All-in sustaining cost (AISC) has become the most quoted metric in gold mining. It’s easy to compare, widely reported, and seemingly comprehensive. Many mines proudly advertise low AISC as proof of operational excellence. But AISC, on its own, tells an incomplete—and sometimes misleading—story.

Some mines with attractive AISC destroy shareholder value. Others with higher AISC generate strong cash flow, fund growth internally, and outperform across cycles. The difference lies in what AISC doesn’t capture.

To understand whether a gold mine is truly creating value, operators and investors must look beyond AISC to a broader set of financial metrics that reflect cash generation, capital intensity, risk, and long-term sustainability.

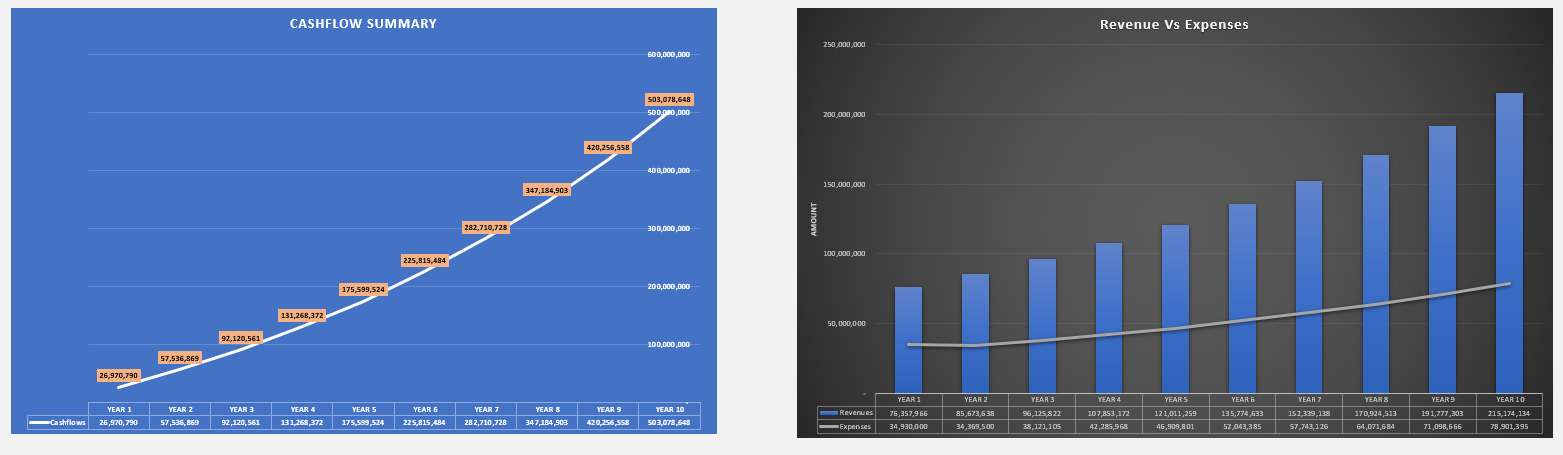

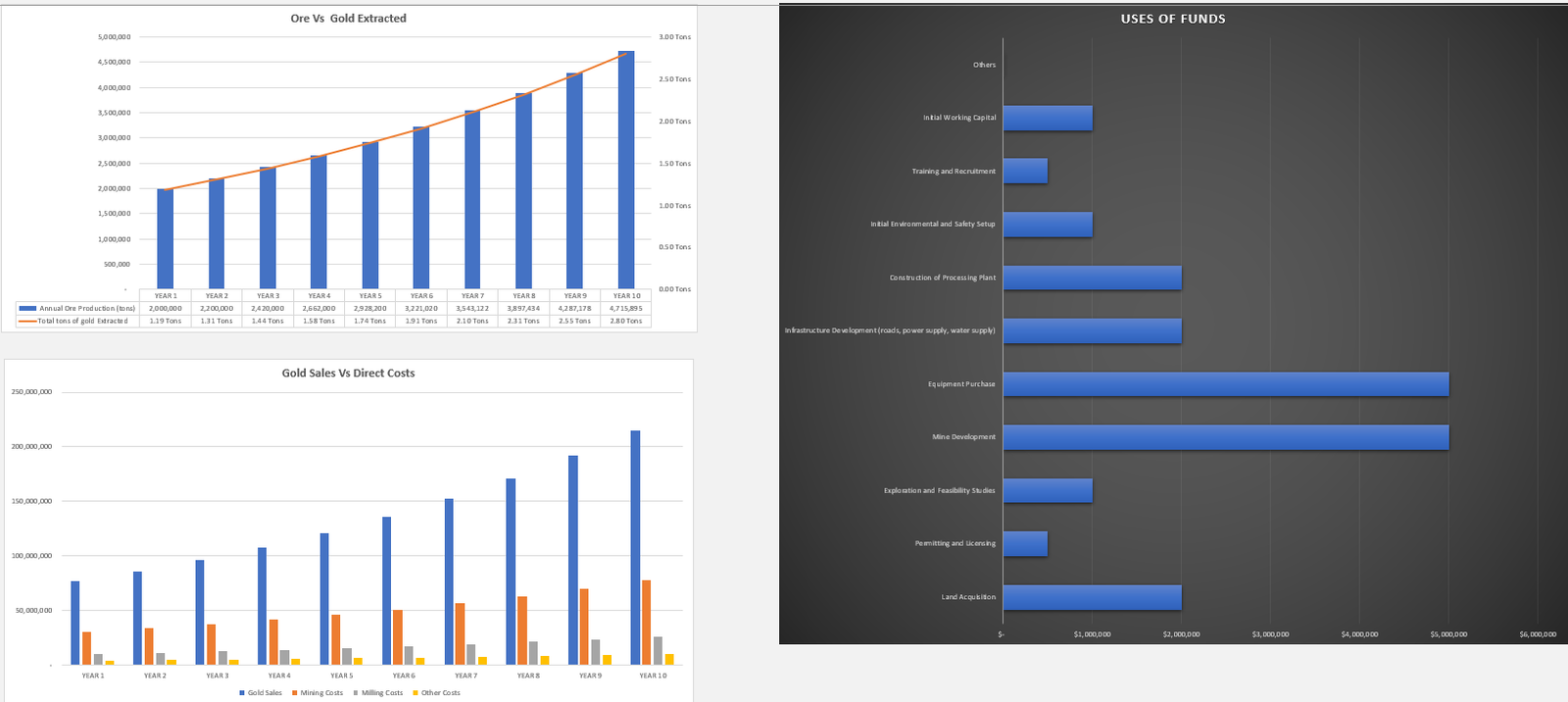

We have also built a ready-to-go Gold Financial Model Template that can be used by a Founder, Entrepreneur or Analyst to input their company assumptions.

Why AISC Became the Default Metric

AISC was introduced to standardize cost reporting across the industry. It includes operating costs, sustaining capital, corporate G&A, reclamation, and closure costs. This was a step forward from cash cost reporting, which ignored critical expenditures.

However, AISC is still backward-looking, averaged across production, blind to capital structure and growth capital, and insensitive to timing and risk. AISC answers the question: “What does it cost to keep producing at today’s level?” It does not answer: “How much value does this mine actually create?”

The Core Limitation: AISC Is a Cost Metric, Not a Value Metric

AISC focuses on minimizing cost per ounce, but mining is a capital-intensive business where timing, scale, and reinvestment matter more than cost alone. Two mines with identical AISC can have vastly different free cash flow, balance-sheet resilience, mine life and optionality, and risk exposure. This is why investors increasingly discount AISC-heavy narratives that lack supporting cash flow metrics.

