Starting a dairy farm can be a rewarding venture, but it requires careful financial planning. A well-constructed financial model will help you understand the capital required, expected revenue, ongoing operating expenses, and how to ensure profitability. Whether starting from scratch or expanding an existing operation, having a clear financial roadmap is essential for success.

This guide will walk you through building a comprehensive dairy farm financial model, from estimating startup costs to forecasting revenue and managing operating expenses.

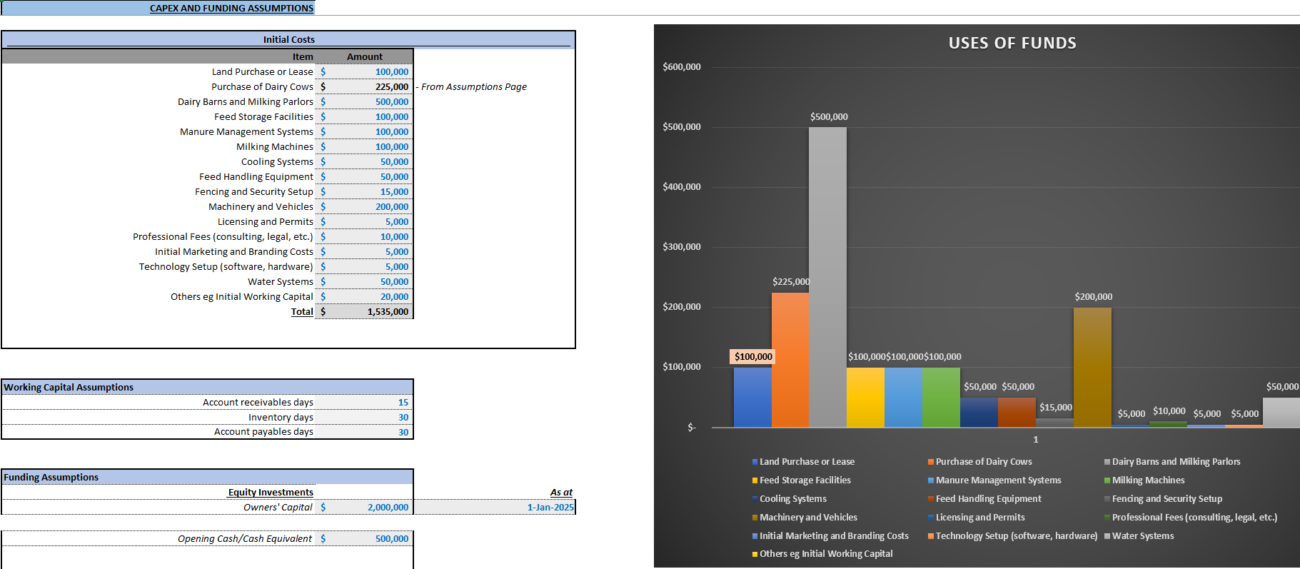

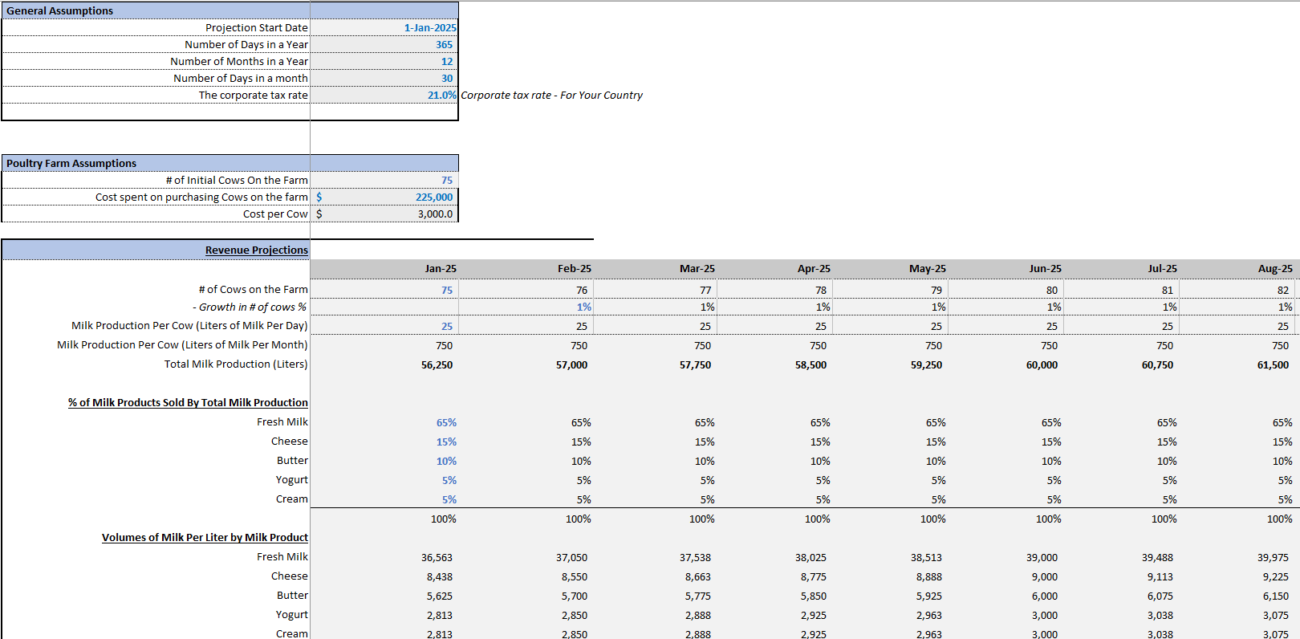

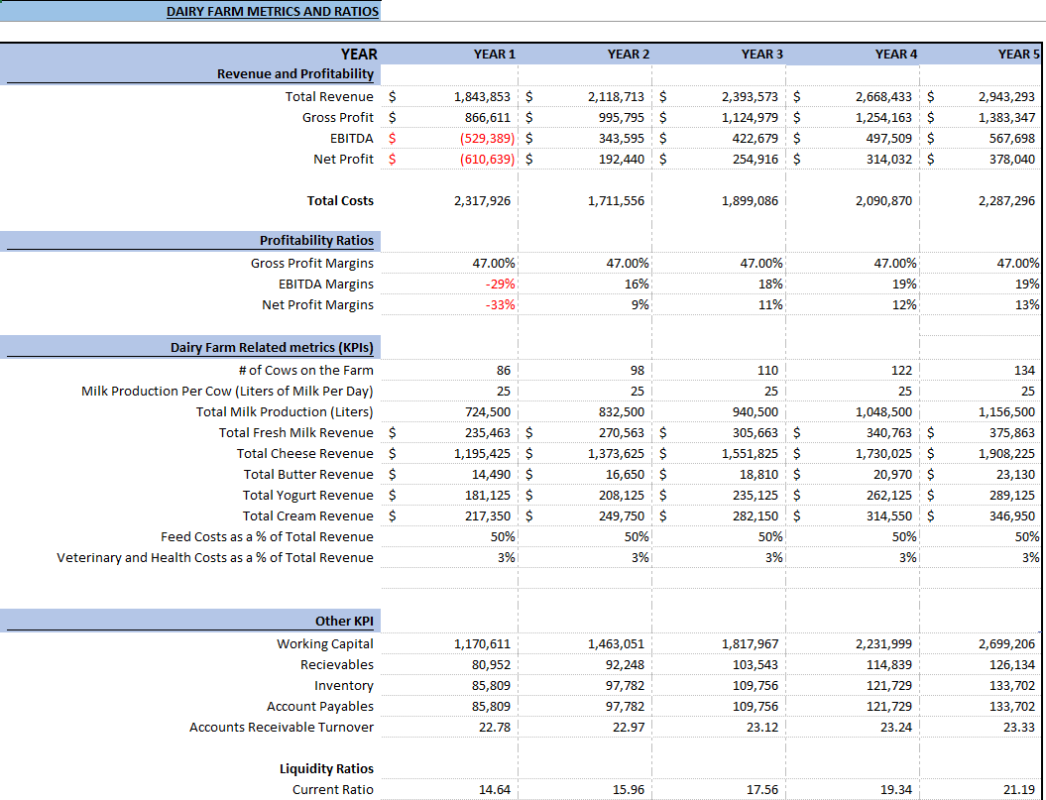

We have also built a Dairy Farm Financial Model Template for Founders to use. Just input your assumptions, and our model does the rest! It’s a complete 3-way financial model with an Income Statement, Balance Sheet, Cash Flow Statement, dairy farm specific metrics, ratios, and more.

Understanding the Basics of a Dairy Farm Financial Model

A dairy farm financial model is a strategic tool that forecasts the farm’s financial performance. It considers income, costs, profitability, and cash flow, enabling informed decisions.

- Startup Costs: Initial capital investments to launch the farm.

- Operating Expenses: Recurring costs for maintenance and operations.

- Revenue: Income from milk and other products.

- Cash Flow Projections: Estimates of income vs. expenses over time.

- Profitability Metrics: Key indicators like ROI and break-even analysis.

Learn more about Dairy Farming Industry Financial Models.

Step 1: Estimate Your Initial Startup Costs

Land Acquisition

- Purchase or Lease: Costs vary based on location, soil, and market conditions.

- Preparation: Clearing, leveling, and drainage improvements may add costs.

Dairy Equipment

- Milking Equipment: Including machines and refrigeration units.

