Investing in residential real estate presents an array of lucrative opportunities, from flipping houses to generating rental income or building a long-term portfolio. To succeed, understanding the financial dimensions of your investments is crucial. A well-structured residential real estate financial model is essential to evaluate potential deals, forecast cash flows, and assess profitability.

In this comprehensive guide, we explore a step-by-step approach to building a residential real estate financial model, tailored for first-time investors and seasoned professionals alike. We have also built a ready-to-go Residential Real Estate Financial Model Template for Founders looking for an easy-to-use Financial model which will allow them to model out their financials and provide an Income Statement, Balance Sheet and Cash Flow Statement for their business.

What is a Residential Real Estate Financial Model?

A residential real estate financial model is a robust tool for evaluating the financial viability of property investments. It captures crucial metrics such as cash flow, profits, expenses, and ROI, enabling investors to assess potential purchases, anticipate rental income, and evaluate equity or loan impacts.

The ultimate aim is to illustrate the economic potential of a property, guiding investors in making informed decisions about investments. For an in-depth understanding, refer to the ultimate guide to real estate financial modeling.

Step 1: Gather Key Inputs for Your Financial Model

Property Purchase Price

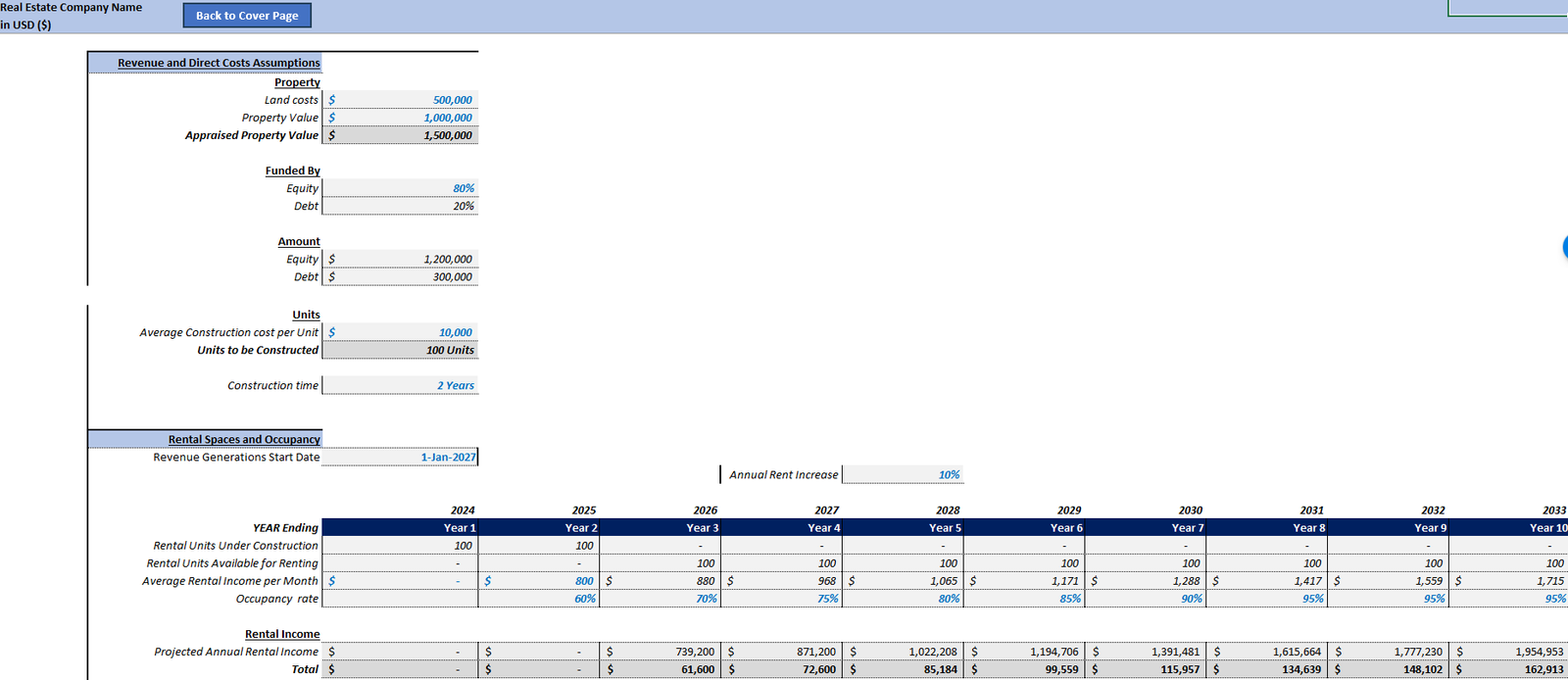

Begin by determining the property’s purchase price, whether it’s a single-family home or a multi-family unit. This dictates your financing possibilities and profitability potential.

Financing Assumptions

- Loan Amount and Interest Rate: Establish how much to borrow and the associated interest rate, affecting monthly payments and total property costs.

