Gold has always been cyclical—but capital allocation in the gold sector often isn’t. Time and again, companies and investors make the same mistake: they deploy the most capital at the top of the cycle, chase growth when prices are strongest, and pull back just as long-term value opportunities emerge.

The result is a familiar pattern—overinvestment, cost inflation, balance-sheet stress, and value destruction when prices retreat.

Understanding gold price cycles is not about predicting the next peak or trough. It’s about aligning capital allocation decisions with where you are in the cycle, so that returns are resilient across price environments rather than dependent on perfect timing.

This article explores how gold price cycles work, why they matter for capital allocation, and how disciplined decision-making can turn cyclicality from a risk into a strategic advantage.

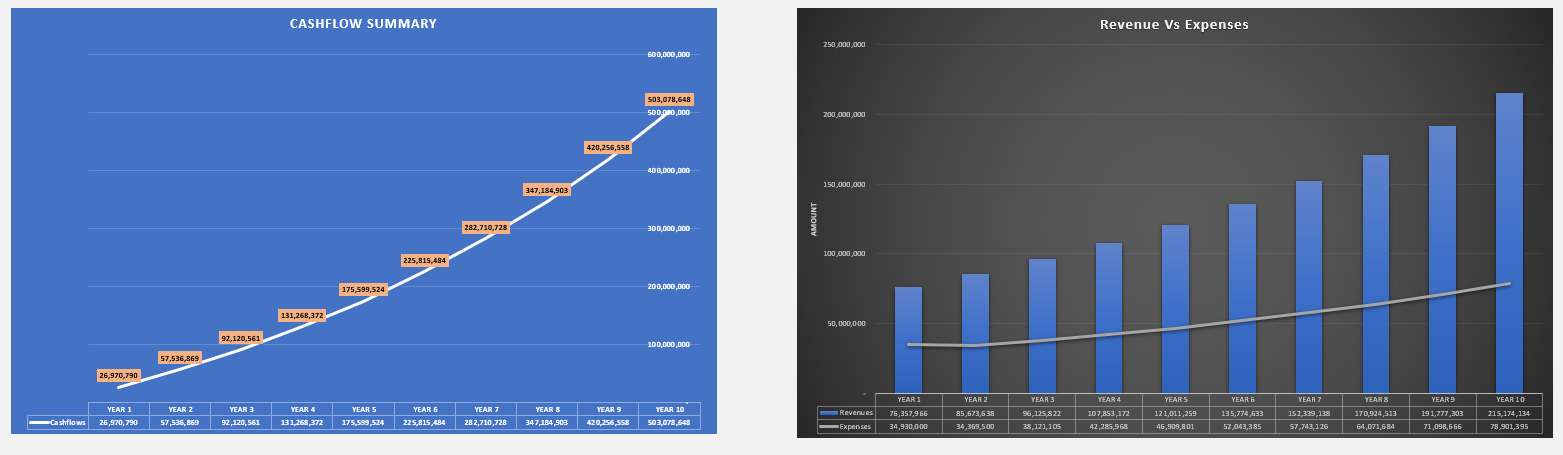

We have also built a ready-to-go Gold Financial Model Template that can be used by a Founder, Entrepreneur or Analyst to input their company assumptions.

Why Gold Is Inherently Cyclical

Gold behaves differently from most commodities. It is both a monetary asset and store of value, and a mined commodity with real production costs and constraints. This dual nature creates cycles driven by a mix of real interest rates, inflation expectations, currency movements, geopolitical risk, investor sentiment, and capital flows.

While no two cycles are identical, gold prices tend to move through recognizable phases—each of which should imply very different capital allocation priorities.

The Four Phases of the Gold Price Cycle

Rather than thinking in terms of “high” or “low” prices, it’s more useful to think in cycle phases.

1. Recovery Phase

- Prices have stabilized after a downturn

- Marginal producers are under pressure

- Capital availability is limited

- Investor sentiment is cautious

2. Expansion Phase

- Prices rise steadily

- Margins improve

- Capital markets reopen

- Growth narratives return

3. Peak / Overheating Phase

- Prices spike or plateau at high levels

- Costs inflate rapidly

- M&A activity accelerates

- Capital discipline weakens

4. Correction Phase

- Prices fall or stagnate

- Balance sheets matter again

- Projects are delayed or written down

- Investors punish overleveraged players

Capital allocation mistakes usually occur in phases three and four—but the consequences are often set up much earlier.

Why Capital Allocation Fails in Gold Cycles

The core problem is procyclicality. When prices are high, cash flows surge, confidence increases, growth pressure intensifies, and capital becomes cheap and abundant. This encourages expensive acquisitions, greenfield project approvals with optimistic assumptions, cost inflation disguised as “investment,” and balance-sheet leverage justified by strong prices.

