Hotels generate enormous amounts of data. Every booking, check-in, invoice, and guest interaction creates numbers that promise insight—but too often, owners are buried in reports without clarity.

The problem isn’t lack of data. It’s lack of focus.

Successful hotel owners don’t track everything. They track the right numbers consistently and use them to make better decisions month after month. This guide breaks down the essential KPIs every hotel owner should review monthly—and how each one connects directly to profit.

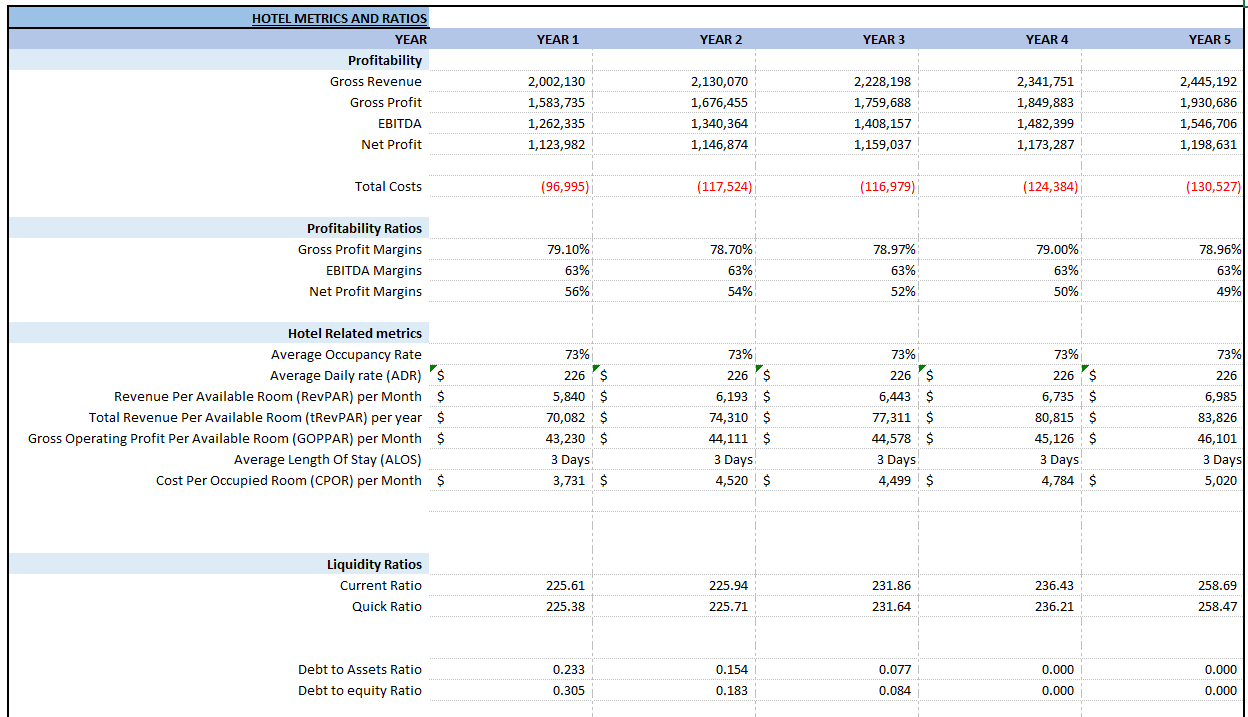

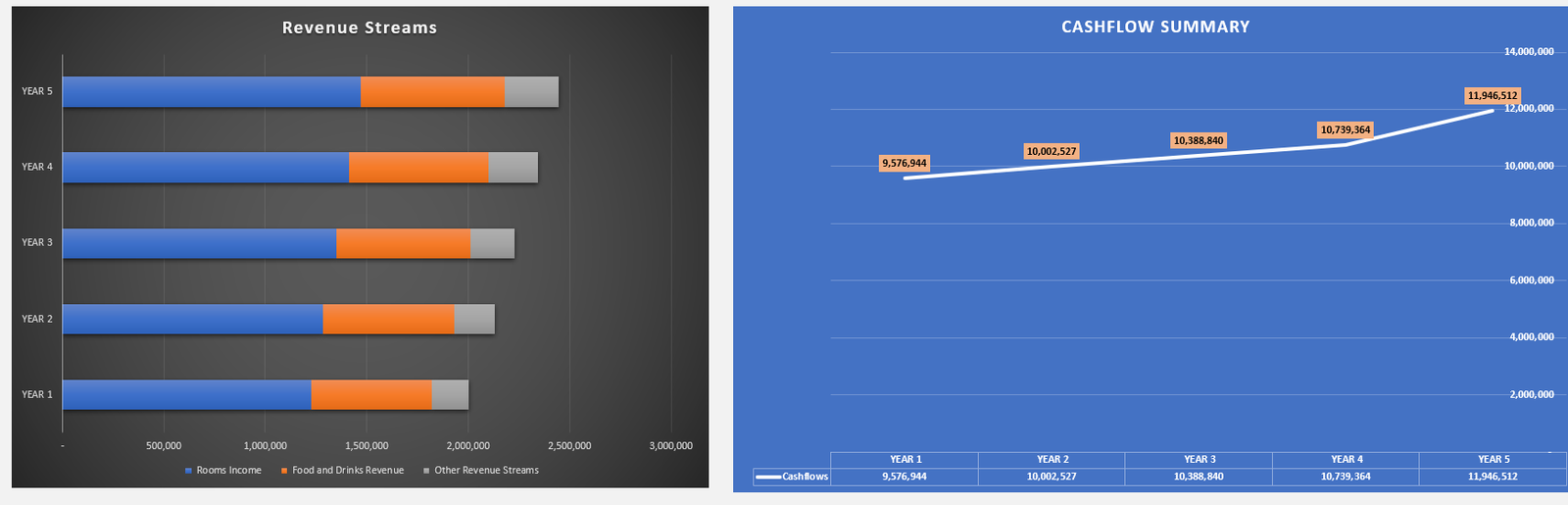

