Starting a business is an exciting and challenging journey. One of the key aspects that will shape the future of your startup is its financial health. Building a financial modeling for startups is an essential step to ensure you understand the financial mechanics of your business, attract investors, and plan for long-term success. Whether you’re preparing for a pitch meeting or just want to have a clear financial roadmap, a well-structured financial model will provide you with valuable insights.

In this article, we will walk you through the process of creating a startup financial model, step by step. You don’t need to be an accountant to get started, but a basic understanding of financial statements and Excel will certainly help. Let’s dive into how you can create a financial model that serves as a solid foundation for your startup’s growth. We also have a ready-made Startup Company Financial Model Template which you can use that is perfect for Founders looking for an easy to use template for their business.

What is a Financial Model?

A startup financial model is a representation of a company’s financial performance and projections. It is typically built using spreadsheets and is used to forecast revenues, expenses, profits, and cash flows. For startups, a financial model helps you estimate how much money you need to get your business off the ground, how long it will take to become profitable, and what the financial trajectory of your business might look like.

A good startup financial model provides you with answers to questions like:

- How much capital do I need to raise?

- What are my key revenue drivers?

- When will my startup break even?

- How much profit can I expect over time?

The purpose of your financial model is to give you, potential investors, and stakeholders a clear view of your startup’s financial future and to guide your decision-making as you grow.

Step 1: Set Up Your Startup’s Key Financial Assumptions

Before diving into the actual numbers, you’ll want to set up your key assumptions. These are the foundational elements that will drive your model’s projections. Without clearly defined assumptions, your financial model might lack accuracy and clarity. Here are the key assumptions you should consider:

1.1 Revenue Assumptions

Revenue assumptions are a critical component of your financial model. They determine how much money you expect your startup to make. Your revenue will depend on:

- Pricing: What will you charge for your product or service? Will you have different pricing tiers?

- Sales Volume: How many units of your product will you sell per month or year?

- Growth Rate: How fast will your revenue grow each year? Will you expect to scale significantly as you acquire more customers or expand to new markets?

1.2 Expense Assumptions

You’ll also need to set assumptions about the costs of running your business. These typically include:

- Fixed Costs: Costs that remain constant, such as rent, salaries, and insurance.

- Variable Costs: Costs that change with the level of production or sales, such as cost of goods sold, commissions, and marketing expenses.

- One-time Costs: Initial investments or one-off expenses, such as legal fees, office setup, or purchasing equipment.

1.3 Financing Assumptions

These assumptions relate to how you will finance your startup. You need to make assumptions about:

- Equity Financing: How much capital are you raising from investors (venture capital, angel investors, crowdfunding, etc.)?

- Debt Financing: Will you take out loans? If so, what are the terms of the debt (interest rate, repayment schedule)?

- Investment Round Structure: If you’re raising funds in rounds, what is the dilution expected at each stage?

1.4 Growth and Market Assumptions

Your startup’s growth assumptions are closely tied to your business model and the market you’re operating in. This could include:

- Market Size: What is the total addressable market (TAM)? How big is the opportunity?

- Market Share: What percentage of the market do you expect to capture, and how will this change over time?

- Customer Acquisition Cost (CAC): How much will it cost to acquire each customer? This will influence your marketing and sales budget.

1.5 Timeframe

Decide the timeframe for your financial model. Most startup models span 3 to 5 years, with projections for revenue and expenses each year. You’ll also want to create monthly projections for the first year or two to track more granular changes.

Step 2: Build Your Financial Model Structure

Now that you have your assumptions, you can begin setting up the actual structure of your financial model. Here’s a typical framework that you can follow in an Excel spreadsheet:

2.1 Revenue Model

Your revenue model will be the starting point for your financial model. The structure of your revenue model will depend on the nature of your business (e.g., subscription-based, one-time purchases, services, etc.).

- For a Subscription-Based Business: If you offer a subscription, calculate the expected monthly or annual recurring revenue (MRR or ARR). This can be done by multiplying the number of customers by your subscription price.

- For a Product-Based Business: Estimate the sales volume and price per unit to calculate revenue.

Factor in growth assumptions, like an increase in customers or expanding to new markets.

2.2 Expense Model

Once you have your revenue projections, you’ll need to account for all the costs associated with running your business. Your expense model will include both fixed and variable costs:

- Fixed Costs: These will remain constant regardless of how much you sell. Examples include salaries, rent, utilities, and insurance.

- Variable Costs: These costs scale with your sales volume. For example, if you’re selling products, your cost of goods sold (COGS) will increase as you sell more units.

- Marketing and Sales Expenses: You’ll need a separate section to track customer acquisition costs, digital marketing spend, sales commissions, and so on.

- R&D Costs: If your startup is product-based, you may have research and development costs that need to be accounted for, particularly in the early stages.

- Operational Costs: This could include software tools, customer support, office supplies, and other day-to-day operating expenses.

2.3 Cash Flow Statement

The cash flow statement tracks the inflow and outflow of cash in your business, giving you a picture of your liquidity and ensuring you can pay your bills. Even if your startup is not yet profitable, it’s essential to understand your cash flow because many early-stage companies run into problems simply due to poor cash management.

Your cash flow statement will consist of:

- Operating Cash Flow: Cash generated or spent on day-to-day operations (from sales, services, or other business activities).

- Investing Cash Flow: Cash used for purchasing or selling investments (e.g., buying equipment or property).

- Financing Cash Flow: Cash raised from investors or debt providers, and cash paid back to investors or lenders.