When prices fall, those same decisions destroy value. Projects become uneconomic, debt becomes restrictive, and shareholder dilution follows. The cycle punishes emotion and rewards discipline.

Capital Allocation Priorities by Cycle Phase

The most effective gold companies do not allocate capital the same way at all times. They change priorities as the cycle evolves.

1. Recovery Phase: Preserve Optionality, Not Growth

In the recovery phase, gold prices may still feel fragile. The instinct is often to “wait for clarity.” But this phase offers some of the best long-term capital allocation opportunities.

Smart Capital Moves:

- Balance-sheet repair

- Low-cost brownfield optimization

- Selective exploration near existing assets

- Acquiring distressed or undervalued assets quietly

What to Avoid:

- Large, irreversible capital commitments

- Overpaying for ounces in the ground

- Assuming price recovery will be rapid

The goal in recovery is optionality—positioning the portfolio so it benefits from higher prices without depending on them.

2. Expansion Phase: Invest for Quality, Not Volume

As prices rise and margins expand, pressure mounts to grow production and reserves. This is where discipline starts to matter.

Smart Capital Moves:

- Incremental expansions with clear capital returns

- Productivity and recovery improvements

- Technology and process upgrades that lower unit costs

- Selective M&A focused on asset quality, not size

Key Question:

“Would this project still make sense if gold prices were 20–30% lower?” If the answer is no, the project is probably a cycle-dependent bet rather than a value-creating one.

3. Peak Phase: Return Capital, Don’t Chase Growth

At peak prices, the biggest risk is not missing upside—it’s locking in permanent value destruction.

Counterintuitive but Proven Strategies:

- Return excess cash to shareholders

- Pay down debt aggressively

- Slow project approvals

- Raise hurdle rates instead of lowering them

4. Correction Phase: Protect the Core, Prepare for the Next Cycle

When prices fall, capital allocation becomes defensive—but it should not become short-sighted.

Smart Capital Moves:

- Preserve liquidity

- Protect core, low-cost assets

- Reassess project portfolios honestly

- Maintain exploration spend selectively

Critical Mistake to Avoid:

Cutting all future-facing investment.

The companies that emerge strongest from downturns are those that continue to invest selectively, even when sentiment is poor.

Gold Price Assumptions: The Silent Value Killer

One of the most dangerous capital allocation practices in gold is embedding optimistic price assumptions into long-term decisions. Problems arise when projects require sustained peak prices to break even, acquisition models assume permanent price shifts, and cost inflation is underestimated because margins are strong.

Best-in-class allocators:

- Use conservative long-term gold price assumptions

- Stress-test projects across multiple price scenarios

- Separate “price upside” from “base case economics”

Capital Allocation Is About Risk, Not Just Return

In gold, risk is asymmetric. Upside is capped by price cycles and operational constraints. Downside, however, can be severe—particularly when leverage and fixed costs are high.

Effective capital allocation considers:

- Balance-sheet resilience across cycles

- Operational flexibility

- Cost curve position

- Jurisdictional and regulatory risk

- Execution complexity

The Role of Shareholder Returns Across the Cycle

Shareholder return strategies should also be cycle-aware.

During High Prices

- Favor dividends and buybacks

- Avoid dilutive equity issuance

- Signal discipline and credibility

During Low Prices

- Preserve cash

- Avoid forced equity raises

- Maintain access to capital markets

Consistency matters more than generosity. Investors reward companies that behave predictably across cycles.

Lessons from Past Gold Cycles

Across decades of gold market history, several patterns repeat:

- Companies that expand aggressively at peaks underperform

- Balance-sheet strength drives survival and opportunity

- Capital discipline outlasts price momentum

- The best acquisitions are often made quietly during downturns

- Investors have long memories for capital allocation mistakes

Gold cycles are unforgiving—but they are also remarkably consistent in how they reward and punish behavior.

Building a Cycle-Aware Capital Allocation Framework

To align decisions with gold price cycles, organizations should formalize discipline rather than rely on judgment alone.

Key elements include:

- Explicit cycle-based capital allocation guidelines

- Tiered hurdle rates linked to price environments

- Clear separation between sustaining and growth capital

- Regular portfolio reviews that challenge legacy projects

- Incentives tied to long-term value, not short-term growth

Capital allocation should be a process, not a reaction.

Final Thoughts: You Can’t Control the Gold Price—But You Can Control Your Decisions

Gold price cycles are inevitable. Overinvestment, write-downs, and shareholder disappointment don’t have to be. The difference between value creators and value destroyers in gold is rarely geology or luck—it is capital allocation discipline across cycles.

Companies and investors who respect cyclicality, resist procyclical behavior, prioritize resilience over expansion, and allocate capital with humility consistently outperform those who assume “this time is different.”

You can’t time gold prices perfectly. But you can decide how your capital behaves when prices move. And in the gold sector, that decision matters more than almost anything else.