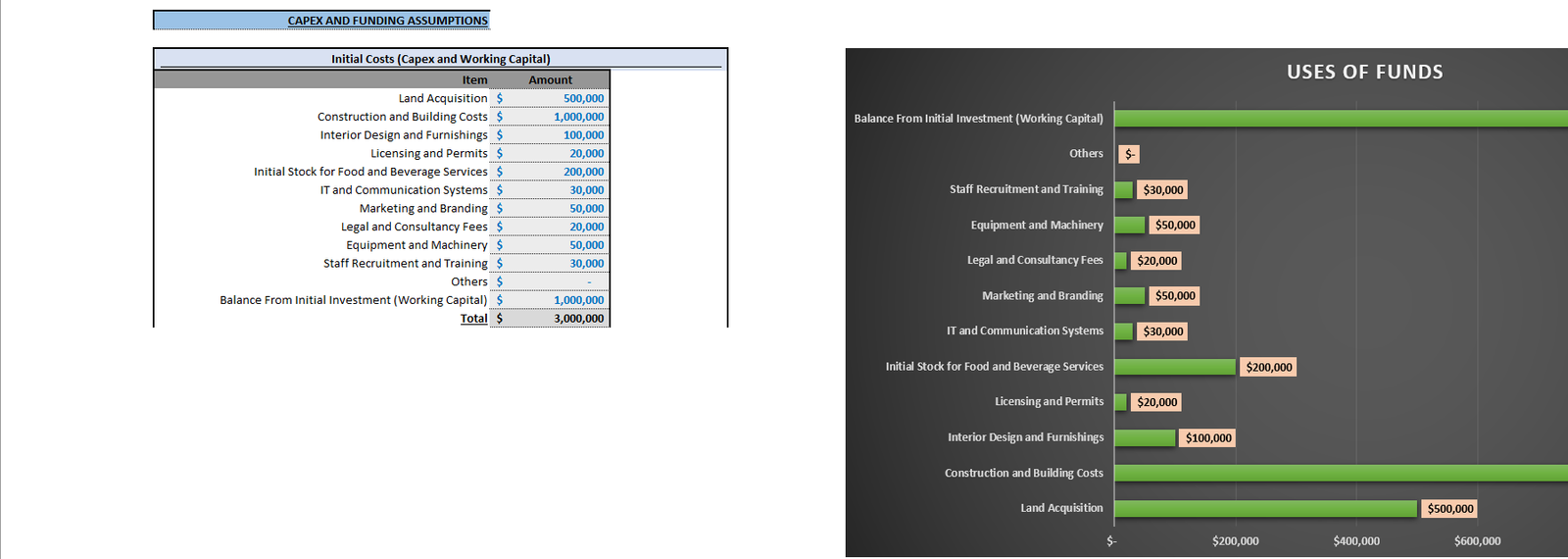

We have also built a Hotel Financial Model Template for Founders and Entrepreneurs to use. Just input your assumptions, and our model does the rest! It’s a complete 3-way financial model with an Income Statement, Balance Sheet, Cash Flow Statement, hotel investment specific metrics, ratios, and more.

Why KPIs Matter More Than Reports

Many hotels produce dozens of reports every month. Occupancy charts, revenue summaries, labor spreadsheets, channel performance dashboards—yet owners still feel unsure about performance.

That’s because reports describe the past, while KPIs guide the future.