Metric 1: Free Cash Flow per Ounce

What it tells you: How much cash the mine actually generates after all sustaining and growth capital. Free cash flow (FCF) captures operating margins, capital intensity, and reinvestment requirements.

Why It Matters More Than AISC

A mine with slightly higher AISC but strong FCF per ounce can fund exploration and expansion, return capital to shareholders, and survive price downturns. A low-AISC mine with weak FCF may be capital-starved, overextended, and dependent on external financing. Key insight: Cash, not cost, pays dividends and funds growth. Learn more about gold mining investment strategies.

Metric 2: Operating Cash Margin (Not Just Margin per Ounce)

Operating margin is often expressed per ounce, but this can obscure scale and volatility. A better view combines margin per ounce, total ounces produced, and consistency of margins across price scenarios.

Why It Matters

High per-ounce margins at small scale may not cover corporate overhead, capital programs, or debt service. Conversely, moderate margins at scale can generate substantial cash flow. Look for durable margins, not just peak margins. Explore more in the analysis of gold mining stocks.

Metric 3: Sustaining Capital Intensity

AISC includes sustaining capital—but it doesn’t reveal how capital-hungry a mine really is. Key questions include: How much sustaining capital is required per ounce? Is sustaining capex increasing as the mine ages? How sensitive is production to underinvestment?

Why This Matters

Some mines maintain low AISC only by deferring capital, mining higher-grade areas, or postponing waste stripping. This creates future cost spikes and production risk. High sustaining capital intensity often signals shorter mine life, higher long-term risk, and lower true economic value.

Metric 4: Mine Life and Reserve Replacement Cost

AISC ignores the cost of replacing reserves. Without ongoing investment, production declines, fixed costs rise, and valuation deteriorates.