- Feed and Water Systems: Essential for feeding and hydration.

- Manure Management: Composting and waste management systems.

- Farm Vehicles: Tractors and trucks for maintenance and operations.

Explore the Dairy Farm Valuation Model Template.

Livestock Acquisition

- Cost per Cow: Varies based on breed and age.

- Breeding Costs: Include artificial insemination and veterinary care.

Infrastructure and Facilities

- Buildings: Barns, milking parlors, and storage facilities.

- Fencing: For creating secure pens and enclosures.

Licenses and Permits

Compliance with local regulations requires various permits, influencing startup financial plans.

Insurance

- Livestock and Property Insurance: Protects against loss and damage.

- Liability Insurance: Covers accidents involving others.

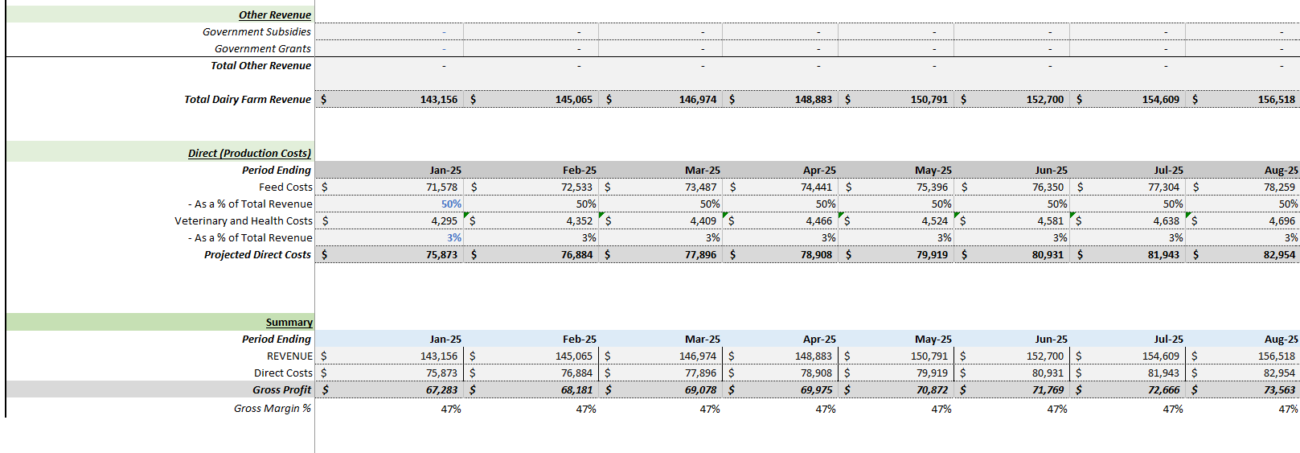

Step 2: Estimate Ongoing Operating Costs

Feed Costs

- Balanced Diet: Essential for milk production and cow health.

- Grain and Silage: Mainstay feeds include grains and fermented plants.

Labor Costs

- Salaries and Benefits: Payments for workers managing farm operations.

Veterinary and Healthcare Costs

- Routine Checkups: Regular vet visits for health monitoring.

- Emergency Care: For sick or injured animals.

Utilities

- Electricity and Water: For daily operations and irrigation.

- Fuel: Powers farm vehicles and machinery.

Maintenance and Repairs

Regular upkeep of equipment and infrastructure is necessary for smooth farm operation and is a part of farm financial management.

Marketing and Distribution

- Packaging and Transportation: Costs for getting products to market.

- Marketing: Advertising and promotional efforts.

Step 3: Estimate Revenue

Milk Revenue

- Milk Production and Price: Determine total and per-unit income.

Other Dairy Products

Additional products like cheese and yogurt can boost revenue.

Byproducts and Ancillary Revenue

Sales of manure and breeding services can supplement income.

Step 4: Calculate Cash Flow and Profitability Metrics

Cash Flow Projections

Illustrate income and expenses over time, ensuring a realistic cash flow for sustainability.

Profitability Metrics

Evaluate gross margin, ROI, and break-even analysis to ensure long-term viability and success.

Frequently Asked Questions

What are the main components of a dairy farm financial model?

A comprehensive model includes startup costs, operating expenses, revenue projections, cash flow, and profitability metrics.

How can dairy farms improve their financial performance?

By optimizing farm cash income, operating costs, and exploring new revenue streams through strategic marketing and distribution.

Why is a dairy farm financial forecast essential?

It aids in predicting income and expenses, helping farmers make informed strategic and operational decisions.

Building a financial model for a dairy farm is crucial for both startup and operational success. By accurately estimating costs and revenues and continually updating the model with actual performance data, farmers can maintain a sustainable and profitable operation.