Good KPIs:

- Highlight problems early

- Link operations to financial results

- Support faster, calmer decision-making

- Keep management accountable

The goal isn’t measurement—it’s profit improvement.

The 3 KPI Categories Every Owner Needs

To keep things manageable, KPIs should be grouped into three categories:

- Revenue & Demand KPIs – Are you selling rooms at the right price?

- Cost & Efficiency KPIs – Are you keeping what you earn?

- Cash Flow & Sustainability KPIs – Is the business financially stable?

Tracking a small number in each category is far more effective than tracking dozens poorly.

Revenue & Demand KPIs

These KPIs tell you whether your pricing, distribution, and demand strategy are working.

Occupancy Rate

What it tells you: How much of your available inventory you’re selling.

Occupancy is the most visible hotel KPI—but also the most misleading if viewed alone. Learn more about it in this guide.

High occupancy with heavy discounting often means:

- Lower profit

- Higher operating stress

- Faster asset wear

Use it correctly:

- Compare occupancy to ADR and RevPAR

- Track trends by day of week and season

- Watch for sudden drops or spikes

Occupancy should support profit—not replace it as a goal.

Average Daily Rate (ADR)

What it tells you: How well you’re pricing your rooms.

ADR reflects:

- Rate discipline

- Demand strength

- Discounting behavior

A falling ADR is often the first warning sign of revenue mismanagement. Further information can be found here.

Monthly review questions:

- Is ADR rising during high-demand periods?

- Are discounts becoming permanent?

- Is ADR improving faster through direct bookings?

ADR reveals confidence—or lack of it—in your pricing strategy.

Revenue per Available Room (RevPAR)

What it tells you: How well you’re balancing price and occupancy.

RevPAR combines occupancy and ADR, making it a more reliable revenue KPI. Discover additional insights in this article.

Why owners should care:

- It shows true room revenue performance

- It prevents over-focusing on occupancy

- It allows benchmarking against competitors

If RevPAR is flat while occupancy rises, you’re likely over-discounting.

Cost & Efficiency KPIs

Revenue growth alone doesn’t create profit. These KPIs show whether your operation is efficient.

Labor Cost Percentage

What it tells you: How efficiently your largest expense is managed.

Labor is often the single biggest cost in a hotel.

Formula: Labor Cost ÷ Total Revenue

Monthly insights:

- Rising labor % without revenue growth signals inefficiency

- Low labor % with falling guest scores signals understaffing

Learn more about aligning labor costs with efficiency through this article.

The goal is balance—not extreme cost cutting.

Cash Flow & Sustainability KPIs

Profit on paper doesn’t guarantee survival. These KPIs protect financial stability.

Gross Operating Profit per Available Room (GOPPAR)

What it tells you: How much profit your hotel generates per room.

GOPPAR considers:

- All operating revenue

- All operating expenses

It’s one of the most honest measures of hotel performance.

Owners should review:

- Month-over-month trends

- Seasonal comparisons

- Impact of pricing or cost changes

GOPPAR answers the question: Is the business actually working? Explore its full significance in this guide.

Cash Flow from Operations

What it tells you: Whether your hotel is generating real cash.

A hotel can be profitable but cash-poor due to:

- Debt payments

- Timing gaps

- High fixed costs

Monthly cash flow tracking helps you:

- Avoid low-season crises

- Plan capital spending

- Control owner distributions

Cash flow keeps the business alive between peak seasons.

Turning KPIs into Action

Tracking KPIs without action is a waste of time.

Every monthly KPI review should answer:

- What changed?

- Why did it change?

- What decision will we make next?

Limit reviews to:

- 10–12 core KPIs

- One clear takeaway per KPI

- One or two actions per month

For more on using KPIs effectively, consider this resource.

Final Thoughts: Data Is a Tool, Not a Trophy

The most profitable hotels aren’t the ones with the biggest dashboards. They’re the ones that use a small set of numbers relentlessly and intelligently.

When you track the right KPIs:

- Problems surface early

- Decisions become less emotional

- Profit improves sustainably

Data doesn’t replace experience—but it sharpens it.

If you want your hotel data to drive profit instead of confusion, start by tracking fewer numbers, more often—and acting on what they tell you.

Frequently Asked Questions

Why are KPIs crucial for hotel management?

KPIs are crucial because they allow hoteliers to turn data into actionable insights, thereby guiding strategic decisions that improve profitability and operational efficiency.

How can Occupancy Rate impact hotel profit?

While a high Occupancy Rate indicates strong demand, if achieved through heavy discounting, it can lead to reduced profits. It’s essential to balance occupancy with ADR and RevPAR.

What is the role of KPIs in revenue management?

KPIs like ADR, RevPAR, and Net ADR help in evaluating pricing strategies and optimizing revenue management by showing the relationship between pricing, demand, and profitability.