Better Metrics to Watch

Reserve life index (RLI), annual reserve replacement rate, and cost per ounce of reserves added are critical. A mine with low AISC but shrinking reserves is liquidating its future. Long-term value depends not just on cost, but on the sustainability of production.

Metric 5: Return on Invested Capital (ROIC)

ROIC is rarely emphasized in mining—but it should be. It answers the critical question: “How efficiently does this mine turn invested capital into cash flow?”

Why ROIC Is Powerful

ROIC penalizes capital-heavy projects, highlights execution discipline, and forces comparison across assets and opportunities. A mine with moderate AISC and strong ROIC is often superior to one with low AISC and weak returns on capital. Discover more about financial modeling for gold mining.

Metric 6: Free Cash Flow Breakeven Gold Price

AISC breakeven prices are commonly quoted—but they miss growth and financing needs. FCF breakeven price includes sustaining capital, growth capital (where appropriate), and debt service.

Why It Matters

This metric shows how resilient the mine is across price cycles, whether it can self-fund operations, and how exposed it is to gold price volatility. Mines with low FCF breakevens are strategically flexible.

Metric 7: Capital Flexibility and Timing Risk

Mining cash flows are uneven. Metrics that capture flexibility include the ratio of fixed to variable costs, the ability to defer non-critical capital, and exposure to large, lumpy capital programs.

Why This Matters

A mine that looks attractive on AISC can become cash-negative during capital peaks, forced to issue equity at low prices, or strategically constrained. Flexibility is an underrated source of value in cyclical industries.

Metric 8: Net Asset Value (NAV) Sensitivity

Many mines look good at spot prices—but collapse under stress testing.

Better Analysis Includes

NAV at multiple gold prices, sensitivity to cost inflation, and sensitivity to recovery or grade changes.

Why It Matters

High NAV sensitivity means greater upside in bull markets and greater downside risk in downturns. Understanding this trade-off is essential for capital allocation decisions.

Metric 9: Balance Sheet Strength at the Asset Level

AISC ignores financing structure entirely. Yet leverage amplifies both returns and risk.

Key Metrics

Net debt to EBITDA, interest coverage under lower price scenarios, and liquidity relative to capital commitments are vital. Strong balance sheets turn good assets into great ones.

Why Investors Are Moving Beyond AISC

Institutional investors increasingly focus on free cash flow yield, capital discipline, return metrics, and resilience across cycles. Low AISC remains attractive—but only when supported by cash generation, capital efficiency, and mine life visibility. AISC is now a starting point, not a conclusion.

How Operators Should Use AISC Going Forward

AISC is still useful—but only in context. Best practice includes reporting AISC alongside FCF metrics, explaining capital assumptions clearly, stress-testing performance across price scenarios, and avoiding “AISC optimization” that harms long-term value. Transparency builds credibility—and credibility lowers the cost of capital.

Final Thoughts: Value Is Created Above the Cost Curve

AISC tells you where a mine sits on the cost curve. It does not tell you where it sits on the value curve. Long-term success in gold mining depends on cash flow, capital efficiency, and resilience, not just margins. Mines that manage for true economic performance tend to outperform—across cycles and price environments. Discover insights about metals and mining investment banking.

In an industry defined by uncertainty, the metrics that matter most are the ones that reveal how a mine behaves when conditions change. And that’s something AISC alone will never show.

Frequently Asked Questions

What is AISC in gold mining? AISC stands for All-in Sustaining Cost, a comprehensive metric capturing the cost of mining operations, including operating costs, sustaining capital, and other associated costs. It standardizes cost reporting.

Why is Free Cash Flow more important than AISC? Free Cash Flow per ounce reflects a mine’s true cash generation ability after all expenditures, providing insight into its financial health, investment capacity, and resilience against price fluctuations.

How does ROIC differ from AISC in evaluating a mine? Return on Invested Capital (ROIC) measures how effectively a mine turns invested capital into profits, focusing on efficiency and allowing better comparison across different investments.

Gold mining investment strategies, operational leverage, and portfolio diversification remain essential aspects, further highlighted by the ongoing gold equities boom and continuous need for detailed gold stocks analysis, especially concerning ASX gold stocks. Emphasizing gold mining fundamentals, understanding mining finance ratios, addressing gold production costs, and aligning with metals mining investment opportunities ensure strategic growth within the precious metals distribution market. Engaging with promising gold-copper projects and maintaining a positive gold price outlook are crucial for sustainable development. As the industry adapts, financial modeling in gold mining must consider emerging market trends and persistently scrutinize AISC margins and key performance metrics for optimal investment outcomes.