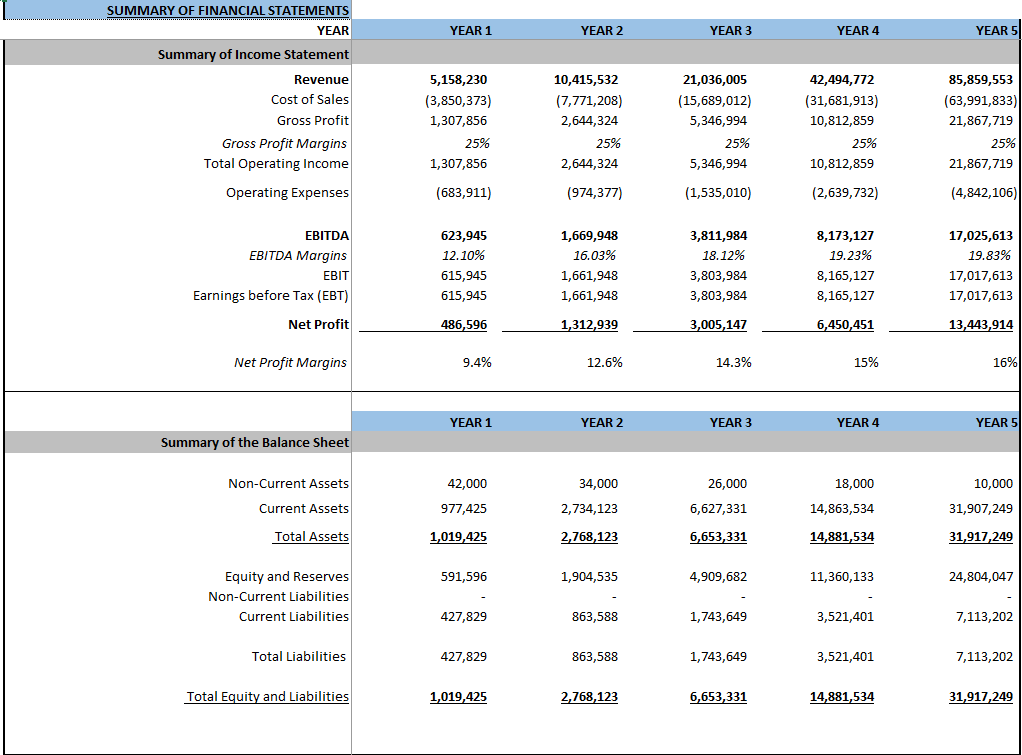

2.4 Profit and Loss Statement (P&L)

The Profit and Loss Statement (also known as the income statement) is where you’ll track whether your startup is making a profit or loss over time. This statement includes:

- Revenue: All the money coming into the business from sales or services.

- Cost of Goods Sold (COGS): The direct costs of producing goods or services.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: These are the indirect costs of running the business, like salaries, marketing, rent, and utilities.

- EBITDA: Earnings before interest, taxes, depreciation, and amortization.

- Net Profit: The bottom line—what’s left after all expenses.

2.5 Balance Sheet

The balance sheet provides a snapshot of your company’s financial position, showing what you own (assets), what you owe (liabilities), and your equity. It’s broken into two sections:

- Assets: What your business owns, such as cash, inventory, equipment, and intellectual property.

- Liabilities: What your business owes, such as loans, credit lines, or accounts payable.

- Equity: The value of the owners’ stake in the business.

Step 3: Forecast and Projections

With your financial model structure in place, it’s time to build out your forecasts. Start by inputting your assumptions and using them to project revenues, expenses, and profits for the next few years.

3.1 Sales Forecasting

Create a detailed sales forecast, breaking down your expected sales volume, pricing, and growth rate. For the first few months or years, your sales forecast will likely be based on more conservative estimates, but as you gain traction, you can revise projections to reflect growth.

3.2 Expense Forecasting

Similarly, forecast your expenses based on your current assumptions. Break this down month-by-month for the first year or two and yearly afterward.

3.3 Profitability and Break-even Analysis

Evaluate your profitability and break-even point. The break-even point is when your total revenues cover your total expenses—any sales beyond that point are pure profit. A break-even analysis helps you understand how many customers or sales you need to reach to become profitable.

Step 4: Test and Refine Your Financial Model

Once you’ve built your initial financial model, it’s important to test and refine your assumptions. Consider:

- Are your revenue projections realistic? What if customer acquisition costs are higher than expected?

- Are you underestimating any costs, such as unexpected legal or operational fees?

- What are the implications of raising less capital than expected?

Adjust your assumptions to see how they affect financial outcomes. This process is called sensitivity analysis, and it helps explore risks and opportunities in your financial model.

Step 5: Presenting Your Financial Model to Investors

If your financial model is intended to attract investors, be prepared to present it clearly and concisely. Investors will want to see:

- How much capital you’re raising and how you’ll use it.

- Your plans to generate revenue and grow your business.

- When they can expect a return on investment (ROI).

Use graphs and charts to make projections more visually appealing and easier to understand.

Frequently Asked Questions

What is the main purpose of a startup financial model?

A startup financial model forecasts the financial performance and health of a startup, offering insights for planning, attracting investors, and guiding business decisions.

How often should a financial model be updated?

Regular updates are crucial; ideally, revise it quarterly or whenever significant changes occur in business strategy or market conditions.

What are key elements of a robust financial model?

Key elements include revenue projections, expense breakdown, cash flow management, and a balance sheet for evaluating assets and liabilities.

Final Thoughts

Building a financial model for your startup is crucial for understanding the financial dynamics of your business. Using a structured approach and breaking it down into manageable steps will help create a solid financial plan. Understand your revenue streams, expenses, and cash flow to make informed decisions, attract investors, and navigate challenges. Remember that financial modeling is iterative; as your business grows and assumptions change, continuously update your model to ensure financial health and success.