Creating a financial model for a real estate development project is crucial for developers and investors. It assesses profitability, manages risk, and secures financing. In this guide, we’ll walk you through the process of building a robust financial model. We have also built a ready-to-go Real Estate Developer Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their business.

The Importance of Financial Modeling in Real Estate Development

A real estate financial model is essential for:

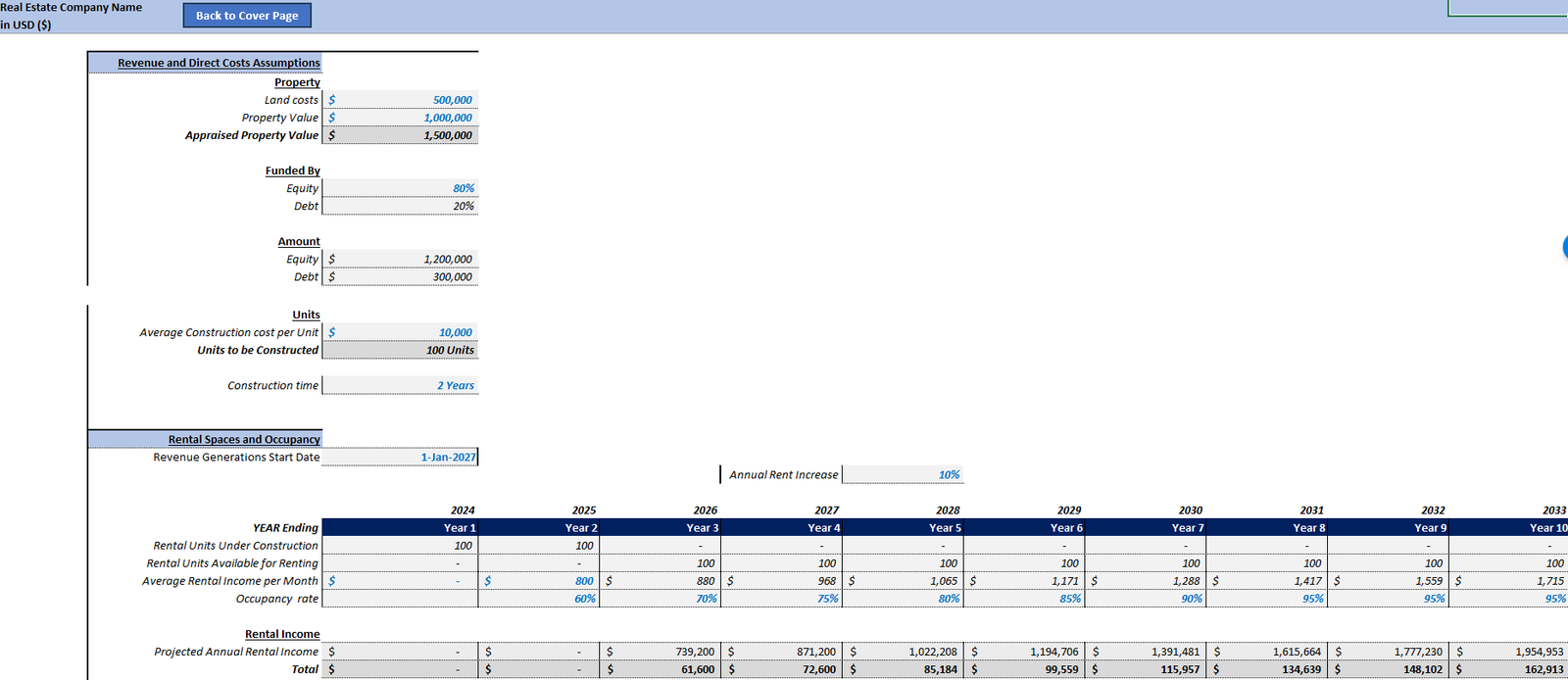

- Revenue Potential: Estimating income from sales or leasing.

