap rate) is a critical metric used in real estate to assess the return on investment (ROI) for a property. It’s an essential tool for investors, brokers, and property managers to evaluate the potential profitability and relative value of real estate assets. The cap rate formula offers a straightforward way to compare different real estate opportunities, regardless of the size or location of the property. In this article, we will explore the cap rate formula in detail, how to calculate it, and how it impacts investment decisions.

What is the Cap Rate?

The cap rate is a percentage that represents the rate of return on a real estate investment, based on the income the property generates. More specifically, it is the ratio of a property’s net operating income (NOI) to its current market value (or purchase price). This metric helps investors gauge the potential return on a property if it were purchased outright, without financing.

In simple terms, the cap rate formula shows how much return an investor can expect from an income-producing property, based on its current value or purchase price. It is an important metric because it provides a snapshot of the property’s profitability and allows for comparisons between different investment opportunities, regardless of the property type or location.

The Cap Rate Formula

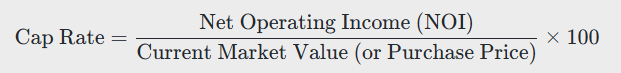

The formula for calculating the cap rate is as follows:

Where:

- Net Operating Income (NOI) is the annual income generated by the property after operating expenses are deducted but before mortgage payments, taxes, and depreciation.

- Current Market Value or Purchase Price refers to the price that the property is expected to sell for or the price the investor paid for the property.

This formula gives the cap rate as a percentage, allowing investors to understand how much income they can expect to generate from their investment relative to its market value. For more detailed insights, refer to the JPMorgan Chase article.

Key Components of the Cap Rate Formula

1. Net Operating Income (NOI)

Net Operating Income (NOI) is the income that a property generates through rent or other income streams, minus the operating expenses associated with maintaining and running the property. NOI is a crucial part of the cap rate formula because it reflects the property’s operational efficiency, excluding financing costs, taxes, and depreciation. For more information on calculating the cap rate using NOI, visit Investopedia.

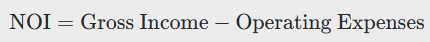

To calculate NOI, you subtract the following operating expenses from the total income generated by the property:

- Gross rental income: Total rent paid by tenants or any other income generated by the property (e.g., parking fees, vending machines).

- Operating expenses: Costs associated with running the property, such as property management fees, insurance, repairs and maintenance, utilities (if paid by the landlord), property taxes, and administrative expenses.

The formula for NOI is:

2. Current Market Value (or Purchase Price)

The current market value is the price at which the property is expected to sell in the open market, or the price the investor paid for the property. This is an important component because the cap rate is directly related to the property’s market value. For additional details on calculating the cap rate, check out Corporate Finance Institute.

Step-by-Step Calculation of the Cap Rate

Let’s walk through the steps involved in calculating the cap rate using the formula provided:

Example 1: Simple Cap Rate Calculation

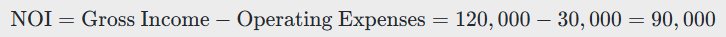

Imagine you are considering purchasing a small retail property. The property generates $120,000 in annual rent income and incurs $30,000 in operating expenses per year. The property’s market value is estimated to be $1,000,000.

- Calculate the NOI:

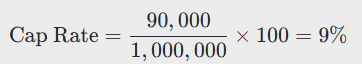

- Apply the Cap Rate Formula:

In this case, the cap rate is 9%. This means the investor can expect to earn a return of 9% annually based on the property’s market value, assuming all the income and expenses remain constant. For further reading, see the Wall Street Prep article.

Interpreting the Cap Rate

The cap rate is a reflection of the risk and return associated with a property. It offers insight into the expected return based on the property’s income and market value. Here’s how to interpret different cap rate values:

1. Higher Cap Rates

A higher cap rate typically indicates a higher potential return on investment but also suggests higher risk. Properties with higher cap rates are often found in less desirable locations or with higher levels of risk. For instance, a higher cap rate may appeal to investors looking for higher returns, but they must be prepared for the associated risks. To understand the pros and cons of high cap rates, see Buyers Agent.

2. Lower Cap Rates

A lower cap rate suggests a lower return on investment but typically implies lower risk. Properties with lower cap rates are often located in prime markets or in areas with strong demand and low vacancy rates. For an example of interpreting low cap rates, visit PropertyMetrics.

Cap Rate and Investment Strategy

The cap rate can be an essential tool when developing an investment strategy. Here are some ways investors can use the cap rate formula in their strategies:

1. Comparing Investment Opportunities

Investors often use the cap rate to compare properties within the same market or across different markets. It’s crucial to assess the risk associated with a higher cap rate. For a detailed comparison tool, refer to the Omni Calculator.

2. Identifying Market Trends

By monitoring cap rates over time, investors can identify trends in specific real estate markets. For an overview of market trends, read the Wikipedia article.

3. Assessing the Risk-Return Profile

The cap rate provides a quick way for investors to evaluate the risk and potential return on a property. By analyzing both the cap rate and other factors, investors can determine whether the return justifies the level of risk.

Limitations of the Cap Rate

While the cap rate is a helpful metric, it does have certain limitations that investors should be aware of:

- Does Not Account for Financing: The cap rate does not account for financing costs. Leverage may alter the return on investment.

- Ignores Future Appreciation: The cap rate only reflects the property’s current income and value, not potential future increases.

- No Consideration for Depreciation: The cap rate ignores tax implications.

- Does Not Reflect All Costs: Some costs, like property acquisition fees and renovations, are not reflected.

Alternatives to the Cap Rate

While the cap rate is widely used, there are other metrics that investors can employ:

- Cash-on-Cash Return: This calculates the annual return based on the actual cash invested.

- Net Present Value (NPV): NPV considers the profitability of an investment over time.

- Internal Rate of Return (IRR): IRR calculates the expected return from a property considering cash flows over time.

Conclusion

The cap rate is a vital tool for real estate investors, providing a quick and easy way to assess the return on investment based on a property’s income and market value. However, the cap rate should not be used in isolation. It is essential to consider other factors, such as financing and future appreciation, to get a complete picture of the investment’s potential.

By understanding the cap rate formula, its applications, and limitations, real estate investors can make more informed, data-driven decisions when purchasing income-generating properties.

Frequently Asked Questions

1. What is a good cap rate for real estate investments?

A good cap rate varies based on the market and property type. Generally, a cap rate between 4% and 12% is considered reasonable, depending on the level of risk an investor is willing to accept.

2. How do you use a cap rate calculator?

A cap rate calculator helps investors quickly compute the cap rate by inputting figures such as net operating income and property value. It automates the calculation process, providing instant results.

3. Why might a higher cap rate be riskier?

Higher cap rates often indicate higher potential returns but also suggest higher risks due to factors like location stability, property condition, and tenant strength.