- Loan Term and Down Payment: Determine the loan duration and upfront payment, commonly 20% of the purchase price.

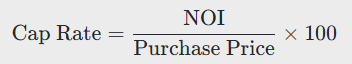

Rental Income

- Monthly Rent: Set a realistic rent charge based on comparable local properties.

- Vacancy Rate: Assess the expected period the property remains unoccupied, typically 5-10%.

Operating Expenses

- Property Taxes and Insurance: Factor in government taxes and insurance against risks like natural disasters.

- Maintenance and Property Management: Budget for repairs and managerial fees, often 8-12% of rental income.

- Utilities: Include owner-responsible utilities like water and electricity.

The residential real estate modeling guide offers further insights on managing these variables.

Appreciation and Capital Gains

Estimate the annual appreciation and expected selling price post-investment, accounting for both market and property improvements.

Step 2: Structure Your Financial Model

Create an Assumptions Tab

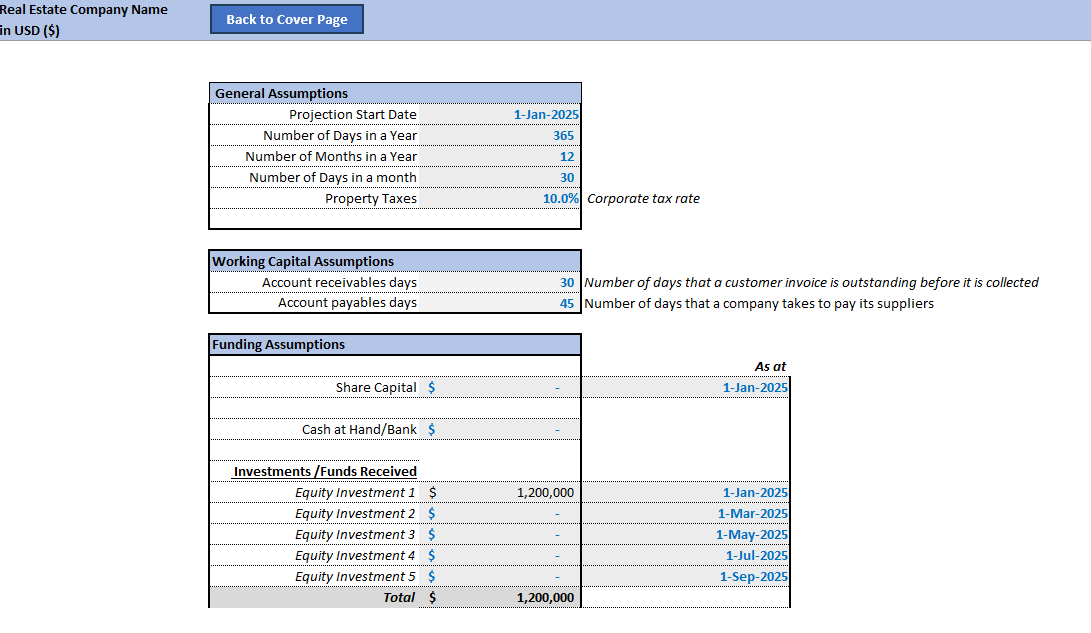

Consolidate all input data—purchase price, financing, rent, expenses, and appreciation—into an assumptions sheet. Any modifications here will reflect across the model. Resources like the library of Excel real estate models provide templates for structuring these inputs.