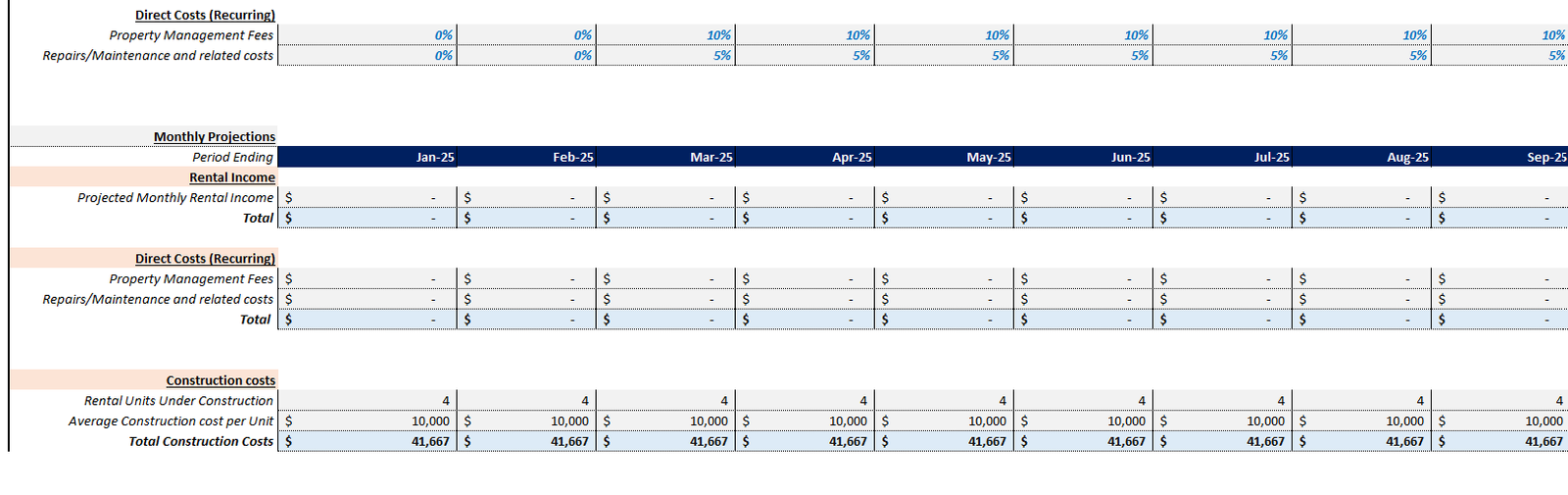

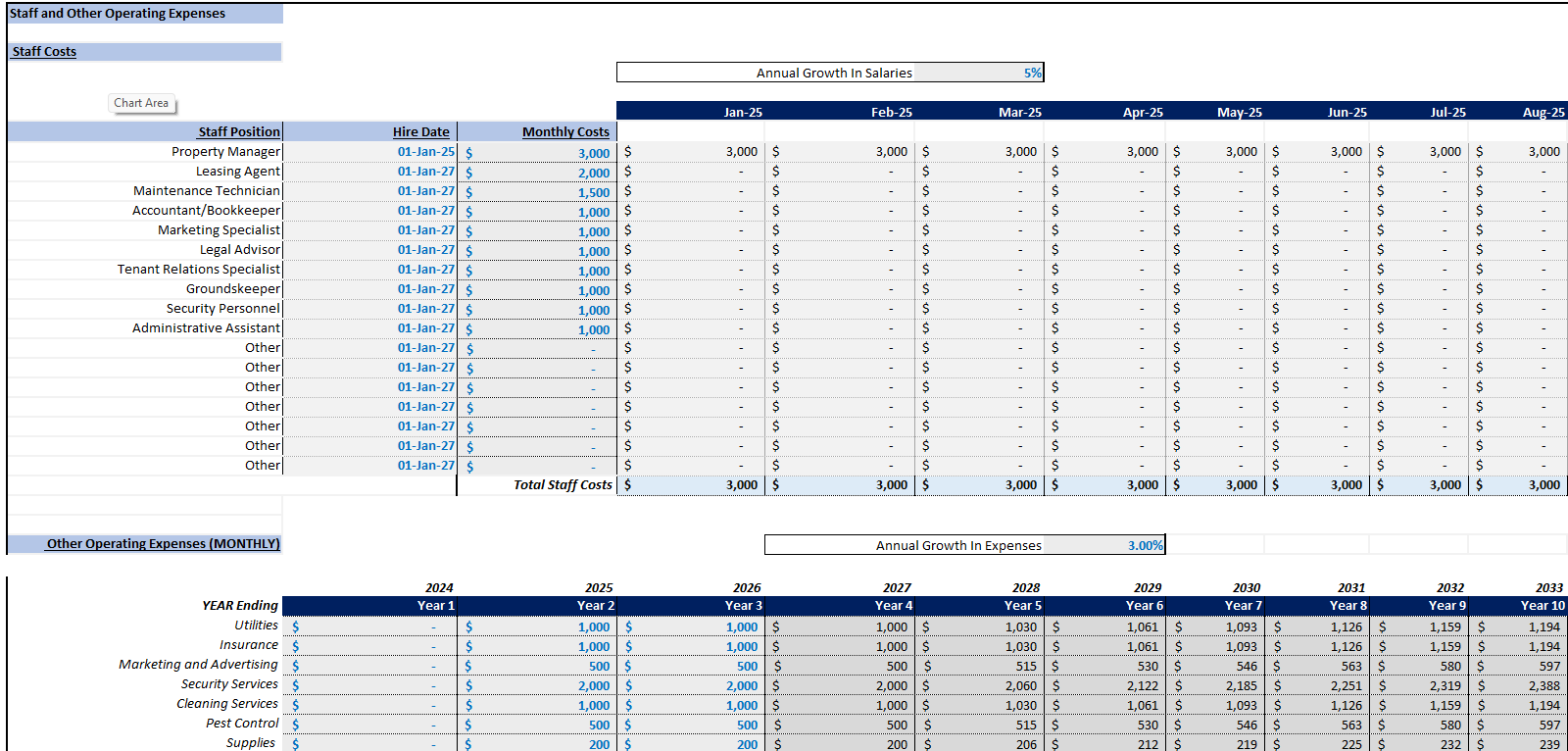

- Cost Forecasting: Understanding expenses for land, construction, and operations.

- Cash Flow Tracking: Managing cash inflow and outflow.

- Risk Management: Identifying risks like market downturns or delays.

- Investor Confidence: Demonstrating project viability to potential financiers.

A real estate development model acts as a comprehensive roadmap, aligning developers and investors with achievable financial outcomes.

Key Components of a Real Estate Financial Model

Project Revenue Streams

- Sales Revenue: Income from property sales.

- Rental Income: Ongoing income from leases.

- Other Income: Revenue from additional services like parking.

Costs and Expenses

- Land Acquisition: Purchase costs for development land.

- Construction Costs: Expenditures on building materials and labor.

- Soft Costs: Non-construction costs like legal fees.

- Financing Costs: Interest and fees related to project funding.

Financing Structure

- Debt Financing: Loans and mortgages for the project.

- Equity Financing: Capital from personal or investor funds.

The REFM guide provides insight into evaluating financing options from the perspectives of both equity and debt investors.

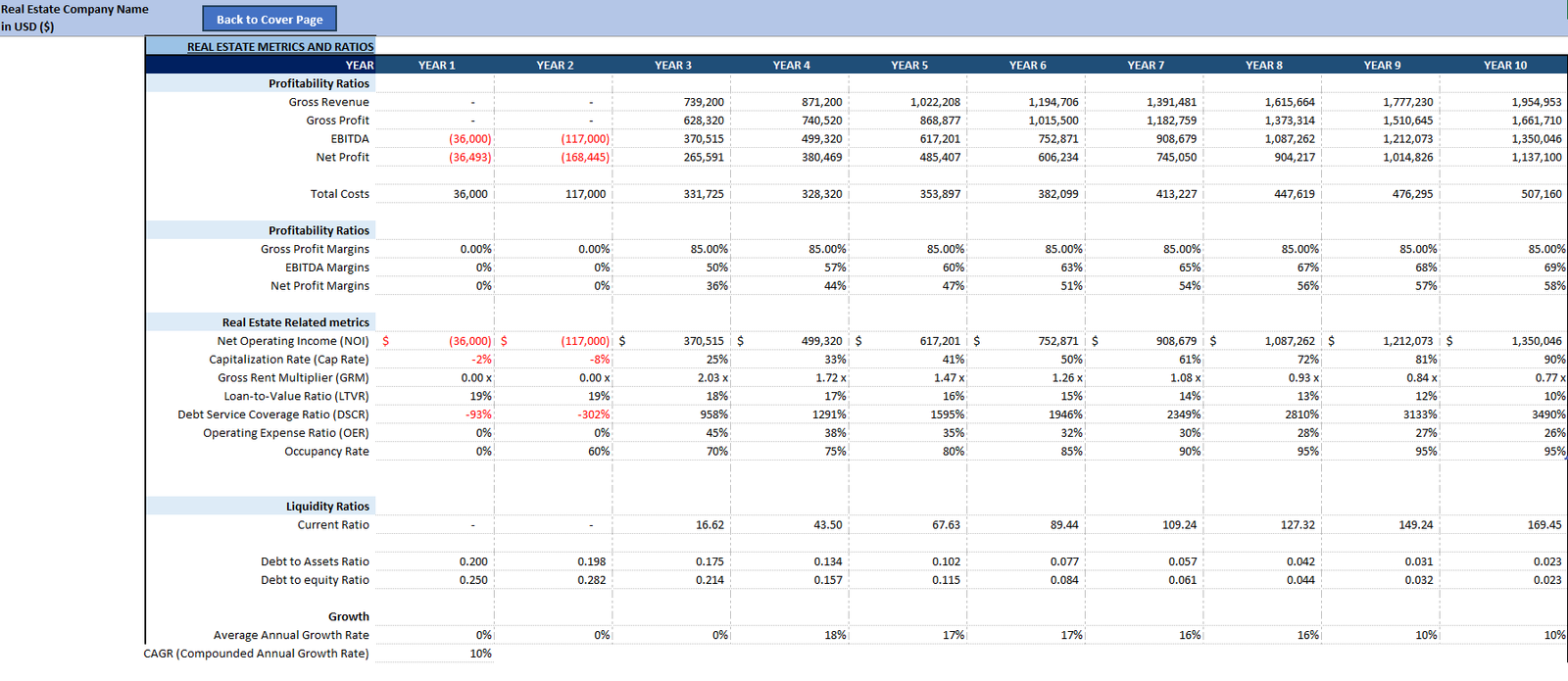

Key Performance Indicators (KPIs)

- Net Present Value (NPV): Current value of future cash flows.

- Internal Rate of Return (IRR): Profitability measure.

- Debt Service Coverage Ratio (DSCR): Debt payment capability.

- Return on Investment (ROI): Profit potential percentage.

Exit Strategy

Plans for selling or leasing the property to achieve financial returns.

Step-by-Step Guide to Building the Model

Step 1: Define Project Scope and Time Frame

Identify property type, size, and project timeline. Understand these elements to better estimate costs and revenues. The Wall Street Oasis guide offers a detailed overview of model setup.

Step 2: Estimate Revenue

Forecast sales prices and rental income. In a scenario involving 50 residential units priced at $500,000 each, total sales revenue would be $25 million.

Step 3: Estimate Costs

Account for land, construction, and marketing costs. Detail is vital, as indicated in a study of financial models by Realty Capital Analytics.

Step 4: Define the Financing Structure

- Debt and Equity: Determine the proportion and terms of each.

- Capital Stack: Visualize debt and equity layers in funding.

Step 5: Cash Flow Projections

Forecast both inflows and outflows, considering timing and magnitude. A comprehensive cash flow model is covered in the Corporate Finance Institute foundations guide.

Step 6: Calculate KPIs

Use KPIs like NPV and IRR to assess project viability. Sensitivity analysis will uncover potential risks affecting these metrics.

Step 7: Sensitivity Analysis

Evaluate the impact of variable changes on the project’s financials. Understanding these sensitivities helps mitigate unforeseen issues.

Step 8: Finalize the Model and Review

Review calculations, assumptions, and perform scenario testing. Consistency in data is key to accurate modeling.

Frequently Asked Questions

What is a real estate financial model?

A structured evaluation tool for assessing a project’s profitability, risks, and cash flow.

How do you finance a real estate development project?

Typically through a combination of debt and equity. Online resources, like Synario’s guide, offer in-depth analysis.

Why is KPI analysis essential in financial modeling?

KPIs provide a measure of project success and investment returns, informing better decision-making.

Final Thoughts!

Building a real estate financial model is fundamental in evaluating project success, managing risks, and securing necessary funding. Each step, from defining scope to KPI analysis, contributes to a model that facilitates informed decisions. To further enhance your modeling skills, use resources like the Real Estate Financial Modeling guide, which explores tools and techniques for effective analysis.