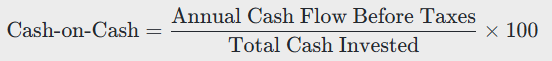

Set Up a Cash Flow Tab

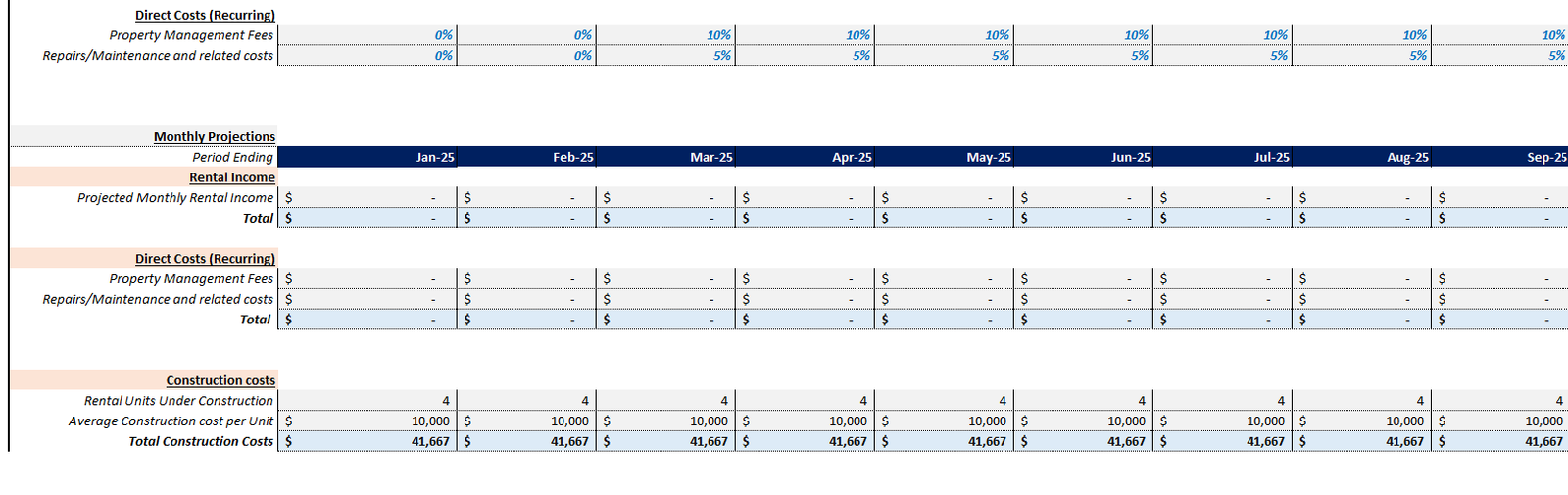

This captures money movement over time, incorporating:

- Rental Income and Operating Expenses

- Mortgage Payments and Net Operating Income (NOI)

- Cash Flow Before and After Taxes

Refer to elements from breakdowns of financial models for detailed setup guidance.

Add a Financing Tab

Detail debt financing, calculating monthly mortgage payments using loan amortization schedules.

Step 3: Calculate Key Metrics

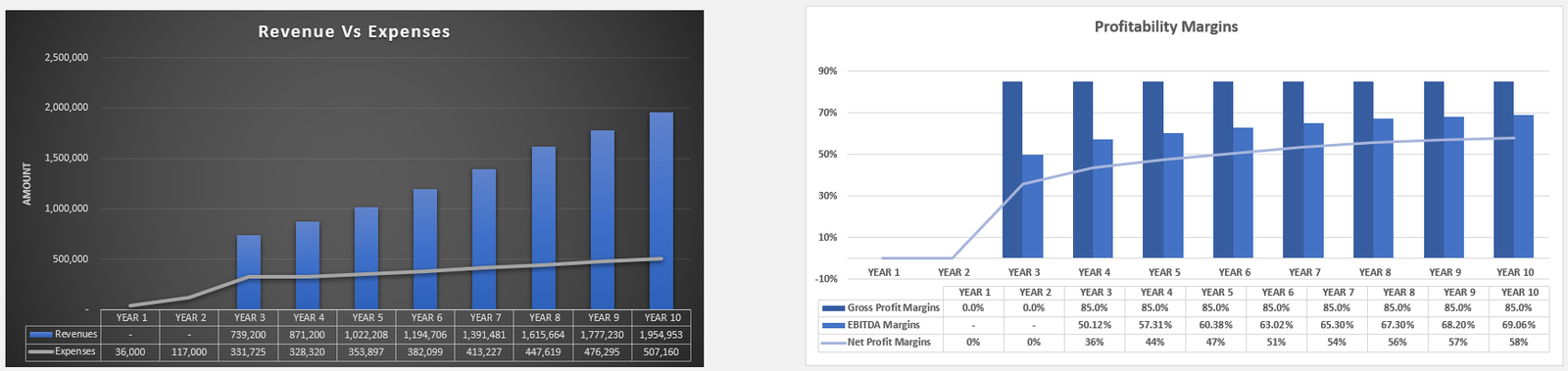

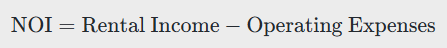

Net Operating Income (NOI)

Cap Rate

Cash-on-Cash Return

Internal Rate of Return (IRR)

Utilize Excel’s IRR function for long-term investment profitability, as explored in foundational resources like the real estate investment model guide.

Step 4: Sensitivity Analysis and Scenario Planning

Conduct sensitivity analysis to test various scenarios, understanding shifts in key assumptions like rents or appreciation. This step ensures preparedness for market changes, guided by methodology from the real estate development model overview.

Final Thoughts!

Constructing a residential real estate financial model equips investors with detailed forecasts and key metrics like cash flow, NOI, and IRR to evaluate investment soundness. This foundational tool facilitates sensitivity analyses and strategic planning, essential for thriving in fluctuating markets. Explore more on residential land developments for broader applications.

Frequently Asked Questions

What is the purpose of a residential real estate financial model?

A financial model forecasts cash flows and evaluates the profitability of property investments, aiding in data-driven decision-making.

How do you calculate the cap rate in real estate?

The cap rate is derived by dividing the net operating income by the property’s purchase price and multiplying by 100.

Why is sensitivity analysis important in real estate modeling?

Sensitivity analysis evaluates potential market fluctuations, ensuring preparedness for variable financial outcomes.